Delight your customers with Smart Digital Omni-Channel Banking Experience powered by Conversational AI

Request a Demo

Trusted By

Pandemic has changed the entire landscape of the Businesses including Banking. With businesses going online, foot falls in branches have drastically reduced whereas with rise of FinTech, customer expectations continue to rise! Also, as per global survey by Forbes, there is a 95% jump in customers that now prefer to use Digital Banking post pandemic. Further, research by TechCrunch states that the usage of social media platforms and asynchronous messaging channels including WhatsApp, Facebook Messenger, Skype, SMS have surged by 40%. This has led the traditional Banking Executives to think on how they can revamp their business process and meet their customers wherever they are with personalized and seamless banking experience. However, the biggest challenge for the LOB & IT is that with their limited tech budgets how can they roll-out Digital Omni-Channel Customer experiences? How can they manage these experiences across a variety of new voice and chat channels where the customers are spending their time.

Rolling out Smart Multi-Experiences leveraging Software Automation and Conversational AI

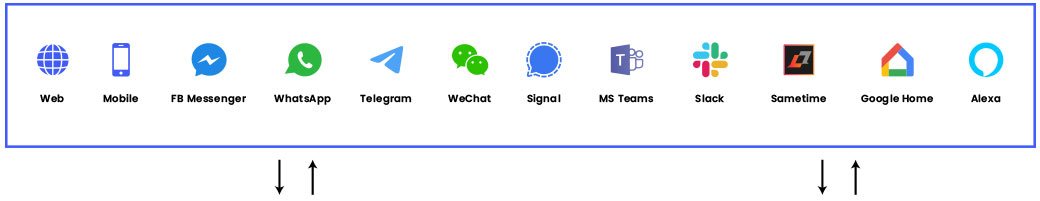

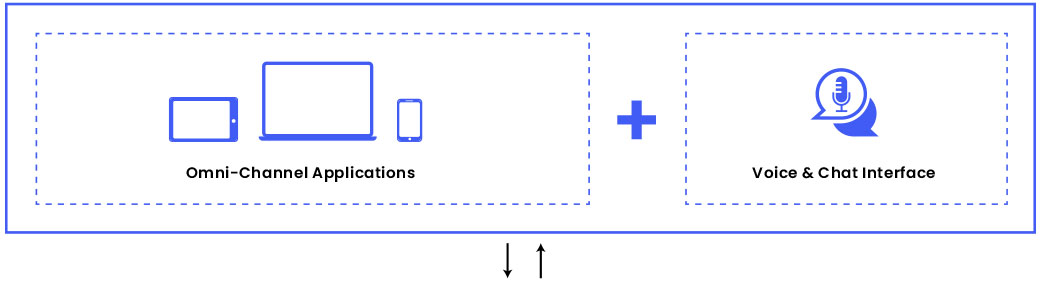

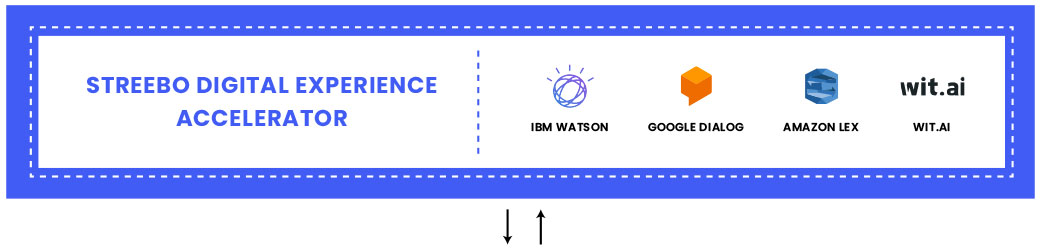

Leveraging the advancements in AI and Automation, Streebo altogether with large technology partners like IBM, Google and Amazon have solved some of these challenges. Streebo has rolled out, ready-to-go, packaged Customer facing Banking solution (COTS) that are truly omni-channel and can delight your customers. Powered by technology from the likes of IBM, RedHat, Google and Amazon these solutions are slick and intuitive and can be surfaced across Web, Mobile and various conversational Interfaces (both voice and chat).

Fully Integrated Digital Solutions

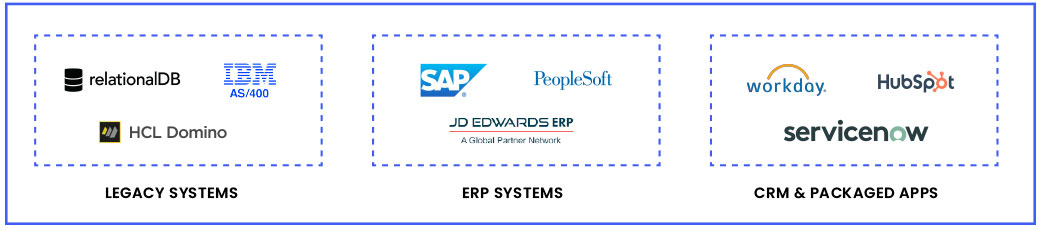

Powered by Streebo App Builder which is our low code no code tooling allows easy management of these solutions both by IT and LOB. Further, the “Point and Click” Interface in the App Builder, allows for easy integration with enterprise backends or to any core banking systems including SAP Core Banking, Finacle, Oracle Flex Cube, FIA, Temenos, among others. leveraging AI technology, Streebo even delivers application to various voice and chat channels including WhatsApp, Facebook Messenger, SMS, Signal, Telegram and allows to extend the same to voice devices such as Google Home, Amazon Alexa, Siri, among others. Thus, Streebo delivers a truly AI Powered omni-channel banking solution. The solution deployed across various channels will be a single code base thus making it easy to manage and update by IT as well as non-IT teams. Lastly, customer can choose to continue the usage of current web and mobile app(s) and simply leverage Streebo’s Conversational Interfaces to extend their current web and mobile experiences to Conversational Channels. Natural Language Processing technology from IBM or Google or Amazon they can easily make their current applications “Voice and Chat” activated.

Comprehensive Banking Solutions for you!

Retail Banking

Solution

Credit Card

Solution

Corporate Banking

Solution

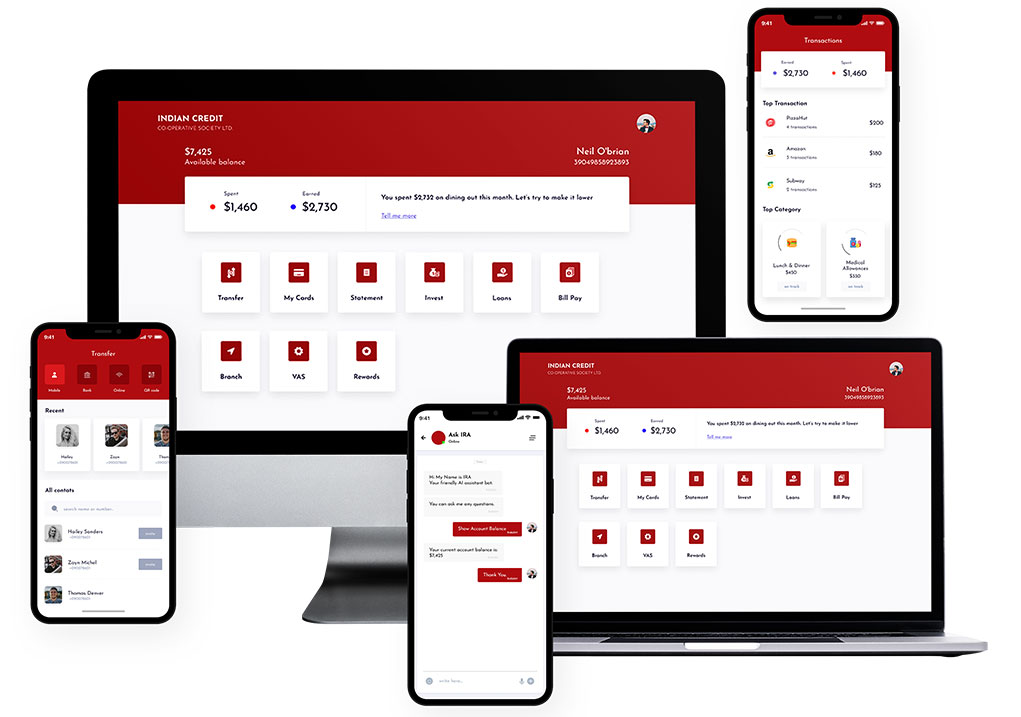

Retail Banking Solution

Deliver an exceptional banking experience across web, mobile, voice and chat interfaces to improve customer service and provide all banks functions at customers’ fingertips. Also, the Retail Banking Solution provides:

Solve FAQs (Frequently Asked Questions)

Solve FAQs (Frequently Asked Questions) Branch Locator

Branch Locator Check Balance

Check Balance Check last 5 Transactions

Check last 5 Transactions View Account Statement

View Account Statement Add Beneficiary

Add Beneficiary Fund Transfer

Fund Transfer Apply for Mortgage Loan

Apply for Mortgage Loan Block Credit/Debit Card

Block Credit/Debit Card Multi Factor Authentication

Multi Factor Authentication Open an Account

Open an Account Apply for a Credit Card

Apply for a Credit Card Apply for an FD

Apply for an FD Avail a Loan

Avail a Loan Personal Loan Calculator

Personal Loan Calculator Learning Center (Videos/Articles)

Learning Center (Videos/Articles) Talk to a Live Agent for assistance

Talk to a Live Agent for assistance Check/Download Statement

Check/Download Statement Check/Download FD Summary

Check/Download FD Summary Request a Cheque Book

Request a Cheque Book Find IFSC

Find IFSC Reset PIN

Reset PIN Bill Payment

Bill Payment Mobile Recharge

Mobile Recharge Track Loan Application

Track Loan Application Update KYC

Update KYC Submit Form 15G/15H

Submit Form 15G/15H Update Personal Details

Update Personal Details Value Added Services

Value Added Services  Rewards Point – Balance, History, Redemption, Queries

Rewards Point – Balance, History, Redemption, QueriesStreebo helped a Leading American Bank drive customer engagement with a Multi-channel Wealth Management Solution

Read More

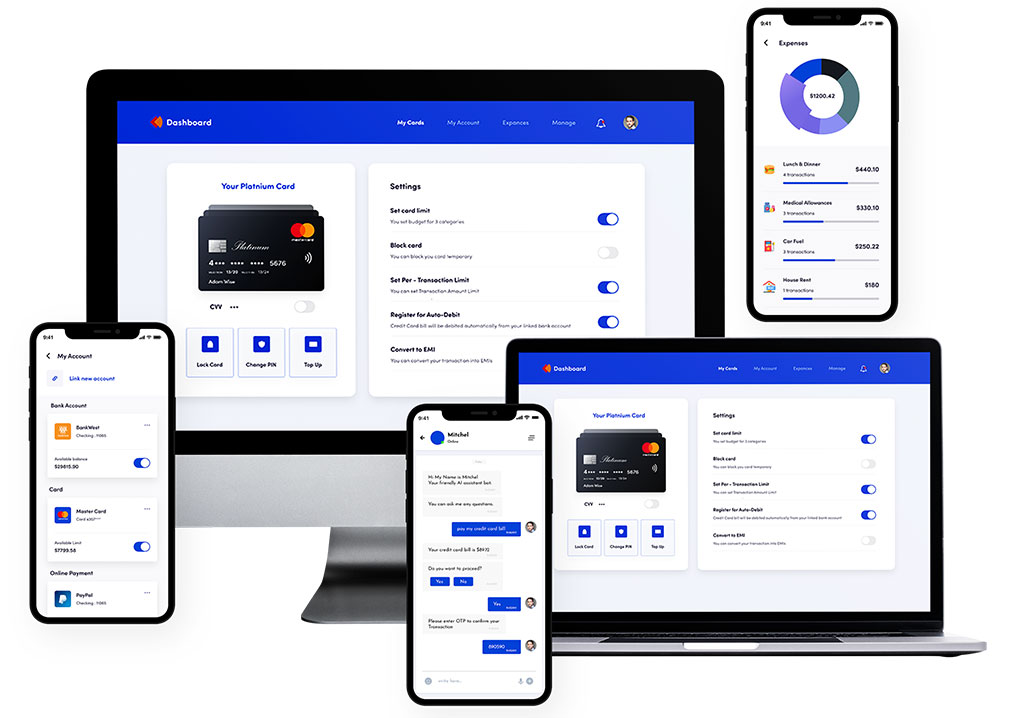

Credit Card Solution

Credit card omnichannel solution makes the life of the customer easier with self-service functions for proper management of credit cards. This can help customers with a range of services like:

FAQs (Frequently Asked Questions)

FAQs (Frequently Asked Questions) Branch Locator

Branch Locator Multi Factor Authentication

Multi Factor Authentication Talk to a Live Agent for assistance

Talk to a Live Agent for assistance Apply for a Credit Card

Apply for a Credit Card Tailored Search and Offers for a Credit Card

Tailored Search and Offers for a Credit Card Existing Credit Card Details

Existing Credit Card Details Summary of individual Credit Card

Summary of individual Credit Card Analytics on Spending History and Pattern

Analytics on Spending History and Pattern Membership Enrollment

Membership Enrollment Upgrade Membership

Upgrade Membership Refer a Friend

Refer a Friend Link to download relevant Apps

Link to download relevant Apps Integration with Payment Gateway for paying bills and/or making payments

Integration with Payment Gateway for paying bills and/or making paymentsDiscuss your goals to determine the best path forward for your business

- Trained until 99% Accurate

- Pay-Per-Usage

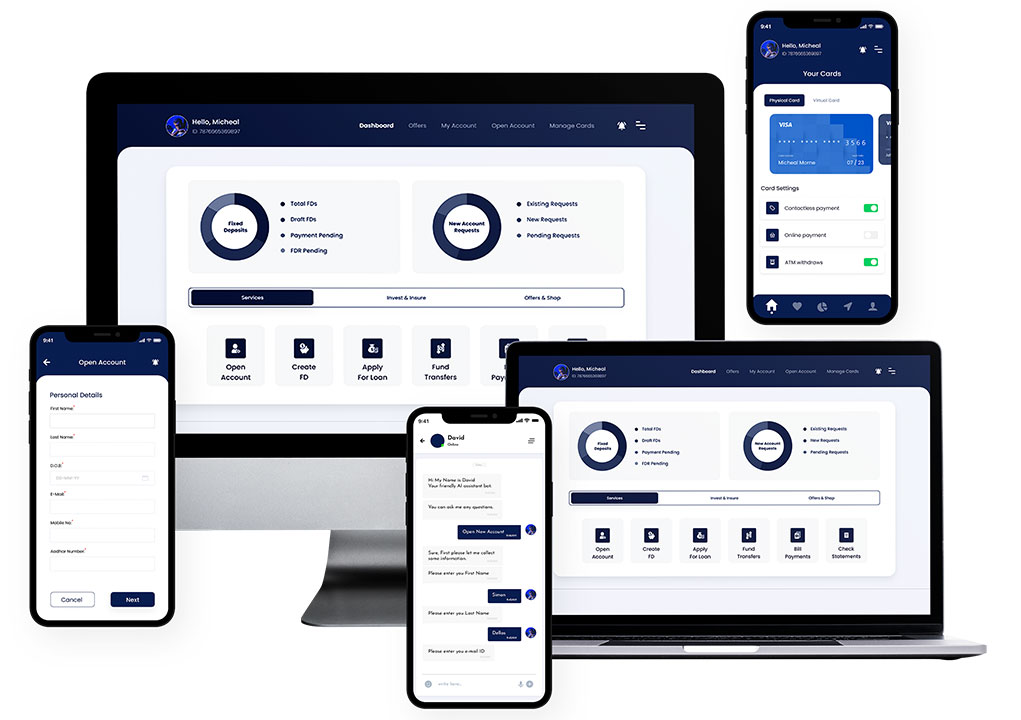

Corporate Banking – Customer & Agent Facing

Any bank has relationship managers who interact with customers and help in cross-sell and up-sell opportunities. An omnichannel solution would help bank advisors work more efficiently and help in enhanced customer service. Streebo’s omnichannel bank advisor solution has modules for:

FAQs (Frequently Asked Questions)

FAQs (Frequently Asked Questions) Branch Locator

Branch Locator Check Account Summary

Check Account Summary Check Balance and Clearing Status

Check Balance and Clearing Status Check Account Statement

Check Account Statement Display Tailored Offers

Display Tailored Offers Check Transaction History

Check Transaction History Foreign Exchange

Foreign Exchange Payroll Dashboard

Payroll Dashboard Payroll Update

Payroll Update Learning Center (Videos/Articles)

Learning Center (Videos/Articles) Multi Factor Authentication

Multi Factor Authentication Offerings by the Bank

Offerings by the Bank Services by the Bank

Services by the Bank Download Forms

Download Forms Link to download relevant Apps

Link to download relevant Apps Filter customers to check individual customer details

Filter customers to check individual customer details Find IFSC

Find IFSC Check customer specific offers and reminders if any

Check customer specific offers and reminders if any Agent Dashboard

Agent Dashboard Open an account on behalf of customers

Open an account on behalf of customers Talk to a Live Agent for assistance

Talk to a Live Agent for assistance Avail the Offering/Services offered by the Bank. Use registered credentials

Avail the Offering/Services offered by the Bank. Use registered credentialsMedium sized co-operative credit society modernized its Advisor and Member Applications with Streebo’s mobile banking expertise

Read More

Key Features & Differentiators

Streebo in collaboration with its technology partner deploys cognitive intelligent omnichannel solution which can emulate your business processes.

Streebo’s Omnichannel Banking solutions can be deployed across web, mobile app, social media channels including WhatsApp, Facebook Messenger, SMS, Signal, We Chat, Viber, Google Chat, Telegram, among others. This solution can further be deployed on voice channels like Google Home, Amazon Alexa, Siri and even IVR.

Streebo’s Omnichannel Banking Solution are built on top of robust infrastructure from top technology providers such as IBM, Red Hat, Google and Amazon. Hence, they have a tight security and scalable infrastructure in place.

As the Omnichannel Banking application is built with a Single Code Base for all the Digital Assets and Automation Tool – the application can be updated and deployed in one single click, thus saving the cost of managing individual application across various platforms.

Streebo’s Banking Solution can be deployed on-premise or on IBM Cloud, Microsoft Azure, Amazon AWS or Google Cloud Platform.

Streebo’s Banking Solution is built using a low code no code tooling to assemble, integrate and manage the solution. Thus, making it easy for both Line of Business and people in IT to assemble, integrate and manage the solution moving forward.

Streebo’s AI Powered Banking Solution is NLP Agnostic – be it IBM Watson Assistant, Google Dialog Flow, Amazon Lex based upon customer’s preference.

Streebo’s analytics dashboard is developed to record and display systemic data, metrics, preferences, and trends which eventually help in monitoring user interactions, and can be adapted accordingly to give relevant responses and take business decisions.

Pricing Options

Capex Option

You can choose to buy the Omnichannel Banking Solution.

You can choose to buy the Omnichannel Banking Solution.Opex Option

You can choose to Subscribe to the Omnichannel Banking Solution at a monthly charge with no upfront setup fee.

You can choose to Subscribe to the Omnichannel Banking Solution at a monthly charge with no upfront setup fee.Pay Per Usage

You can get the Conversational Interface “add-on” for your existing Web and Mobile app and simply pay per usage of voice and chat channels.

You can get the Conversational Interface “add-on” for your existing Web and Mobile app and simply pay per usage of voice and chat channels.