Unlocking the future of Conversational AI with Generative AI – a revolutionary technology that’s changing the way we operate! A Gamechanger!

The emergence of advanced large language models and Generative AI platforms has

become a game-changer that revolutionized the way we conduct conversations. They employ a unique

artificial intelligence (AI) technology capable of understanding and responding to natural text,

allowing machines to communicate with humans as if they were interacting with other human beings.

Using this revolutionary technology, businesses can automate conversations, streamline customer

service, and provide more comprehensive customer engagement experiences tailored to each individual’s

needs. With Generative AI & latest LLMs, just imagine the possibilities in terms of reaching more

people on a global scale while giving them the information they need when they need it most. Moreover,

the advanced AI capabilities will help reduce costs, maximize efficiency and productivity levels, and

bring new insights into customer behavior patterns across the board for businesses. Truly, it is an

amazing and inspirational advancement for the future!

Stepping into the future of Banking with the game changing LLM & Generative AI Technologies!

The future of banking has arrived with the revolutionary Gen AI technologies! This

game-changing technology unlocks a raft of new opportunities in finance, creating a perfect ecosystem

for modern banking. Users can access various financial services in the comfort of their homes while

enjoying enhanced security and improved user experience. Banks can benefit from these technologies by

providing personalized product offerings, more accurate lending decisions, risk management, and fraud

detection. Combining cutting-edge LLMs, FMs, and Generative AI platforms like GPT on Azure, IBM’s

Watsonx, Amazon BedRock, AWS SageMaker, Google’s PaLM and open-source models available on

HuggingFace,, we are seeing an unprecedented era in banking – one that is more efficient, secure, and

enjoyable than ever before. With advanced AI technologies at our fingertips, the traditional notion of

banking is being turned on its head – Banking Reimagined!

Boosting customer engagement & accelerating business growth is now a reality with Generative AI in banking!

Let us discover the top 10 use cases

that prove the powerful ROI of LLM & Gen AI powered bots:

1. In-Depth Project Research

The sheer wealth of information and data banks need to stay up-to-date with

industry trends is staggering. Advanced chatbots powered by Generative AI are ideal for this purpose

as they can conduct quick, in-depth research more efficiently than ever before with the ability to tap

into, and understand unstructured data such as PDFs, Presentations and more. From identifying banking

guidelines set by authorities to analyzing how they will impact the bank’s operations, chatbots can

help make informed decisions and policies that bankers usually make on a daily basis.

Further, Generative AI’s Factual Answering feature can assist banks to create sustainable Banking Bot apps, that will keep customer satisfaction high. For example, banking institutions can use this feature to provide facts on credit card charges, interest rates or even address customer issues more quickly and accurately. By leveraging these advanced technologies, banks stand to increase efficiency through improved accuracy in factual research so that their customers will be given better results and services.

Further, Generative AI’s Factual Answering feature can assist banks to create sustainable Banking Bot apps, that will keep customer satisfaction high. For example, banking institutions can use this feature to provide facts on credit card charges, interest rates or even address customer issues more quickly and accurately. By leveraging these advanced technologies, banks stand to increase efficiency through improved accuracy in factual research so that their customers will be given better results and services.

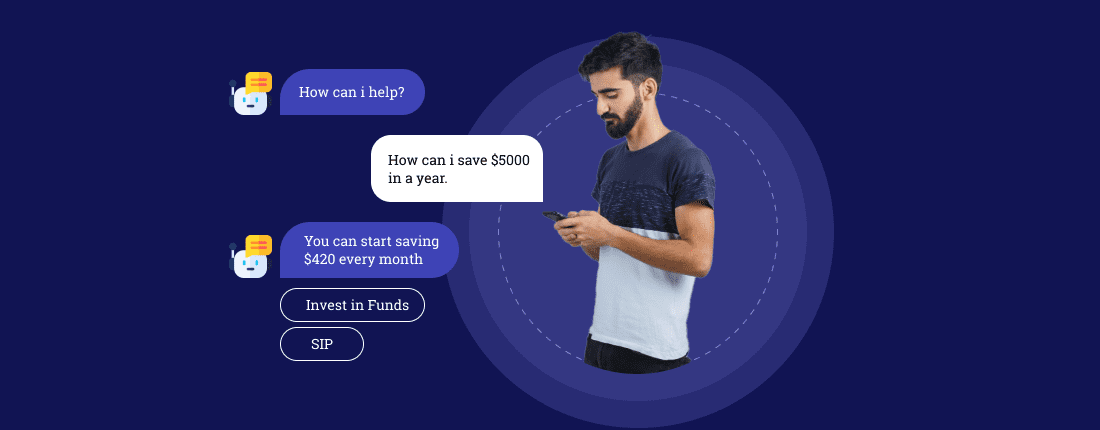

2. Personalized Financial Advice

The latest large language models like GPT on Microsoft Azure, IBM’s Watsonx, AWS

SageMaker, Amazon BedRock, and Open-source models available on HuggingFace have made banking virtual

assistants powerful and robust. They can be used to provide personalized financial advice and services

to customers. These banking bots combine the advantages of AI technology with its ability to parse

large amounts of unstructured data and extract key information and patterns from it. This allows banks

to gain insight into their customers’ spending habits, preferences, and cash flow. Based on such

analysis, Gen AI-powered banking chatbots can provide timely advice tailored to the individual needs

of customers, offering targeted suggestions on how to reduce spending or increase investments for

better returns. Such intelligent virtual assistants are much more efficient and customer-oriented than

traditional Personal Financial Management systems used by banks. The capabilities of this innovative

technology will surely enhance customer engagement and satisfaction with

banks.

3. Email Bot for Customer as well as Employee Service Automation

Banking is an incredibly hectic field, and fortunately, there are ways, such as

email automation feature of Gen AI, to make the workload more manageable. It can quickly process

emails to extract the needed information, generate a compelling response, and even fill in any missing

details. Additionally, Gen AI-powered chatbots have advanced features like Classification and

Sentiment Analysis that accurately classify emails and assess customers’ feelings in their messages.

This gives bankers the tools to conveniently handle customer inquiries while ensuring quality

communication. Ultimately, the utilization of banking chatbots helps maximize efficiency in the

workplace by freeing up time so bankers can focus on tasks that matter.

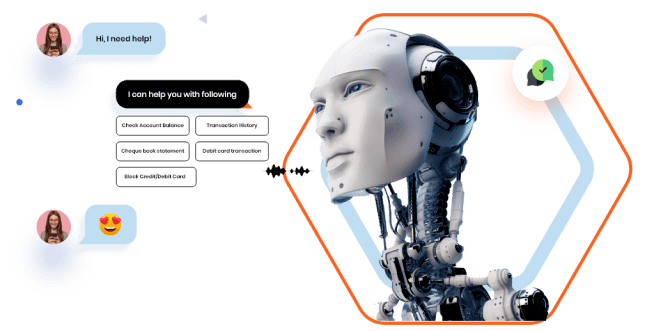

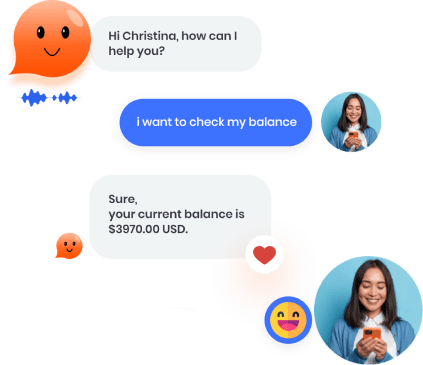

4. Customer Service Automation over Chat as well as Voice

Generative AI for Banking offers a revolutionary way for banks to optimize their

customer services using the latest technology. It provides an AI-based platform that generates

high-quality text for product descriptions and frequently asked questions, automating and enhancing

the customer service process. The platform incorporates Sentiments, Summarization, Conversations, and

Classification, creating more human-like interactions. This streamlines the experience by automating

common queries like “Check Account Balance” and “Credit Card Transaction History,” allowing executives

to focus on unique and challenging requests. The technology significantly improves customer

satisfaction by promptly responding to complex inquiries in an engaging manner. Voice Recognition and

automated customer service tools further enhance customer experiences, making it easier for banks to

respond dynamically to complex queries with efficiency. These advancements are game changers in the

digital banking era, fostering transparency and predictability, and nurturing better relations between

clients and banks.

5. Bank Marketing

Generative AI has been gaining traction as a leading tool for banks looking to

bolster their marketing practices. The latest advancements in LLMs and Gen AI platforms can help banks

create persuasive copy, such as email subjects, website copy, and advertisements, with minimal effort

and cost. Its Text Completion, as well as Text Edit and Text Conversion features, leverage the power

of Gen AI to craft powerful yet concise taglines for businesses in the blink of an eye! Advanced

AI-driven technologies can generate high-quality content tailored to bankers’ specifications without

them having to invest much effort or money, providing an impressive rate of return on investment. By

leveraging Generative AI-powered chatbots’ cutting-edge capabilities, bankers can confidently seize

opportunities as they present themselves, whether forming partnerships with other organizations or

winning over new customers.

6. Legal Contracts

Creating and formulating a legally binding contract is a tedious and precise

process. While human lawyers may use their experience to anticipate errors in legal documents,

chatbots built on a strong foundation of the latest LLMs and Gen AI offer a more accurate alternative.

With Text Embeddings’ Anomaly Detection, Diversity Measurement, and Recommendation features, Gen

AI-powered applications can generate legal documents with precision and accuracy far beyond that of

humans. This has made chatbots’ use cases in banking situations more widespread, including typical

scenarios like creating contractual clauses related to non-auto renewal, return of information, or

compliance with regulatory requests. By leveraging advancements in Artificial Intelligence technology,

Generative AI makes the vital work of contract creation easier, even for legal professionals in the

banking space.

7. Account Inquiries

Banking chatbot technology is revolutionizing banking customer service. By

leveraging the Search feature of a preferred large language model, banking chatbots can quickly

provide customers with all the information about their accounts – whether it’s an account statement

for the last six years or details about a specific transaction. This reduces the workload for bankers

and increases the efficiency and accuracy of results for customers. Moreover, customers can access the

information they need from the comfort of their homes, leading to increased loyalty and engagement

levels with banking institutions. In short, banking chatbots are set to make banking more efficient,

safer, and smoother than ever before.

8. Fraud Detection

Generative AI-powered chatbots offer corporate banking customers an enhanced

capability to identify instances of fraud. Leveraging the Classification feature, these chatbots break

down customer and banking data into structured sets and automatically present them in tables, charts,

and distributions. This swift data analysis empowers users to efficiently detect any irregularities in

their payment history, which may indicate fraudulent activity. The dynamic nature of Generative AI

technology enables rapid trend analysis, contributing to the prevention of financial losses for

customers. Early detection of potential fraud enhances the financial security of banks, solidifying

Generative AI’s role as a valuable asset for corporate banking.

9. Product Design

Generative AI for Retail Banking is a smart way for banks to bolster their product

lineup and provide their customers with the best available products. Now, banks have access to many

features that can help them curate smarter products and services tailored to individual customer

needs. This could include customizing Savings Accounts for customers who may prefer higher interest

rates or creating more flexible terms for Mortgage Loans. Additionally, Gen AI chatbots can create

visuals from scratch, such as images to accompany Fixed Deposit Plans or graphics that encapsulate the

overall value of an insurance policy, enriching the entire banking experience. Banks are capable of

providing a range of products and services not seen before, thanks to LLM technology and the image

generation feature, creating even better experiences for customers.

10. Enhanced Reporting & Translation

The Retail Banking chatbot, driven by Generative AI, presents a robust solution for

efficiently managing extensive datasets. Among its array of advantageous functionalities, the

Clustering feature stands out by generating insightful vector representations from textual data,

facilitating unsupervised categorization. This Generative AI capability uncovers meaningful patterns

within datasets, providing executives with invaluable insights that significantly impact their

reporting and analytical endeavors.

Furthermore, the integration of Language Model (LLM)-powered Banking Bots introduces a personalized dimension to customer service. Incorporating a Translation feature empowers customers to interact with services in their preferred languages, resulting in an elevated level of customer satisfaction and fostering a significant feeling of delight. In this context, Generative AI emerges as a dynamic and versatile asset, delivering substantial value to all stakeholders involved.

Furthermore, the integration of Language Model (LLM)-powered Banking Bots introduces a personalized dimension to customer service. Incorporating a Translation feature empowers customers to interact with services in their preferred languages, resulting in an elevated level of customer satisfaction and fostering a significant feeling of delight. In this context, Generative AI emerges as a dynamic and versatile asset, delivering substantial value to all stakeholders involved.

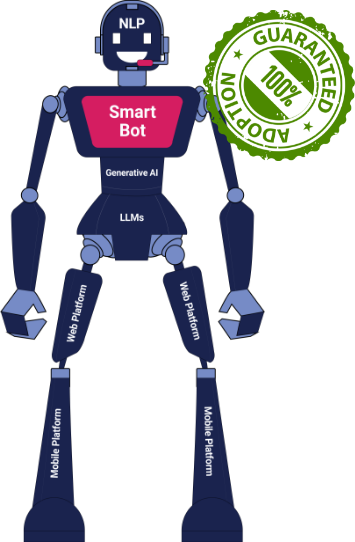

Introducing Streebo-Banking: A state-of-the-art solution powered by the latest in NLP and Generative AI technology. We’ve developed this solution to make banking more secure and efficient!

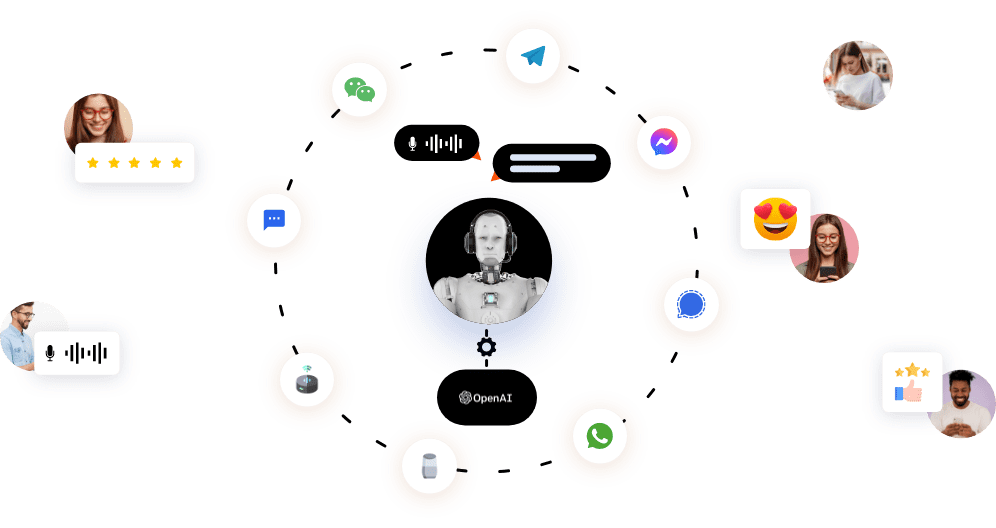

Streebo leads the way in conversational AI technology with its latest innovation,

Streebot – a smart chatbot solution designed for companies, brands, businesses, and professional

organizations. Our chatbot architecture offers businesses the flexibility to select the most

appropriate natural language processing (NLP) techniques, language models (LLMs), Generative AI

platforms, and AI technologies to suit their specific requirements. Leveraging state-of-the-art AI

technologies such as GPT- on Microsoft Azure, Google Gemini, IBM Watsonx, AWS SageMaker, Amazon BedRock,

open-source models on HuggingFace, and more, our exceptional chatbot solution delivers unmatched

performance.

Streebo’s Virtual Banking Assistants leverage this advanced technology to provide

unmatched customer service. Leveraging industry-leading NLPs such as IBM Watson, Microsoft Azure’s

CLU, Amazon Lex, Google DialogFlow, and Wit.AI from Meta, our chatbots ensure accurate comprehension

of users’ requests. These chatbots powered by Generative AI possess sophisticated context-switching

abilities, enabling them to effortlessly handle complex queries. They excel in addressing inquiries

that involve seamlessly managing multiple dialogue elements, guaranteeing a smooth transition between

various conversation topics.

Streebo’s Banking Virtual Assistants can offer superior engagement and automation, resounding ROI and guaranteed adoption. Some of the features include

Streebo’s Banking Virtual Assistants can offer superior engagement and automation, resounding ROI and guaranteed adoption. Some of the features include

Some of the features

include:

- Built-in domain intelligence

- Omnichannel experience on all platforms such as Facebook, WhatsApp, and Websites

- Data security and compliance

- Advanced chat analytics

- Inbuilt live agent support

- Multi-lingual support

- Support of both Voice and Chat as well as

- Secured communication

- Context Switching Capabilities

- Multimodal Capabilities

- Secure Transactions and Text Exchange for Financial Organisationss

Our Cognitive Assistants use industry-leading, secure, world-class NLPs such as IBM Watson, Google’s GCP, Amazon’s Lex, Microsoft CLU, Copilot, Power Virtual Agents (previously called LUIS), and more, providing unmatched peace of mind for enterprise data processing. All sensitive and other types of data are encrypted and masked using sophisticated algorithms, creating the most secure environment possible. To top it off, the Text Generation feature ensures no manipulation, computation, or processing of business data, making it an effective tool for customers who need assurance that all aspects of security will be taken into account. With our smart virtual assistants as part of your arsenal against data breaches and cybercrime, there is no better way to ensure safety!

Clients that have deployed these Smart Bots are seeing

Final Food for Thought for Banking Leaders!

The latest innovation in Generative Artificial Intelligence (AI) indicates that the

global chatbot market is set to grow at a faster pace than reported. Markets and Market research

predicts that the market size will reach $10.5 billion by 2026, with a compound annual growth rate of

23.5%. However, the impressive adoption rate shown by Gen AI technology clearly displays the demand

for such services and capabilities, suggesting that this figure could be substantially higher.

Businesses across all industries are embracing AI-based conversation agents to enhance customer

service and engagement, implying that the future potential for growth in this sector is only

increasing.

Streebo’s Banking Bots offer an unbeatable Generative AI experience for banks and financial institutions, courtesy of two powerful tools – NLPs such as IBM Watson, Google DialogFlow, Microsoft CLU, Amazon Lex, and Regenerative AI capabilities of preferred LLM and Gen AI platform. With this innovative combination, customers now have access to something truly remarkable in the world of banking and finance. Don’t miss out on the opportunity to experience this cutting-edge technology! Check out our Banking Bot Webpage and drop us a note today to schedule your personalized demo.

Streebo’s Banking Bots offer an unbeatable Generative AI experience for banks and financial institutions, courtesy of two powerful tools – NLPs such as IBM Watson, Google DialogFlow, Microsoft CLU, Amazon Lex, and Regenerative AI capabilities of preferred LLM and Gen AI platform. With this innovative combination, customers now have access to something truly remarkable in the world of banking and finance. Don’t miss out on the opportunity to experience this cutting-edge technology! Check out our Banking Bot Webpage and drop us a note today to schedule your personalized demo.

Ready to see the difference?

Don’t just wonder—try it with zero commitment! Kickstart your 30-day free trial today and witness its capabilities firsthand. Once you’re convinced, seal the deal.Explore, Then Engage!

Contact Us Today to Get Started.

Contact Now!

Frequently Asked Questions

Generative AI-powered chatbots bring numerous advantages to the banking sector, including enhanced security, improved user experiences, and personalized financial advice. They can process large amounts of data, offer customized financial insights, and automate various customer service tasks.

Some specific use cases include in-depth project research, personalized financial advice, email bot automation, customer service automation over chat and voice, bank marketing content generation, legal contract creation, account inquiries, fraud detection, and product design enhancement.

Streebo-Banking is an innovative solution powered by the latest in NLP and Generative AI technology. It offers advanced virtual banking assistants that deliver human-like conversations to enhance customer interactions. Streebo’s solution leverages LLMs and Generative AI platforms, providing capabilities such as context-switching, multi-lingual support, and secure communication

Generative AI technology is experiencing rapid adoption across various industries, including banking. The global chatbot market is projected to grow substantially, with a compound annual growth rate of 23.5%. As businesses recognize the value of AI-based conversation agents, the potential for growth in the banking sector is significant.

Gen AI-powered banking chatbots excel in addressing complex queries that involve seamlessly switching between different dialogue elements or topics. Their context-switching capabilities allow them to maintain coherent and meaningful conversations, ensuring that users’ queries are understood and addressed accurately, even when discussing multiple subjects within the same conversation.

Ready to Transform Your Banking

Experience with Generative AI

Powered chatbots?

Explore Streebo’s Banking chatbot Solutions andSchedule a Personalized Demo.