Generative AI Powered AI Agent for Banking Credit Card Marketing

The Future of Credit Card Engagement in Banking Is Already Here

Why Credit Card Customer Behavior Is Changing and What Banks Must Do About It

Consumers today expect instant gratification, hyper personalized offers, and always on support. For credit card marketers, this represents both a challenge and an opportunity.

Key Behavioural Shifts in Credit Card Prospects and Customers

Users are bypassing brochures and web forms. Instead, they initiate conversations often on mobile to learn, compare, and apply for credit cards. A chatbot banking credit card marketing solution fits seamlessly into this behaviour shift.

Questions like “What card offers 5% cashback?” or “Am I eligible for a free lounge access card?” demand immediate, accurate answers. Traditional channels like emails or call centres are simply too slow.

Customers don’t want to parse through terms and conditions. They want clear, plain language guidance delivered in a natural, conversational tone by an AI Agent banking credit card marketing solution.

Over 85% of digital banking activity occurs on smartphones. Banks must now ensure that the entire journey from exploration to application is mobile friendly and ideally powered by a virtual assistant for credit card marketing in banking.

From applying at midnight to querying a declined transaction on a Sunday morning, users expect availability around the clock. The AI driven chatbot for credit card marketing services can be the answer.

The New Center of Gravity: AI Powered Conversations

Enter the next generation AI Agent not a chatbot, not an FAQ tool, but a dynamic marketing assistant that drives lead capture, prequalification, application assistance, and card servicing all in real time.

Banks leveraging this credit card marketing AI Agent for banking have seen:

Higher lead to approval rates

Higher lead to approval rates Faster customer onboarding

Faster customer onboarding Lower acquisition costs

Lower acquisition costs Improved customer satisfaction

Improved customer satisfaction

Meet Smart & Secure AI Agent for Credit Card Marketing

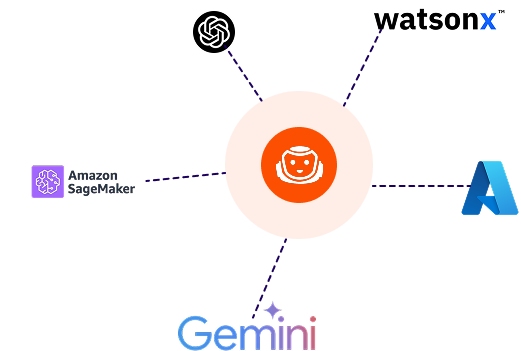

Built on innovative LLM technologies such as IBM watsonx, Microsoft Copilot Studio, Google Gemini, and Amazon Bedrock, the AI Agent understands banking specific user intents from card eligibility checks and application tracking to personalized card recommendations and promotional offers. It seamlessly integrates with core banking systems, CRM platforms, and credit bureaus, to deliver an end to end, secure, and responsive customer journey across web, mobile, and social channels.

Once deployed, the AI powered agent acts as a smart digital banker, proactively engaging users with curated credit card offers, answering FAQs, assisting with onboarding, and upselling premium cards all while adhering to brand tone and regulatory compliance.

What Makes this AI Agent Different?

Web, mobile apps, WhatsApp, SMS, Google Business Chat, voice assistants, and more.

Unified experience across platforms users can start on mobile, continue web, and finish over chat.

Connects seamlessly with CRM, core banking, card application systems, and campaign management platforms.

Supports nuanced, multilingual, multi turn conversations with real time data fetching.

Real World Use Cases for the Credit Card AI Agent

01.

Lead Qualification and Prospect Nurturing

The AI Agent captures website visitors, social media leads, and app users asking targeted questions to identify their intent and match them with suitable card offerings.

outcome

Higher lead quality, lower drop offs.

02.

Product Comparison and Recommendation

Instead of browsing comparison tables, users can ask: “Which card is best for international travel?” or “What’s the best cashback card under ₹500 annual fee?”

outcome

Personalized offers delivered instantly via the banking chatbot for credit card service marketing.

03.

Credit Card Application Assistance

From document submission to eligibility checks, the AI Agent guides users step by step through the application process reducing abandonment and improving approvals.

outcome

Streamlined onboarding and better conversion from digital channels.

04.

Onboarding and Activation Journey

After approval, the AI Agent supports PIN generation, usage tips, reward programs, and fraud safety encouraging card activation and first swipe.

outcome

Faster activation rates and lower early churn.

05.

Cross Sell and Upsell

Based on user profile, behaviour, and spending history, the AI Agent can recommend upgrades, co-branded cards, or balance transfer offers.

outcome

Increased wallet shares through contextual offers.

06.

Card Servicing and Support

Whether it’s checking statements, tracking rewards, reporting fraud, or updating contact details the Agent manages it all.

outcome

80%+ service queries overseen automatically with reduced call centre volume.

Old World vs New World: How AI Agents Transform Credit Card Interactions

Scenario 1

Finding the Right Card

Scenario 2

Application Drop Off

Scenario 3

First Time Activation

Scenario 4

Statement Clarification

Scenario 5

Targeted Upsell

Under the Hood: AI Agent Capabilities and Integration

-

Interprets natural language using GenAI models.

-

Understands intent, emotion, context.

-

Handles ambiguous or multi part queries.

Connects with:

-

Core banking systems (CBS)

-

Card issuance platforms

-

Loan origination systems (LOS)

-

KYC/AML engines

-

CRM & marketing automation tools

-

Payment gateways

-

Lead qualification scripts.

-

Application guidance

-

Document checklists

-

Support FAQs

-

Reward programs

-

Cross sell campaigns

Business Impact for Banks

3x improvement in lead to application rate

3x improvement in lead to application rate 40% reduction in application abandonment

40% reduction in application abandonment

70 85% automation of Tier 1 queries

70 85% automation of Tier 1 queries Reduced live agent overhead.

Reduced live agent overhead.

25% increase in card usage within 30 days

25% increase in card usage within 30 days 30 50% improvement in upsell conversion.

30 50% improvement in upsell conversion.

Handles thousands of concurrent sessions.

Handles thousands of concurrent sessions. Supports multiple languages and geographies.

Supports multiple languages and geographies.

Key Differentiators of Gen AI Powered Credit Card Marketing AI Agent

Powered by leading generative AI engines like IBM watsonx, Microsoft Copilot Studio, Google Gemini, and Amazon Bedrock.

Powered by leading generative AI engines like IBM watsonx, Microsoft Copilot Studio, Google Gemini, and Amazon Bedrock. Banks can choose and orchestrate the most cost effective LLM based on performance, region, or data compliance.

Banks can choose and orchestrate the most cost effective LLM based on performance, region, or data compliance.

Pre trained on credit card marketing and banking use cases.

Pre trained on credit card marketing and banking use cases. Supports advanced intents such as eligibility screening, interest rate comparison, spend analysis, and card upgrades.

Supports advanced intents such as eligibility screening, interest rate comparison, spend analysis, and card upgrades.

Deploy once and extend across website, mobile app, Facebook Messenger, WhatsApp, Instagram, and SMS.

Deploy once and extend across website, mobile app, Facebook Messenger, WhatsApp, Instagram, and SMS. Unified experience across digital touchpoints with minimal additional development.

Unified experience across digital touchpoints with minimal additional development.

Connects with core banking systems, CRM tools (like Salesforce), credit score APIs, KYC modules, and analytics platforms.

Connects with core banking systems, CRM tools (like Salesforce), credit score APIs, KYC modules, and analytics platforms. Enables real time, data driven interactions for accurate recommendations and compliance.

Enables real time, data driven interactions for accurate recommendations and compliance.

Leverages customer data, transaction history, and behavioural signals to offer hyper personalized card promotions.

Leverages customer data, transaction history, and behavioural signals to offer hyper personalized card promotions. Trigger’s location based or seasonal campaigns to boost conversion and cross sell rates.

Trigger’s location based or seasonal campaigns to boost conversion and cross sell rates.

Built with bank grade security and privacy frameworks.

Built with bank grade security and privacy frameworks. Supports data masking, encryption, session tracking, and audit logging to meet financial regulations.

Supports data masking, encryption, session tracking, and audit logging to meet financial regulations.

Tracks conversation drops offs, campaign ROI, engagement heatmaps, and lead conversion metrics.

Tracks conversation drops offs, campaign ROI, engagement heatmaps, and lead conversion metrics. Continuously learns and optimizes messaging based on user feedback and performance data.

Continuously learns and optimizes messaging based on user feedback and performance data.

Offers conversational fluency in 100+ languages, with support for voice, text, and rich media (images, videos, PDFs).

Offers conversational fluency in 100+ languages, with support for voice, text, and rich media (images, videos, PDFs). Ideal for banks targeting diverse demographics and expanding to new geographies.

Ideal for banks targeting diverse demographics and expanding to new geographies.

Available as on premise, private cloud, or hybrid deployment.

Available as on premise, private cloud, or hybrid deployment. IdCompatible with OpenShift, Azure, AWS, and Google Cloud ideal for banks with strict data residency policies.

IdCompatible with OpenShift, Azure, AWS, and Google Cloud ideal for banks with strict data residency policies.

Pricing Options

Starts at $99/month for multi-tenant SAAS or $999/month for single-tenant (Private Hosting)

Starting @ 1$/user – unlimited chats

Ready to See It in Action?

- Request a live demo tailored to your credit card portfolio

- Try AI Agent risk free for 30 days