Generative AI Powered Smart Bot Solution

Omni-Channel Bots – Deploy on Chat, Voice, Email, Instagram, Facebook, WhatsApp and Even SMSCheck out Demo

Check out the Enterprise Grade AI Agent Powered by Gen AI. No Setup Fees.

ChatGPT For Insurance

The industry is often associated with legacy processes, maze of paperwork, and complex affairs. Deploying more humans to manage these complexities is not a viable solution, so what’s next? To bridge this gap, it is necessary for all insurers and insurtechs globally to invest in solutions like AI-powered insurance bots to strengthen customer experience.

According to a Juniper Study, the use of conversational AI chatbots for insurance will lead to cost savings of almost $1.3 billion by 2024.

Conversational AI in Insurance: The Future

-

Conversational AI and Strong NLP engines are two disruptive forces that have transformed industries of all sizes. Artificial Intelligence has come a long way from a “Good-to-have” to a “Must-have” differentiator. Conversational AI has matured to a point where it can match human cognition. The arrival of ChatGPT from Open.AI powered by their GPT platform has become a game changer for Insurance industries to entail enhanced customer experience with several key benefits.

Conversational AI and Strong NLP engines are two disruptive forces that have transformed industries of all sizes. Artificial Intelligence has come a long way from a “Good-to-have” to a “Must-have” differentiator. Conversational AI has matured to a point where it can match human cognition. The arrival of ChatGPT from Open.AI powered by their GPT platform has become a game changer for Insurance industries to entail enhanced customer experience with several key benefits. -

AI-powered ChatGPT solution is revolutionizing the way these brands acquire, engage, and serve their customers. These Insurance ChatGPT-like bots ask customers questions about their requirements, offer them personalized policy recommendations, and help them compare two or more plans, along with other details, much like a human insurance agent.

AI-powered ChatGPT solution is revolutionizing the way these brands acquire, engage, and serve their customers. These Insurance ChatGPT-like bots ask customers questions about their requirements, offer them personalized policy recommendations, and help them compare two or more plans, along with other details, much like a human insurance agent. -

Customer demands are ever-changing. Those who fail to ride the wave of innovation may find themselves struggling for existence as consumer expectations set new market norms. Streebo, a leading digital transformation and Conversational AI company focused on Chat, Voice and Email Bots powered by industry-leading NLP Engines(IBM Watson, Google DialogFlow, Amazon Lex) has taken the technology to the next level by integrating its bots with GPT series language models using Open.AI APIs to create ChatGPT integrated solution specifically for Insurance Companies. And with it comes an opportunity for businesses to revolutionize customer retention rates- and CSAT ratings. These Smart Cognitive Assistants create an opportunity to leverage unprecedented channels such as Facebook Messenger, WhatsApp, SMS, Amazon Alexa, Google Assistant, Siri, etc. for agents to interact with their end customers

Customer demands are ever-changing. Those who fail to ride the wave of innovation may find themselves struggling for existence as consumer expectations set new market norms. Streebo, a leading digital transformation and Conversational AI company focused on Chat, Voice and Email Bots powered by industry-leading NLP Engines(IBM Watson, Google DialogFlow, Amazon Lex) has taken the technology to the next level by integrating its bots with GPT series language models using Open.AI APIs to create ChatGPT integrated solution specifically for Insurance Companies. And with it comes an opportunity for businesses to revolutionize customer retention rates- and CSAT ratings. These Smart Cognitive Assistants create an opportunity to leverage unprecedented channels such as Facebook Messenger, WhatsApp, SMS, Amazon Alexa, Google Assistant, Siri, etc. for agents to interact with their end customers

According to Genpact, 87% of brands invest over $5 million in AI-related technologies every year.

Streebo’s Conversational AI Solution for Insurance Sector

-

Leveraging the latest NLP engines from Industry leaders like IBM Watson, GCP and Amazon Lex, Streebots guarantee conformance to the most recent compliance requirements as well as security requirements.

Leveraging the latest NLP engines from Industry leaders like IBM Watson, GCP and Amazon Lex, Streebots guarantee conformance to the most recent compliance requirements as well as security requirements.

Key Business Benefits of these cutting-edge Bots designed specifically for Insurance Companies

Provide Personalized Advice and Cross-Selling

Provide Personalized Advice and Cross-Selling Reduce Operational Cost

Reduce Operational Cost Prevent Fraud

Prevent Fraud Increase Revenue & Customer Outreach

Increase Revenue & Customer Outreach

-

FAQs (Frequently Asked Questions)

FAQs (Frequently Asked Questions) -

Product Catalogue

Product Catalogue -

Download Forums

Download Forums -

Login/Registration

Login/Registration -

Quote Management

Quote Management -

Policy Service (View, Download)

Policy Service (View, Download) -

Newsletters

Newsletters

-

Learning Center (Videos/Articles)

Learning Center (Videos/Articles) -

Order Management

Order Management -

Profile Management

Profile Management -

Branch Locator

Branch Locator -

Claim Management

Claim Management -

POnline Payment

POnline Payment -

Contact Us/Customer Support (Live Agent)

Contact Us/Customer Support (Live Agent)

Pre-trained Bots/Virtual Assistants

Why AI-powered Streebo’s Smart, Omnichannel, Industry-Relevant, Cognitive Assistants for Insurance Sector?

Built-in Domain Intelligence

Built-in Domain IntelligenceAdditionally, this creates cost savings for the business due to reduced number of calls into contact centers and improved productivity.

Omni-Channel Experience

Omni-Channel Experience Pre-Integrated with Backends

Pre-Integrated with Backends Flexible Deployment Models

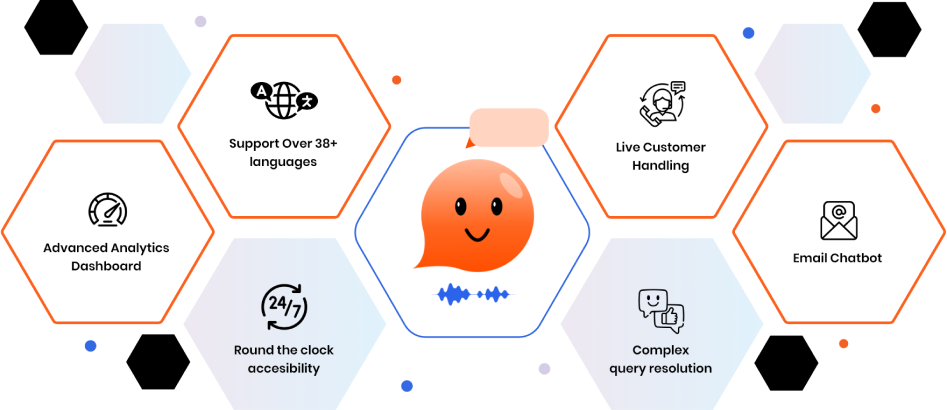

Flexible Deployment Models Advanced Chat Analytics

Advanced Chat Analytics Multi-Lingual Support

Multi-Lingual SupportThe support of 38+ languages and advanced training of bots to understand the dialects and accents of end users according to their demographics and geography helps brands to reach a wider audience.

Inbuilt Live Agent Support

Inbuilt Live Agent Support Guaranteed Bot Intelligence Index (BII) of 99%

Guaranteed Bot Intelligence Index (BII) of 99% Data Privacy and Security

Data Privacy and Security Technically Advanced

Technically AdvancedRedefining Insurance via Game-Changing Conversational AI Technology!

Pricing Options

ChatGPT integrated MVP (Minimum Viable Product) virtual assistant includes

-

3 transaction used cases

3 transaction used cases -

1 back-end integrations

1 back-end integrations -

50 FAQ’s

50 FAQ’s

Capex Option

You can choose to buy the product with an upfront amount.

You can choose to buy the product with an upfront amount.Opex Option

You can choose to Subscribe to the MVP Bot for a fixed monthly charge with no upfront setup fee.

You can choose to Subscribe to the MVP Bot for a fixed monthly charge with no upfront setup fee.Pay Per Usage

This is a conversation-based subscription and is tied to the number of conversations & messages the bot handles. Thus, you only pay if the Bot is getting used and is actually deflecting calls.

This is a conversation-based subscription and is tied to the number of conversations & messages the bot handles. Thus, you only pay if the Bot is getting used and is actually deflecting calls. Final Food for Thought

-

According to a report by McKinsey, The sector could earn a staggering $1.1 trillion by embracing artificial intelligence.

According to a report by McKinsey, The sector could earn a staggering $1.1 trillion by embracing artificial intelligence. -

Also, Juniper Research says that using chatbots in businesses saves 2.5 billion hours which means along with the profit in monetary value, time is also saved.

Also, Juniper Research says that using chatbots in businesses saves 2.5 billion hours which means along with the profit in monetary value, time is also saved. -

A study by Deloitte reported that nearly 74% of executives from the industry are considering investing more in the field of AI in 2023.

A study by Deloitte reported that nearly 74% of executives from the industry are considering investing more in the field of AI in 2023.

Insurance chatbots represent a cutting-edge solution for optimizing operational efficiency and delivering unparalleled customer service of the highest caliber. These innovative tools offer insurmountable opportunities for streamlining processes and elevating the customer experience to new heights.

So, what are you waiting for? Make a visit to our bot store and schedule a demo today to preview the library of entire Smart, cloud-ready solutions!!

Frequently Asked Questions

Conversational AI enables round-the-clock availability, personalized services, rapid response times, and efficient interactions, addressing the evolving needs and expectations of modern insurance customers.

Streebo’s bots support over 38 languages and are trained to understand different dialects and accents, enabling insurance companies to reach a wider and more diverse audience.

Conversational AI assists in timely FAQ responses, quick claim settlement, and efficient customer interactions, impressing customers and enhancing their satisfaction with the insurance company’s services.

AI-powered ChatGPT solutions offer benefits such as personalized advice, cross-selling opportunities, reduced operational costs, fraud prevention, increased revenue, and improved customer outreach.

Conversational AI bots facilitate quick and accurate claims processing by guiding customers through the process, verifying documents through OCR, and providing real-time support for any issues that arise.

Yes, integrating Conversational AI bots can lead to immediate improvements in ROI, as they enhance customer satisfaction, increase sales opportunities, and streamline operations.

Streebo’s bots are pre-integrated with industry-leading NLP engines, enabling them to understand and respond accurately to customer queries. Their accuracy rate of 99% is maintained by continuous learning and context retention.

Streebo’s solution is pre-integrated with various enterprise backend systems, including ERPs, Insurance Management Systems, CRM, and more. This integration enhances efficiency and allows for a seamless customer experience.