#Smart Generative AI Agent

Check out Demo

Generative AI Powered Smart Bot Solution

Omni-Channel Bots – Deploy on Chat, Voice, Email, Instagram, Facebook, WhatsApp and Even SMSCheck out Demo

Trusted by hundreds of leading companies

×

Check out the Enterprise Grade AI Agent Powered by Gen AI. No Setup Fees.

Banks around the world are gearing up for WhatsApp chatbots by adopting technologies like Artificial Intelligence (AI) and Natural Language Processing (NLP). This is because of the massive penetration and increase in usage of WhatsApp across the world. In this article, we will explore why Banks & FinTech’s need to develop an omni-channel Conversational Interface that will make banking functions available over multiple channels such as a WhatsApp. This article will also help you understand how WhatsApp and chatbot or Cognitive Virtual Assistant Technology together can improve the marketing and customer services in Banking.

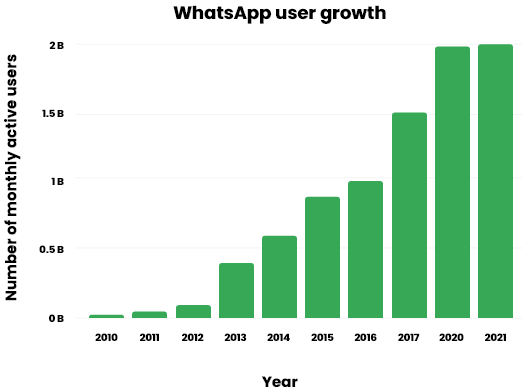

WhatsApp for Everyone

WhatsApp has 2 billion active users worldwide. It is ranked as the most used mobile messenger app in the world, more than 100 billion messages are sent each day on WhatsApp. The average WhatsApp user on Android spends 38 minutes per day on the app.The WhatsApp messenger app was already quite popular worldwide across all age groups. And has grown significantly under Facebook (Meta), becoming the most popular mobile messaging app on the planet.

What is WhatsApp Bot for Banking?

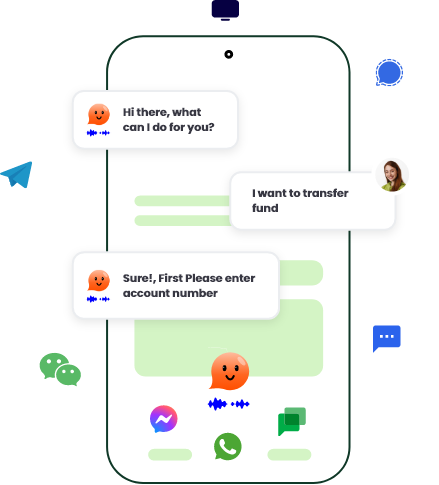

The Banking chatbot on WhatsApp is basically designed to have a conversation with humans over chat. It acts as a Virtual Assistant to facilitate easy interaction with prospects and existing customers, generates leads, resolves queries, offers support, and delivers assistance as and when needed through the app that they use most. In an extremely competitive Banking & FinTech space, where consumers often complain of the lack of accessibility to a bank’s services and lengthy & unsatisfying customer support; WhatsApp bots play a vital role and can be a real game-changer. Juniper Research predicts that 63% of interactions in banks will be automated by the end of 2023 using chatbots.

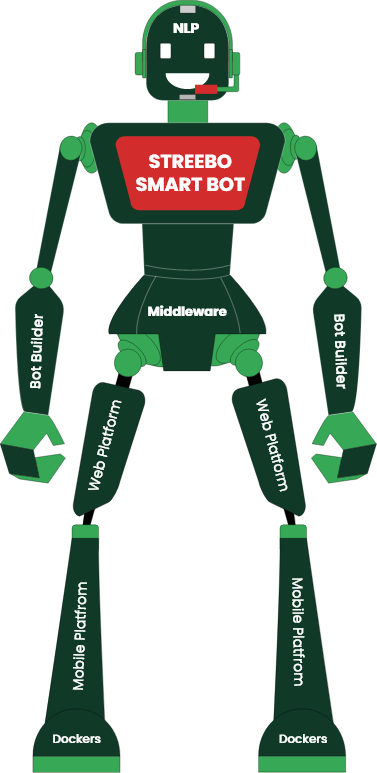

Streebo in conjunction with leading artificial intelligence (AI) products in the market such as IBM Watson, Google Dialogflow and Amazon Lex has rolled out an omni-channel smart virtual assistant that can serve all channels including a chatbot for WhatsApp for Banking. This Smart Bot provides voice & chat support on WhatsApp in multiple languages along with in-built Live Agent Support. It is secured and provides 99% accuracy and is pre-integrated with a wide variety of Core Banking softwares such as EdgeVerve Finacle, Oracle FLEXCUBE Core Banking, and SAP Core Banking Services among others. The Smart Bot for WhatsApp Banking also provides the Advanced Analytics of user interactions that can be used to take business decisions. Accenture research shows that 57% of Banks agree that chatbots can result in a large ROI with minimal effort

Streebo in conjunction with leading artificial intelligence (AI) products in the market such as IBM Watson, Google Dialogflow and Amazon Lex has rolled out an omni-channel smart virtual assistant that can serve all channels including a chatbot for WhatsApp for Banking. This Smart Bot provides voice & chat support on WhatsApp in multiple languages along with in-built Live Agent Support. It is secured and provides 99% accuracy and is pre-integrated with a wide variety of Core Banking softwares such as EdgeVerve Finacle, Oracle FLEXCUBE Core Banking, and SAP Core Banking Services among others. The Smart Bot for WhatsApp Banking also provides the Advanced Analytics of user interactions that can be used to take business decisions. Accenture research shows that 57% of Banks agree that chatbots can result in a large ROI with minimal effort

Functional areas of Banking where WhatsApp chatbot has brought transformation

An AI Powered WhatsApp chatbot is better than a form for generating leads. It’s better than phone calls for customer support and more effective than emails for customer engagement. Messages delivered on WhatsApp see 3x the conversion of other channels. 51% of Americans prefer online banking channels and around 26% of them would prefer using an asynchronous messaging channel like WhatsApp to perform their banking operations rather than talking to a human agent.

Let’s go through the best use-cases for a Banking WhatsApp chatbot.

Marketing/Prospect Bot on WhatsApp

By staffing Banking with this 24X7 available Intelligent WhatsApp Bot, Banks can empower their agents to both cross-sell and improve their customer conversion rate by an average of 23% thus reducing their call center costs as well.Advertising & Lead Generation

Banking chatbot on WhatsApp can send advertisements on WhatsApp Chat that has a 100% delivery rate, 95% open rate and 78% click-through rate (CTR) which helps in generating leads efficiently. Read MoreProspecting & Conversions

Once a bank has collected a prospect’s contact details, they can now move to qualification. If a lead’s demand is defined as intent and it has the ability to purchase, a lot of these leads are still lost at the last hurdle. Read MoreCross-Sell & Upsell

Banks can also send promotional notifications to existing customers in order to cross-sell the products. Advanced Analytics feature provided by WhatsApp chatbot for Banking can be used in identifying such customers. Read MoreCustomer Service Bot on WhatsApp

WhatsApp Bots for Banking made 65% of Consumers believe ‘customer service’ was smooth. Further, 47% of consumers would interact with Banks through chatbots and 57% of consumers are interested in chatbots for their instantaneity.Account Management

WhatsApp Bots for banking can help customers to simplify the process of Account Management and facilitate different account-related requests in a single WhatsApp conversation. The bot is pre-trained to retrieve customer… Read MorePayment & Money Transfer

By accessing their bank accounts through the WhatsApp Bot that follows compliance with the security protocol by the Bank or FinTech, customers can make easy bill payments, P2P payments, EMI payments and transfer… Read MoreLoan Application & Management

With the help of a Pre-trained WhatsApp Bot for Banking and Lending processes, customers can seamlessly apply for a loan. On the other hand, the Bot also helps Banks & FinTechs to easily process the application through… Read MoreDocuments Upload & Management

In various banking processes, customers have to share a wide variety of documents with banks on a day-to-day basis. In order to faster the processes of KYC, Customer Onboarding and Loan Application Processing among… Read MoreInstant Feedback

After using banking services on WhatsApp, Banks can ask customers to provide feedback immediately in the same conversation. This will ensure real-time updates and a high-response rate… Read MorePersonalized Financial Advice

With the Advanced Analytics feature of the WhatsApp Banking chatbot, Banks & FinTechs can now leverage this customer usage & feedback data to understand and serve their customers better. Read MoreThe Bottomline

One of the primary reasons for banks to lose customers is poor customer service and lengthy processing. As a result, the banking sector is now gearing towards a paradigm shift in the way customer communication takes place. WhatsApp chatbot for banking and FinTech makes your banking services more accessible to customers. This not only helps you retain your customers but also attracts new ones to become loyal customers.