#Smart GenAI For Insurance

Check out Demo

Generative AI Powered Smart Bot Solution for Insurance Industry

Omni-Channel Bots – Deploy on Chat, Voice, Email, Instagram, Facebook, WhatsApp and Even SMSCheck out Demo

Trusted by hundreds of leading companies

×

Check out the Enterprise Grade AI Agent Powered by Gen AI. No Setup Fees.

Insurance Made Easy: Smart Virtual Assistants Powered By Generative AI

In today’s uncertain times, insurance is no longer just about life and health; people are

now insuring various valuable assets like properties, travel, automobiles and more. This

shift is evident in the 35% year-over-year increase in customer inquiries

to insurance companies according to Forrester’s report. Understanding the intricacies of

policy documents and getting relevant answers to insurance queries can be a daunting task

for customers. They often hesitate to repeatedly reach out to agents and may lose interest

in purchasing insurance if they don’t fully understand it.

What if insurance companies provide a 24/7 companion that allows customers

to ask all their insurance questions at any time and receive instant responses? This

challenge underscores the need for a human+AI approach. Generative AI and

Large Language Models (LLMs) are at the forefront of this transformation, making insurance

processes more efficient. They can reduce claims processing time by 25% and generate

quick responses with an exceptional accuracy rate according to Statista’s

report. These technologies are simplifying insurance and improving customer

experiences, setting the stage for a more dynamic and customer-focused industry

future.

Let’s explore the potential benefits that this cutting-edge technology can offer to your insurance company.

Let’s explore the potential benefits that this cutting-edge technology can offer to your insurance company.

Pre-trained AI Agent and Chatbot

Uncover How Top Insurance Companies Have Journeyed towards EX-cellence?

The insurance industry has undergone a significant transformation by incorporating

Generative Artificial Intelligence (AI) and Large Language Models (LLMs). In

the traditional insurance landscape, customers had to rely on policy advisors or agents to

understand their policies, and the process of filing claims could be complex, leading to

frustrating experiences. Especially during health emergencies, seeking claim reimbursements

through customer service channels was often a source of annoyance.

However, the rise of automation has brought about a profound shift. Slow responses to

customer inquiries can now result in customer attrition. Today’s consumers are increasingly

drawn to insurers that adopt a forward-thinking approach and utilize Generative AI.

In this new automated environment, customers receive instant responses to their

insurance queries and experience accelerated claims processing, among other

benefits.

Now adoption of AI Agent and Chatbot is also rising due to improved capabilities, Let’s understand this –

Conclusion

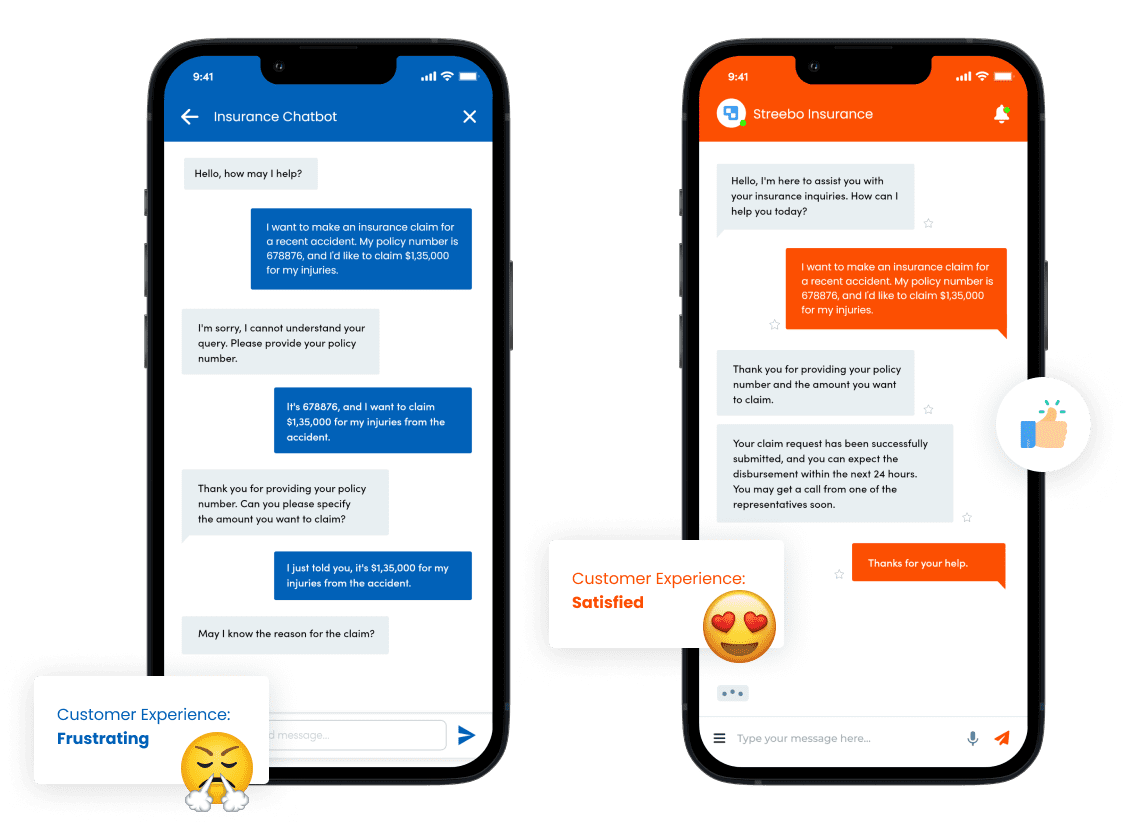

In the “Old World” conversation, the AI Agent and Chatbot struggles to process multiple pieces of information in a single customer response, leading to repetitive queries and a frustrating customer experience. In the “New World” conversation, the generative AI-powered AI Agent and Chatbot efficiently understands and processes all the information provided by the customer, resulting in a smooth and satisfying interaction.

In the “Old World” conversation, the AI Agent and Chatbot struggles to process multiple pieces of information in a single customer response, leading to repetitive queries and a frustrating customer experience. In the “New World” conversation, the generative AI-powered AI Agent and Chatbot efficiently understands and processes all the information provided by the customer, resulting in a smooth and satisfying interaction.

Generative AI in Insurance: Use Cases and Challenges

Streebo’s Generative AI Powered Virtual Assistants for Insurance – Smart Solutions for Smart Enterprise

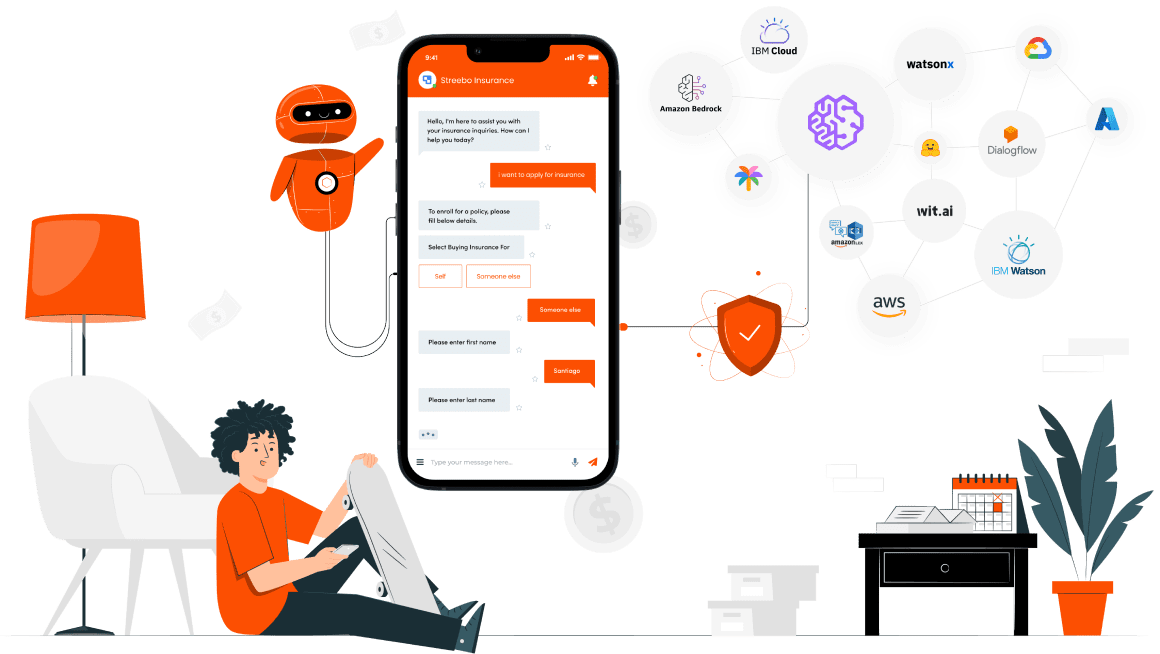

Streebo, a leading company in Digital Transformation and Artificial Intelligence, has

developed a suite of pre-trained AI Agent and Chatbot solutions tailored specifically for the

insurance sector. These solutions encompass a wide spectrum of insurance types,

offering versatility to address diverse insurance categories comprehensively.

Our plug-and-play AI Agent and Chatbot architecture offers insurance companies the flexibility to select technology solutions that align seamlessly with their strategic objectives. Leveraging a powerful technology stack, we harness the capabilities of industry-leading Natural Language Processing (NLP) engines such as IBM Watson, Microsoft Copilot Studio, Power Virtual Agents, Google DialogFlow, Amazon Lex, and more. In a progressive move, we have integrated cutting-edge Generative AI platforms and Large Language Models (LLMs) like GPT on Microsoft Azure, IBM Watsonx, Google Gemini, AWS SageMaker, and BedRock.

Our plug-and-play AI Agent and Chatbot architecture offers insurance companies the flexibility to select technology solutions that align seamlessly with their strategic objectives. Leveraging a powerful technology stack, we harness the capabilities of industry-leading Natural Language Processing (NLP) engines such as IBM Watson, Microsoft Copilot Studio, Power Virtual Agents, Google DialogFlow, Amazon Lex, and more. In a progressive move, we have integrated cutting-edge Generative AI platforms and Large Language Models (LLMs) like GPT on Microsoft Azure, IBM Watsonx, Google Gemini, AWS SageMaker, and BedRock.

To further enhance functionality, our AI Agent and Chatbot solutions seamlessly integrate with LLMs

available on open-source platforms, such as HuggingFace. Our comprehensive

insurance AI Agent and Chatbot solution comes pre-integrated with a host of fundamental components widely

used in the insurance industry. These include compatibility with most ERP and

Insurance Management Systems, CRM capabilities for efficient lead management, OCR

technology for document verification, and a sophisticated Quote Generation

engine.

Remarkably intuitive and highly intelligent, our chatbots are adaptable to multiple communication channels, including social media platforms (WhatsApp, Facebook Messenger ,Instagram, Email, SMS, and voice-enabled platforms such as Google Home and Amazon Alexa. This adaptability ensures accessibility and engagement across a wide array of client touchpoints.

Remarkably intuitive and highly intelligent, our chatbots are adaptable to multiple communication channels, including social media platforms (WhatsApp, Facebook Messenger ,Instagram, Email, SMS, and voice-enabled platforms such as Google Home and Amazon Alexa. This adaptability ensures accessibility and engagement across a wide array of client touchpoints.

Our pre-trained Insurance Bots are trained in the following Operations

FAQs (Frequently Asked Questions)

FAQs (Frequently Asked Questions) Learning Center (Videos/Articles)

Learning Center (Videos/Articles) Download Forums

Download Forums Login/Registration

Login/Registration Quote Management

Quote Management Online Payment

Online Payment Policy Service (View, Download)

Policy Service (View, Download) Order Management

Order Management Product Catalogue

Product Catalogue Profile Management

Profile Management Branch Locator

Branch Locator Claim Management

Claim Management Newsletters

Newsletters Contact Us/Customer Support (Live Agent)

Contact Us/Customer Support (Live Agent)How Life Insurance chatbots are redefining Customer Experience with Generative AI Excellence?

Top Use Cases of Our chatbots for Insurance Sector with Generative AI Capabilities

Customer Assistance

Customer AssistanceOur chatbots offer around-the-clock customer support, addressing policy-related inquiries and providing assistance with claims.

Policy Management

Policy ManagementCustomers can leverage these ChatGPT-like chatbots to make policy adjustments, such as updating personal information or modifying coverage.

Policy Recommendations

Policy RecommendationsThese Generative AI chatbots are adept at analyzing user input and data to make tailored insurance policy recommendations.

Risk Evaluation

Risk EvaluationThey employ AI capabilities to assess risks and make customers aware.

Regulatory Guidance

Regulatory GuidanceThey help customers comprehend and adhere to insurance regulations, fostering compliance.

Personalized Engagement

Personalized EngagementOur Conversational interfaces deliver personalized policy suggestions and updates based on customer data.

Claims Streamlining

Claims StreamliningThey play a crucial role in simplifying the claims process by efficiently gathering information, delivering real-time updates, and guiding customers through each step.

Underwriting Support

Underwriting SupportThey assist underwriters by effectively organizing and extracting pertinent information from insurance applications.

Emergency Aid

Emergency AidIn critical situations, they offer guidance on filing claims and connecting with emergency services.

Feedback Collection

Feedback CollectionOur chatbots collect valuable customer feedback and conduct surveys to gather actionable insights.

Do you Know?

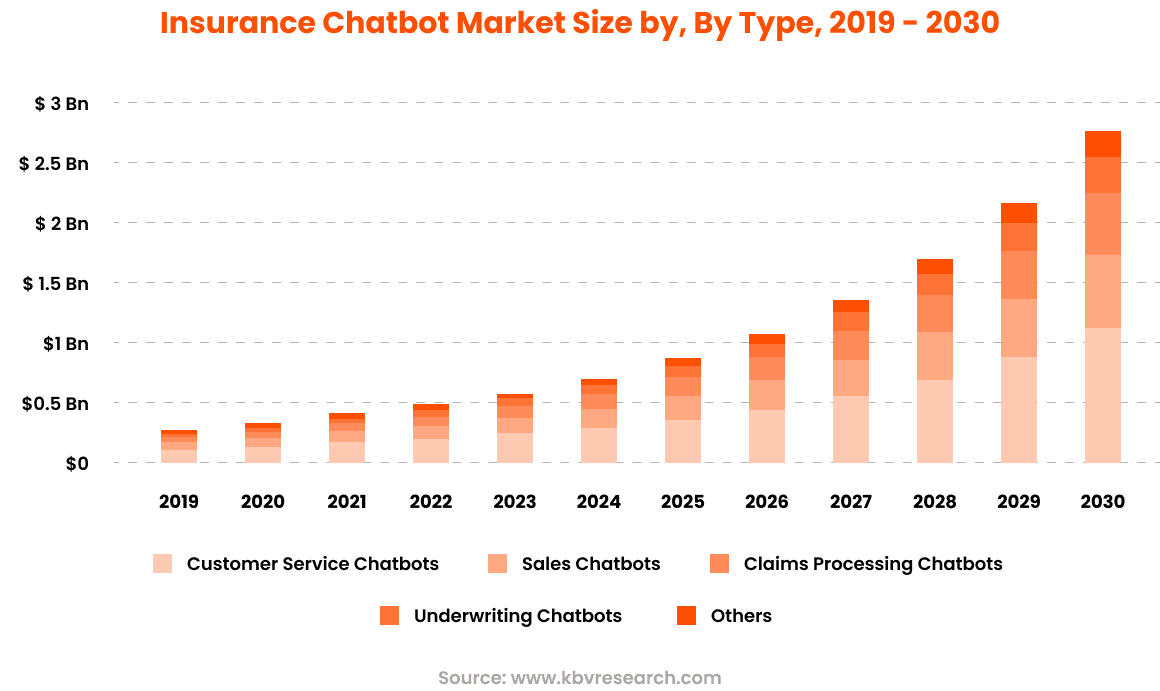

- The Global Insurance AI Agent and Chatbot Market size is expected to reach $2.6 billion by 2030, rising at a market growth of 24.9% CAGR during the forecast period.

- For Instance, Lemonade, an American insurance company, boasts its policy chatbot, Maya, that can onboard customers in just 90 seconds, a stark contrast to the typical 10-minute process with other methods. Additionally, Lemonade’s claims chatbot, Jim, resolves claims in seconds, outperforming traditional methods who take days or even months to settle home insurance claims.

Business Benefits of Generative AI Based Virtual Assistants for Insurance

- According to a study by Gartner, Gen AI-driven

chatbots can reduce customer support costs by up to 30%

while improving efficiency and customer satisfaction

– Gartner

- Research by Salesforce reveals that companies using

Generative AI for customer engagement see an average revenue

increase of 25% and a 35% improvement in customer

satisfaction

–

Salesforce

- A report by McKinsey suggests that Generative

AI-driven automation can increase business productivity by up to

20%

– McKinsey

- A survey conducted by Zendesk found that businesses

providing 24/7 support see a 3.3% higher customer retention

rate than those with limited support

hours

– Zendesk

How is Generative AI revolutionizing customer experience in General Health Insurance through smart chatbots?

Key Features of Streebo’s Pre-Trained Smart chatbots for Insurance

Built-in Domain Intelligence

Built-in Domain IntelligenceOur Generative AI powered AI Agent and Chatbot comes pre-trained with deep domain intelligence specific to the insurance sector. This inherent understanding allows it to effectively emulate and assist with complex insurance-related processes and workflows.

Omni-Channel Experience

Omni-Channel ExperienceStreebo’s Insurance bot is designed for deployment across a wide spectrum of communication channels. It extends its reach to social media platforms such as WhatsApp, Facebook Messenger, SMS, Telegram, Signal, WeChat, Skype, and voice channels like IVR, Amazon Alexa, and Google Home. It can also be deployed on web and mobile platforms, ensuring a unified and consistent customer experience.

Pre-Integration with Backends

Pre-Integration with BackendsThe AI Agent and Chatbot seamlessly integrates with commonly used ERP/Insurance Management Systems (e.g., Applied Epic, AMS 360, Jenesis) and CRMs (e.g., Salesforce, SugarCRM). This pre-integration reduces implementation complexities and accelerates deployment.

Access to Unstructured Data

Access to Unstructured DataOur Pre-Trained Smart AI Agent and Chatbot possesses the capability to access and harness unstructured data effectively. This feature empowers insurers to leverage unstructured data sources, thereby enhancing their data-driven decision-making processes.

Data Classification

Data ClassificationOur AI Agent and Chatbot offers advanced data classification functionality, enabling the efficient organization and categorization of data. In the insurance sector, this translates into streamlined data management and improved data quality.

Multilingual Support

Multilingual SupportOur chatbots are proficient in over 38 languages, ensuring effective communication with diverse audiences by comprehending context, dialect, tone, and subtleties with precision.

Flexible Deployment Models

Flexible Deployment ModelsWhether deployed on-premises or on leading cloud platforms like IBM Cloud, Microsoft Azure, Amazon AWS, or Google Cloud Platform, our AI Agent and Chatbot offers deployment flexibility to align with your organization’s specific requirements.

Live Agent Support

Live Agent SupportIn scenarios that require human intervention, our AI Agent and Chatbot seamlessly integrates with live agent support. This feature ensures a smooth transition between automated and personalized assistance, enhancing the overall customer experience.

Multimodal Capabilities

Multimodal CapabilitiesThis feature allows the AI Agent and Chatbot to communicate with users through various modes, including text, voice, and visuals. It can also integrate with messaging apps for a seamless user experience.

Security

SecuritySecurity features ensure the protection of user data and privacy. This includes data encryption, identity verification, compliance with regulations, and more to address security vulnerabilities.

Pricing Options

Pay Per Usage

(per message/token based pricing)

Starts at $99/month for multi-tenant SAAS or $999/month for single-tenant (Private Hosting)

Starts at $99/month for multi-tenant SAAS or $999/month for single-tenant (Private Hosting)

Per User Pricing

Starting @ 1$/user – unlimited chats

Starting @ 1$/user – unlimited chats

Single-Tenant Ready-to-Go Pre-Trained Smart AI Agent: Customer can choose to Buy the AI Agent Solution (contact sales for pricing)

Are you ready to harness the power of NLP + Generative AI solution for your insurance company?

Take the first step today and get our exclusive offer: a 30-day free trial, with absolutely zero setup fees.

Don’t miss out on this risk-free opportunity to transform your business. Contact us now to get started and give your business the edge it deserves!