Generative AI Powered Smart Bot Solution

Omni-Channel Bots – Deploy on Chat, Voice, Email, Instagram, Facebook, WhatsApp and Even SMSCheck out Demo

Check out the Enterprise Grade AI Agent Powered by Gen AI. No Setup Fees.

Generative AI-Powered Customer Service Chatbot for Stock Market Customer Service

The Evolution of Customer Support in Stock Trading Apps

AI-powered customer service chatbots, also known as stock market chatbots or AI agents, are transforming the landscape by offering instant, reliable, and intelligent assistance. Whether it’s resolving trade execution issues, providing portfolio insights, addressing queries, trading chatbots (AI agents) ensure traders receive accurate support when they need it most.

Pre-trained AI Agent and Chatbot

Challenges in Traditional Stock Market Customer Service Apps

Despite the growth of stock market apps, traders continue to face customer support challenges, including:

The Role of AI in Transforming Financial Services

Generative AI is revolutionizing financial services by introducing intelligent automation, predictive analytics, and real-time support. In stock trading, Gen AI-powered financial chatbots & AI agents bridge the gap between customer expectations and traditional support limitations by:

Why Stock Market Apps Need AI Agents (Chatbots)?

The Importance of Customer Service in Stock Trading

Reliable customer support is critical in retaining users in stock trading apps. Best trading app chatbot ensures traders have 24/7 assistance, boosting confidence in the platform.

The cost of poor customer service in financial markets

AI-driven customer service as a competitive advantage

AI-powered customer service solutions differentiate stock trading platforms by:

Gen AI Powered Stock Market Customer Service AI Agent & Chatbot

Streebo, a leading AI and digital transformation company, introduces Generative AI-Powered Stock Market Financial Chatbot (AI Agent)—a cutting-edge solution designed to revolutionize trading assistance and customer support in financial markets. This AI-powered chatbot provides traders, investors, and financial institutions with instant, intelligent financial insights, delivering real-time stock updates, portfolio analytics, and trade execution support with high accuracy.

Leveraging industry-leading NLP engines like IBM Watson Assistant, Microsoft Copilot, Google Dialogflow, Amazon Lex, and Salesforce Einstein Copilot, along with advanced Generative AI technologies such as Enterprise GPT on Microsoft Azure, Google Gemini, IBM Watsonx, and AWS SageMaker, it ensures secure and data-driven market engagement.

Built on enterprise-grade cloud platforms like AWS, GCP, IBM Cloud, and Microsoft Azure, these Gen AI-powered stock market chatbot (AI agent) seamlessly integrates with trading platforms, CRM, portfolio management, and financial risk assessment systems. Accessible across multiple channels including Web Apps, Mobile Apps, SMS, WhatsApp, Email, and Voice Assistants, it empowers traders with 24/7 support, automated compliance monitoring, and fraud detection. By streamlining knowledge access and optimizing trading decisions, financial institutions can enhance customer engagement, reduce operational costs, and drive market efficiency with AI-driven automation.

Current World vs. New World: AI-Powered Customer Support in Action

In today’s fast-moving financial landscape, traders, investors, and analysts demand instant access to market data, portfolio insights, and regulatory guidance. However, traditional customer support systems often fail to keep pace, resulting in delays, missed opportunities, and financial losses. AI-powered stock market chatbots are transforming the way financial professionals interact with trading platforms, providing real-time support, automated insights, and seamless resolutions to complex queries.

Let’s explore real-world scenarios where AI-driven customer support redefines efficiency and profitability.

Scenario 1:

Checking Stock Prices & Market Trends

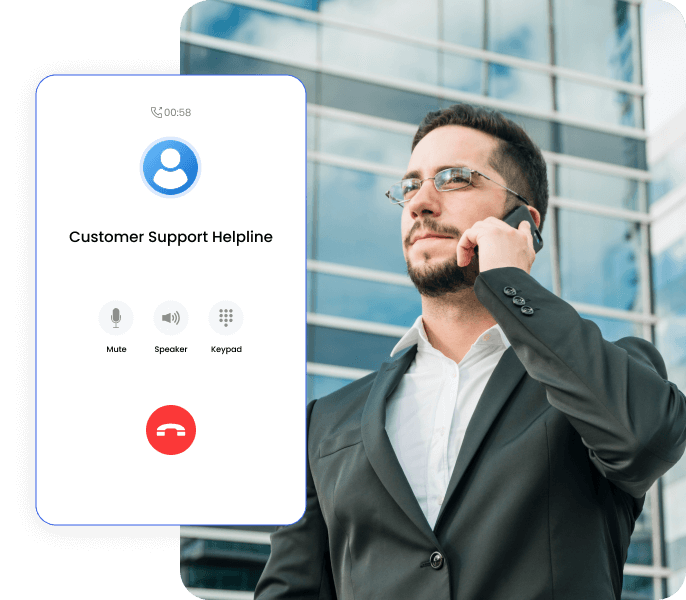

John, a frequent trader, is about to make a high-stakes trade. Before proceeding, he needs to check real-time stock prices and analyze market trends. His trading platform does not offer instant updates, so he calls the customer support helpline for assistance.

Outcome:

John experiences frustration, loses a profitable opportunity, and struggles to trust the platform’s responsiveness.

John simply types his query into a stock market chatbot (AI agent) embedded in his trading app. Within seconds, the AI-powered assistant retrieves real-time stock prices, market trends, and AI-driven predictions based on historical data.

What’s XYZ’s current price?

XYZ is trading at $148.30, up 2.1% today.

Any prediction for the week?

AI predicts a 2–3.5% rise this week with moderate confidence.

Set an alert at $155.

Alert set! You’ll be notified if it crosses $155.

Outcome:

John maximizes his profits with well-timed trades, avoids the frustration of delayed support, and fully leverages the AI-powered trading ecosystem.

Scenario 2:

Resolving a Trade Execution Issue

Emily, an active trader, places an order to buy a stock but faces an unexpected execution error. She immediately reaches out to customer support via email.

Outcome:

Emily suffers unnecessary financial losses and loses trust in the platform’s ability to handle urgent trading issues.

Emily reports the issue through a stock market trading app chatbot available within WhatsApp.

Hi Emily How can I help you today?

Hi, I tried placing an order to buy a stock earlier, but it didn’t go through. Can you check what happened?

Sure thing! One moment while I review your recent orders… It failed because your limit price was below the market price.

Got it. Can I place a market order instead?

Absolutely. Same quantity?

Yes, please.

Market order placed! You’ll get a confirmation soon. Let me know if you need anything else

Outcome:

Emily successfully completes her trade without delays through Stock app chatbot on WhatsApp, avoids financial losses, and gains confidence in the AI-drive support system.

Scenario 3:

Portfolio Insights & Risk Analysis

Mark, a long-term investor, wants to assess the risk exposure of his portfolio and make adjustments to optimize performance. He submits a request to his financial advisor, expecting a detailed analysis.

Outcome:

Mark experiences slow decision-making, potentially missing profitable reallocation opportunities.

With an AI-powered stock market chatbot, Mark gets instant portfolio insights and risk analysis based on live market data.

What’s XYZ’s current price? Hi, can you check the risk exposure of my current portfolio?

You’re 43% in large-cap tech, 25% in emerging markets—both high risk. Overall risk score: 7.8/10.

That’s higher than I’d like. What can I do to lower it without sacrificing too much return?

Rebalance: cut tech to 30%, add 10% to staples/utilities, diversify bonds with short-term corporates. This could lower your risk score to 6.1 while maintaining a strong return profile.

Sounds good.

Outcome:

Mark makes timely, data-driven investment decisions, optimizing his portfolio performance and reducing exposure to market volatility.

Scenario 4:

Trade Compliance & Regulatory Queries

Sophia, a financial analyst, is preparing a trade and needs to ensure compliance with regulatory guidelines. However, compliance information is fragmented across multiple websites and legal documents.

Outcome:

Sophia wastes valuable time on compliance checks instead of executing high-value trades.

Sophia queries her Stock market/trading chatbot, which is pre-integrated with regulatory databases and legal frameworks.

Hi, I’m preparing a trade involving a tech stock in the U.S. market. Can you check the compliance requirements?

Compliance check complete: SEC Rule 15c3-5 and FINRA Rule 3110 apply.

Can you generate the necessary compliance paperwork?

Done! I’ve created and attached the pre-trade compliance report

Great! Any updates I should be aware of?

Outcome:

Sophia ensures compliance instantly, minimizes risks, and spends more time on data-driven financial strategies.

Practical Applications of AI Chatbots in Stock Market Apps

How should I start investing with $500?

Let’s begin with low-risk index funds. Want me to show some options?

AI-powered financial advisory for beginners and experts: AI chatbots or AI agents serve as digital financial advisors, offering tailored guidance to both novice and experienced traders. They analyze user preferences, historical trading patterns, and market trends to provide personalized investment recommendations, risk assessments, and strategic insights. With real-time data integration, traders can make informed decisions based on market fluctuations and emerging opportunities.

Notification from Smart trading assistants

2m ago

ABC is nearing your target exit price of $194. Want to lock in gains?

Smart trading assistants for automated trade execution: AI-powered trading assistants automate the execution of trades based on predefined strategies, market conditions, and user-set triggers. These chatbots provide real-time trade alerts, suggest optimal entry and exit points, and execute trades with precision, ensuring that traders never miss a lucrative opportunity. The automation eliminates human error and enables a more efficient, data-driven approach to stock trading.

Why was my trade blocked?

Unusual login and high-risk trade detected from a new device. Action blocked for your safety.

Thanks, that wasn’t me.

You’re protected. Activity reported. Session locked & flagged.

Instant transaction monitoring: AI-driven chatbots (AI agents) enhance security by detecting fraudulent transactions and suspicious trading activities in real time. By leveraging advanced machine learning algorithms, these systems monitor user behavior, identify anomalies, and flag potential risks before they escalate. Additionally, they ensure compliance with regulatory requirements, protect sensitive financial data, and minimize the risk of cyber threats, providing a secure trading environment for users and financial institutions.

Eye-Opening Stats About Gen AI in Financial Services & Stock Market

Key Benefits of AI-Powered Stock Market Customer Service Chatbots

Key Differentiators

Final Thoughts: Why AI is the Future of Stock Market Customer Service

The financial landscape is shifting at an unprecedented pace, with traders and investors demanding greater efficiency, accuracy, and security. AI-driven solutions are no longer an advantage but a necessity in navigating thecomplexities of modern financial markets. The integration of Generative AI-powered financial chatbots is bridging the gap between human expertise and intelligent automation, ensuring that financial institutions stay ahead of industry challenges.

By embracing AI, businesses can eliminate inefficiencies, optimize risk management, and enhance customer experiences. The future of stock market operations will be defined by how well organizations leverage AI-powered chatbots to deliver real-time intelligence, predictive insights, and seamless financial services. As market expectations evolve, AI will continue to shape a new era of trading, where decisions are faster, smarter, and more secure than ever before.

Pricing Model:

Capex Option

Capex Option

You can choose to buy the product with an upfront amount.

Opex Option

Opex Option

You can choose to Subscribe to the MVP Bot for a fixed monthly charge.

Pay Per Usage

Pay Per Usage

Pay only for active usage.

- Multi-Tenant Ready to Go Pre-Trained Smart Bot starts at $99/Month.

- Single-Tenant Ready to Go Pre-Trained Smart Bot starts at $999/Month.

Ready to transform your stock trading customer support with AI?

Schedule a demo today and explore how trading chatbot (AI agent) can revolutionize your customer experience!