Re-imagine Banking with

Omnichannel & AI Experiences

Offer an augmented customer experience with consistent, personalized and seamless banking on multiple channels Explore

Align with Customer Expectations through

Omnichannel Banking Solutions

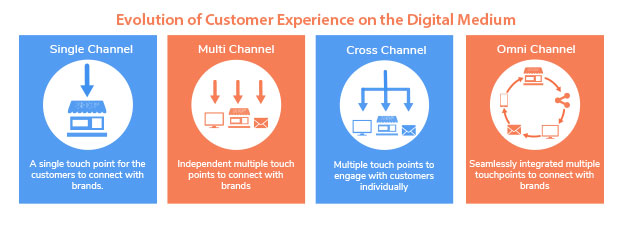

Digital transformation influenced the banking and has changed the way users access interact with banks and access banking services. Tech savvy customers own a variety of devices like laptops, tablets, mobile devices, to name a few, and they prefer to use any device as per convenience for banking. This has compelled the bank to look beyond the traditionally defined channels and adopt an omnichannel strategy that extends a seamless experience across multiple platforms and devices.

Omnichanneling for easy and intuitive user experience

Omnichannel banking enables bankers to offer secure banking services anytime, anywhere. It enables them to merge customer data from physical and digital channels and offer multiple benefits to customers like digital payments, mobile banking, online applications and much more. According to a recent survey by PWC, 61% of bank executives say that a customer-centric model is extremely important, and 75% banks are investing in this area. Along with omnichannel banking solutions, artificial intelligence capabilities for banking are also on the rise. Banks are embedding intelligent chatbots into their systems to help customers transfer funds, pay bills, manage expenses etc. while conversing with a bank. According to a Foye study, banks could automate up to 90% of their interactions with chatbots by 2022.

Streebo’s Omnichannel Banking Solution

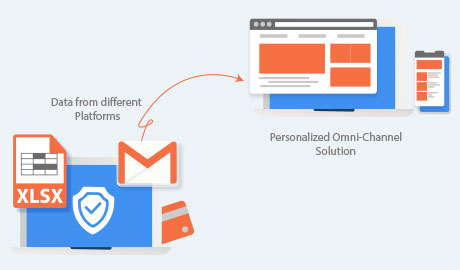

Streebo’s Banking Suite enables banks to deliver a consistent, personalized experience across all devices and meet the rising customer expectations. The web and mobile banking apps are built with highly customizable widgets that allow the bank’s IT and Line of Business teams to control the security, access and govern the solutions.

Banking Application

Transforming agent and customer interactions with Banks – driven by omnichannel, cross-platform applications. Managing data on the go.

Banking chatbot

Tailoring seamless customer experiences, with AI-powered interactions, driven by secure, omni-channel banking bots. A Conversational approach to agent and customer interactions.

Streebo DX Accelerator, with its low or no code tooling allows business teams to rapidly assemble sleek, intuitive and secure Web, Mobile and chatbot interfaces for banks with just drag and drop. You can also embed AI features such as chatbot, visual recognition, fingerprint authentication etc. on web, app and 3rd party chat clients. Moreover, all the platforms can be seamlessly integrated with the bank’s backend system using the point and click interface.

Why Streebo?

Expertise in complex banking projects implementation with modern infrastructure

‘Drag and Drop’ Interface for IT/LoB to modify and manage apps at ease

3rd party integrations and secure payment gateways

A single code base for all digital assets and automation tool

Deploy on-premise OR on cloud

Expertise in complex banking projects implementation with modern infrastructure