#Smart GenAI For Banking

Check out Demo

Generative AI Powered Smart Bot Solution for Banking Industry

Omni-Channel Bots – Deploy on Chat, Voice, Email, Instagram, Facebook, WhatsApp and Even SMSCheck out Demo

Trusted by hundreds of leading companies

×

Check out the Enterprise Grade Bots Powered by Gen AI. No Setup Fees.

Opportunities for Credit Card Service Providers – The Growth Mindset !

This article starts with the talk of the changing landscape of the Credit card industry. In this change, lays an

excellent opportunity for service providers to increase profits and improve customer satisfaction with social media

presence. The article suggests that credit card companies can take advantage of advanced artificial intelligence

technologies, such as Natural Language Processing and Generative AI, to automate routine business operations and

interactions with customers.

Lastly, the article also proposes a comprehensive solution that combines NLP technologies from leading providers, including IBM Watson, Google Dialog, Amazon Lex, and Open.AI’s GPT 3.5. By leveraging these technologies, clients can own a unified solution that benefits from the shift in the user base, resulting in increased revenue and improved customer satisfaction while reducing interaction costs.

Lastly, the article also proposes a comprehensive solution that combines NLP technologies from leading providers, including IBM Watson, Google Dialog, Amazon Lex, and Open.AI’s GPT 3.5. By leveraging these technologies, clients can own a unified solution that benefits from the shift in the user base, resulting in increased revenue and improved customer satisfaction while reducing interaction costs.

The Tech-Driven Tectonic Shift in Credit Card Companies: A Closer Look

In recent years, social media has experienced a substantial increase in traffic, largely due to the COVID-19 pandemic

and the resulting shift towards remote work and socialization. According to TechCrunch, there has been a 40%

year-over-year growth in social media traffic and messaging platform usage which has transformed the way we communicate.

According to Statista’s report for 2022, There are currently 4.59 billion social media users worldwide. For businesses,

including those in the Credit card industry, this shift presents both opportunities and challenges. On one hand, it

provides a new channel for reaching customers and building brand awareness. Banks and Credit card companies that embrace

popular messaging platforms and extend their presence beyond the traditional web and mobile interfaces are

well-positioned to capture market share and drive efficiency. But managing these channels effectively with the human

workforce can be highly unscalable, requiring banks to explore automation and other cost-saving measures.

Transformation of Credit Card Services with advanced AI & Bot Technology

The advent of Artificial Intelligence, particularly in the area

of Natural Language Processing, has brought a paradigm shift in the realm of automated chat and voice interactions. NLP

technologies such as IBM Watson, Amazon Lex, and Google Dialog and now ChatGPT are sophisticated tools

that can process and respond to user interactions, providing a seamless customer experience. A report by McKinsey

estimates that AI-powered chatbots in banking can reduce operational costs by 30% and increase efficiency by 20%.

Also, a study by Accenture showed that customers who interact with AI-powered chatbots in banking have a satisfaction

rate of 85%, compared to 60% with human customer service representatives. These statistics highlight the positive impact

of AI bots in the Credit industry and demonstrate the growing trend of their implementation

and usage.

Arrival of GPT 3.5 Platform – The Game Changer!!

Open.AI’s GPT 3.5 platform has taken the NLP to the next level, with its Generative.AI capabilities that has enabled it

not only to understand natural language but also to generate dynamic text. This has led to the emergence of highly

advanced chatbots, like ChatGPT, which can engage users and offer precise information. As a result, it has become

imperative for credit card companies to adopt these AI-powered chatbots to automate voice and chat interactions and

reach new customers via asynchronous messaging channels such as WhatsApp, Google Chat, Facebook, and SMS, among others.

ChatGPT powered credit bots make the best use of machine learning and AI algorithms to analyze customer data, and

provide useful insights that can help improve credit card services and offer more personalized experiences effectively.

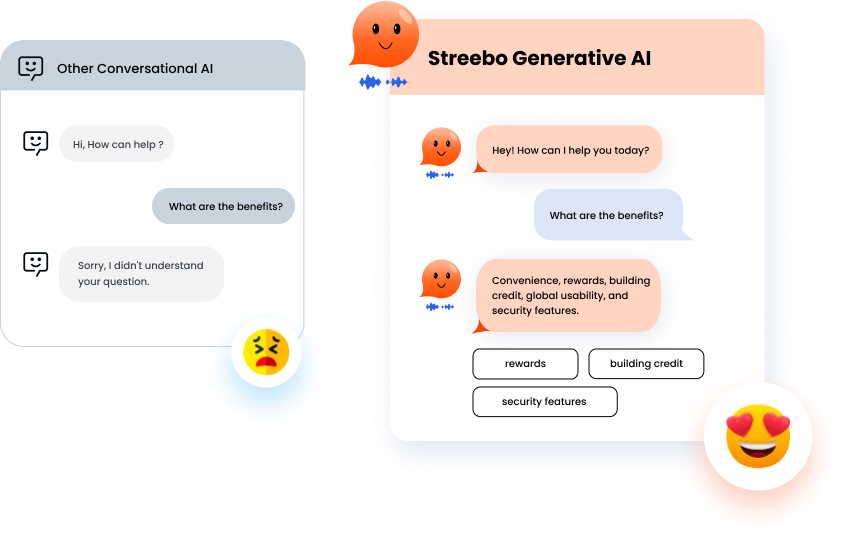

Why Streebo’s GPT 3.5 Powered Conversational AI Solution for Credit Card Services?

Streebo a leading AI and Digital Transformation Company, has created an immensely powerful, intelligent, and Pre-trained

AI-Powered chatbot for Credit Card Applications. Our bots are powered by industry-leading NLP engines such as IBM

Watson, Google Dialogflow from GCP, Wit.AI from Meta, and Amazon Lex from AWS. We have now levelled up customer

interactions by successfully integrating our bots (Streebots) with the latest GPT 3.5 series language models from

Open.AI. Initially with powerful NLP engines, we were delivering quality customer service experiences but with a limited

set of responses. Our responses were static. But this new addition has changed the whole game by providing a unique

level of conversational ability. Now our chatbots have become more powerful and intelligent with human-like dynamic

responses. With advanced natural language generation capabilities, our ChatGPT like credit card bots can accurately

understand and respond to customer inquiries in real-time, providing prompt and precise information.

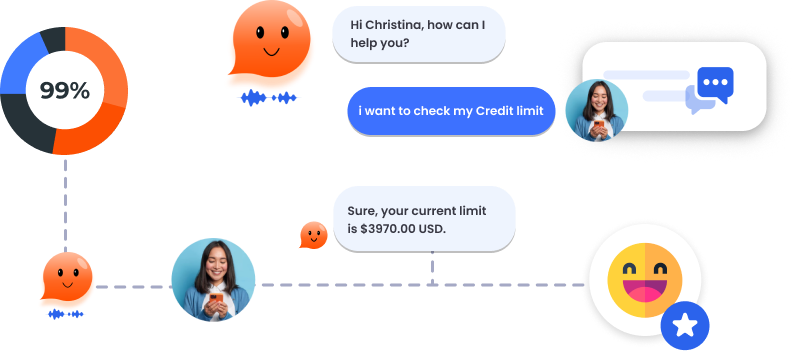

Our AI-powered credit card bots come with an accuracy rate of up to 99%. We continue to train them with rigorous testing

procedures until they reach the desired accuracy level. They can be integrated with a wide variety of Core Credit card

Software (Finacle, SAP Core Banking, Oracle Flex Cube), Credit Card Systems. and Payment Systems. Our Smart Cognitive

Assistants create an opportunity to leverage unprecedented channels such as Facebook Messenger, Google Chat, WhatsApp,

SMS, Amazon Alexa, Google Assistant, Siri, and now Email too for Credit Card agents to interact with their end

customers. That is why our AI-powered Credit Card chatbot has a powerful ROI as it can improve sales and reduces costs

for organizations deploying them.

Our pre-trained Credit Card chatbot is trained in the following Credit Card Operations:

FAQs

FAQs

Eligibility Checks of a Customer

Eligibility Checks of a Customer

Browse Products Details

Browse Products Details

Generate a Credit Limit

Generate a Credit Limit

Apply for a Credit Card

Apply for a Credit Card

Create an account

Create an account

Manage Service Request

Manage Service Request

Customer Support and query resolution

Customer Support and query resolution

Underwriting

Underwriting

Track status of Credit Account

Track status of Credit Account

Interact with e-Commerce Platforms

Interact with e-Commerce Platforms

Payment and Repayment Transactions

Payment and Repayment Transactions

Update Profile

Update Profile

Document Upload

Document Upload

Product Recommendations based on user behavioral pattern

Product Recommendations based on user behavioral pattern

chatbot Analysis

chatbot Analysis

Feedbacks and reviews

Feedbacks and reviews

Offers and Promotions

Offers and Promotions

Rewards for Consumer

Rewards for Consumer

Key Business Benefits of these cutting-edge Bots designed specifically for Credit Sector

As per Gartner’s report –

With chatbot for Credit Card companies, it has been observed that close to 10% customers would buy items from

conversational Interface and close to 23% of consumers are interested in chatbots for their instantaneity.

With chatbot for Credit Card companies, it has been observed that close to 10% customers would buy items from

conversational Interface and close to 23% of consumers are interested in chatbots for their instantaneity.

85% of customer interactions will happen via chatbot and will save upto $8 billion annually.

85% of customer interactions will happen via chatbot and will save upto $8 billion annually.

By leveraging Streebo’s AI Powered Credit Card Services Bots – banks can avail below mentioned benefits:

Increased Revenue

Increased RevenueStreebo’s AI-powered Credit card solution present on variety of social media channels can analyze customer data and recommend products and services that may be of interest to them. This can increase sales and revenue and provide customers with a more personalized experience. With the progress of conversational commerce, Our super smart bots for Credit Card Services can cross-sell products to customers efficiently.

Improved Customer Satisfaction Index

Improved Customer Satisfaction IndexWith NLP-aided features and transactional agility, Streebo’s ChatGPT-powered bots not only improve engagement with the customer but drive adoption amongst dormant credit card customers. Streebots provide instant responses to customer queries, reducing wait time and improving accuracy.

Reduced Intervention

Reduced InterventionStreebo’s Credit Card Application Virtual assistant assists customers in operations like creating an account, eligibility checks, applying for a credit card, service requests, payments, etc. AI-powered bots for Credit Card Companies allow interaction with multiple e-Commerce platforms and payment gateways for customer’s shopping, billing & payments.

Advanced Underwriting Assistance

Advanced Underwriting AssistanceStreebo’s AI-bot powered for Credit Cards can assist in process of underwriting which reduces the TAT for credit card approvals and communicates with all parties on basic underwriting questions for a loan application, seeks additional or missing data to perform the underwriting process.

Let’s have a quick rundown of Our Key Differentiators –

In-Built Domain Intelligence

In-Built Domain IntelligenceStreebo in collaboration with its technology partner, deploys highly intelligent cognitive solutions which can emulate your business processes. They can automate repetitive tasks, such as balance inquiries and transaction history, freeing up customer service agents to handle more complex issues.

Omni-Channel Experience

Omni-Channel ExperienceStreebo’s GPT 3.5 Integrated Credit Card Service Bots provide a truly comprehensive omni-channel experience that businesses can use to connect with customers, no matter what platform they choose. Customers have the flexibility and convenience to interact with the bots via channels such as WhatsApp, Facebook Messenger, Google Chat, SMS, Telegram, Signal, WeChat, Skype, IVR, Amazon Alexa, Google Home, and now Email as well.

Email Assistance

Email AssistanceOur ChatGPT integrated bots for Credit Card Industry can automate email responses through the use of natural language processing (NLP) and machine learning algorithms. This technology enables chatbots to understand the context of an email and generate an appropriate response based on predefined rules and criteria. This can improve efficiency and speed in handling customer inquiries and reduce the workload for human customer service agents.

Voice Technology from GPT:

Voice Technology from GPT:Streebots incorporate the cutting-edge technologies in voice such as Whisper(beta) from Open.AI and Speech-To-Text technologies from IBM Watson, Google Dialogflow and Amazon Lex. Whisper is an AI-powered voice platform that enables banks to better understand their customers and respond quickly with virtual support. STT, or Speech to Text technology, is a real-time transcription service that can scan conversations for keywords to help ensure the correct information is collected from each call. This leads to improved customer experience, as customers receive quick and accurate answers to their questions. This optimized response time contributes to a strengthened relationship between the banks and its customers, leading to increased loyalty and profitability. In conclusion, the integration of whisper and Speech-to-Text technology serves as a valuable asset for banks in their pursuit of modernizing and staying ahead in the industry.

Role based & Secure access

Role based & Secure accessStreebo’s Omnichannel Banking Solution is built on top of robust infrastructure from top technology providers such as IBM, Red Hat, Google, and Amazon. Hence, they have tight security and scalable infrastructure in place. Using ChatGPT for credit card cognitive assistants, come with advance security measures including encryption and secure storage protocols.

Flexible Deployment Models

Flexible Deployment ModelsStreebo’s Banking Solution for Credit Card Services can be deployed on-premises or on IBM Cloud, Microsoft Azure, Amazon AWS, or Google Cloud Platform.

Access to Unstructured Data

Access to Unstructured DataInnovative tools and technologies like Classification, Clustering, Embedding, and Generative AI technology in the GPT platform have made it seamless for Enterprises of all sizes to tap into unstructured information silos. This includes Web Pages, User Manuals, Product Documentation, and other unstructured information such as logs, and emails to find the relevant information for the end users. Streebots integrated with GPT 3.5 can leverage this powerful capability and bring the right information to the product sales or servicing cycle at the right time.

Advanced Chat Analytics

Advanced Chat AnalyticsStreebo’s analytics dashboard is developed to record and display systemic data, metrics, preferences, and trends which eventually help in monitoring user interactions, and can be adapted accordingly to give relevant responses and take informed business decisions.

Pre-Integrated with Backends

Pre-Integrated with BackendsStreebo’s ChatGPT-integrated Banking Bot comes pre-integrated with common core banking systems such as SAP Core banking, Oracle Flex cube, Finacle-eliminating the complexity of design, development, and upkeep of bots manually. The end result? A seamless experience that can drive improved customer engagement without the hassle of hardcoded solutions. With Streebo’s Credit bot solution, you can stay ahead of the competition through faster implementation cycles.

Guaranteed Bot Intelligence Index

Guaranteed Bot Intelligence IndexStreebo’s Credit Card solution comes with a Guaranteed Bot Intelligence Index* of up to 99% (*BII= No. of questions answered correctly/No. of relevant questions asked). We continue to train the bot until they reach a high degree of accuracy. Our solution is designed while comprehending all necessary aspects and challenges. The bots are powered by GPT 3.5 series language models, and open APIs making them a perfect virtual partner for all credit card operations especially credit card services with accuracy.

Multi-Language Capabilities:

Multi-Language Capabilities:Using ChatGPT in credit card bots, Streebo’s smart bot is capable of seamlessly switching between languages. This pre-trained solution for Credit Card Services is trained to understand the unique dialects and accents of users based on their demographics and geography, enabling support for 38+ languages. This helps banks and financial institutions to expand their reach by providing customer service in the language customers are most comfortable with.

In-built Live Agent Support:

In-built Live Agent Support:Streebo’s advanced bot solution for Credit Card Services also has integrated human support. This allows customers to receive real-time assistance if they are unable to find a solution to their query through interaction with the bot. The seamless transition between human operators and chatbots ensures that customer questions are promptly and effectively resolved.

Pricing Model

Capex Option

You can choose to buy the Bot solution.

Opex Option

You can choose to Subscribe to our Bot solution for a fixed monthly charge.

Pay Per Usage

This is a conversation-based subscription and tied to the number of conversations & messages the bot handles. Thus, you only pay if the Bot is getting used and is actually deflecting calls.

Conclusion

AI powered bots have immense potential to transform

banking and credit card industries by enhancing customer experience and

streamlining operations with a structured approach.

The use of chatbots in the Credit Card industry has reduced the average handling time of customer inquiries by

up to 30%, as reported by Gartner, leading to improved efficiency and higher productivity for the staff.

The use of chatbots in the Credit Card industry has reduced the average handling time of customer inquiries by

up to 30%, as reported by Gartner, leading to improved efficiency and higher productivity for the staff.

The chatbots can handle an average of 82% of routine customer inquiries, freeing up

valuable human resources to focus on more complex tasks.

The chatbots can handle an average of 82% of routine customer inquiries, freeing up

valuable human resources to focus on more complex tasks.

The above-mentioned statistics demonstrate the clear benefits of incorporating AI-powered bots into banking and credit card

operations. In today’s fast paced tech-driven world, it is imperative for Credit card companies to stay at the forefront and

maximize the usage of technology to level up customer services. According to a survey by Accenture, 72% of customers expect

a response from a chatbot within seconds.

Here Streebo’s smart AI bots powered by industry leading NLP engines (IBM Watson, Google Dialog Flow, Amazon Lex) and now GPT 3.5 meet this expectation with fast and accurate responses. By leveraging Generative AI technology, our highly innovative, high-tech bots for credit card companies can enhance customer engagement with dynamic responses, offer personalized services and assess credit risks accurately. With our advanced chatbots, Credit Card Companies can stay ahead of the curve and continue to provide unparalleled services to their clients over web, mobile and social media platforms. Failure to embrace these cutting- edge technologies may result in falling behind and losing market share to more progressive and forward-thinking competitors.

Here Streebo’s smart AI bots powered by industry leading NLP engines (IBM Watson, Google Dialog Flow, Amazon Lex) and now GPT 3.5 meet this expectation with fast and accurate responses. By leveraging Generative AI technology, our highly innovative, high-tech bots for credit card companies can enhance customer engagement with dynamic responses, offer personalized services and assess credit risks accurately. With our advanced chatbots, Credit Card Companies can stay ahead of the curve and continue to provide unparalleled services to their clients over web, mobile and social media platforms. Failure to embrace these cutting- edge technologies may result in falling behind and losing market share to more progressive and forward-thinking competitors.

So, what are you waiting for? Make a visit to our bot store and book a demo today

to preview the library of entire Smart, cloud-ready solutions.