Streebo SMART® Financial Services Bot for Marketing

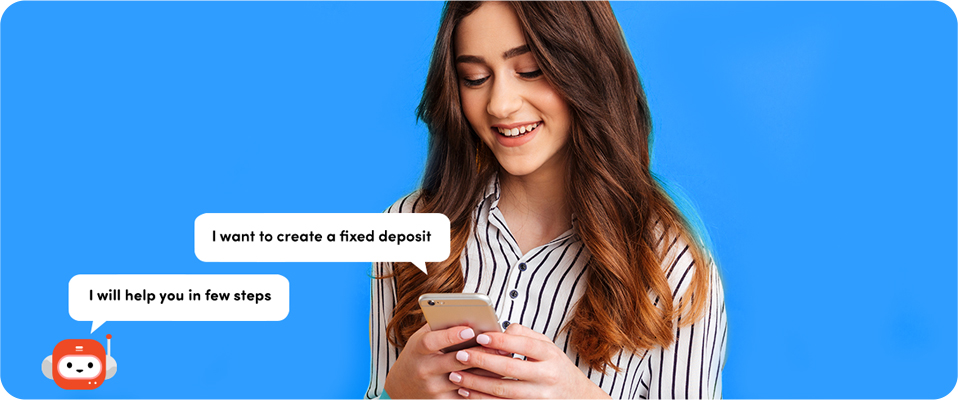

Post pandemic, enterprises are experiencing a rise in contactless and asynchronous communication through mobile. A significant increase has been observed in the usage of social media and messaging platforms among end-users. A recent Tech Crunch study noted a 40% jump in the usage of social media platforms such as Facebook Messenger, WhatsApp, Skype, and SMS. This change in customer behavior accelerated the already trending adoption of asynchronous channels and digital communications in the financial services industry. Financial Institutes (FIs) that will leverage these asynchronous communication channels to interact with their prospects and customers stand to acquire new customers and gain market share. So, the question is…

What Financial Institutes can do to adapt and take advantage of the Industry Change

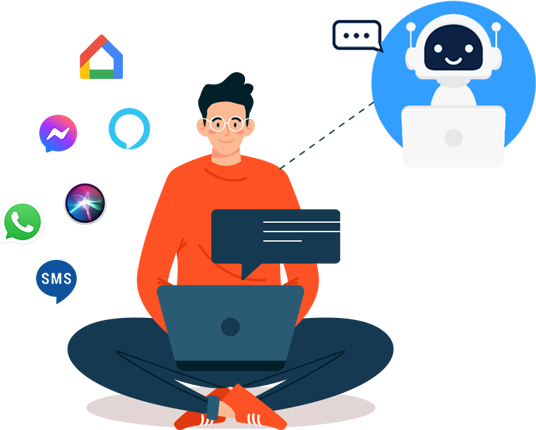

With the advancements in Artificial Intelligence (AI), particularly in Natural Language Processing (NLP) technology, it is now possible to deploy automated and scalable chatbots or Virtual Assistant solutions to interact with customers or prospects over social media channels. chatbots and Virtual Assistants powered by Artificial Intelligence can emulate human conversations and provide seamless yet secured interactions to end-users over these social media channels. The digital experience now has to move beyond the web & mobile, and financial services institutes have to think about giving an omnichannel experience including a conversational interface. Using the chatbot as a component in an omnichannel financial services strategy enables financial services institutes to expand their network. By utilizing these newer channels such as Facebook Messenger, WhatsApp, SMS, Amazon Alexa, Google Assistant, Siri, etc. for their prospective interactions.

With the help of a conversational AI, Financial Institutes can boost operational efficiency and “rightsizing” headcount based on evolving demand. Growing the top line through enhanced personalized targeting of offers and optimization of sales processes using chatbots/Virtual Agents. Lastly, by adding chatbot to their web page financial institutes can increase the average time spent on their web page which in turn has a direct effect on their SEO rankings. According to a recent Deloitte study, on an average, financial institutes improved their bounce rate by over 17% by deploying chatbots on their website. A report from Salesforce reveals that only 32% of companies in the finance industry currently use AI chatbots, and 37% are planning to start using them within 18 months.

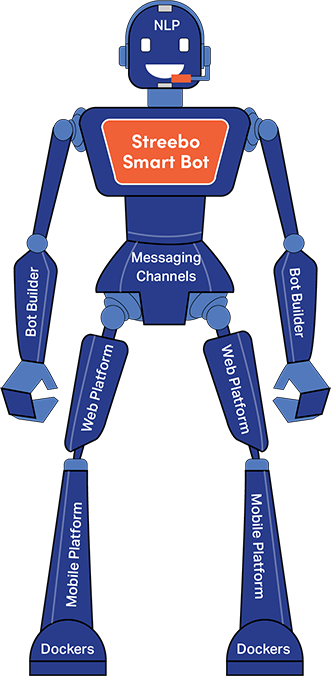

Streebo’s SMART® Bots

Streebo a leading AI and Digital Transformation Company has created an immensely powerful, intelligent, and Pre-trained AI Powered chatbot for Financial Services. These bots are guaranteed to be Trained until 99% Accurate and are pre-integrated with a wide variety of CRMs, Campaign Management Systems, Core Financial Systems Software and Payment Systems. Moreover, these Bots leverage leading Natural Language Processing (NLP) engines such as IBM Watson Assistant, Amazon Lex, and Google Dialogflow to extend these commerce experiences to a variety of social media platforms.

Streebo’s Financial Services chatbot for Marketing includes advanced reporting and analytics to gain better insights into acquired leads. That is why Streebo’s AI Powered Financial Services chatbot for prospects has a powerful ROI as it can improve lead conversion ratio and thus increase revenue for organizations deploying them.

Streebo’s Financial Services chatbot for Marketing includes advanced reporting and analytics to gain better insights into acquired leads. That is why Streebo’s AI Powered Financial Services chatbot for prospects has a powerful ROI as it can improve lead conversion ratio and thus increase revenue for organizations deploying them.

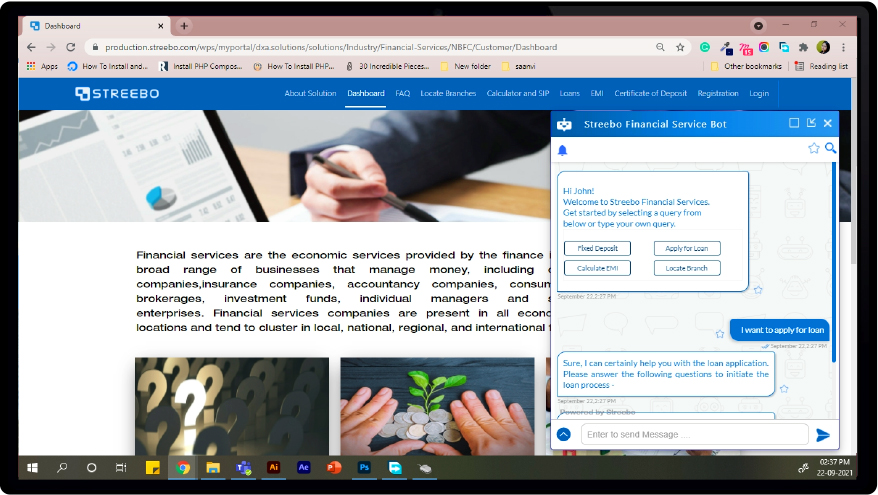

AI Powered Conversational Interface extended on Social Media Channels

WebApp

WebApp

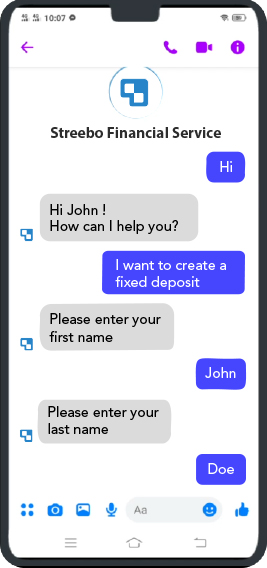

FB Messenger

FB Messenger

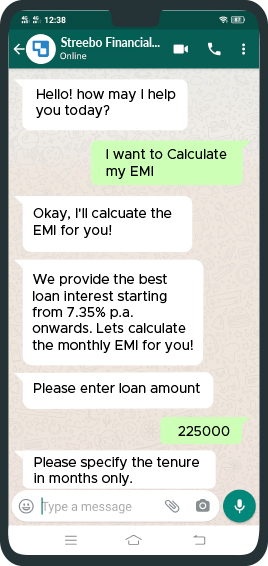

WhatsApp

WhatsApp

SMS

SMS

Business Benefits

A recent survey conducted by Statista revealed that 54% of responders find that chatbots are somewhat effective, and 33% consider marketing service chatbots very effective.

Hence by adopting Streebo’s SMART Conversational Marketing Bot across channels and making existing digital properties omnichannel will help financial institutes with the following benefits:

Hence by adopting Streebo’s SMART Conversational Marketing Bot across channels and making existing digital properties omnichannel will help financial institutes with the following benefits:

Increased Lead Generation and Qualification

Bot can leverage digital properties such as web & mobile app, and multiple digital channels such as WhatsApp, Facebook Messenger, SMS, among others to easily reach out to new and existing connections to generate leads and qualify those leads with relevant questions.

Improved SEO

The bot can engage users on a financial services’ website thus increasing the session time and significantly reducing bounce rate. This improves SEO page ranking and improves leads generation by an average of 23% thus even making the organizational online ad spending more effective.

Improved Agent Productivity

hatbot can help by gathering initial information and analysis about a service case before handing it off to an Agent. chatbot also handles customer service requests without human intervention which reduces the workload for an Agent.

Improved Customer Engagement

NLP-aided features and transactional agility will not only improve engagement by educating the customer but drive adoption amongst the dormant loan accounts, also sends important notifications and reminders.

Reduced Marketing Cost

Having a Financial Services chatbot for Marketing in your Team results in a significant decrease in marketing and promotion costs and a remarkable increase in the lead to conversion ratio.

Provide Financial Advice

chatbot can keep track of customer accounts, analyze their spending habits and recommend a budget or savings plan. In addition to dealing with all consumer requests, the chatbot can advise customers on their financial health.

Our AI Powered Financial Services chatbot Supports Below Mentioned Features

Omni-channel Solution

Omni-channel Solution Secured Architecture

Secured Architecture Multilingual Support for over 38 languages

Multilingual Support for over 38 languages Support for both voice and chat channels

Support for both voice and chat channels Advance Chat Analytics

Advance Chat Analytics 99% Accuracy

99% Accuracy Cross-sell & Upsell

Cross-sell & Upsell Improve SEO

Improve SEOStreebo’s Pre-Trained Financial Services chatbot for Customers and Prospects is Trained in the Following Marketing Operations

Answer FAQs (Frequently Asked Questions)

Answer FAQs (Frequently Asked Questions) Eligibility Checks of a Customer

Eligibility Checks of a Customer Browse Products Details

Browse Products Details Generate A Quote

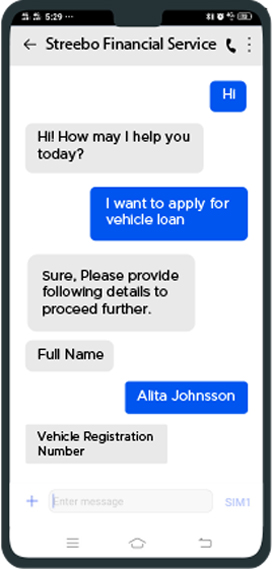

Generate A Quote Apply for a Loan

Apply for a Loan Create an Account

Create an Account Manage Service Request

Manage Service Request Update Profile

Update Profile Track status of Loan Account

Track status of Loan Account Interact with e-Commerce Platforms

Interact with e-Commerce Platforms Payment and Repayment Transactions

Payment and Repayment Transactions Customer Support and Query Resolution

Customer Support and Query Resolution Document Upload

Document Upload Feedbacks and Reviews

Feedbacks and Reviews Offers and Promotions

Offers and Promotions Rewards for Consumer

Rewards for ConsumerWhy Streebo’s Marketing chatbot for Financial Services?

Streebo in collaboration with leading technology organizations like IBM, RedHat, Google, Amazon, and HCL Technologies has created a powerful and secured solution.

Key differentiators of Streebo’s Pre-Trained and pre-integrated AI Powered Financial Services chatbot:

Key differentiators of Streebo’s Pre-Trained and pre-integrated AI Powered Financial Services chatbot:

SMART Bots with Built-in Domain Intelligence

SMART Bots with Built-in Domain IntelligenceStreebo’s Financial Services AI chatbots holds deep domain knowledge that can emulate business processes of various Financial Services.

Omnichannel Marketing

Omnichannel MarketingMarketing Bot can be deployed across social media channels such as FB Messenger, WhatsApp, WeChat, Skype, and even SMS. They can even handle voice channels such as IVR, Amazon Alexa, and Google Home Bots can even be deployed to existing digital properties such as the Website and Mobile App.

Pre-Integrated with Backends

Pre-Integrated with BackendsStreebo’s Financial Services Bot comes in pre-integrated with Financial Services Packaged Solutions from companies like IBM, Finacle, Oracle and SAP s among others.

Flexible Deployment

Flexible Deployment Streebo’s Pre-Trained Conversational AI for Financial Services can be deployed on-premise or on IBM Cloud, Microsoft Azure, Amazon AWS, or Google Cloud Platform.

99% Accuracy

99% AccuracyStreebo chatbot comes with Guaranteed Bot Intelligence Index* of 99% (*BII= No. of questions answered correctly/No. of relevant questions asked).

Advance Chat Analytics

Advance Chat AnalyticsStreebo’s analytics dashboard is developed to record and display systemic data, metrics, preferences, and trends which eventually help in monitoring user interactions, and can be adapted accordingly to give relevant responses and take business decisions.

Lower Maintenance

Lower MaintenanceStreebo’s Pre-Trained Financial Services chatbot is built using open standards such as Java and JavaScript. Streebo’s Pre-Tranied Bot is optional development-only tooling that the customer can choose or they can directly develop and manage it using standard IDEs such as Eclipse and Visual Studio that significantly lower app development costs as well as reduced support & maintenance costs.

Standard Architecture

Standard ArchitectureBuild on Natural Language Processing engines such as Amazon Lex, Google Dialog, and IBM Watson Assistant, Streebo’s Smart Bots are built on robust software. Application Platform technologies include support for standard J2EE engines including IBM WebSphere or JBOSS and can be deployed as standard Docker and Kubernetes packages on platforms such as RedHat OpenShift.

Pricing Options

MVP (Minimum Viable Product) bot includes:

3 transactional use cases

3 transactional use cases 1 backend integrations

1 backend integrations 50 FAQ’s

50 FAQ’s Channels – Web, Mobile App, 1 Social media channel such as WhatsApp/Facebook Messenger

Channels – Web, Mobile App, 1 Social media channel such as WhatsApp/Facebook MessengerCapex Option

You can choose to buy the MVP Bot. This option covers unlimited messages.

You can choose to buy the MVP Bot. This option covers unlimited messages.Opex Option

You can choose to Subscribe to the MVP Bot for a fixed monthly charge with no upfront setup fee.

You can choose to Subscribe to the MVP Bot for a fixed monthly charge with no upfront setup fee.Pay Per Usage

This is a conversation-based subscription and tied to the number of conversations & messages the bot handles.

This is a conversation-based subscription and tied to the number of conversations & messages the bot handles.