#Smart Generative AI Agent

Check out Demo

Generative AI Powered Smart Bot Solution

Omni-Channel Bots – Deploy on Chat, Voice, Email, Instagram, Facebook, WhatsApp and Even SMSCheck out Demo

Trusted by hundreds of leading companies

×

Check out the Enterprise Grade AI Agent Powered by Gen AI. No Setup Fees.

ChatGPT’s Revolutionary Conversational AI Technology Unleashes the Potential of Human-Machine Interaction

With the advancement of technology, human-machine interactions have come a long way.

Conversational AI is one of the most exciting breakthroughs in this field, thanks to natural

language processing. ChatGPT, a large language model developed by OpenAI, is at the forefront of

this technological advancement. It has the ability to understand and respond to a wide range of

human language inputs, making it an invaluable tool for various applications such as customer

service, financial services, and entertainment.

The potential of ChatGPT is vast, as businesses and organizations can leverage this technology to offer more engaging and personalized experiences for their customers. This technology has the power to revolutionize the way we interact with machines, paving the way for a smarter and more connected future. ChatGPT has significant potential to transform conversational AI, particularly in the business sector, by streamlining customer interactions and enhancing overall efficiency. As this technology continues to evolve, we can expect to see more exciting breakthroughs in the field of human-machine interaction.

The potential of ChatGPT is vast, as businesses and organizations can leverage this technology to offer more engaging and personalized experiences for their customers. This technology has the power to revolutionize the way we interact with machines, paving the way for a smarter and more connected future. ChatGPT has significant potential to transform conversational AI, particularly in the business sector, by streamlining customer interactions and enhancing overall efficiency. As this technology continues to evolve, we can expect to see more exciting breakthroughs in the field of human-machine interaction.

Unlocking the Potential of the Financial Services -Industry: ChatGPT and GPT Technologies Revolutionizing Learning and Transforming Customer Experience

The Financial Services Industry is rapidly evolving, and one of the most exciting developments

in this field is the integration of conversational AI technology such as ChatGPT and GPT. These

technologies have the ability to unlock the potential of the industry by transforming customer

experience and revolutionizing the way we learn. ChatGPT, a state-of-the-art large language

model developed by Open AI, can comprehend and respond to a wide range of human language inputs,

making it a valuable tool for various financial services applications such as customer support,

financial analysis, and fraud detection.

By utilizing ChatGPT and GPT technologies, businesses in the financial services industry can

provide more personalized and efficient customer experiences while also streamlining their

internal operations. Additionally, these technologies can revolutionize the way we learn about

finance, allowing for more engaging and interactive educational experiences that are tailored to

individual learning styles. The potential of ChatGPT and GPT technologies to transform the

financial services industry is significant, and we can expect to see more exciting developments

in the field as this technology continues to evolve.

Revolutionizing Financial Services: Empowering the Future with ChatGPT and GPT Technologies

Let us discover the top 10 use cases that prove the powerful ROI of ChatGPT-powered chatbots

in

the Financial Services Sector

Customer Support

Providing customer support is a critical use case for chatbots in the financial services

industry. ChatGPT, a state-of-the-art conversational AI technology, has the ability to

respond to a wide range of customer requests using its text completion, speech-to-text,

and multi-modal features via text, voice, and images. Financial institutions can

leverage this technology to provide round-the-clock support to their customers without

employing many support staff members, which can result in significant cost savings.

Additionally, Financial Services Bots like ChatGPT can provide consistent responses to client inquiries and follow up on previous conversations, which can help boost customer satisfaction and reduce customer turnover. With the ability to handle complex inquiries related to financial planning, Financial Services ChatGPT can act as a virtual financial advisor for customers, offering personalized and helpful advice. The potential of advanced Bots like Financial Services ChatGPT in providing customer support in the financial services industry is vast, and we can expect to see more financial institutions leveraging this technology to enhance their customer support capabilities.

Additionally, Financial Services Bots like ChatGPT can provide consistent responses to client inquiries and follow up on previous conversations, which can help boost customer satisfaction and reduce customer turnover. With the ability to handle complex inquiries related to financial planning, Financial Services ChatGPT can act as a virtual financial advisor for customers, offering personalized and helpful advice. The potential of advanced Bots like Financial Services ChatGPT in providing customer support in the financial services industry is vast, and we can expect to see more financial institutions leveraging this technology to enhance their customer support capabilities.

Personalized

Suggestions

Financial Services Bots like ChatGPT are invaluable tools for providing

individualized

assistance to consumers in the financial services industry. Financial

chatbots based on

the GPT Platform can offer personalized guidance and suggestions to customers by

analyzing their data and behavior patterns using built-in features such as Clustering,

Classification, Search, Parsing of Unstructured Data, and Recommendation. By offering

tailored advice and recommendations, Financial ChatGPT can

significantly increase

customer satisfaction and loyalty.

For example, Financial Services Bot like ChatGPT can provide customized investment advice to customers by considering their financial goals, comfort level with financial risk, and investing history. By doing so, Financial Services ChatGPT can help establish stronger connections with consumers, increasing the likelihood that they will continue to use the company’s products and services. The potential for GPT-based Financial Services Bots to provide individualized assistance to customers in the financial services industry is vast, and we can expect to see more financial institutions leveraging this technology to improve their customer engagement and satisfaction.

For example, Financial Services Bot like ChatGPT can provide customized investment advice to customers by considering their financial goals, comfort level with financial risk, and investing history. By doing so, Financial Services ChatGPT can help establish stronger connections with consumers, increasing the likelihood that they will continue to use the company’s products and services. The potential for GPT-based Financial Services Bots to provide individualized assistance to customers in the financial services industry is vast, and we can expect to see more financial institutions leveraging this technology to improve their customer engagement and satisfaction.

Fraud Detection and

Prevention

Fraud protection and detection is a crucial aspect of the financial services industry,

and advanced Financial Services chatbots like ChatGPT can play a

significant role in

mitigating fraudulent activities. Financial Services ChatGPT can help

financial

institutions quickly and efficiently discover and prevent fraudulent conduct using

features such as Diversity Measurement and Anomaly Detection. By analyzing vast amounts

of data using Parsing, Searching, Clustering, and Classification features,

Financial

Bots like ChatGPT can identify patterns and anomalies that may indicate

fraudulent

activity.

This is critical in preserving customers’ trust and reducing financial losses caused by fraudulent behavior. With the ability to monitor and detect suspicious activity in real-time, GPT-based Financial Services Bot can act as a virtual fraud protection assistant for financial institutions, ensuring that their customers’ interests are safeguarded at all times. The potential for Financial ChatGPT in fraud protection and detection in the financial services industry is immense, and we can expect to see more financial institutions leveraging this technology to mitigate the risks associated with fraudulent activities.

This is critical in preserving customers’ trust and reducing financial losses caused by fraudulent behavior. With the ability to monitor and detect suspicious activity in real-time, GPT-based Financial Services Bot can act as a virtual fraud protection assistant for financial institutions, ensuring that their customers’ interests are safeguarded at all times. The potential for Financial ChatGPT in fraud protection and detection in the financial services industry is immense, and we can expect to see more financial institutions leveraging this technology to mitigate the risks associated with fraudulent activities.

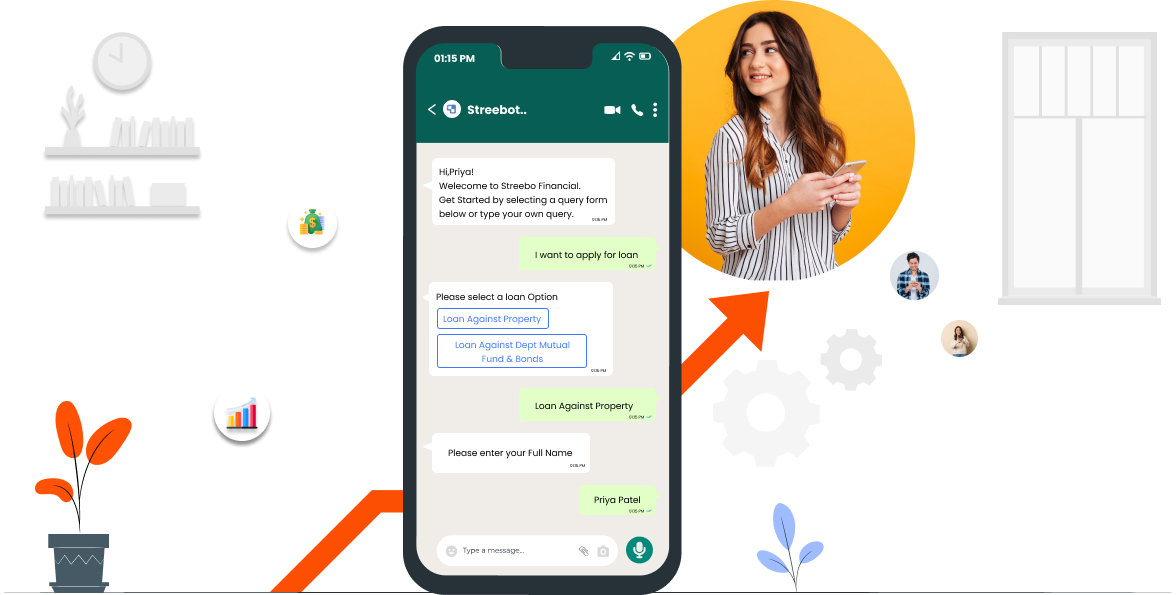

Loan Processing

ChatGPT’s advanced features can also help simplify the loan processing procedure for

financial institutions. With its ability to automate the loan application process,

ChatGPT for Financial Services can assist financial institutions in

improving the client

experience while reducing the time spent processing applications. Advanced bots like

Financial Services ChatGPT can collect customer information in

real-time while

simultaneously verifying their identification and determining their creditworthiness

using features such as Text Conversation, Sentiment Analysis, and Anomaly Detection.

This not only reduces the chances of errors but also ensures that customers have a faster and more efficient experience when it comes to processing loans. By leveraging ChatGPT-based Bots for Financial Services, financial institutions can offer a more streamlined and convenient loan application process, resulting in higher customer satisfaction levels and increased efficiency for their organization.

This not only reduces the chances of errors but also ensures that customers have a faster and more efficient experience when it comes to processing loans. By leveraging ChatGPT-based Bots for Financial Services, financial institutions can offer a more streamlined and convenient loan application process, resulting in higher customer satisfaction levels and increased efficiency for their organization.

Wealth Management

ChatGPT for Financial Services is also effective in improving wealth

management for

financial institutions. Advanced chatbots such as Financial Services

ChatGPT can provide

individualized investment advice, manage investment portfolios, and monitor market

trends by analyzing customer data and activity patterns through real-time analysis and

recommendation features. This enables financial institutions to enhance the quality of

their investment advice and management services, resulting in higher levels of customer

satisfaction and loyalty.

Additionally, GPT-based Financial Services Bots can address customer queries and concerns and offer guidance on wealth management using its natural language generation (NLG) capabilities, providing personalized and human-like interactions. By utilizing ChatGPT for Financial Services, financial institutions can provide a higher quality of wealth management services while also improving customer engagement and retention.

Additionally, GPT-based Financial Services Bots can address customer queries and concerns and offer guidance on wealth management using its natural language generation (NLG) capabilities, providing personalized and human-like interactions. By utilizing ChatGPT for Financial Services, financial institutions can provide a higher quality of wealth management services while also improving customer engagement and retention.

Account Opening

Financial Services Bots such as ChatGPT can revolutionize the account

opening process

and enhance the customer experience. With the help of its advanced features, such as

Real-Time Analysis, Text Completion & Generation, and Sentiment Analysis, ChatGPT can

reduce the processing times and make the process of collecting customer information and

confirming their identities much faster and smoother. This can result in an error-free

and less time-consuming account opening experience for customers.

Moreover, Financial Services Bots like ChatGPT can personalize the account opening experience based on the customers’ preferences and interests, presenting them with relevant information and options. In addition, Financial Services ChatGPT can aid financial organizations with compliance inspections and AML procedures during the account opening process. It can verify customer information and paperwork in real-time and flag potential concerns or risks, enabling financial institutions to ensure regulatory compliance.

Moreover, Financial Services Bots like ChatGPT can personalize the account opening experience based on the customers’ preferences and interests, presenting them with relevant information and options. In addition, Financial Services ChatGPT can aid financial organizations with compliance inspections and AML procedures during the account opening process. It can verify customer information and paperwork in real-time and flag potential concerns or risks, enabling financial institutions to ensure regulatory compliance.

Compliance

Compliance is a crucial aspect of the Financial Services sector, and

ChatGPT-powered

Financial Services Bots can assist financial institutions in adhering to

regulations.

GPT-based Financial Services Bots can assist financial institutions in

monitoring

transactions and identifying compliance breaches. The use of factual responses generated

by GPT-based Financial Services Bots can aid financial institutions in

staying

up-to-date on the latest compliance regulations.

This can help financial institutions avoid potential fines and penalties and protect their reputation. Additionally, advanced Financial Services chatbots such as ChatGPT can be utilized to ensure that all regulatory requirements are met. Through the use of Diversity Measurement and Anomaly Detection features, these bots can analyze customer data and detect potential regulatory issues, allowing financial institutions to address and manage them promptly.

This can help financial institutions avoid potential fines and penalties and protect their reputation. Additionally, advanced Financial Services chatbots such as ChatGPT can be utilized to ensure that all regulatory requirements are met. Through the use of Diversity Measurement and Anomaly Detection features, these bots can analyze customer data and detect potential regulatory issues, allowing financial institutions to address and manage them promptly.

Investment Research

Advanced Financial Services Bots like ChatGPT can also provide

investment analysts and

portfolio managers with real-time updates on market trends and investment opportunities,

allowing financial institutions to make well-informed investment decisions. With its

Real-Time Analysis and Recommendation features, ChatGPT can analyze vast amounts of data

from different sources, including news articles, financial reports, and social media, to

identify investment opportunities and trends.

Additionally, GPT-powered Financial Services Bots can assist in creating investment portfolios that are tailored to the needs and goals of individual clients. By analyzing customer data and activity patterns, these bots can suggest personalized investment strategies that are optimized to deliver the best possible returns based on a customer’s risk profile and long-term financial goals. With these capabilities, Financial Services chatbots can help financial institutions stay ahead of market trends and provide better investment advice to their clients.

Additionally, GPT-powered Financial Services Bots can assist in creating investment portfolios that are tailored to the needs and goals of individual clients. By analyzing customer data and activity patterns, these bots can suggest personalized investment strategies that are optimized to deliver the best possible returns based on a customer’s risk profile and long-term financial goals. With these capabilities, Financial Services chatbots can help financial institutions stay ahead of market trends and provide better investment advice to their clients.

Cross-Selling and

Upselling

Cross-selling and upselling can be made easier and more effective with Financial

Services Bots like ChatGPT. Using advanced Recommendation features,

Financial Services

chatbots can evaluate customer data and behavior patterns to identify

opportunities to

offer new products or services to customers.

For example, if a customer contacts a Financial Services Bot like ChatGPT with a question about a credit card, the Financial Services Bot can take this opportunity to present the customer with an offer for a personal loan or another type of loan product that may be of interest to them. Similarly, if a customer indicates interest in a particular investment product, the Financial Services ChatGPT can recommend additional investment products that may align with the customer’s financial goals and risk tolerance. This personalized approach to cross-selling and upselling can help financial institutions improve customer satisfaction and loyalty while increasing revenue.

For example, if a customer contacts a Financial Services Bot like ChatGPT with a question about a credit card, the Financial Services Bot can take this opportunity to present the customer with an offer for a personal loan or another type of loan product that may be of interest to them. Similarly, if a customer indicates interest in a particular investment product, the Financial Services ChatGPT can recommend additional investment products that may align with the customer’s financial goals and risk tolerance. This personalized approach to cross-selling and upselling can help financial institutions improve customer satisfaction and loyalty while increasing revenue.

Customer Onboarding

Customer onboarding is a crucial process for Financial Organizations to attract and

retain customers, but it can be a challenging and time-consuming task. With the help of

Financial Services Bots like ChatGPT, Financial Organizations can streamline the

process, reduce wait times, and provide a better customer experience. Advanced Financial

Services Bots like ChatGPT can automate many aspects of the customer onboarding process,

using features such as Speech-To-Text, Multi-Modal, Conversation, and Sentiment

Analysis.

In addition, by leveraging these features, ChatGPT can provide personalized guidance to customers based on their needs and circumstances, making the process more tailored to their specific situation. Additionally, ChatGPT can interact with customers in a natural language, providing a seamless experience that feels like speaking to a human. Overall, the use of Financial Services Bots like ChatGPT can significantly improve customer onboarding, helping Financial Organizations attract and retain customers more efficiently.

In addition, by leveraging these features, ChatGPT can provide personalized guidance to customers based on their needs and circumstances, making the process more tailored to their specific situation. Additionally, ChatGPT can interact with customers in a natural language, providing a seamless experience that feels like speaking to a human. Overall, the use of Financial Services Bots like ChatGPT can significantly improve customer onboarding, helping Financial Organizations attract and retain customers more efficiently.

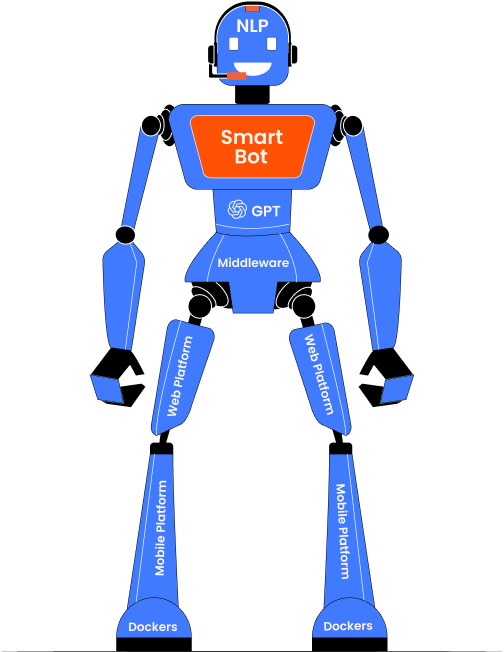

Introducing Streebots for Financial Services Industry

A state-of-the-art solution powered by the latest in NLP and GPT technology. We’ve developed

this solution to make the Financial Services sector more secure and efficient!

Streebo is a leading provider of AI-powered chatbot solutions tailored to meet the unique requirements of the Financial Services industry. By leveraging the power of advanced GPT language models and OpenAI’s API technology, Streebo’s bespoke ChatGPT solution generates conversation prompts and responses that mimic human-like interactions, enabling businesses to engage with customers more effectively in the digital space.

Streebo is a leading provider of AI-powered chatbot solutions tailored to meet the unique requirements of the Financial Services industry. By leveraging the power of advanced GPT language models and OpenAI’s API technology, Streebo’s bespoke ChatGPT solution generates conversation prompts and responses that mimic human-like interactions, enabling businesses to engage with customers more effectively in the digital space.

Streebo’s Financial Services Bots are supported by cutting-edge NLP engines from top-tier

industry leaders such as IBM Watson, Amazon Lex, Microsoft’s CLU, and Google Dialog. With these

advanced capabilities, businesses can offer personalized customer experiences that are

unparalleled in the market. Streebo’s chatbot solutions are designed to empower financial

institutions to remain at the forefront of customer service innovation in the Financial Services

sector, helping them stay ahead of the competition and deliver exceptional customer experiences.

Streebo’s Financial Services Bots can offer superior engagement and automation, resounding ROI, and guaranteed adoption

Some of the features include

Built-in domain intelligence

Built-in domain intelligence

Omnichannel experience on all platforms such as Facebook, WhatsApp,

and Website

Omnichannel experience on all platforms such as Facebook, WhatsApp,

and Website

Data security and compliance

Data security and compliance

Advanced chat analytics

Advanced chat analytics

Lower TCO

Lower TCO

Inbuilt live agent support

Inbuilt live agent support

Multi-lingual support

Multi-lingual support

Support of both Voice and Chat as well as

Support of both Voice and Chat as well as

Secured communication

Secured communication

Context Switching Capabilities

Context Switching Capabilities

99% Accuracy

99% Accuracy

Secure Transactions and Text Exchange

When it comes to data processing and security, there can be no compromises. Our Bots understand this and use only the best in the industry – IBM Watson, Google’s GCP, Amazon’s Lex, and Microsoft CLU, to name a few. These branded NLPs provide unmatched peace of mind to enterprises that cannot afford any data breaches. But that’s not all – we go one step further by ensuring that all sensitive and other types of data are encrypted and masked using advanced algorithms. And with Open AI’s GPT Text Generation feature, there’s no need to worry about any manipulation, computation, or processing of business data. As a business owner, you can rest easy knowing that our Bots are the perfect ally to combat cybercrime and protect your sensitive information.

When it comes to data processing and security, there can be no compromises. Our Bots understand this and use only the best in the industry – IBM Watson, Google’s GCP, Amazon’s Lex, and Microsoft CLU, to name a few. These branded NLPs provide unmatched peace of mind to enterprises that cannot afford any data breaches. But that’s not all – we go one step further by ensuring that all sensitive and other types of data are encrypted and masked using advanced algorithms. And with Open AI’s GPT Text Generation feature, there’s no need to worry about any manipulation, computation, or processing of business data. As a business owner, you can rest easy knowing that our Bots are the perfect ally to combat cybercrime and protect your sensitive information.

Clients that have deployed these Smart Bots are seeing

Increase in Revenue ~1-5%

Increase in Revenue ~1-5%

Improvement in Customer Satisfaction Ratings ~5-9%

Improvement in Customer Satisfaction Ratings ~5-9%

We guarantee to cut your current customer service costs in

HALF!!

We guarantee to cut your current customer service costs in

HALF!!

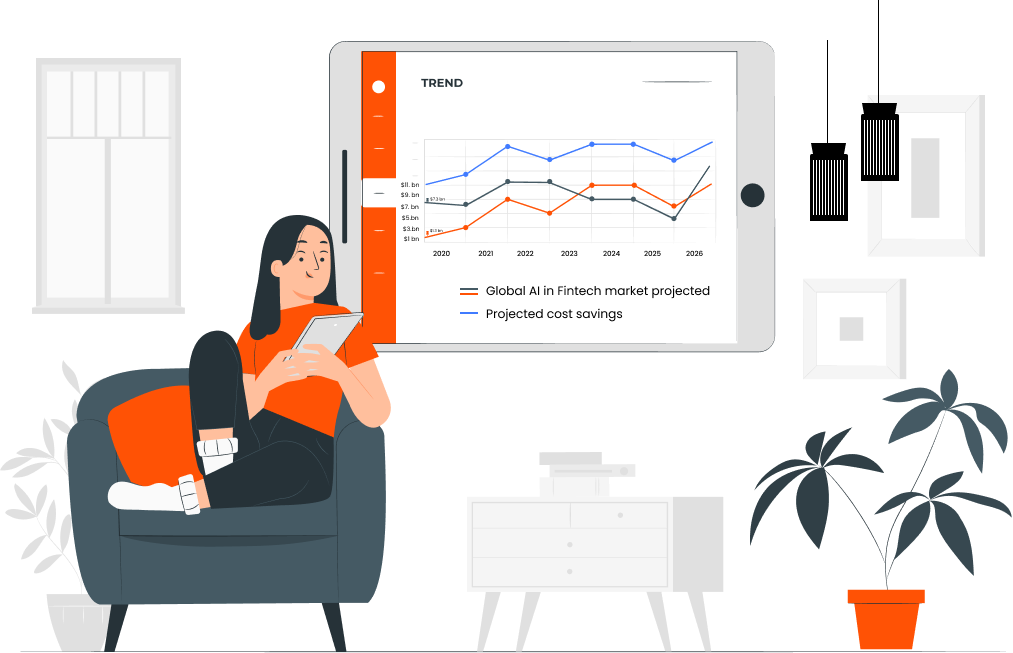

Final Food for Thought for Financial Services Sector Leaders!

The Financial Services industry is increasingly relying on technologies like AI and ChatGPT to

provide faster and more efficient services to customers. According to a report by Market satnd

Markets, the global AI in Fintech market size is expected to grow from $1.3 billion in 2020 to

$7.3 billion by 2026, at a compound annual growth rate (CAGR) of 33.7%.

The report highlights the key drivers of this growth as increasing demand for customer-centric

services, growing adoption of cloud-based technology, and the need for streamlining business

operations. ChatGPT-based solutions, in particular, are playing a significant role in the

industry, with a report by Juniper Research forecasting that chatbot interactions will deliver

$11 billion in cost savings by 2023, up from an estimated $6 billion in 2018. As financial

institutions continue to adopt these technologies, they can expect to see improvements in areas

such as customer service, compliance monitoring, investment analysis, and more.

Streebo’s ChatGPT Financial Services Bots are revolutionizing the Financial Services industry by providing advanced conversational AI experiences to businesses and organizations. By leveraging the latest GPT platform’s regenerative AI capabilities with leading NLP tools from industry leaders such as IBM Watson, Google Dialog, Microsoft CLU, and Amazon Lex, this solution delivers exceptional benefits. Customers can enjoy unparalleled levels of convenience and efficiency, making it easier for them to access the assistance they need. To stay ahead of the competition and take advantage of this cutting-edge technology, visit the Financial Services Bot webpage and schedule a personalized demo today. Don’t miss out on the opportunity to elevate your Financial Services to new heights!

Streebo’s ChatGPT Financial Services Bots are revolutionizing the Financial Services industry by providing advanced conversational AI experiences to businesses and organizations. By leveraging the latest GPT platform’s regenerative AI capabilities with leading NLP tools from industry leaders such as IBM Watson, Google Dialog, Microsoft CLU, and Amazon Lex, this solution delivers exceptional benefits. Customers can enjoy unparalleled levels of convenience and efficiency, making it easier for them to access the assistance they need. To stay ahead of the competition and take advantage of this cutting-edge technology, visit the Financial Services Bot webpage and schedule a personalized demo today. Don’t miss out on the opportunity to elevate your Financial Services to new heights!

Want to Know- How This Will Work for Your Business?

Visit our Enterprise-Grade Bot Store.

Visit our Enterprise-Grade Bot Store.

Learn what it can do for your business by scheduling a demo

session.

Learn what it can do for your business by scheduling a demo

session.

Try it yourself with a Free 30-day trial.

Try it yourself with a Free 30-day trial.

Start your 30-day free trial now and witness firsthand how our

intelligent chatbot can

transform your service delivery, boost efficiency, and skyrocket guest satisfaction.

Don’t let this chance slip by! Get in touch with us today to begin your journey towards unparalleled business management, risk-free!

Don’t let this chance slip by! Get in touch with us today to begin your journey towards unparalleled business management, risk-free!

Disclaimer: ChatGPT and GPT are registered trademarks and terms fully owned

by Open.AI. Author

has used the term “ ChatGPT in Financial Services ” to convey the idea of a ChatGPT kind of

Bot,

but for the Financial Services