#Smart GenAI For Banking

Check out Demo

Generative AI-Powered AI Agent and Chatbot for Banking: Transform Banking with AI-Driven Customer Engagement

Enhance Security and Trust with Intelligent Gen AI Powered Intelligent Banking SolutionsCheck out Demo

Trusted by hundreds of leading companies

×

Check out the Enterprise Grade AI Agent Powered by Gen AI. No Setup Fees.

Generative AI’s Role

in Transforming Global

Banking Operations

Banking, an integral part of daily life, has seen a transformation with the advent of online

services, from internet banking to mobile apps, and now, AI-driven chatbots.

The pervasive use of digital channels for everyday financial activities, from paying bills to conducting complex transactions, reflects this transformation. Fintechs and neobanks have set new standards by putting customers in control of their finances. As Statista predicts, the number of active online banking users worldwide will reach one billion by 2024, underscoring the urgency for traditional banks to embrace digital technologies and models.

The pervasive use of digital channels for everyday financial activities, from paying bills to conducting complex transactions, reflects this transformation. Fintechs and neobanks have set new standards by putting customers in control of their finances. As Statista predicts, the number of active online banking users worldwide will reach one billion by 2024, underscoring the urgency for traditional banks to embrace digital technologies and models.

Customers are no longer limited to online banking; they demand a comprehensive, seamless, and

personalized banking experience across multiple touchpoints. This evolution extends beyond the realm

of traditional online banking and includes services such as mobile banking, social media

interactions, and even voice-activated assistants. Customers seek convenience, accessibility, and

immediate assistance.

So, the major point of concern for the banking executives is…

So, the major point of concern for the banking executives is…

How can a Banking

Industry meet the changing

customer demands?

The advent of cutting-edge technology, particularly Artificial Intelligence (AI) and its advancements

in Natural Language Processing (NLP) and Large Language Models (LLMs), has paved the way for

the development of intelligent Generative AI-Powered Virtual Assistants. These Generative AI-driven

solutions are poised to revolutionize customer interactions within the banking sector. In contrast to

conventional chatbots that rely on predefined responses, Generative AI-powered chatbots facilitate

dynamic and individualized interactions.

They incorporate functionalities like aiding with email inquiries, analyzing sentiments, delivering accurate responses, and recognizing both images and voices, resulting in higher rates of AI Agent and Chatbot adoption. By efficiently handling customer queries, they not only drive down operational costs but also open up opportunities to maximize revenue generation, ultimately positioning banks to meet evolving customer demands and remain competitive in an ever-dynamic financial landscape.

They incorporate functionalities like aiding with email inquiries, analyzing sentiments, delivering accurate responses, and recognizing both images and voices, resulting in higher rates of AI Agent and Chatbot adoption. By efficiently handling customer queries, they not only drive down operational costs but also open up opportunities to maximize revenue generation, ultimately positioning banks to meet evolving customer demands and remain competitive in an ever-dynamic financial landscape.

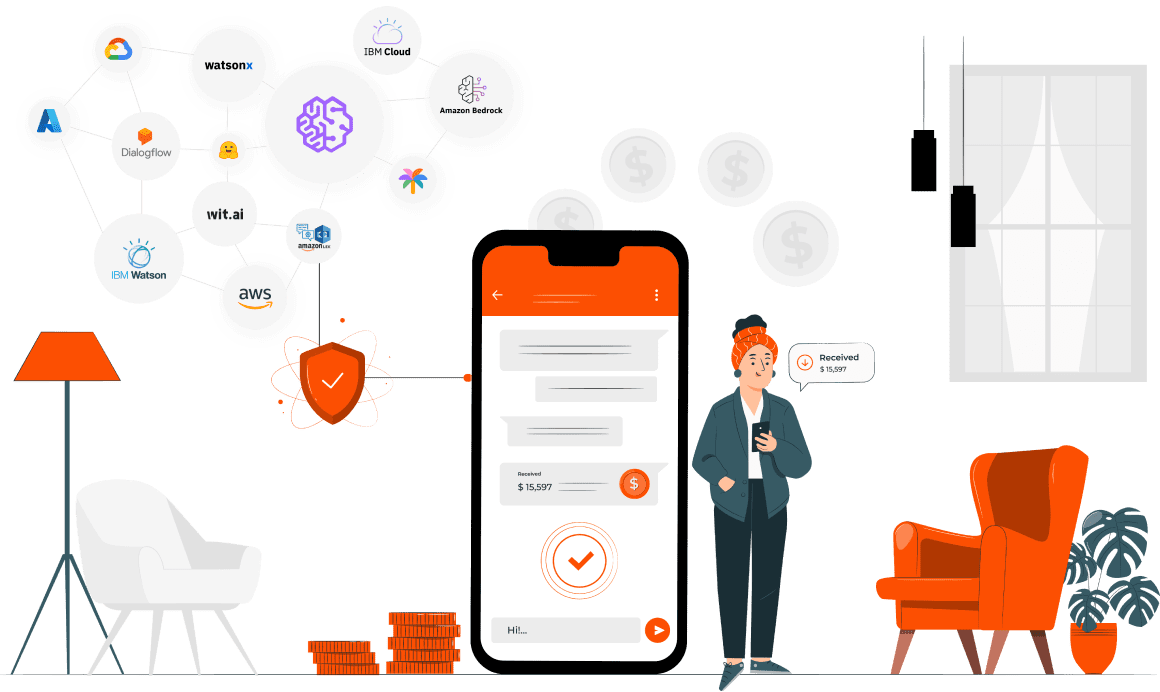

Streebo, a leading AI and Digital Transformation Company, has unveiled an intelligent AI Powered

Pre-trained Banking AI Agent and Chatbot capable of managing a diverse array of banking tasks, from Fund

Transfers to New Account Openings and Loan Applications. Our advanced AI Agent and Chatbot framework offers

enterprises the flexibility to select the most suitable NLP, LLM, and cutting-edge AI technologies for

their unique business requirements. Our smart AI Agent and Chatbot solution leverages state-of-the-art Generative

AI technologies like GPT on Microsoft Azure, Google Gemini, Watson X, AWS SageMaker, and others.

Additionally, open-source repositories such as HuggingFace, Cohere, and similar platforms contribute

to this innovative trend by providing a wide array of features and valuable insights.

Our smart chatbots for banks are backed by world-class NLP engines such as IBM Watson Assistant,

Microsoft Copilot Studio, Power Virtual Agents, Google Dialog Flow, and Amazon Lex to deliver accurate and safe interactions.

Our Conversational AI for Customer Service extends the digital experience to various social media

platforms like WhatsApp, Facebook Messenger, SMS, WeChat, Google Chat, Signal, SMS, Email among

others & can further be extended to voice channels including Google Home, Amazon Alexa. through

natural language interactions.

Our intelligent chatbots are built on robust enterprise-grade cloud platforms including AWS, GCP, IBM Cloud, and Azure. These powerful AI Agent and Chatbot solutions are pre-integrated with the core-banking system including Finacle, SAP Core Banking, Oracle Flex Cube, among others. Furthermore, our Banking Bots incorporate advanced analytics and reporting capabilities, enabling banks to gain insights into customer usage patterns. This valuable data aids in enhancing sales strategies, ultimately leading to increased ROI for the organizations that deploy these chatbots.

Our intelligent chatbots are built on robust enterprise-grade cloud platforms including AWS, GCP, IBM Cloud, and Azure. These powerful AI Agent and Chatbot solutions are pre-integrated with the core-banking system including Finacle, SAP Core Banking, Oracle Flex Cube, among others. Furthermore, our Banking Bots incorporate advanced analytics and reporting capabilities, enabling banks to gain insights into customer usage patterns. This valuable data aids in enhancing sales strategies, ultimately leading to increased ROI for the organizations that deploy these chatbots.

Pre-trained AI Agent and Chatbot for Banking Sectors

Check out the Enterprise Grade AI Agent available for the Industry.

Zero setup costs and no commitments. Secure your spot now!- Trained until 99% Accurate

- Pay-Per-Usage

Do you Know?

- As per the National Market and Statistical Consortium (NMSC), the worldwide market for chatbots in the banking, financial services, and insurance (BFSI) sector was appraised at 586 million U.S. dollars in 2019. Projections indicate that by 2030, this market is anticipated to reach a substantial value of 6.83 billion U.S. dollars.

- According to EY, by 2030, chatbots will have become such an integral part of the banking process that customers will struggle to distinguish whether they are engaging with a bot or a human.

Unlocking the Potential of Our Generative AI powered AI Agent and Chatbot for Banking Sector

01 Customer Support and Engagement

- Handling routine customer inquiries.

- Providing account balance updates.

- Assisting with transaction history queries.

- Addressing frequently asked questions.

02 Account Management

- Facilitating fund transfers between accounts.

- Helping users open new accounts.

- Assisting with account closures.

- Supporting account statement requests.

03 Loan and Credit Services

- Assisting with loan applications.

- Calculating loan eligibility.

- Providing information on interest rates.

- Offering guidance on improving credit scores.

04 Investment and Financial Planning

- Offering investment advice.

- Providing portfolio insights.

- Assisting with stock market inquiries.

- Offering retirement planning guidance.

05 Fraud Detection and Security

- Monitoring unusual account activity.

- Guiding users on security best practices.

- Assisting with card blocking and replacements.

06 Sales and Product Recommendations

- Suggesting suitable financial products.

- Promoting credit card offers.

- Cross-selling and upselling banking services.

- Providing Personalized financial advice based on user data.

Experience a Day with Banking chatbot! Check Out Our Blog to follow a day in the life of a bank using our AI Agent and Chatbot across channels. Don’t miss out!

Business Benefits of

Generative AI powered Banking

Conversational Interfaces

By leveraging Streebo’s Generative AI Powered Banking Bots – banks can avail below mentioned benefits:

$13.9 Billion is the project growth for the digital banking platform market size by 2026.

– Source: MarketandMarkets

$13.9 Billion is the project growth for the digital banking platform market size by 2026.

– Source: MarketandMarkets

Reduced Operational Costs

Reduced Operational Costs

Managing all customer inquiries through the AI Agent and Chatbot itself can lead to substantial cost savings, potentially boosting conversion rates by up to 15%.

Enhanced Sales Performance

Enhanced Sales Performance

Leveraging analytics for strategic adjustments based on customer preferences has the potential to revitalize sales strategies and drive increased revenue. This has yielded an average sales increase of 10% as per Forrester’s report.

Elevated Customer Satisfaction

Elevated Customer Satisfaction

By offering round-the-clock support and accommodating customer inquiries through their preferred communication channels, overall engagement and customer satisfaction levels are significantly improved.

Global banks are experimenting with Generative AI inside their walls

Morgan Stanley, the multinational investment bank, is launching an advanced AI Agent and Chatbot powered by OpenAI. It aims to assist its 16,000 financial advisors in harnessing the bank’s vast research and data library. This AI Agent and Chatbot provides instant answers sourced exclusively from MSWM content, streamlining financial advisory services.

– Morgan Stanley

Morgan Stanley, the multinational investment bank, is launching an advanced AI Agent and Chatbot powered by OpenAI. It aims to assist its 16,000 financial advisors in harnessing the bank’s vast research and data library. This AI Agent and Chatbot provides instant answers sourced exclusively from MSWM content, streamlining financial advisory services.

– Morgan Stanley

Banking chatbot: Elevating with Generative AI and NLP Excellence

Some of the Key differentiators of Streebo’s Pre-Trained and pre-integrated banking bot Powered by Generative AI & World-Class NLPs are-

Power of Generative AI

Power of Generative AI

We have highly intelligent, pretrained chatbots equipped with the ability to access unstructured banking data and emulate intricate processes within the Banking and Financial sectors.

Seamless Omnichannel Experience

Seamless Omnichannel Experience

Our Generative AI-Powered Banking chatbots offer an omnichannel experience, extending their reach across various social media platforms including FB Messenger, WhatsApp, Signal, WeChat, Instagram, Email and even SMS. These versatile bots seamlessly integrate with existing digital properties such as websites and mobile apps.

Streamlined Backend Integrationt

Streamlined Backend Integrationt

Our Generative AI powered AI Agent and Chatbot arrives pre-integrated with essential core banking systems, including SAP Core Banking, Oracle Flexcube, and Finacle, ensuring a smooth and efficient connection to the financial infrastructure.

Flexible Deployment Solutions

Flexible Deployment Solutions

It provides flexibility in deployment, allowing placement on-premises or on leading cloud platforms such as IBM Cloud, Microsoft Azure, Amazon AWS, or Google Cloud Platform, catering to diverse operational needs.

Advanced Chat Analytics

Advanced Chat Analytics

Our advanced chat analytics dashboard is designed to capture and display systemic data, metrics, user preferences, and emerging trends. This analytical capability enables real-time monitoring of user interactions and facilitates data-driven decision-making and personalized responses.

Multi-modal Capabilities

Multi-modal Capabilities

Our AI-powered banking AI Agent and Chatbot excels in multi-modal capabilities, seamlessly handling tasks such as analyzing bank statements, interpreting visual data, or providing voice-based account updates. It ensures a comprehensive and versatile user experience across different channels, enhancing customer interactions.

Data Classification

Data Classification

Our chatbots excel in data classification, ensuring the secure handling and categorization of sensitive information, such as banking statements and personal data, in compliance with industry regulations and privacy standards.

Live Agent Support

Live Agent Support

Our chatbots seamlessly integrate live agent support when necessary, ensuring a smooth transition from automated interactions to human assistance. This feature enhances customer satisfaction by providing real-time expert assistance when needed.

Global Accessibility and Multilingual Support

Global Accessibility and Multilingual Support

Our Customer Service Banking chatbots are equipped to support over 38 languages, making them accessible to a diverse global audience.

Power of Generative AI

Power of Generative AI

We have highly intelligent, pretrained chatbots equipped with the ability to access unstructured banking data and emulate intricate processes within the Banking and Financial sectors.

Seamless Omnichannel Experience

Seamless Omnichannel Experience

Our Generative AI-Powered Banking chatbots offer an omnichannel experience, extending their reach across various social media platforms including FB Messenger, WhatsApp, Signal, WeChat, Instagram, Email and even SMS. These versatile bots seamlessly integrate with existing digital properties such as websites and mobile apps.

Streamlined Backend Integrationt

Streamlined Backend Integrationt

Our Generative AI powered AI Agent and Chatbot arrives pre-integrated with essential core banking systems, including SAP Core Banking, Oracle Flexcube, and Finacle, ensuring a smooth and efficient connection to the financial infrastructure.

Flexible Deployment Solutions

Flexible Deployment Solutions

It provides flexibility in deployment, allowing placement on-premises or on leading cloud platforms such as IBM Cloud, Microsoft Azure, Amazon AWS, or Google Cloud Platform, catering to diverse operational needs.

Advanced Chat Analytics

Advanced Chat Analytics

Our advanced chat analytics dashboard is designed to capture and display systemic data, metrics, user preferences, and emerging trends. This analytical capability enables real-time monitoring of user interactions and facilitates data-driven decision-making and personalized responses.

Multi-modal Capabilities

Multi-modal Capabilities

Our AI-powered banking AI Agent and Chatbot excels in multi-modal capabilities, seamlessly handling tasks such as analyzing bank statements, interpreting visual data, or providing voice-based account updates. It ensures a comprehensive and versatile user experience across different channels, enhancing customer interactions.

Data Classification

Data Classification

Our chatbots excel in data classification, ensuring the secure handling and categorization of sensitive information, such as banking statements and personal data, in compliance with industry regulations and privacy standards.

Live Agent Support

Live Agent Support

Our chatbots seamlessly integrate live agent support when necessary, ensuring a smooth transition from automated interactions to human assistance. This feature enhances customer satisfaction by providing real-time expert assistance when needed.

Global Accessibility and Multilingual Support

Global Accessibility and Multilingual Support

Our Customer Service Banking chatbots are equipped to support over 38 languages, making them accessible to a diverse global audience.

Pricing Options

Pay Per Usage

(per message/token based pricing)

Starts at $99/month for multi-tenant SAAS or $999/month for single-tenant (Private Hosting)

Starts at $99/month for multi-tenant SAAS or $999/month for single-tenant (Private Hosting)

Per User Pricing

Starting @ 1$/user – unlimited chats

Starting @ 1$/user – unlimited chats

Single-Tenant Ready-to-Go Pre-Trained Smart AI Agent: Customer can choose to Buy the AI Agent Solution (contact sales for pricing)

Experience Banking’s Future

Today!

Get Started with Our Generative AI-Powered Banking chatbotand Unlock a 30-Day Free Trial.

Zero Commitment. No setup Fees. See Results Before You Invest!

Join Us in Shaping the Future of Banking!