ChatGPT for Life Insurance in the Digital Age: How Technology is Transforming the Industry

Schedule a demo

Schedule a demo

The insurance industry has witnessed a heightened level of recognition post pandemic, as individuals have realized the significance of a life insurance plan and a savings policy to secure their financial future. However, with the increasing number of insurance providers offering various plans with diverse features, choosing the most appropriate savings policy has become a challenging task for consumers.

Here social media with its widespread adoption, has proven to be an outstanding tool for bridging this gap and reaching a diverse population. The integration of social media into the daily lives of internet users continues to expand.

Here social media with its widespread adoption, has proven to be an outstanding tool for bridging this gap and reaching a diverse population. The integration of social media into the daily lives of internet users continues to expand.

The most recent statistics from Business Insider predict that the global number of social media users will reach 4.89 billion in 2023, reflecting a year-over-year growth of 6.5%. Now, consumers spend more time on their phones and social media platforms to socialize transparently and exchange thoughts.

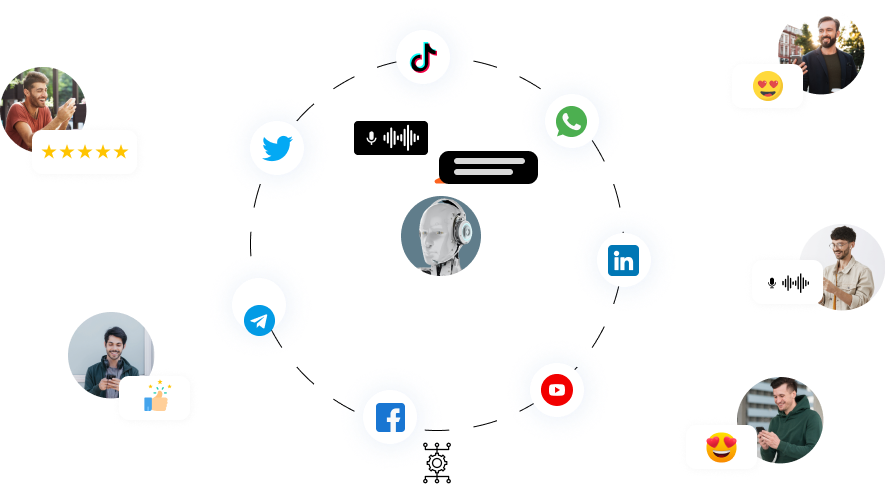

Consequently, it has become imperative for insurance companies to extend their online presence to the platforms where their customer base is most active, including asynchronous messaging channels such as WhatsApp, Facebook Messenger, SMS, and various social media platforms. The deployment of human agents to respond to customer inquiries on these channels is cost-prohibitive and unscalable, thus, to provide rapid and consistent customer service round-the-clock, a self-serve approach powered by advanced Natural Language Processing (NLP) and Artificial Intelligence (AI) is necessary. The integration of AI-powered life insurance chatbots on various social media platforms is an imperative strategy to gain market share, drive operational efficiency, and increase customer outreach.

Transform Your Life Insurance Experience with Cutting-

Edge Artificial Intelligence & Bot Technology

The integration of cutting-edge Artificial Intelligence (AI) and advanced Natural Language Processing (NLP) technology into the life insurance industry has created a paradigm shift in the way customers interact with insurance brands.

Conversational AI and strong NLP engines have transformed industries of all sizes, and AI has evolved from being considered a “good-to-have” feature to a critical component of businesses. With the help of AI-powered solutions, life insurance companies can now provide customers with quicker and more accurate answers to their questions, while also reducing operational costs and increasing customer outreach.

Automation

AI powered Life Insurance bots can automate routine tasks, such as policy renewals, claim submissions, and premium payments, making it easier for customers to manage their policies.

Automation

AI powered Life Insurance bots can automate routine tasks, such as policy renewals, claim submissions, and premium payments, making it easier for customers to manage their policies.

Customer Service

With 24*7 availability, health insurance chatbots can generate prompt responses to customer queries, reduce wait times and deliver tailored recommendations and guidance about policies based on patients’ health history.

Customer Service

With 24*7 availability, health insurance chatbots can generate prompt responses to customer queries, reduce wait times and deliver tailored recommendations and guidance about policies based on patients’ health history.

Predictive Analytics

Conversational AI bots can process vast amounts of data to identify trends and forecast outcomes, enabling life insurance companies to make informed business decisions. The brand image can be monitored and maintained well through AI chatbots on social media platforms.

Predictive Analytics

Conversational AI bots can process vast amounts of data to identify trends and forecast outcomes, enabling life insurance companies to make informed business decisions. The brand image can be monitored and maintained well through AI chatbots on social media platforms.

Customer Insights

AI chatbots for Life Insurance industry, rolled out on different social media platforms can gather data and feedback, providing insights into customer preferences, behaviors, and opinions to drive informed decisions and enhance the customer experience.

Customer Insights

AI chatbots for Life Insurance industry, rolled out on different social media platforms can gather data and feedback, providing insights into customer preferences, behaviors, and opinions to drive informed decisions and enhance the customer experience.

Arrival of GPT in Life Insurance Services

The advancement in Artificial Intelligence, specifically Natural Language Processing, has made it possible to automate chat and voice interactions. The entry of GPT in Life Insurance sector represents a significant milestone in the industry’s digital transformation journey. This advanced language model by Open.AI brings a suite of innovative capabilities including natural language processing, conversational AI and machine learning algorithms. OpenAI’s GPT platform takes NLP to a whole new level, as it not only processes natural language but also generates text through its Generative AI capabilities. The incorporation of Generative AI into the life insurance ecosystem can help companies to stay competitive and address the evolving needs of the customers.

By utilizing asynchronous messaging platforms such as Facebook Messenger, WhatsApp, SMS, Amazon Alexa, Google Assistant, Siri, and others, insurance companies can reach a wider audience and provide 24/7 customer support with routine tasks like claim settlement, policy tracker, and premium reminders, etc. This innovative approach has the potential to significantly enhance customer retention and satisfaction rates, and is a crucial step in revolutionizing the life insurance experience for consumers.

Why ChatGPT powered Streebo’s Smart, Omnichannel,

Industry-Relevant, Cognitive Assistants for Life

Insurance?

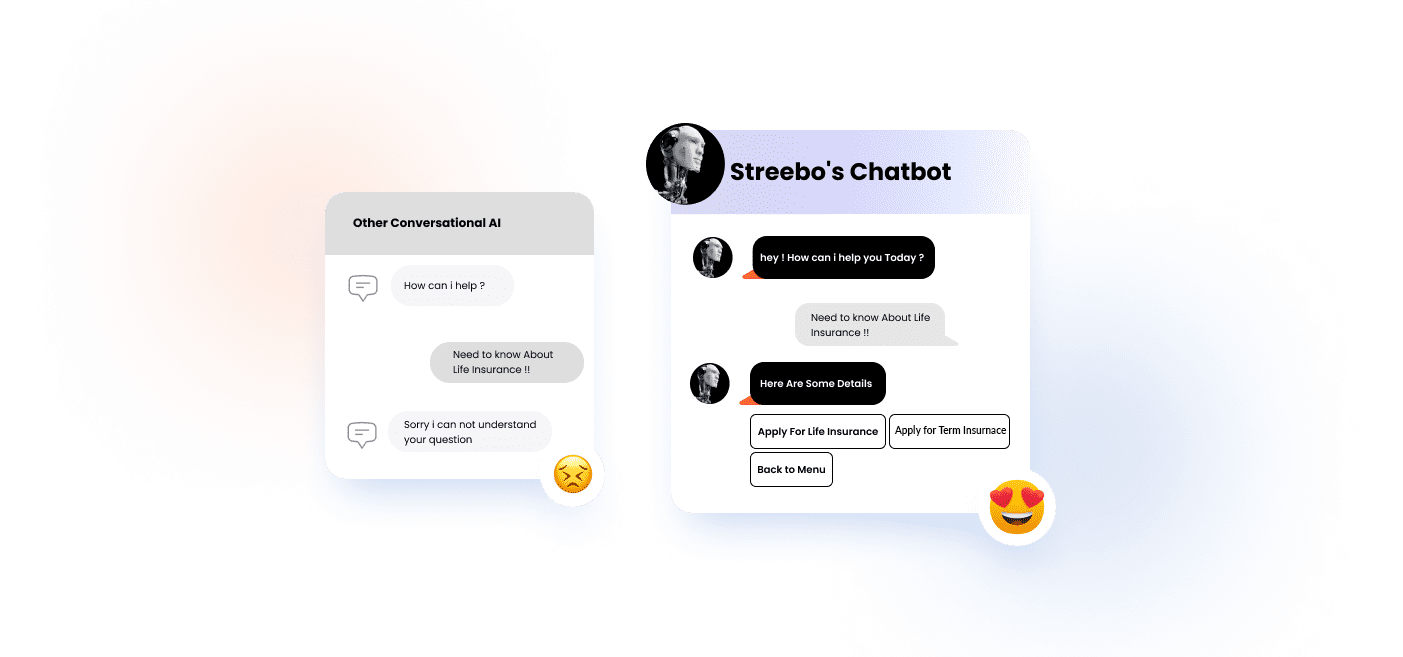

At Streebo, a leading provider of conversational AI solutions, we have developed a library of Chat, Voice and Email Bots powered by industry-leading NLP engines such as IBM Watson, Google Dialogflow from GCP, Amazon Lex from AWS and Wit.AI from Meta.

In our latest release, we have integrated GPT series language models and APIs to create ChatGPT-like solutions for the Life Insurance Sector. Our intuitive, highly intelligent bots can be extended to multiple channels and help customers to make informed decisions while picking the right policy listing all terms and conditions in a simplified manner.

In our latest release, we have integrated GPT series language models and APIs to create ChatGPT-like solutions for the Life Insurance Sector. Our intuitive, highly intelligent bots can be extended to multiple channels and help customers to make informed decisions while picking the right policy listing all terms and conditions in a simplified manner.

Our Smart Bots, commonly referred to as Streebots, offer a highly intuitive experience, making them well-suited for handling complex customer inquiries. With an accuracy rate of up to 99%, and pre-integration with a diverse array of third-party backend systems, including ERP/Insurance Management Systems such as SAP, Oracle ERP, IBM AS/400 Systems, CRM for lead management purposes, OCR for verification of documents, Quote Generation engine, etc.,

Key Business Benefits of these cutting-edge Bots

designed specifically for Insurance Companies

- According to a Juniper Study, the insurance sector will be benefited from AI including chatbots with cost savings of $1.3 billion (about $4 per person in the US) by 2023, up from $300 million in 2019.

- According to a study by Accenture, chatbots can save insurance companies up to 30% of operational costs.

Increased Revenue & Customer Outreach

Increased Revenue & Customer OutreachDue to extended presence on multiple digital channels such as WhatsApp, Facebook Messenger, SMS, WeChat, Telegram, Skype, our smart bots can generate new leads and scale business on social media platforms. Moreover, Our life Insurance chatbots powered by ChatGPT can be easily integrated into the company’s existing systems without any compatibility issues. This allows businesses to benefit from their capabilities immediately after implementation – allowing them to increase their ROI quickly and efficiently. Our sophisticated Insurance solution lowers the operational cost by 50% while doubling the speed (2X) of accurate responses and secure transactions across a variety of back-end systems.

Increased Customer Satisfaction

Increased Customer Satisfaction

Our AI-powered Conversational Interfaces for Life Insurance maintain a track record of the customer’s usage patterns and engage customers with better deals and policy advice. Based on Customer behavior, habits, and previous choices, Our Insurance solution can make tailor-made recommendations – bringing greater value as well as increased sales opportunities. Round the clock Customer Query Resolution significantly increases Customer Satisfaction rate and Customer Retention rate.

Personalized underwriting

Traditional underwriting methods were often time consuming and included a maze of paperwork and manual efforts for data entry and verification. But with our AI powered Life insurance virtual assistants, keeping track of customer data including medical history, lifestyle habits and financial history helps insurance companies to make more advanced and personalized underwriting decisions.

Personalized underwriting

Traditional underwriting methods were often time consuming and included a maze of paperwork and manual efforts for data entry and verification. But with our AI powered Life insurance virtual assistants, keeping track of customer data including medical history, lifestyle habits and financial history helps insurance companies to make more advanced and personalized underwriting decisions. Our pre-trained Life Insurance Cognitive Assistants are trained in the following Operations

FAQs (Frequently Asked Questions)

FAQs (Frequently Asked Questions)

Learning Center (Videos/Articles)

Learning Center (Videos/Articles)

Quote Generation

Quote Generation

Product Catalogue

Product Catalogue

Order Management

Order Management

Human Life Value Calculator

Human Life Value Calculator

Check Existing Policy Details

Check Existing Policy Details

Newsletters Login/Registration

Newsletters Login/Registration

Branch Locator

Branch Locator

Browse Products

Browse Products

Quote Management

Quote Management

News & Events

News & Events

Claim Management

Claim Management

Policy Status Tracker

Policy Status Tracker

Login/Registration

Login/Registration

Online Payment & Renewals

Online Payment & Renewals

Contact Us/Customer Support (Live Agent)

Contact Us/Customer Support (Live Agent)

Key differentiators of our pre-trained and pre-integrated

AI-Powered Health Insurance Bots for Customers:

Built-in Domain Intelligence

Streebo in collaboration with its technology partner, deploys highly intelligent pre-trained Bots that can emulate business processes pertaining to various Insurance Industries.

Built-in Domain Intelligence

Streebo in collaboration with its technology partner, deploys highly intelligent pre-trained Bots that can emulate business processes pertaining to various Insurance Industries.

Omni-Channel Experience

Omni-Channel ExperienceStreebo’s ChatGPT integrated Life Insurance Bot can be deployed across social media channels such as WhatsApp, Facebook Messenger, SMS, Telegram, Signal, WeChat, Skype, among others. They can even handle voice channels such as IVR, Amazon Alexa, and Google Home. Bots can even be deployed on web (existing health insurance site) and mobile (existing mobile app), and now even email. With ChatGPT integration, now even email responses can be automated thus making it a powerful solution for sales and services alike. This feature ensures the customers get prompt responses on whatever platform they are.

Pre-Integrated with Backends

Pre-Integrated with BackendsStreebo’s Life Insurance Virtual Assistant is pre-integrated with most of the ERP/Insurance Management Systems such as SAP, Oracle ERP, IBM AS/400 Systems, and CRM such as Salesforce, SugarCRM, etc. which are commonly used in the insurance industry.

Access to Unstructured Data

Access to Unstructured DataThe incorporation of advanced technologies such as Classification, Clustering, Embedding, and Generative AI within the GPT platform has made it effortless for companies of all sizes to access and utilize unstructured information sources, including web pages, user manuals, product documentation, and other unstructured data like policy logs, documentation notes and emails. Streebo’s bots, integrated with GPT, can take advantage of this capability and provide relevant information at the appropriate time during the product sales or service cycle.

Voice Technology from GPT

Voice Technology from GPTStreebo incorporates cutting-edge voice technologies, including Whisper (beta) from Open.AI and Speech-to-Text technologies from IBM Watson, Google Dialog Flow, and Amazon Lex. Whisper is an AI-powered voice platform that allows insurance companies to better understand their customers and respond quickly with virtual support. Speech-to-Text (STT) technology is a real-time transcription service that scans conversations for keywords, ensuring the correct information is captured from each call. This results in improved customer experience and quick, accurate responses to customer inquiries, fostering a strengthened relationship between the Insurance Company and its customers and ultimately leading to increased loyalty and profitability.

Flexible Deployment Models

Flexible Deployment ModelsStreebo’s Pre-Trained Life Insurance Conversational Interface can be deployed on-premises or on IBM Cloud, Microsoft Azure, Amazon AWS, or Google Cloud Platform.

Chat Analytics

Chat AnalyticsStreebo’s analytics dashboard is developed to record and display systemic data, metrics, preferences, and trends which eventually help in monitoring user interactions, and can be adapted accordingly to give relevant responses and take business decisions.

Multilingual Support

Multilingual SupportStreebo’s Insurance Virtual Assistant stands out among its peers with its multilingual capability, allowing clients to converse in a language of their choice. The selection of an insurance policy can often be a daunting task for customers as this includes lots of hidden clauses and terms/conditions. By providing the ability to comprehend these details in a preferred language, Streebo’s Insurance Virtual Assistant instills confidence and trust in clients, fostering a positive purchasing experience.

The support of over 38 languages, along with the sophisticated training of the bot to understand the nuances of various dialects and accents, expands the reach of brands to a diverse and global audience.

Guaranteed Bot Intelligence Index

Guaranteed Bot Intelligence IndexStreebo’s ChatGPT powered Life insurance chatbot comes with a Guaranteed Bot Intelligence Index* of 99% (*BII= No. of questions answered correctly/No. of relevant questions asked). We continue to train our virtual agents until they reach the highest level of accuracy. Our Cognitive assistants (COGS) are designed while comprehending all necessary aspects and challenges of Life Insurance companies.

Built-in Live Agent Support

Built-in Live Agent SupportStreebo’s cutting-edge bot solution comes equipped with integrated live agent support, allowing users to receive immediate help if they are unable to find an answer to their questions through interaction with the bot. Seamless transitions between human operators and the chatbot ensure that customer inquiries are promptly and efficiently resolved.

Data Privacy and Security:

Data Privacy and Security:In today’s business landscape, secure chatbots are no longer a luxury, but rather a fundamental requirement. Streebo’s ChatGPT-powered Life Insurance bot is equipped with security features such as fingerprint and facial recognition for claim resolution, providing a highly secure solution that places complete control over your data and information in your hands. Its AI and NLP capabilities enable secure deployment of bots within your own infrastructure, integrated with your own firewall, making it a one-stop solution for data privacy and security.

Pricing Model

ChatGPT powered MVP (Minimum Viable Product) virtual assistant includes :

3 transaction used cases.

3 transaction used cases. 1 backend integrations

1 backend integrations 50 FAQ’s

50 FAQ’s Channels – Web, Mobile App, 1 Social media channel such as WhatsApp, Facebook Messenger

Channels – Web, Mobile App, 1 Social media channel such as WhatsApp, Facebook Messenger

Capex Option

You can choose to buy the MVP Bot.

Opex Option

You can choose to Subscribe to the MVP Botfor a fixed monthly charge with no upfront

setup fee.

Pay Per Usage

This is a conversation-based subscriptionand tied to the number of conversations &

messages the bot handles. Thus you only

pay if the Bot is getting used and is actually

deflecting calls.

Final Food for thought – The Growth Mindset!!

The behavioral shift of customers towards social media channels is enough to understand that if Life insurance companies want to stay ahead in the competition and enhance the customer experience, then they have to move towards automation. One of the key-ways AI has transformed the life insurance industry is through the development of chatbots. The 24*7 availability of chatbots on all popular social media channels and prompt accurate responses have raised the expectations of customers. Do you know? – Customer acquisition in insurance is 9X more expensive than customer retention. Therefore, insurers must increase their presence on social media channels to keep policyholders satisfied and engaged.

Do you know? – Customer acquisition in insurance is 9X more expensive than customer retention. Therefore, insurers must increase their presence on social media channels to keep policyholders satisfied and engaged.

Streebo, a leader in conversational AI solutions, has extended the latest NLP technology with GPT series language models from Open.AI to create a unique ChatGPT solution for the Life insurance industry. This integration allows life insurance companies to offer a highly personalized customer experience, where customers can interact with AI chatbots and receive tailored policy recommendations, just like they would with a human insurance agent. By providing accurate and personalized answers, reducing operational costs, and increasing customer outreach, life insurance companies can provide a better, more efficient, and convenient experience for their customers. With the help of advanced AI, the life insurance industry is poised for a promising future.

Disclaimer: ChatGPT and GPT are registered trademarks and terms fully owned by Open.AI. The author has used the term “ChatGPT for life insurance” to convey the idea of a ChatGPT kind of Bot, but for life insurance.

So, what are you waiting for?

Make a visit to our bot store of pre-trained & cloud-ready solutions and schedule a demo today!! Schedule a demo

Make a visit to our bot store of pre-trained & cloud-ready solutions and schedule a demo today!! Schedule a demo