#Smart Generative AI Agent

Check out Demo

Generative AI Powered Smart Bot Solution

Omni-Channel Bots – Deploy on Chat, Voice, Email, Instagram, Facebook, WhatsApp and Even SMSCheck out Demo

Trusted by hundreds of leading companies

×

Check out the Enterprise Grade AI Agent Powered by Gen AI. No Setup Fees.

Embrace Intelligent Virtual Assistants for Corporate Banking

The ever-advancing realm of technology has revolutionized the way we communicate, and in the realm of banking, this

transformation has been nothing short of remarkable. Remember the days when every basic banking need necessitated a visit to the bank

branch and long waits in queues? Well, those days have been supplanted by the era of digital banking and automation, putting

everything at our fingertips. Automation has become the catalyst reshaping how banks engage with their customers, whether individuals

or corporate clients.

The journey began with banks embracing chatbots for customer service, albeit in their early stages characterized by menu-based interactions. These chatbots, however, quickly evolved, progressing from Rule-based to Keyword-driven, and eventually reaching the pinnacle of Conversational AI chatbots.

The journey began with banks embracing chatbots for customer service, albeit in their early stages characterized by menu-based interactions. These chatbots, however, quickly evolved, progressing from Rule-based to Keyword-driven, and eventually reaching the pinnacle of Conversational AI chatbots.

These conversational AI chatbots marked a significant turning point, especially for corporate banks, as they

seamlessly handled a substantial portion of banking operations with remarkable speed and accuracy, effectively reducing the workload

on bank employees.

Yet, even during this golden age of AI chatbots, banks noticed a reluctance among customers to fully embrace them. Upon investigation, several factors emerged as obstacles to widespread adoption.

Yet, even during this golden age of AI chatbots, banks noticed a reluctance among customers to fully embrace them. Upon investigation, several factors emerged as obstacles to widespread adoption.

These included limitations such as-

Inability to handle multifaceted questions

Inability to handle multifaceted questions

Gaps in understanding nuanced queries

Gaps in understanding nuanced queries

Reliance on fixed and static responses

Reliance on fixed and static responses

Concerns regarding data security

Concerns regarding data security

Absence of sentiment analysis

Absence of sentiment analysis

However, the primary reason that encapsulated these challenges was the absence of the human touch—a personal connection that had traditionally been the hallmark of the banking sector.

Enter Generative AI Powered chatbots for Corporate Banking

The emergence of Generative AI technology, coupled with the utilization of Large Language Models (LLMs), has brought

about a transformative shift. It has added a crucial dimension: the ability to engage in conversations. Before the advent of Generative

AI, Conversational AI chatbots excelled at listening and processing but were limited in their capacity for dynamic interactions.

With the introduction of Generative AI platforms and the incorporation of various LLMs, these chatbots have undergone a remarkable transformation, becoming smarter and more secure. Currently, responses generated by corporate banking chatbots exhibit dynamic and context-aware characteristics. They possess the capability to grasp nuances like tone, dialect, and sentiment analysis.

This transformation has not only improved customer interactions but also addressed security concerns. According to Juniper’s recent statistics:

With the introduction of Generative AI platforms and the incorporation of various LLMs, these chatbots have undergone a remarkable transformation, becoming smarter and more secure. Currently, responses generated by corporate banking chatbots exhibit dynamic and context-aware characteristics. They possess the capability to grasp nuances like tone, dialect, and sentiment analysis.

This transformation has not only improved customer interactions but also addressed security concerns. According to Juniper’s recent statistics:

Dynamic Interactions

Dynamic Interactions

Banking chatbots powered by Generative AI now handle approximately 75% more dynamic interactions than their predecessors.

Sentiment Analysis

Sentiment Analysis

With sentiment analysis, chatbots can accurately gauge customer sentiment, leading to a 60% increase in customer satisfaction levels.

Data Security

Data Security

Enhanced security features have reduced data security concerns among corporate banking clients by 40%.

In the realm of Corporate Banking, offering diverse financial solutions

to both large corporations and small to medium-sized businesses, the integration of Generative AI

technology has streamlined processes, enhancing efficiency and customer satisfaction.

How is the banking industry being transformed by generative AI chatbots?

Streebo’s Smart & Safe Generative AI Powered chatbots for Corporate Banking

This integration empowers banking customers to engage securely and conduct transactions through our corporate banking chatbots. Our

chatbots can be tailored to specific corporate banking use cases such as credit management, asset management, trade finance, and more.

They are built upon enterprise-grade cloud platforms such as IBM Cloud, Azure, AWS, or GCP. Moreover, utilizing open-source platforms

like HuggingFace & more, our corporate banking chatbots have become extremely powerful with advanced features.

These bots are pre-integrated with a wide variety of Core Banking Software such as EdgeVerve Finacle, Oracle FLEXCUBE Core Banking, and SAP Core Banking Services among others. Moreover, they extend the banking experience to a variety of social media platforms such as Facebook Messenger, WhatsApp, Google Chat, Instagram, Email, SMS and more.

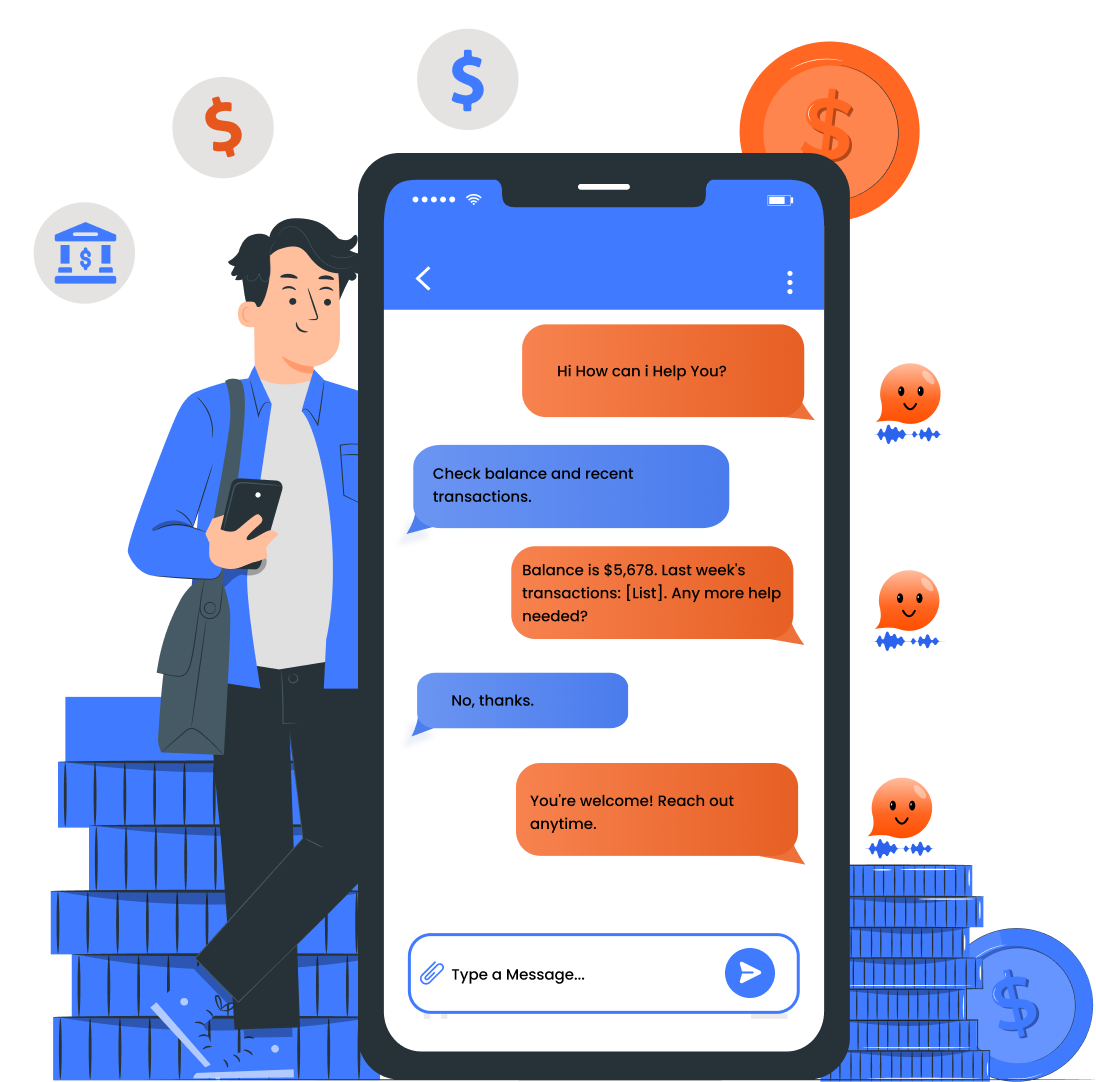

Our corporate banking chatbots undergo meticulous training on extensive datasets, equipping them with the proficiency to comprehend customer inquiries adeptly and respond promptly. To augment their capabilities, we have seamlessly integrated advanced features like sentiment analysis, entity recognition, and intent detection, enabling them to gain a deeper understanding of customer requirements and provide personalized assistance.

These bots are pre-integrated with a wide variety of Core Banking Software such as EdgeVerve Finacle, Oracle FLEXCUBE Core Banking, and SAP Core Banking Services among others. Moreover, they extend the banking experience to a variety of social media platforms such as Facebook Messenger, WhatsApp, Google Chat, Instagram, Email, SMS and more.

Our corporate banking chatbots undergo meticulous training on extensive datasets, equipping them with the proficiency to comprehend customer inquiries adeptly and respond promptly. To augment their capabilities, we have seamlessly integrated advanced features like sentiment analysis, entity recognition, and intent detection, enabling them to gain a deeper understanding of customer requirements and provide personalized assistance.

Top Use Cases of Our Generative AI Powered chatbot Solutions for Corporate Banking

For Customer/ Corporate Businesses

Account Management

Account ManagementAssisting corporate clients in managing their accounts, including account setup, queries, and account balance inquiries.

Transaction Support

Transaction SupportFacilitating large fund transfers, payroll processing, and bulk payments for corporate customers.

Credit Application Assistance

Credit Application AssistanceGuiding businesses through the complex process of applying for loans or credit lines, collecting necessary documentation, and providing application status updates.

Treasury Services

Treasury ServicesAssisting with cash management, liquidity optimization, and investment strategies for corporate clients.

Trade Finance Support

Trade Finance SupportProviding information on trade finance products, including letters of credit and trade credit insurance, and helping clients with trade-related n

Foreign Exchange Services

Foreign Exchange ServicesOffering real-time exchange rates, currency conversion services, and hedging strategies for international corporate clients.

For Agents

Agent Support

Agent SupportAssisting relationship managers and banking agents by providing them with detailed client information, transaction history, and account insights during interactions with corporate clients.

Complex Issue Escalation

Complex Issue EscalationIdentifying intricate financial matters and seamlessly escalating them to specialized banking agents while preserving context.

For Marketing

Client Engagement

Client EngagementSending personalized corporate banking updates, financial market insights, and tailored promotions to corporate clients based on their financial needs and preferences.

Lead Generation

Lead GenerationInitiating conversations with potential corporate clients, collecting business information, and identifying prospects for tailored banking solutions.

Feedback and Surveys

Feedback and SurveysConducting surveys and gathering feedback from corporate clients to enhance banking services and products.

Product Information

Product InformationProviding comprehensive details about corporate banking products and services, including corporate loans, treasury solutions, and cash management options.

Market Insights

Market InsightsOffering data-driven market insights and economic forecasts to assist corporate clients in making strategic financial decisions.

Business Benefits of Corporate Banking chatbot Solution-

85% of bank-customer interactions will be handled without a human by

2024 due to enhanced customer satisfaction. – Gartner

85% of bank-customer interactions will be handled without a human by

2024 due to enhanced customer satisfaction. – Gartner

There will be nearly $11 billion in cost savings from utilizing

Corporate Banking chatbots in banking by 2023. – Juniper Research

There will be nearly $11 billion in cost savings from utilizing

Corporate Banking chatbots in banking by 2023. – Juniper Research

79% of bankers consider chatbots in banking to be part of their customer engagement strategy. – AYTM

79% of bankers consider chatbots in banking to be part of their customer engagement strategy. – AYTM

Key Features of Our Generative AI Powered Corporate Banking chatbot Solution-

Omni-Channel Accessibility

Omni-Channel Accessibility

Dynamic Responses

Dynamic Responses

Efficient Information Summarization

Efficient Information Summarization

Structured Answers from Unstructured Data

Structured Answers from Unstructured Data

Accurate Responses to Unfamiliar Queries

Accurate Responses to Unfamiliar Queries

Streamlined Email Automation

Streamlined Email Automation

Seamless Backend Integration

Seamless Backend Integration

Sentiment Analysis

Sentiment Analysis

Robust Security Measures

Robust Security Measures

Live Agent Support

Live Agent Support

Multilingual Support with 38+ Languages

Multilingual Support with 38+ Languages

Multimodal Capabilities (Image, Speech, Text)

Multimodal Capabilities (Image, Speech, Text)

Pricing Model

Capex Option

Capex OptionYou can choose to buy the Bot solution.

Opex Option

Opex OptionYou can choose to Subscribe to our Bot solution for a fixed monthly charge with no upfront setup fee.

Pay Per Usage

Pay Per UsageThis is a conversation-based subscription and tied to the number of conversations & messages the bot handles. Thus, you only pay if the Bot is getting used and is actually deflecting calls.

Video Center

Watch our Virtual assistant in action

See our video channel to explore our variety of available service.

See our video channel to explore our variety of available service.

Case Study

Streebo helps Medium sized co-operative credit society to transform their customer service by building a chatbot on Facebook Messenger

With thousands of transactions and customer queries lined up every day, Medium sized co-operative credit society’s agents were losing valuable time handling repetitive customer queries. READ MORE