Introduction – Opportunities for Banking Sector

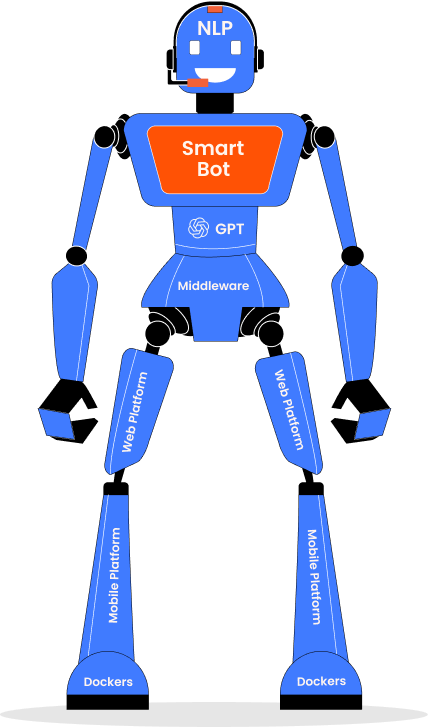

The article discusses a significant change in the customer base that presents a

valuable opportunity for the banking sector to increase profits and enhance customer satisfaction.

It

explores the potential of advanced artificial intelligence technologies, such as Natural Language

Processing and Generative AI, and suggests that banking institutions can benefit from these

technologies by automating routine business operations and customer interactions using platforms

like

Open.AI’s GPT. The latter part of the article proposes a comprehensive solution that utilizes

leading

NLP technologies from IBM Watson, Google Dialog Flow, Microsoft CLU, Amazon Lex, and Open.AI’s GPT.

This approach allows clients to use any combination of these powerful AI providers to create an all-in-one solution that takes advantage of the shift in the user base to increase revenue and customer satisfaction while minimizing interaction costs with customers and prospects.

This approach allows clients to use any combination of these powerful AI providers to create an all-in-one solution that takes advantage of the shift in the user base to increase revenue and customer satisfaction while minimizing interaction costs with customers and prospects.

Digital Disruption in Banking – A Tectonic Shift

The last couple of years has seen a huge surge in social media traffic. The

Pandemic forced users to work and socialize remotely and this change has been irreversible. Tech

Crunch reported a 40% surge YOY over the last few years in social media traffic and in the usage

of

messaging platforms both internal and external. This has fundamentally altered how we interact

at

work and socialize outside work.

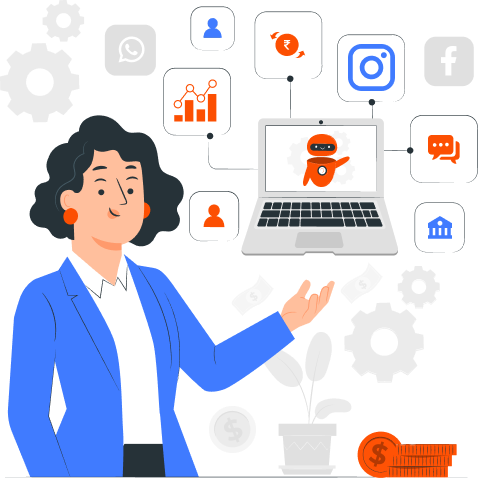

What does this mean for the Banking segment? Simple, we have to be where our users are – Banks that will extend their presence beyond web and mobile and embrace these messaging platforms will stand to gain market share and improve efficiencies. There are numerous case-studies and independent reports that show new customer acquisition through social media channels such as WhatsApp, FB (Meta) Messenger, Twitter, Instagram and even SMS.

Banks that are using internal messaging platforms to communicate are seeing productivity gains and thus are helping with cost-cutting. Needless to say, managing these channels with real live humans is cost prohibitory thus banks have to look for ways to automate the interactions on these channels.

What does this mean for the Banking segment? Simple, we have to be where our users are – Banks that will extend their presence beyond web and mobile and embrace these messaging platforms will stand to gain market share and improve efficiencies. There are numerous case-studies and independent reports that show new customer acquisition through social media channels such as WhatsApp, FB (Meta) Messenger, Twitter, Instagram and even SMS.

Banks that are using internal messaging platforms to communicate are seeing productivity gains and thus are helping with cost-cutting. Needless to say, managing these channels with real live humans is cost prohibitory thus banks have to look for ways to automate the interactions on these channels.

The Power of Conversational AI in Banking Sector

Thanks to advancements in Artificial Intelligence and particularly the field

of

Natural Language Processing now chat and voice interactions can be indeed automated. Natural

Language

Processing (NLP) technologies such as IBM Watson, Amazon Lex and Google Dialog are powerful NLP

engines that can process incoming interactions. The presence of AI-powered chatbots on

asynchronous

messaging channels like WhatsApp, Facebook, and SMS among others has opened up new opportunities

for

banks to reach new customers, particularly younger generations who are more likely to use social

media

and digital channels for banking.

- 90% of bank-related interactions will be automated by 2024 using chatbots.

- 7.3 B$ of the operational cost will be saved using chatbots in the banking sector by 2023.

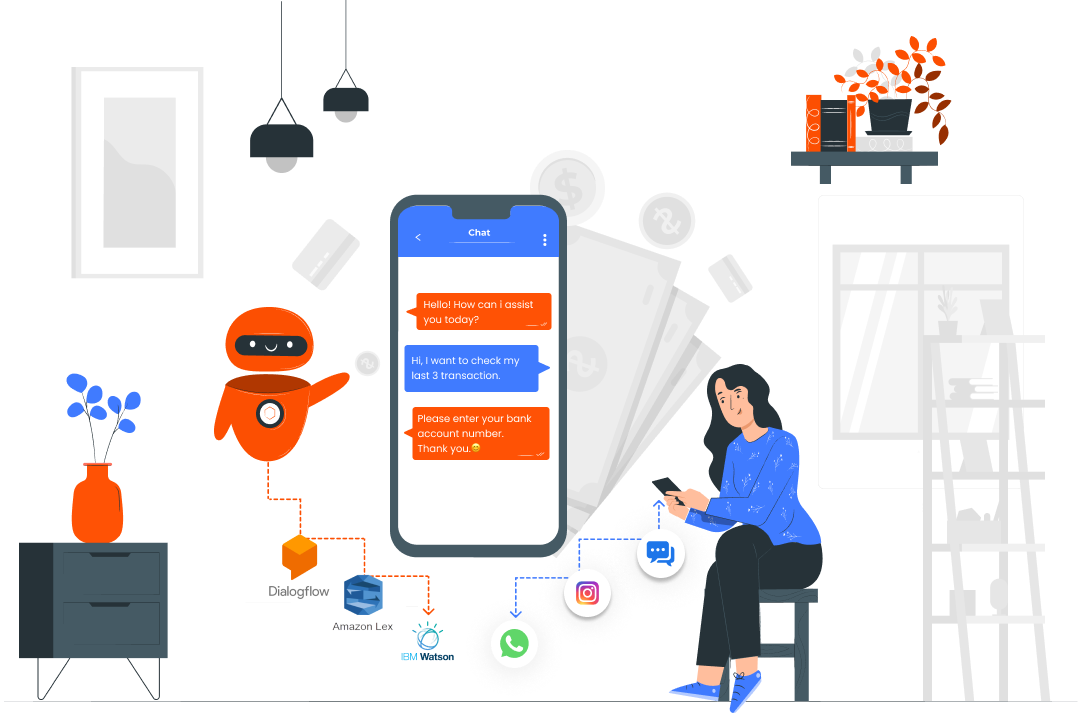

Conversational Artificial Intelligence, Machine Learning, and Natural language

processing (NLP) technology are revolutionizing the banking sector like never before. Customers

can

communicate with a variety of conversational AI banking workflows with the chat interface,

including

reporting possible fraud on their banking cards, requesting an increase in their credit card

limit,

and obtaining a breakdown of recent transactions.

Conversational AI solutions have evolved from the early days of basic question and answer type interactions to now bring customers through high-value journeys with automated end-to-end workflows. We are currently in an era where improved user experiences are meeting increased degrees of automation, allowing self-service models like never before. This is due to the maturation of natural language processing and machine learning technology.

Conversational AI solutions have evolved from the early days of basic question and answer type interactions to now bring customers through high-value journeys with automated end-to-end workflows. We are currently in an era where improved user experiences are meeting increased degrees of automation, allowing self-service models like never before. This is due to the maturation of natural language processing and machine learning technology.

Enter ChatGPT – A Disrupter

The latest GPT platform from Open.AI takes the NLP even further as it is not

only able to process natural language but also Generate Text using its Generative.AI

capabilities.

ChatGPT is a powerful chatbot that can engage the users and give precise information to the

end-user. Thus, with GPT integration, chatbots have evolved to a point where it can understand

the

requests, and respond with high accuracy and dynamic texts. This helps in increasing customer

engagement.

With expertise in chatbots and Conversational AI,

Streebo, a leading digital transformation company has rolled out pre-integrated smart

bots

powered by top NLP engines including IBM Watson, Microsoft CLU, Amazon Lex from AWS, and

Google DialogFlow from GCP. In the latest release, we have integrated our bots with

Generative AI technology GPT from Open.AI, taking the capabilities of these new

technologies

even further with cutting-edge Conversational AI solution, ChatGPT for Enterprise. GPT

stands

for Generative Pre-trained Transformer, an NLP model that generates text based on

natural

language structures. Our Virtual Banking Assistants utilize this technology to provide

unparalleled customer service.

Why Conversational AI Solution for Banking Services with ChatGPT capabilities?

At Streebo, our focus is Conversational AI. We have come up with a smart AI

Powered, Pre-trained Banking chatbot solution that can handle all banking-related activities

including

Fund Transfer, Opening a New A/c, and Loan Applications, among others. All these banking

transactions

require confidential information about the customers and to ensure the security of the

conversations,

our AI-Powered Banking Bot leverages leading NLP engines such as IBM Watson Assistant, Microsoft

Azure’s CLU, Google Dialog flow from GCP, Amazon Lex from AWS, and Wit.AI from Meta and now GPT from

Open.AI for processing incoming requests in a secure manner. They generate human-like responses thus

giving a ChatGPT kind of experience for the Enterprise user.

Our banking bots can be integrated with the core-banking systems such as

Our banking bots can be integrated with the core-banking systems such as

- Finacle

- SAP Core Banking

- Oracle Flex Cube.

Our banking chatbots, powered by ChatGPT, have the ability to resolve queries

with

an accuracy rate of up to 99%, resulting in improved sales and reduced operational costs. We

continually train our chatbots to achieve the highest levels of accuracy. In addition, our chatbots

have context-switching capabilities, allowing them to seamlessly transition between conversation

topics without disrupting the flow of the conversation. This feature is particularly useful for

complex topics such as banking regulations and policies that may require detailed explanations or

instructions from an experienced banker or financial advisor. Overall, ChatGPT like bot for

Banking has advanced capabilities and unlimited potential, making it a significant step forward in

the

transformation of the banking sector and a key player in shaping its future.

Our pre-trained, industry-relevant Banking Bots supports below mentioned use cases

Customer Facing Bots

- FAQs (Frequently Asked Questions)

- Open an Account

- Apply for an FD

- Personal Loan Calculator

- Talk to a Live Agent for assistance

- Check last 5 Transactions

- Add Beneficiary

- Apply for Mortgage Loan

- Check/Download Statement

- Request a Cheque Book

- Bill Payment

- Track Loan Application

- Submit Form 15G/15H

- Rewards Point – Balance, History, Redemption, Queries

- Branch Locator

- Apply for a Credit Card

- Avail a Loan

- Learning Center (Videos/Articles)

- Check Balance

- View Account Statement

- Fund Transfer

- Block Credit/Debit Card

- Check/Download FD Summary

- Reset PIN

- Update KYC

- Update Personal Details

- Find IFSC

Agent Facing Bots

Key Business Benefits of these cutting-edge Bots designed specifically for the Banking Sector

By leveraging Streebo’s AI-Powered Banking Bots – banks can avail below mentioned

benefits:

Studies by Statista have shown that banks that use bots for customer service have seen a 20% reduction in costs and a 12% increase in overall revenue. Having a presence on popular social media platforms can also help banks attract new leads and customers, as they can reach a wider audience and showcase their products and services to a diverse demographic which can translate into increased revenue.

By deploying banking bots on social media channels, Banks can reach customers where they are and provide instant responses to their queries and needs. This can greatly improve the customer experience and increase customer satisfaction, leading to increased loyalty and positive word-of-mouth referrals

Banking chatbots powered by AI technologies like GPT can mimic human conversations and can handle the initial line of communication. They save time for banking personnel to focus more on sophisticated and impactful tasks where a higher level of expertise is required. Our ChatGPT-powered Banking Bots are extremely intelligent and pre-trained to handle administrative tasks and mundane query resolution. This will remarkably increase the conversion rate by 15%.

Streebo’s AI-powered Conversational Interfaces for the Banking sector process transactions at a faster pace. Quick resolution is something that most customers love. Keeping this at the front foot, Streebo Bots (Streebots) are dedicated to giving faster resolutions with up to 99% accuracy.

Key differentiators of Pre-Trained and pre-integrated Banking Virtual Assistants are

Streebo in collaboration with its technology partner, deploys highly intelligent pre-trained Bots that can emulate business processes pertaining to various Banking and Financial Sectors.

Streebo’s GPT Integrated Banking Bots provide a truly comprehensive omnichannel experience that businesses can use to connect with customers, no matter what platform they choose. Customers have the flexibility and convenience to interact with the bots via channels such as WhatsApp, Google Chat, Facebook Messenger, SMS, Telegram, Signal, WeChat, Skype, Phone IVR, Amazon Alexa, Google Home, and now even email. This ensures the customers get prompt responses on whatever platform they are.

Our banking virtual assistants have made a major breakthrough in email communication with the integration of GPT technology. The latest addition to our bots’ capabilities enables them to produce emails that closely resemble human interactions, leading to more successful outcomes while also managing backend integrations. This achievement is a critical milestone in our continuous efforts to deliver the highest level of customer satisfaction.

ChatGPT-integrated Banking Bot comes pre-integrated with common core banking systems such as SAP Core banking, Oracle Flex cube, Finacle. This gives an ease of access to the core services of banks promptly.

Innovative tools and technologies like Classification, Clustering, Embedding, and Generative AI technology in the GPT platform, have made it seamless for Enterprises of all sizes to tap into unstructured information silos. This includes Web Pages, FD descriptions, New Schemes, Loan assessment documentation, and other unstructured information such as logs, and emails to find the relevant information for the end users. Using GPT in banking bots, bankers can leverage this powerful capability and bring the right information to the product sales or servicing cycle at the right time.

It is the process of determining the emotional tone of a piece of text, and it can be used to identify suspicious behavior or potential fraud. For example, ChatGPT can be trained to detect certain keywords or phrases that may indicate fraud, such as “urgent” or “transfer all funds.” If a chatbot detects such language in a customer’s message, it can flag the transaction for further review by bank security personnel.

Another outstanding feature that sets Streebots apart is – They can be deployed on-premise or on IBM Cloud, Microsoft Azure, Amazon AWS or Google Cloud Platform. This gives flexibility of picking an engagement model for banks to interact with the customers.

Streebots powered by GPT from Open.AI for Banks come with a Guaranteed Bot Intelligence Index* of up to 99% (*BII= No. of questions answered correctly/No. of relevant questions asked). We continue to train the bot until they reach a high degree of accuracy. This high accuracy effectively reduces manual intervention on the part of the Banking staff, thus improving overall efficiency and performance.

Streebo’s Banking Virtual Assistants allow customers to communicate in multiple languages. They support over 38+ languages. That helps customers to make informed decisions by making them understand all clauses in a simplified manner. The advanced training of bots to understand the dialects and accents of end users according to their demographics and geography inculcates a sense of trust and confidence in the customers.

Streebo’s Banking solution has built-in live agent support, which enables users to get real-time assistance if they cannot find a solution to their queries by interacting with the bot. Customers can make a smooth transition from chatbots to human operators, ensuring that their queries are resolved effectively in no time.

Our solution leverages cutting edge NLP engines, including IBM Watson, Google Dialog, Microsoft Azure’s CLU, and Amazon Lex, to ensure that all processed data is secure and adheres to regulatory standards. In addition, all communication between GPT and our solution is encrypted and masked, guaranteeing the security of all data, not just sensitive information.

Pricing Options

Capex Option

Opex Option

Pay-Per-usage

Conclusion

The use of AI-powered chatbots in the Banking sector is rapidly increasing and

is expected to continue to grow in the upcoming years. According to a recent report by

Accenture,

80% of banking customers prefer using chatbots for their inquiries. Moreover, a Gartner report

estimates that organizations utilizing AI technologies may experience up to a 25% increase in

customer satisfaction by 2023. These statistics highlight the significance of chatbots in

providing

efficient customer service while streamlining business operations and reducing resource costs.

With

the emergence of new technologies, such as ChatGPT, that produce human-like dynamic text in a

conversational context, the use of AI in banks is set to surge.

Streebo’s innovative ChatGPT-like bots are

transforming

the way banks interact with their customers, offering high accuracy and customization.

Leveraging the best technologies from leading companies such as IBM Watson, GCP,

Microsoft,

AWS, and Open. AI, Streebo creates efficient solutions. With these bots, banks can

create a

personalized experience for their customers, minimize errors and increase accuracy in

predicting user behavior over time. They increase customer engagement and offer

tailor-made

solutions and recommendations while staying compliant with banking regulations. These

innovative tools offer insurmountable opportunities for streamlining processes and

elevate

the customer experience to new heights.

Disclaimer: ChatGPT and GPT are registered trademarks and terms fully owned by

Open.AI. Author has used the term “Banking industry” to convey the idea of a ChatGPT kind of

Bot, but for the Banking industry

Want to Know- How This Will Work for Your Business?

1.

Visit our Enterprise-Grade Bot Store.

2. Learn what it can do for your business by scheduling a demo session.

3. Try it yourself with a Free 30-day trial.

Start your 30-day free trial now and witness firsthand how our intelligent chatbot can transform your service delivery, boost efficiency, and skyrocket guest satisfaction.

Don’t let this chance slip by! Get in touch with us today to begin your journey towards unparalleled business management, risk-free!

Get in touch

2. Learn what it can do for your business by scheduling a demo session.

3. Try it yourself with a Free 30-day trial.

Start your 30-day free trial now and witness firsthand how our intelligent chatbot can transform your service delivery, boost efficiency, and skyrocket guest satisfaction.

Don’t let this chance slip by! Get in touch with us today to begin your journey towards unparalleled business management, risk-free!

Get in touch