Generative AI Powered Retail Banking Marketing AI Agent on Facebook

I can share details and even help you apply right here on Facebook. ✅

The Future of Retail Banking Marketing Conversations Is Already Here

The retail banking landscape is transforming at an unprecedented pace, driven by customer expectations for immediacy, personalization, and accessibility. While many banks have made investments in web portals, mobile apps, and contact centers, there is a blind spot in their digital strategy: Facebook.

With more than 3 billion users globally, Facebook is no longer just a social media platform. It has evolved into a space where users make financial decisions, research banking products, and interact with brands. For retail banks, engaging customers directly on Facebook, particularly through Facebook Messenger, is now a strategic necessity.

That’s where the Generative AI powered Retail Banking Marketing AI Agent on Facebook plays a critical role.

This AI Agent is not your basic chatbot. It is a sophisticated, multilingual, enterprise-grade assistant built for handling thousands of banking marketing interactions simultaneously. Whether it’s a prospect comparing credit card options, a customer interested in a new savings product, or someone looking to open a fixed deposit, this AI Agent delivers immediate, personalized, and contextual conversations at scale.

This article will explore how retail banks can utilize AI Agents for marketing on Facebook, how customer behavior has shifted in the digital age, and what measurable business benefits banks can achieve through automation, personalization, and intelligent marketing via a social platform billions use every day.

Absolutely 🌍 we’ve got travel cards with no foreign transaction fees and free lounge access. Interested?

How Customer Behavior Has Changed in Retail Banking Marketing

From Browsing to Banking – Customers Expect Real-Time Engagement

Modern retail banking customers no longer wait in branches or navigate static web pages. They want assistance on their terms and platforms, especially mobile-centric social media channels like Facebook.

Behavioral Shifts That Matter:

Customers today prefer messaging over filling out forms or calling helplines. Facebook Messenger offers a natural environment for this communication.

Customers want digestible information, not to wade through complicated PDFs. A conversational AI Agent translates banking terms into everyday language.

Questions like “What’s the best savings plan for me?” or “Am I eligible for a loan?” need instant answers. Emails or offline visits don’t match today’s pace.

Since 80% of Facebook access happens on mobile, it’s essential that banking journeys are optimized for messaging.

Why Facebook Is the Ideal Channel for Retail Banking Marketing

Facebook’s scale enables banks to tap into billions of users across demographics.

Customers are accustomed to chatting with brands here, lowering adoption barriers.

Messenger achieves open rates up to 88%, significantly outperforming email campaigns.

From carousels to payment buttons, Messenger offers everything retail banking marketers need.

Smart & Secure AI Agent Solution for Retail Banking Marketing

We, a global leader in Digital Transformation and Conversational AI, delivers secure and scalable marketing AI Agents for the retail banking sector.

Leveraging industry-leading Generative AI platforms like IBM watsonx, Google Gemini, Microsoft Azure Copilot, and Amazon Bedrock, it builds purpose-built AI Agents tailored for banking workflows. These AI Agents integrate deeply with core systems such as CRM, loan origination, marketing automation, and payment platforms—ensuring every customer query is actionable with 99% accuracy.

AI Agent for retail banking marketing on Facebook helps drive top-of-the-funnel engagement, qualify leads, nurture prospects, cross-sell products, and convert conversations into measurable revenue—all within the Facebook ecosystem.

Retail Banking AI Agent for Marketing – Core Use Cases on Facebook

Engages users who interact with Facebook ads or posts, capturing name, intent, and contact details. Conversations qualify leads in real time and feed CRM for nurturing.

The AI Agent suggests credit cards, savings accounts, or loan options based on the user’s profile and preferences collected during the chat.

Users input basic information, and the AI Agent compares loan or deposit options instantly, presenting rates and benefits in a friendly, carousel format.

The chatbot broadcasts personalized campaign updates (e.g., “0% processing fee on loans this week”) via Messenger, increasing CTRs compared to email.

AI identifies customers eligible for investment products based on transaction history or chat inputs, offering contextual product upgrades.

Users can instantly schedule a meeting with a human banking advisor or video banker without leaving the Messenger thread.

New users are guided through financial literacy content, investment journeys, or product usage tutorials using rich media and automated flows.

After a campaign or interaction, the AI Agent requests feedback to optimize marketing strategies.

Conversations are tagged and linked with ad sets or UTM codes to attribute lead source, channel efficiency, and content ROI.

Customers interacting on WhatsApp can be redirected to Facebook Messenger for a richer experience, ensuring omnichannel continuity.

Old World VS New World – Transforming Retail Banking Marketing via Facebook AI Agents

Scenario 1

Credit Card Inquiry via Website

All credit card information is available online; please check the forms section for details.

Old World

Prospect visits the bank’s website, looks for credit card information. Confusing navigation, long forms, and technical language result in drop-off.

Outcome

- Lead lost.

- No data captured.

- No remarketing opportunity.

Got it! Do you prefer travel rewards, cashback, or low interest?

Here are 3 great options:

1. TravelPlus Card – 2x miles on flights ✈️

2. Global Explorer – no foreign fees 🌍

3. SkySaver Platinum – free lounge access 🛫

4. Can I get your contact info to proceed?

Done ✅. A rep will follow up.

New World with Facebook AI Agent

Prospect sees a Facebook ad, clicks to chat with the AI Agent. Agent qualifies the user, offers 3 tailored credit card suggestions, and collects contact info.

Outcome

Lead captured.

Lead captured. Personalized offer shared.

Personalized offer shared. Conversion likelihood increased.

Conversion likelihood increased.

Scenario 2

Loan Pre-Approval Query

Subject: Pre-Approval Request

From: Josh.Miller84@gmail.com

To: bank@support.com

Date: June 2, 2025

Hi,

I applied for pre-approval three days ago but haven’t heard back. Can you confirm my status?

Josh Miller

Tampa, FL

Subject: Pre-Approval Request

From: bank@support.com

To: Josh.Miller84@gmail.com

Date: June 6, 2025

Please send the required additional forms for processing.

Customer Support

Old World

Customer emails the bank for pre-approval and waits 3 days. Bank requests additional forms. Interest wanes.

Outcome

- Conversion delayed or lost.

- Inefficient manual process.

Sure! 🔍 I’ve pulled your details from our system—you’re pre-approved for up to $20,000. 🎉 Want me to show repayment options?

New World with Facebook AI Agent

Customer chats with AI Agent. It pulls info from the CRM and backend system, validates details, and provides instant pre-approval insights.

Outcome

Faster decisions.

Faster decisions. Better experience.

Better experience. High-intent conversion.

High-intent conversion.

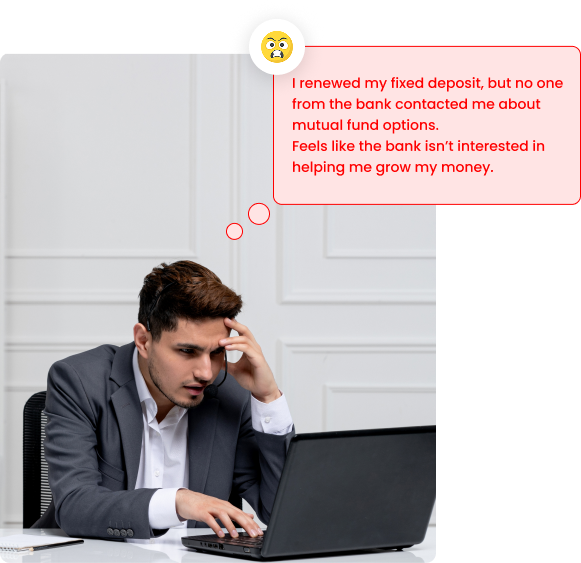

Scenario 3

Cross-Sell Missed During Renewal

Old World

Customer renews a fixed deposit, but no advisor follows up for mutual fund upsell.

Outcome

- Upsell missed.

- Lifetime value stagnant.

Great timing! 🎯 Based on your profile, I recommend

1. Growth Mutual Fund (high return, medium risk)

2. Balanced Fund (steady growth, low risk). Would you like details?

New World with Facebook AI Agent

AI Agent detects renewal action and prompts for investment options. Recommends two mutual funds based on risk profile.

Outcome

Upsell executed.

Upsell executed. Customer value boosted.

Customer value boosted.

Scenario 4

Campaign Feedback Collection

Subject: Feedback Survey Confusion

From: John084@gmail.com

To: bank@support.com

Date: July 2, 2025

Hi,

I got your survey email, but it looks generic and doesn’t relate to my experience. What exactly are you asking me to rate?

Josh Miller

Tampa, FL

Subject: Feedback Survey Confusion

From: bank@support.com

To: John084@gmail.com

Date: July 4, 2025

It’s just our standard post-campaign survey—please fill it out if you can.

Best regards,

Customer Support

Old World

Bank sends generic post-campaign survey via email. Low response rates.

Outcome

- No real insights.

- Campaign iteration slow.

Thanks for joining! 🙌 You can reply with emojis 👍😊😐👎 or leave a quick voice note. Your input helps us improve!

New World with Facebook AI Agent

Post-campaign, users receive a quick Messenger survey with emoji-based response options and optional voice note support.

Outcome

More feedback.

More feedback. Better insights.

Better insights. Faster optimization.

Faster optimization.

Technical Framework & Capabilities

Seamless Backend Integration

- CRM for lead tagging and journey tracking

- Loan & deposit systems for rate retrieval

- Core banking systems for customer authentication

- Marketing automation for campaign triggers

- Calendar & advisor systems for booking

Flexible and Configurable Workflows

- Aligns with your internal campaign sequences

- Fully customizable flows for each product

- Brand-consistent tone and prompts

Real-Time Personalization

- Behavior-based content suggestions

- Contextual chat replies powered by NLP

- Dynamic ad-to-chat retargeting

✈️ Travel Rewards,

🌍 Global Explorer,

🏨 Weekend Getaway.

Language and Region Customization

- Supports regional languages

- Aligns content with geographic banking rules

Analytics and Optimization Suite

- Live dashboards for campaign success

- Drop-off analysis

- Content iteration tools for real-time improvement

Business Benefits – Quantifiable Impact

Up to 4x higher engagement vs email

35% higher lead conversion from Messenger vs static landing pages

60% cost savings over traditional call-based marketing

25% increase in upsells and cross-sells during ongoing conversations

80% automation of Tier 1 marketing queries

Key Differentiators of Retail Banking AI Agent for Marketing

Tailored for acquisition, nurturing, upselling, and retention.

Supports chat, voice, and visual inputs across languages.

Leverages watsonx, Google Gemini, Microsoft Copilot, and Amazon Bedrock.

Transfers complex queries to agents with full chat context.

Follows banking-grade security protocols across all APIs.

Cloud, On-Prem, or Hybrid. Supports multi-tenant structures.

Drag-and-drop tools for business teams to adapt content and journeys.

Messenger-ready design reduces deployment time.

Pricing Options

Starts at $99/month for multi-tenant SAAS or $999/month for single-tenant (Private Hosting)

Starting @ 1$/user – unlimited chats

Experience the future of retail banking marketing automation.

Your customers are already on Facebook.

It’s time your marketing AI Agent meets them there.

30-day free trial available-no credit card required.