Opportunities for Corporate Banking Sector – An Overview

The Tectonic Shift to Technology: How Corporate Banking is Embracing Change

The average person spends approximately 2 hours and 24 minutes on social media every day. The rise and popularity of social media apps and internal messaging platforms has set breathtaking records with skyrocketing usage. The trend of asynchronous messaging platforms like WhatsApp, Facebook, SMS etc. offer customers an enhanced level of control and flexibility. These changes have a significant impact on -how people engage and transact, presenting both opportunities and challenges for businesses and banking organizations.

Overview of Social Media Use

NUMBER OF SOCIAL MEDIA USERS

4.62

BILLION

QUARTER-ON-QUARTER CHANGE IN SOCIAL MEDIA USERS

+1.7%

+77 MILLION

YEAR-ON-YEAR CHANGE IN SOCIAL MEDIA USERS

+10.1%

+424 MILLION

AVERAGE DAILY TIME SPENT USING SOCIAL MEDIA

2h 27M

+1.4% (+2M)

AVERAGE NUMBER OF SOCIAL PLATFORM USED EACH MONTH

2h 27M

+1.4% (+2M)

SOCIAL MEDIA USERS vs. TOTAL POPULATION

58.4%

SOCIAL MEDIA USERS vs. POPULATION AGE 13+

74.8%

SOCIAL MEDIA USERS vs. TOTAL INTERNET USERS

93.4%

FEMALE USERS vs. TOTAL USERS

46.1%

MALE USERS vs. TOTAL USERS

2h 27M

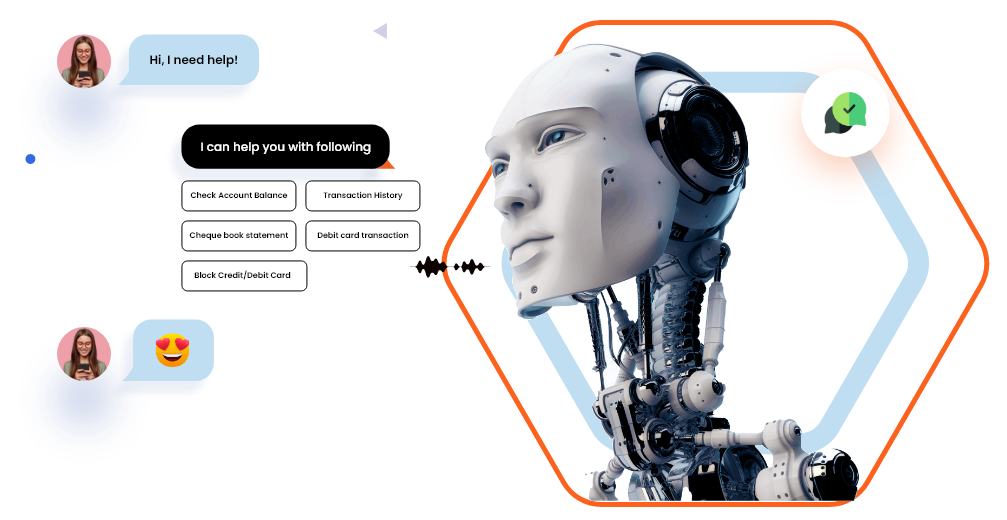

Advent of Artificial Intelligence and NLP Technologies

Their presence on all social media platforms 24*7 with prompt responses and high accuracy has made banking effortless for both customers and corporate clients.

- According to a report by Accenture, 70% of banks are stepping towards Artificial Intelligence and Social media platforms to enhance the customer experience and streamline banking operations.

- Also, a study of Financial Brand has projected that 85% of banks now have a presence on social media platforms to raise awareness and surge financial literacy.

As AI and social media continue to gain traction, the use of these innovative technologies within the realm of corporate banking is poised to experience substantial growth in the future. Predictions forecast that the global market for AI in Corporate banking will attain a staggering $14 billion by 2023.

The Launch of GPT-Unveiling the Next-Generation Conversational AI Solution for Corporate Banking

Our smart, omnichannel chatbots can be pre-trained for following Corporate Banking Key Operations

- FAQs (Frequently Asked Questions)

- Account Balance & Details

- Add Payee

- Fund Transfer

- Payroll management

- Manage Service Request

- Foreign Exchange

- Update Profile

- Business Reports

- Feedbacks and Reviews

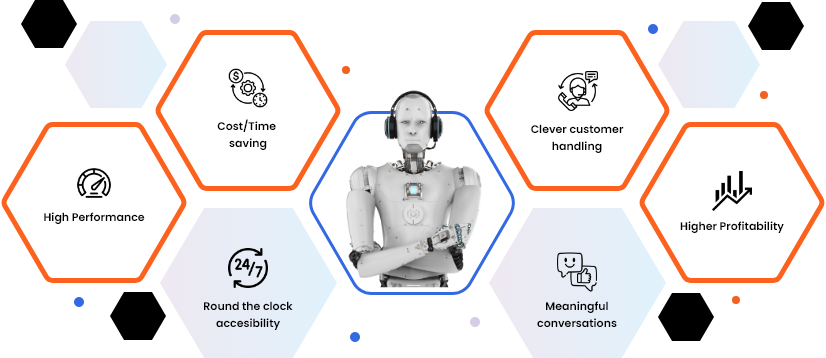

Key Business Benefits of Streebo’s Industry-Geared, Smart, Powerful COGS(Cognitive Assistants) designed specifically for corporate banking

By adopting Streebo’s chatbot for Corporate Banking across channels banks will see the following benefits:

With Streebo’s Corporate Banking Bots powered by GPT Platform, it becomes highly convenient to maintain customer profiles, identify new prospects on social media channels, gather genuine feedback on existing products and services and deliver the right information at right time to cross sell new products and services. Thus, increased sales and revenue.

Streebo’s Corporate Banking solution maintains a track record of the client’s usage patterns and provides them with better deals, investments and Fixed Deposit advice. Based on Client’s behavior, habits, and previous choices, Streebo’s Corporate banking solution can make tailor-made recommendations – bringing greater value as well as increased sales opportunities. Round the clock Customer Query Resolution significantly increases Customer Satisfaction rate and Customer Retention rate.

Leveraging the company’s digital properties and social media channels through ChatGPT Corporate Banking chatbots such as WhatsApp, Facebook Messenger, SMS, Email among others to easily reach out to prospects can help in improving the conversion ratio of inquiry to sales closure. They are effective in keeping customers active by providing the convenience of being there for them always.

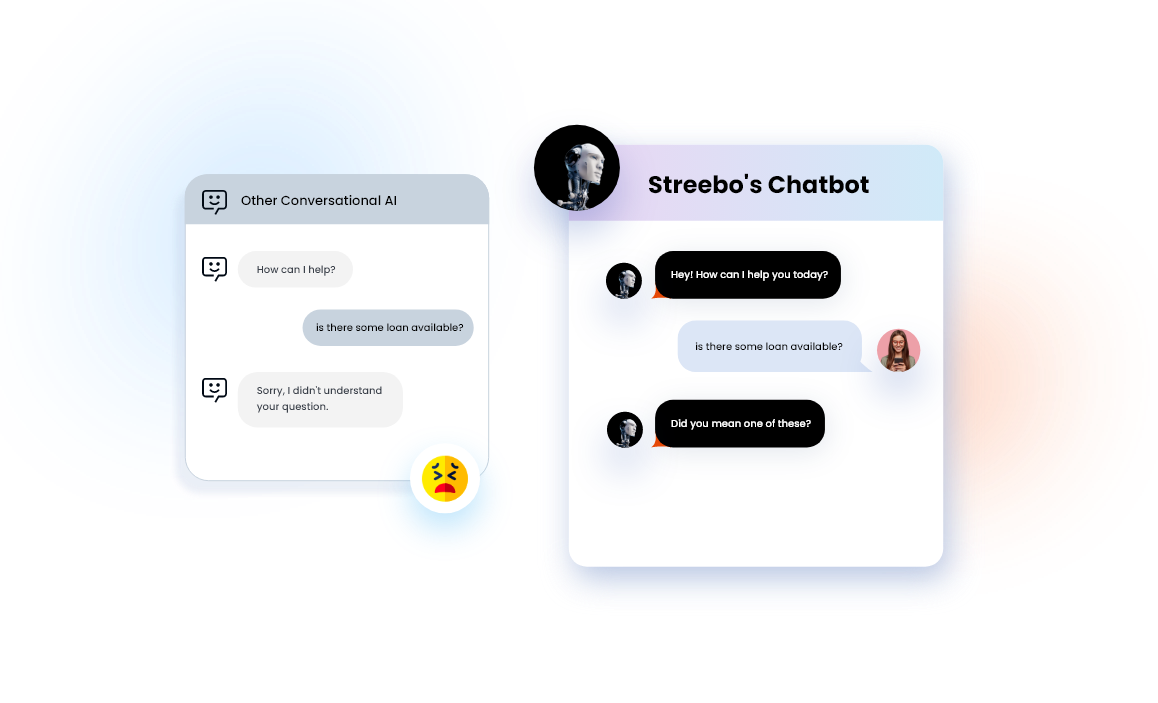

Key-differentiators of Our ChatGPT-powered Smart, Omnichannel, Industry-Relevant, Cognitive Assistants for Corporate Banking

Streebo’s Team with multiple implementations in the Corporate Banking sector holds deep domain knowledge in Corporate Banking. In collaboration with its technology partner(s), it deploys a highly intelligent pre-trained Corporate Banking Cognitive Assistant that can emulate business processes for various operations.

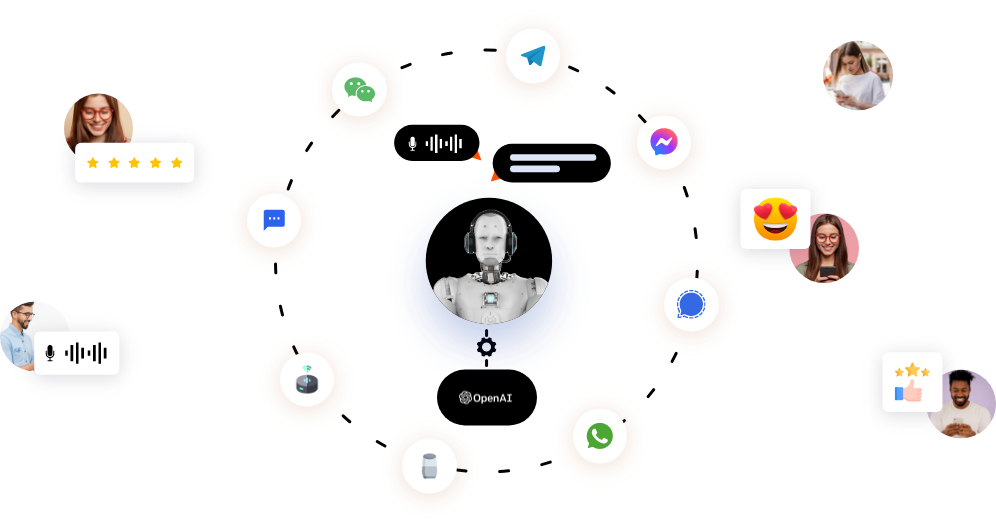

Streebo's Corporate Banking chatbots powered by GPT-3.5 Platform provide a truly comprehensive omni-channel experience that banks can use to connect with customers, no matter what platform they choose. Customers have the flexibility and convenience to interact with the bots via channels such as WhatsApp, Facebook Messenger, Google Chat, SMS, Telegram, Signal, WeChat, Skype, IVR, Amazon Alexa, Google Home, and now even email. With ChatGPT integration, now even email responses can be automated thus making it a powerful solution for sales and services alike. This feature ensures the customers get prompt responses on whatever platform they are.

Streebo’s Corporate Banking chatbot comes pre-integrated with Core Banking Solutions such as Finacle, Oracle FLEXCUBE Core Banking, and SAP Core Banking Services among others. This conserves resources and time by eliminating the need to manually configure or integrate backends or 3rd party systems.

Innovative tools and technologies like Classification, Clustering, Embedding, and Generative AI technology in the GPT platform have made it seamless for Enterprises of all sizes to tap into unstructured information silos. This includes Web Pages, User Manuals, Product Documentation, and other unstructured information such as logs, and emails to find the relevant information for the end users. Streebo’s bots integrated with GPT can leverage this powerful capability and bring the right information to the product sales or servicing cycle at the right time.

Streebots incorporate the cutting-edge technologies in voice such as Whisper(beta) from Open.AI and Speech-To-Text technologies from IBM Watson, Google Dialog flow, Microsoft Copilot Studio, Power Virtual Agents and Amazon Lex.

Whisper is an AI-powered voice platform that enables banks to better understand their customers and respond quickly with virtual support. STT, or Speech to Text technology, is a real-time transcription service that can scan conversations for keywords to help ensure the correct information is collected from each call. This leads to improved customer experience, as customers receive quick and accurate answers to their questions. This optimized response time contributes to a strengthened relationship between the banks and its customers, leading to increased loyalty and profitability.

Streebo’s pre-trained AI-powered bots for Corporate Banking can be deployed on-premises or on IBM Cloud, Microsoft Azure, Amazon AWS, or Google Cloud Platform.

Streebo’s AI-powered conversational interface comes with an analytics dashboard. This dashboard is developed to record and display systemic data, metrics, preferences, and trends which eventually help in monitoring user interactions, and can be adapted accordingly to give relevant responses and take business decisions. The advanced chat analytics dashboard also provides detailed reports on best-selling items, further allowing you to make more informed decisions while fine-tuning your business processes.

Streebo’s ChatGPT-like Banking solution comes with a Guaranteed Bot Intelligence Index* of upto 99% (*BII= No. of questions answered correctly/No. of relevant questions asked). We continue to train our virtual agents until they reach the highest level of accuracy. Our Cognitive assistants (COGS) are designed while comprehending all necessary aspects and challenges of Banking industries.

Another feature that sets Streebo’s Corporate Banking Virtual Assistant apart from other chatbots is its multi-lingual support which allows customers to communicate with it in multiple languages, including English, Spanish, French and Chinese. The support of 38+ languages make easier for banks to cater to customers who do not speak English or have limited proficiency in English.

Our solution leverages cutting edge NLP engines, including IBM Watson, Google Dialog, Microsoft Copilot Studio, Power Virtual Agents, and Amazon Lex, to ensure that all processed data is secure and adheres to regulatory standards. In addition, all communication between GPT and our solution is encrypted and masked, guaranteeing the security of all data, not just sensitive information

Corporate Banking Virtual Assistants have built-in live agent support, allowing users to get immediate assistance if the bot is unable to answer their questions. Customers can easily switch between chatbots and human operators, ensuring that their questions are quickly and effectively answered.

Pricing Model

Capex Option

You can choose to buy the MVP Bot.

You can choose to buy the MVP Bot.Opex Option

You can choose to Subscribe to the MVP Bot for a fixed monthly charge.

You can choose to Subscribe to the MVP Bot for a fixed monthly charge.Pay Per Usage

This is a conversation -based subscription and tied to the number of conversations & messages the bot handles. Thus, you only pay if the Bot is getting used and is actually deflecting calls.

This is a conversation -based subscription and tied to the number of conversations & messages the bot handles. Thus, you only pay if the Bot is getting used and is actually deflecting calls.Future of chatbots in Banking: Forecasts and Insights