Artificial Intelligence Powered Life Insurance Bot

for Customers

Globally COVID-19 has accelerated Digital Transformation across various sectors and has shown just how internet consumption can change drastically – even overnight. Vodafone, a telecommunications company in Europe, has recorded as much as a 50% increase in internet traffic. Resulting in which asynchronous channels like SMS and Facebook Messenger are in vogue. Hence, Insurance Industries must extend their online presence to those platforms where their customers are spending maximum time which in this case is WhatsApp, Facebook Messenger, SMS & other social media platforms. Assigning real humans to these channels to answer customer queries is cost prohibitive. Thus, to provide quick, consistent, 24*7 customer service and to increase customer outreach with advances in Natural Language Processing (NLP) and Artificial Intelligence, Life Insurance chatbots which can be extended to newer platforms and channels have become a need of an hour.

What Life Insurance industries can do to adapt and overcome the Industry Change

Streebo, a leading Digital Transformation Company has created an enormously powerful, intelligent, and Pre-trained AI-Powered Life Insurance chatbot for Customers. These bots are pre-integrated with most of the ERP/Insurance Management Systems such as SAP, Oracle ERP, IBM AS/400 Systems, CRM for lead management purposes, OCR for verification of documents, Quote Generation engine, etc., which are commonly used in the insurance industry. Streebo’s AI-Powered Life Insurance Bots are very intuitive and highly intelligent and can be extended to multiple channels, such as social media channels WhatsApp, Facebook Messenger, SMS, Telegram, Signal, WeChat, Skype and voice-enabled platforms like Google Home, Amazon Alexa.

Business Benefits

According to a Juniper Study, the insurance sector will be benefited from AI including chatbots with cost savings of $1.3 billion (about $4 per person in the US) by 2023, up from $300 million in 2019.

Hence by rolling out AI-Powered Life Insurance Bots and Conversational Interfaces across channels Insurance Industry will witness benefits such as:

Hence by rolling out AI-Powered Life Insurance Bots and Conversational Interfaces across channels Insurance Industry will witness benefits such as:

Decreased Operational Cost as the customer queries will be handled via chatbot itself and will remarkably increase the conversion rate by 15%.

Increased Revenue & Customer Outreach because of the extended presence on multiple digital channels such as WhatsApp, Facebook Messenger, SMS, WeChat, Telegram, Skype.

Increased Productivity by automating business processes.

Round the clock Customer Query Resolution which will significantly increase Customer Satisfaction rate and Customer Retention rate

Hence Virtual Assistants will not only be cost-effective but will also ease out business management by providing automated customer support.

Insurance chatbot extended on Social Media Channels

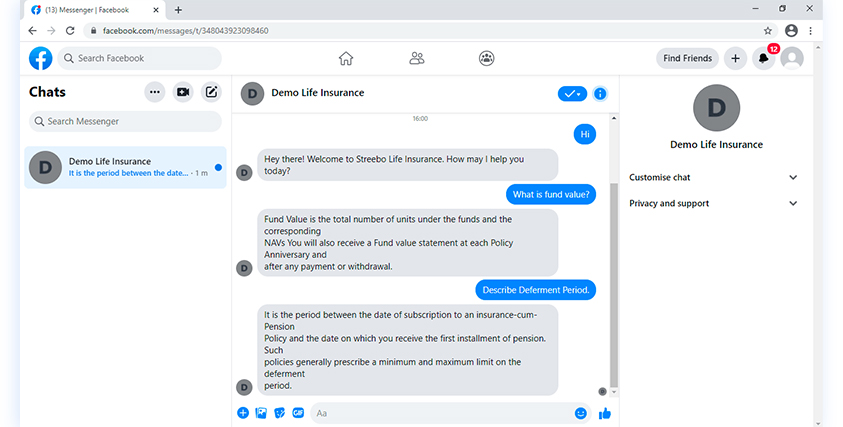

Facebook Messenger Bot

Facebook Messenger Bot

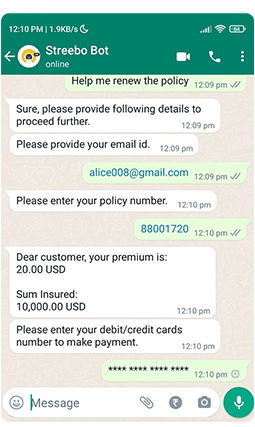

WhatsApp Bot

WhatsApp Bot

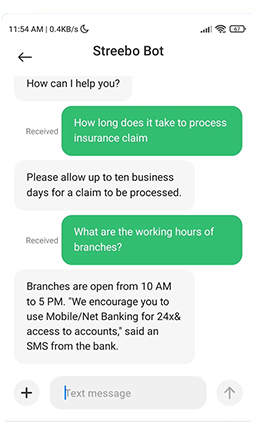

SMS Bot

SMS Bot

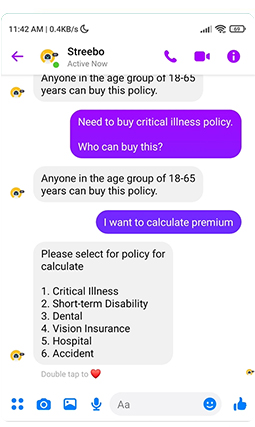

Telegram Bot

Telegram Bot