#Smart GenAI For Bot

Check out Demo

Generative AI Powered Smart Bot Solution

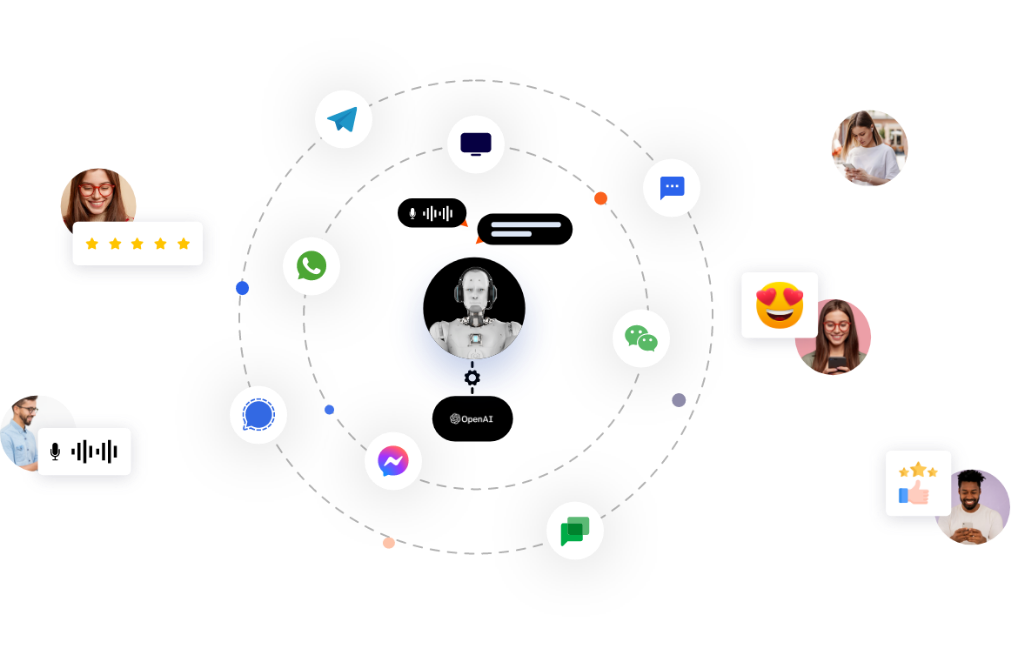

Omni-Channel Bots – Deploy on Chat, Voice, Email, Instagram, Facebook, WhatsApp and Even SMSCheck out Demo

Trusted by hundreds of leading companies

×

Check out the Enterprise Grade Bots Powered by Gen AI. No Setup Fees.

Revolutionizing Communication

How ChatGPT is Paving the Way for the Future of Conversational AI!

The advancements in AI technology have been nothing short of mind-boggling, but Open AI’s ChatGPT models have taken things to the next level. These models have given rise to a diverse and versatile set of tools that have the potential to revolutionize the way we conduct conversations. What sets ChatGPT apart is its ability to understand and respond to natural text, allowing machines to communicate with humans with an unprecedented level of efficiency and effectiveness.

This means that not only can businesses streamline customer service through automation, but they can also provide more personalized, engaging experiences that cater to each individual’s needs. The bottom line here is that ChatGPT has the potential to reduce costs, maximize efficiency and productivity levels, and provide valuable insights into customer behavior patterns. Open AI’s creation is a game-changer, and its possibilities are truly awe-inspiring.

Transforming Insurance Industry with ChatGPT/GPT-Technologies

A Revolutionary Leap towards the Future!

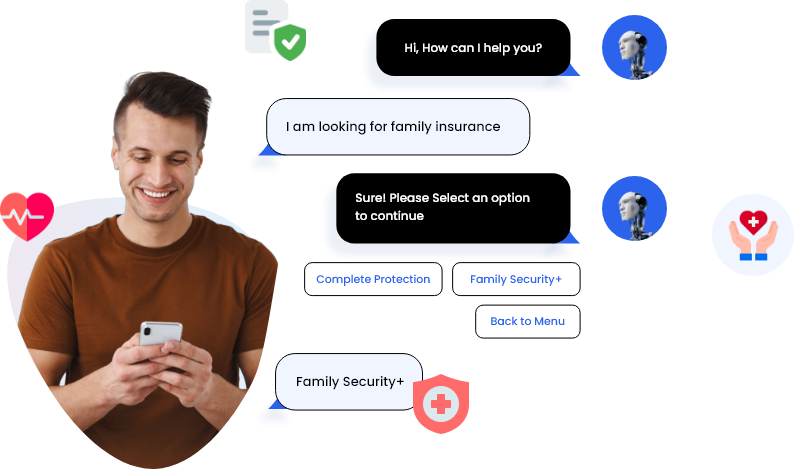

Technology has been a driving force for change across industries, and the insurance sector is no exception. With the advent of chatbots and natural language processing technologies like ChatGPT/GPT, the industry is undergoing a revolutionary leap towards the future. These tools are being implemented to help customers obtain faster and more personalized insurance solutions. By simulating human conversation, chatbots are able to provide clients with on-demand insurance advice, reducing wait times and increasing the industry’s efficiency.

Natural language processing systems like ChatGPT/GPT can also aid insurers in assessing risk and calculating policy prices, leading to more accurate quotes and greater client satisfaction. The insurance industry is transforming at an unprecedented pace, thanks to these innovative technologies, and customers are sure to benefit from the enhanced responsiveness and personalization they provide.

Revolutionizing Customer Engagement in Insurance with ChatGPT

The Ultimate Growth Accelerator!

Let us discover the top 10 ChatGPT Insurance Use Cases that prove the powerful ROI of ChatGPT-powered chatbots

1. Claim Processing

One of the first use cases of chatbots in insurance is claims processing, a crucial aspect of the insurance sector. OpenAI’s factual answering can help create insurance bots to help the claim processing. ChatGPT can evaluate and extract insights from unstructured text-based claims data, such as written reports of accidents or incidents.

This can allow several claim processing procedures to automate, minimizing the need for manual data entry, analysis, and processing time. ChatGPT can efficiently collect and validate data from several sources, including social media, customer databases, and other records, to speed up the procedure. Moreover, GPT APIs can assess the severity of the claim, prioritize the processing of claims, and automate the settlement procedure, allowing for swift and smooth payments to the customer. Using ChatGPT, claims processing for insurers may become more efficient, precise, and cost-effective.

2. Customer Service

ChatGPT’s summarization feature can generate high-quality prose for product descriptions and commonly asked questions to not only automate but also improve the customer care process by giving a more human-like interaction with moods and conversations. Companies can also integrate Customer relationship management (CRM) systems, policy databases, and payment gateways with the customer service system via APIs to improve the quality of service provided to clients.

Insurance chatbots built using ChatGPT illustrate how artificial intelligence can sift through mountains of unstructured data to find the insights that matter. These intelligent bots are significantly more effective and customer-focused than institutions’ conventional Personal Financial Management systems. With continual learning from previous encounters and user feedback, ChatGPT can enhance its replies and customer satisfaction by providing unique suggestions to each client.

3. Underwriting

ChatGPT, equipped with advanced features like Search, can swiftly and accurately access and analyze vast data. ChatGPT features like Classification provide a structured and organized representation of complex data, facilitating better comprehension and analysis. Features like Diversity Measurement and Recommendation can process complex data and generate forecasts based on the extracted insights.

ChatGPT for Insurance is ideal for supporting the underwriting process by evaluating risk variables and anticipating potential claims. With real-time data collection and analysis capabilities, insurers can make informed decisions and provide customized insurance solutions based on the customer’s unique risk profile. Moreover, ChatGPT’s capabilities enable it to extract relevant information from multiple sources and produce actionable insights, leading to enhanced risk profiling and precise pricing.

4. Policy Management

Management of policies is a crucial part of any insurance company’s operations. ChatGPT can potentially improve the process by supplying customers with up-to-date and precise policy details in real-time. Natural language processing (NLP) and Generative AI capabilities is a key parts of Chat GPT, allowing the system to comprehend and respond to user inquiries and comments in their natural language. Methods like entity recognition, sentiment analysis, and language modeling fall under this category.

Corporate insurance can use this to improve the accuracy and efficiency of their policy management operations by directing requests to the relevant people or systems. Moreover, GPT APIs may easily access and evaluate insurance information, such as coverage limitations, premiums, deductibles, and other crucial policy data. For example, ChatGPT can map the links between policyholders, policies, and claims, giving insurers a comprehensive view of their policies and helping them make informed policy administration choices.

5. Fraud Detection

By analyzing massive volumes of transaction data and spotting suspicious trends, ChatGPT can help insurers detect and prevent fraud by using its Classification feature.

This can aid financial institutions in safeguarding their clients’ funds and cutting down on fraud losses. Employees can set up alerts to inform the insurer’s security team when they spot something fishy.

ChatGPT can scan incoming emails for out-of-the-ordinary language pointing to Business Email Compromise (BEC) fraud.

ChatGPT can aid in detecting and preventing fraud via Email by employing Anomaly Detection and its generative AI capabilities to spot irregularities in email correspondence.

6. Compliance

Non-compliance to established rules is a serious problem in the insurance industry that can result in heavy fines and a damaged reputation if not addressed.

OpenAI’s state-of-the-art Predictive Analytics feature can assist the insurance business in foreseeing emerging hazards and meeting compliance requirements.

Thanks to this, ChatGPT can better implement measures to decrease risk and prevent compliance problems.

By keeping tabs on financial transactions and flagging any suspicious activity, ChatGPT aids insurers in meeting regulatory expectations. Insurers may save money and keep their good name by doing this.

7. Marketing and Sales

ChatGPT may assist with marketing and sales in the insurance industry by utilizing its Text Completion feature, which can generate personalized, relevant, and engaging emailers, sales copy, and ad copies for marketing campaigns directed toward clients. ChatGPT can also be used to assist in generating leads. These capabilities work by collecting and qualifying client information via natural language conversations. This can assist insurance businesses in identifying new consumers, allowing them to adapt their marketing efforts better to meet the needs of those customers.

In addition, the system can incorporate ChatGPT’s Semantic Search feature, which analyses the meaning and context of a user’s search queries to produce search results that are more specific and pertinent, hence improving the overall quality of the customer experience. There is no doubt that ChatGPT is the way of the future when it comes to marketing and sales in the insurance industry.

8. Claims Avoidance

One of the most powerful features of ChatGPT is its ability to perform Predictive Analytics, which can help insurers identify possible risk factors and recommend preventative measures.

Predictive analytics involves using statistical algorithms and machine learning techniques to analyze large amounts of data and predict future events, such as weather patterns, transport congestion, and natural calamities.

ChatGPT can assist insurance companies in assessing risk by analyzing data from various sources, such as policyholder information, social media, and news reports.

By identifying potential risks early on, insurance companies can work to prevent claim requests.

9. Customized Insurance

ChatGPT can assess client data and preferences to recommend individualized policies.

ChatGPT, with the help of the Clustering feature, can make recommendations for insurance plans that are optimally suited to the customer’s specific requirements by using customer data such as demographic information, claim histories, and risk factors.

GPT can design visuals from scratch using its Image Generation capability to accompany fixed deposit plans or graphics that encapsulate an insurance policy’s worth.

This makes the customer experience more enjoyable.

10. Risk Management

ChatGPT for retail insurance can also leverage the text-to-speech and speech-to-text capabilities of GPT, which can be used to analyze complex data sets, such as medical records or financial data using Voice, or the multi-modal capabilities of GPT, which can be used to generate synthetic data for testing and training models using various kinds of inputs such as Image or Plain Text that help insurance firms with risk prediction and mitigation.

Moreover, these features may involve everything from detecting potential risks and establishing risk mitigation methods to providing customized insurance plans suited to a customer’s needs.

Introducing Streebots for Insurance Industry

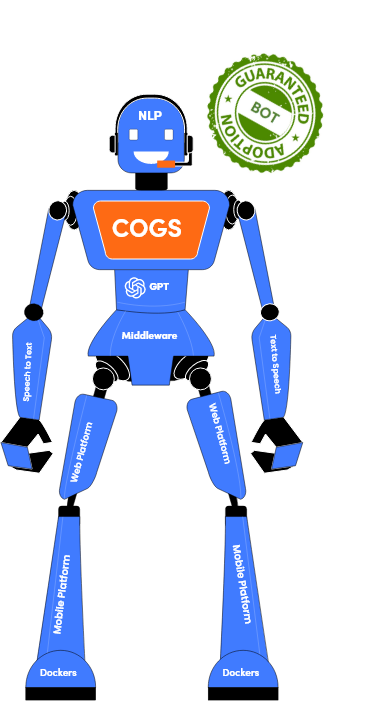

A state-of-the-art solution powered by the latest in NLP and GPT technology. We’ve developed this solution to make Insurance more secure and efficient!

Streebo is leading the way in conversational AI technology with its latest innovation, Streebot – a ChatGPT solution for companies, brands, businesses, and professional organizations. This revolutionary solution utilizes the latest GPT series language models and open.ai API to render human-like conversation prompts and responses, helping businesses to better interact with customers virtually. GPT stands for Generative Pre-trained Transformer, an advanced AI model that generates text based on natural language structures and Streebo’s Virtual Insurance Assistants utilize this technology to provide unparalleled customer service. Powered by leading NLP engines like IBM Watson, Amazon Lex from AWS, Microsoft’s CLU and Google Dialog from GCP, Streebo has now integrated its Bot Solutions with the latest GPT models!

Streebo’s Insurance Virtual Assistants (ChatGPT for Insurance and Financial Organisations) can offer superior engagement and automation, resounding ROI and guaranteed adoption.

Streebo’s Insurance Virtual Assistants (ChatGPT for Insurance and Financial Organisations) can offer superior engagement and automation, resounding ROI and guaranteed adoption.

Some of the features include:

- Built-in domain intelligence

- Omnichannel experience on all platforms such as Facebook, WhatsApp, Website

- Data security and compliance

- Advanced chat analytics

- Lower TCO

- Inbuilt live agent support

- Multi-lingual support

- Support of both Voice and Chat

- Secured communication

- Context Switching Capabilities

- 99% Accuracy

- Secure Transactions and Text Exchange for Financial Organisations

Our Bots use the industry leading, secure, branded NLPs such as IBM Watson, Google’s GCP, Amazon’s Lex, Microsoft CLU, Copilot, Power Virtual Agents (previously called LUIS) and more, providing unmatched peace of mind for enterprise data processing. All sensitive and other types of data is encrypted and masked using sophisticated algorithms that allow the most secure environment possible. To top it off, Open AI’s GPT Text Generation feature ensures no manipulation, computation, or processing of business data; an effective tool for customers who need assurance that all aspects of security will be taken into account. With our Bots as part of your arsenal against data breach and cybercrime, there is no better way to ensure utmost safety!

Clients that have deployed these

Smart Bots are seeing

Ratings ~5-9%

half (50%+)

We guarantee to cut your current customer service costs in HALF!!

Final Food for Thought for Insurance Leaders!

When it comes to the insurance market, chatbots are a game-changer. They offer a unique way for customers to access information and get the help they need quickly and efficiently. In fact, a recent study found that 56% of consumers communicate with chatbots to get answers to their questions in real time. This trend is reflected in the insurance industry, where companies are increasingly turning to chatbots as a way to streamline their operations and provide better customer service. For example, GEICO’s virtual assistant, Kate, is available 24/7 to answer questions and provide assistance to policyholders. With statistics like these, it’s clear that chatbots are poised to become an integral part of the insurance market for years to come.

Streebo’s ChatGPT Insurance Bots offer a truly unbeatable ChatGPT experience for Insurance companies and financial institutions, courtesy of two powerful tools – NLPs such as IBM Watson, Google Dialog, Microsoft CLU, Copilot, Power Virtual Agents and Amazon Lex & Regenerative AI capabilities of the latest GPT platform. With this innovative combination, customers now have access to something truly remarkable in the world of Insurance. Don’t miss out on the opportunity to experience this cutting-edge technology!

So, what are you waiting for?

Check out our Insurance Bot Webpage and drop us a note today to schedule your personalised demo.Schedule your demo today!!