Generative AI Powered Smart Bot Solution

Omni-Channel Bots – Deploy on Chat, Voice, Email, Instagram, Facebook, WhatsApp and Even SMSCheck out Demo

Check out the Enterprise Grade AI Agent Powered by Gen AI. No Setup Fees.

Generative AI Powered Health Insurance AI Agent for Agents

Empowering Health Insurance Agents to Deliver Next Gen Customer Experiences

The health insurance industry is at a turning point. With rising competition, evolving customer expectations, and increasing operational demands, health insurance providers and agents are rethinking how they interact with customers. In a world where customers expect instant responses and seamless digital experiences, health insurers can no longer rely on outdated systems, slow support processes, and rigid communication models.

Enter the Generative AI Powered Health Insurance AI Agent an advanced virtual assistant purpose built to assist health insurance agents and brokers in delivering real time, contextual, and intelligent engagement across channels.

This intelligent AI driven assistant is revolutionizing the way health insurance professionals connect with customers whether its helping agents close more policies, assisting policyholders with claims, or guiding users through complex policy options. It’s not just a chatbot. It’s an AI Agent designed specifically for the health insurance ecosystem.

Why Traditional Health Insurance Workflows No Longer Work

The Old World: Fragmented, Delayed, and Frustrating

- High call volumes and long hold times

- Complex paperwork and document handling

- Difficulty managing policy renewals and add ons

- Disconnected communication with backend systems

- Limited availability outside office hours

- Missed leads and low conversions

- Poor customer satisfaction

- Increased manual overhead

- Delays in claim resolution

- Lost revenue from lapsed renewals

The New World: Instant, Intelligent, and Integrated with an AI Agent

With a Generative AI powered health insurance agent AI Agent, insurers and agents benefit from:

24/7 automated support

Instant policy recommendations and quotes

Guided onboarding and document collection

Smart claims filing with step-by-step assistance

Personalized upsell and renewal management

-

Up to 30% increase in policy conversions

Up to 30% increase in policy conversions

-

40 50% reduction in operational support costs

40 50% reduction in operational support costs

-

Faster resolution times and fewer customer complaints

Faster resolution times and fewer customer complaints

-

Better agent productivity and morale

Better agent productivity and morale

How Customer Behavior Has Shifted in Health Insurance

Today’s Policyholders and Prospects Want:

Chat first engagement

Chat first engagement

Customers prefer natural conversation over static forms or portals.

Instant responses

Instant responses

Inquiries like “Is my child covered?” or “What’s my deductible?” need real time answers.

Mobile first access

Mobile first access

Over 70% of insurance interactions now begin on smartphones.

Always on availability

Always on availability

Emergencies don’t wait for business hours.

Clear communication

Clear communication

Customers seek simplified language not legalese or jargon.

A chatbot for health insurance agent or, more accurately, a health insurance AI Agent, caters to these demands by offering intelligent, multilingual, and secure communication tailored to each customer.

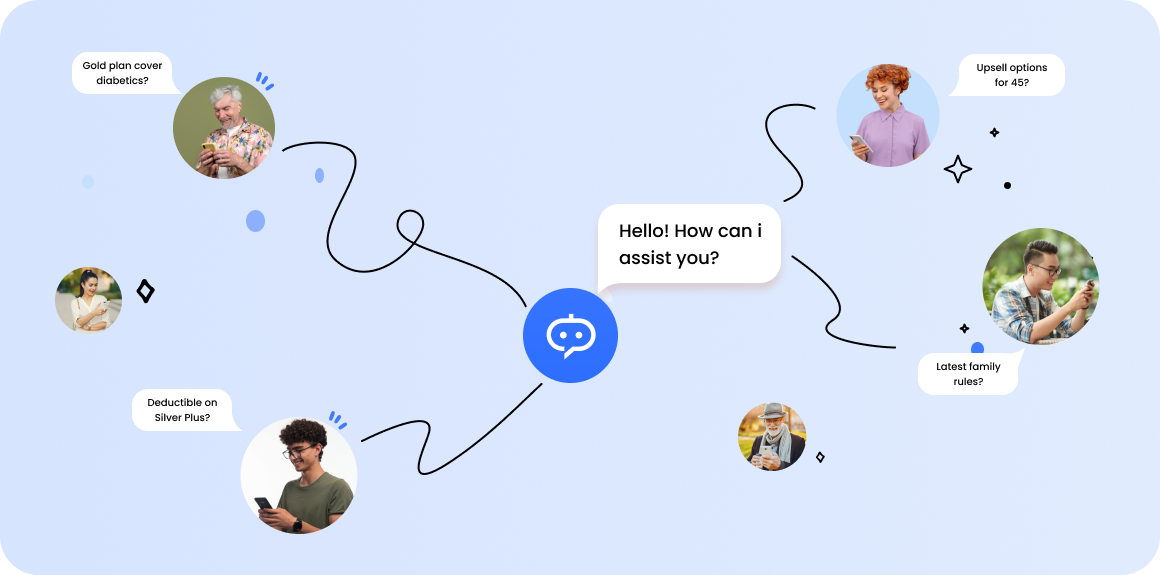

Smart & Secure Gen AI Powered AI Agent for Health Insurance Agents

Streebo, a leading digital transformation and AI company, introduces its next generation Generative AI powered AI Agent designed specifically for health insurance advisors and internal sales teams.

This isn’t just another chatbot. It’s a powerful, secure, and intelligent digital assistant tailored to support health insurance agents in their daily workflows helping them respond to client inquiries faster, access accurate policy information on the fly, and close deals more efficiently.

Powered by enterprise grade Large Language Models (LLMs) from IBM watsonx, Microsoft Copilot & Azure GPT, Google Gemini, and Amazon Bedrock, this internal AI Agent can understand complex insurance queries, fetch relevant plan details, and guide advisors through compliant policy recommendations all through simple, natural language prompts.

Whether an agent needs to ask:

-

“What’s the co pay on our premium silver plan for age 45?”

-

“Show me policies with critical illness add ons for diabetics”

-

“Pull up the latest underwriting guideline changes for family floater plans”

…the AI Agent delivers precise, context aware responses that want to consult an expert operations lead or underwriter but in real time.

Seamlessly integrated with internal systems such as policy databases, CRM, document repositories, and training portals, the AI Agent becomes the central intelligence layer for sales reps and advisors. It supports everything from instant document generation (quotes, benefit charts, comparisons) to onboarding support for new agents and automated knowledge retrieval during live sales calls.

Co-pay = 15%.

Includes OPD & diagnostics.

✅ Eligible for diabetics.

Engineered with a focus on enterprise security and industry compliance, Streebo’s solution offers:

- 99%+ query accuracy on health insurance terminology and workflows

- Regulatory compliant recommendations aligned with underwriting rules

- Audit trails, access controls, and enterprise grade data handling

By reducing time spent searching through brochures, portals, or internal playbooks, this AI Agent empowers insurance agents to focus on what they do best advising, selling, and closing with confidence and speed.

Top Use Cases for Health Insurance Agent AI Chatbot (Internal Facing)

Agents can ask natural language questions like:

-

“What’s the deductible for the gold plan?”

“What’s the deductible for the gold plan?”

-

“Is maternity covered under Plan B?”

“Is maternity covered under Plan B?”

The AI Agent fetches answers from internal documentation, product catalogs, and underwriting manuals instantly, without the agent having to search through portals or PDFs.

The AI Agent helps agents find the right product fit based on customer profiles:

-

“Suggest plans for a 52-year-old with hypertension”

“Suggest plans for a 52-year-old with hypertension”

-

“Compare family floater plans for a family of 4 with dental add ons”

“Compare family floater plans for a family of 4 with dental add ons”

This enhances upselling and cross selling accuracy while reducing manual errors.

Agents can query underwriting rules and get real time feedback:

-

“Can a diabetic customer be enrolled in our top tier plan?”

“Can a diabetic customer be enrolled in our top tier plan?”

-

“What’s the waiting period for preexisting conditions in Plan C?”

“What’s the waiting period for preexisting conditions in Plan C?”

This ensures agents give compliant, accurate advice every time.

Generate documents like:

-

Premium breakdowns

Premium breakdowns

-

Benefit comparisons

Benefit comparisons

-

Eligibility letters

Eligibility letters

…simply by asking: -

“Generate a quote for a 30-year-old male under the silver plan”

“Generate a quote for a 30-year-old male under the silver plan”

-

“Create a comparison sheet for bronze vs gold plan for self + spouse”

“Create a comparison sheet for bronze vs gold plan for self + spouse”

New agents can ask questions like:

-

“What’s the difference between deductible and co pay?”

“What’s the difference between deductible and co pay?”

-

“How do I initiate a claim request?”

“How do I initiate a claim request?”

The AI Agent becomes an interactive training companion, reducing dependency on supervisors and shortening onboarding cycles.

During or before client calls, agents can ask:

-

“Show last interaction notes with Mr. Sharma”

“Show last interaction notes with Mr. Sharma”

-

“Has this lead submitted their medical records?”

“Has this lead submitted their medical records?”

This allows seamless access to CRM integrated insights within platforms like Microsoft Teams or Slack.

Agents can ask:

-

“What disclosures should I share for Plan A?”

“What disclosures should I share for Plan A?”

-

“Is this recommendation compliant for age 60+ with no dependents?”

“Is this recommendation compliant for age 60+ with no dependents?”

The AI Agent ensures every conversation and recommendation is audit ready and regulation compliant.

Agents can check claim statuses and guide customers effectively:

-

“What’s the status of claim ID 45678?”

“What’s the status of claim ID 45678?”

-

“List documents required for cancer treatment claim”

“List documents required for cancer treatment claim”

Reduces time spent waiting on backend teams and improves client experience.

For outbound campaigns, agents can ask:

-

“Give me a call script for promoting critical illness add on to Gen Z prospects”

“Give me a call script for promoting critical illness add on to Gen Z prospects”

-

“Suggest qualifying questions for a self-employed freelancer”

“Suggest qualifying questions for a self-employed freelancer”

The bot becomes a dynamic sales assistant, not just a static knowledge base.

Old World vs New World: How Gen AI Transforms the Day in a Health Insurance Agent’s Life

Scenario 1

Plan Detail Lookup During Call

(Josh scrambles through outdated PDFs, then gives a generic answer)

Old World

Josh is on a client call when the customer asks, “Does your Silver Plus plan cover annual physicals and lab work?”

Caught off guard, Josh scrambles through his company’s outdated intranet and opens multiple PDFs to search for benefits. After a few minutes of stalling, he gives a generic answer and promises to follow up via email.

Outcome

The client sounds skeptical. The deal stalls. Josh feels frustrated and inefficient.

New World (With AI Agent)

Josh opens his internal AI Agent in Microsoft Teams and simply asks, “Does Silver Plus include lab work?”

Within seconds, he receives a concise, policy specific answer along with underwriting notes and optional upgrades.

Outcome

Josh confidently delivers the information mid call, upsells a wellness rider, and books a follow up for enrollments

Scenario 2

Learning Health Insurance Terms

30 Jun

11:45 AM

Can you explain the difference between deductibles and coinsurance?

Emily

Um… I’ll need to confirm. I’ll email my manager and get back to you.

Old World

Emily is in her second week as a health insurance agent. A prospect asks her about “deductibles vs coinsurance.”

Uncertain, she emails her manager and googles terms only to find conflicting information. She ends the call early to avoid saying the wrong thing.

Outcome

Missed opportunity. Low confidence. Slower ramp up to productivity.

New World (With AI Agent)

Emily opens her AI Agent inside her agent portal and types: “Explain deductible vs coinsurance in simple terms.”

The bot returns a clear explanation, real world examples, and even links to internal training content.

Outcome

Emily regains control of the conversation, completes the call successfully, and learns on the job in real time.

Scenario 3

Policy Comparison During Client Meeting

Hours spent on Excel. Risk of errors. Client decision delayed.

Old World

Carlos is in a meeting with a Spanish speaking family who wants to compare three different plans.

He says he’ll send a side-by-side chart later. That night, he manually builds one in Excel by pulling data from multiple PDFs, double checking in the CRM.

Outcome

Time consuming. Risk of human error. Delayed client decision.

New World (With AI Agent)

Carlos opens the AI Agent and asks, “Compare Bronze, Silver, and Gold family plans for a couple in their 40s with two dependents.”

He receives a formatted comparison table in both English and Spanish instantly.

Outcome

He shares it during the meeting, answers questions live, and the family signs up that day.

Scenario 4

Underwriting Uncertainty

48 hours delay. Client switches to competitor.

Old World

A client with Type 1 diabetes asks Monica if they qualify for a high-deductible plan. Unsure, she emails underwriting and waits 48 hours for a reply. Meanwhile, the client gets a quote from a competitor.

Outcome

Delay causes drop off. Missed opportunity.

New World (With AI Agent)

Monica asks her AI Agent, “Is Type 1 diabetes eligible under our HDHP Bronze plan?”

The response includes current underwriting restrictions, required disclosures, and preapproval steps.

Outcome

Monica delivers a precise, compliant answer and schedules medical pre checks immediately retaining the client.

Scenario 5

Mid Call Document Confusion

⏳ 2–3 min gap, searching emails/binder…

Old World

While assisting a policyholder, Derrick can’t remember which documents are needed for a cancer related hospitalization claim.

He places the client on hold, searches his email and a training binder, and still doesn’t feel confident about the list.

Outcome

Frustrated client, poor experience, and potential filing errors.

New World (With AI Agent)

Derrick asks, “What docs are needed for a cancer hospitalization claim under the Platinum Plan?”

The bot provides a checklist with internal links to templates and submission portals.

Outcome

Derrick shares the correct info instantly, guiding the client with clarity and empathy.

Technical Capabilities & Enterprise Grade Integrations

The Health Insurance AI Agent integrates with:

CRM Platforms (Salesforce, HubSpot, etc.)

Policy Administration Systems

Claims Management Software

Document Management Systems

Payment Gateways

Customer Portals and Mobile Apps

This ensures real time access to policy data, claim histories, documents, and status updates without ever switching context.

Business Outcomes What Health Insurers Gain

3x faster policy issuance

25 30% increase in quote to policy conversion

80% automation of Tier 1 support queries

40 50% reduction in human agent dependency

20 35% increase in renewal adherence

25% higher cross sell and upsell conversions

Agents use the AI Agent as their copilot reducing admin work and allowing focus on sales

Key Differentiators of Streebo’s Health Insurance Agent AI Chatbot

This AI Agent is purpose built for internal sales and advisory teams. It helps agents handle client inquiries, underwriting checks, and documentation with speed and accuracy unlike typical customer facing bots.

Agents can ask questions in plain language like “Does Plan B cover maternity?” and get quick, relevant responses based on insurance specific context.

Trained on insurer data and rules, the AI Agent provides accurate, audit ready answers that adhere to compliance and underwriting standards.

Connects with CRMs, policy databases, document repositories, and training portals to deliver a unified support experience within the agent’s workflow.

Available inside Microsoft Teams, Slack, WhatsApp, and internal web/mobile portals, so agents can access help wherever they work.

New agents can quickly learn terminology, workflows, and best practices by interacting with the AI Agent during real time conversations.

Reduces time spent searching for documents, asking supervisors, or manually building plan comparisons accelerating every stage of the sales cycle.

Ensures agents only access permitted information, with full encryption, access control, and HIPAA compliant architecture.

Tailored to your specific products, compliance needs, and sales processes ready to scale across regions, plans, and teams.

Pricing Options

Starts at $99/month for multi-tenant SAAS or $999/month for single-tenant (Private Hosting)

Starting @ 1$/user – unlimited chats

Get Started Today

Launch your AI powered Health Insurance Agent in just days.

Improve customer experience. Drive conversions. Slash costs.

Book a free consultation or try the solution for 30 days no credit card required.