Generative AI Powered Smart AI Agent Solution

Omni-Channel Bots – Deploy on Chat, Voice, Email, Instagram, Facebook, WhatsApp and Even SMSCheck out Demo

Check out the Enterprise Grade AI Agent Powered by Gen AI. No Setup Fees.

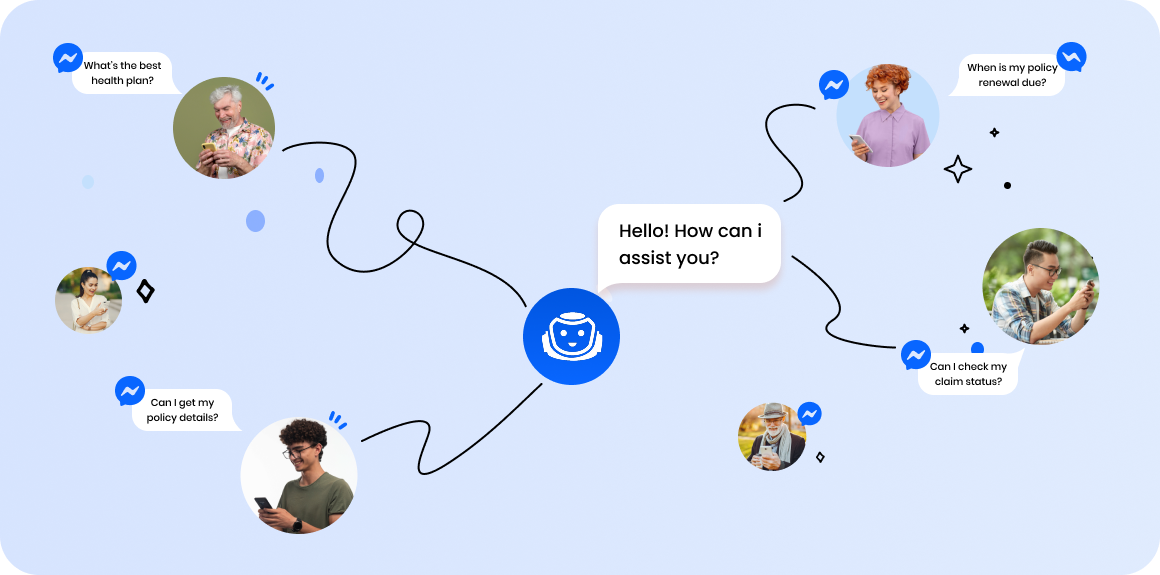

Generative AI Powered Insurance AI Agent Solution on Facebook

The Future of Insurance Conversations Is Already Here

The insurance sector is undergoing a rapid digital transformation driven by

shifting customer expectations, evolving regulatory frameworks, and the need for operational

agility. While insurers have invested in portals, mobile apps, and contact center technology, a

key channel remains underutilized: Facebook.

With over 3 billion global users, Facebook is not just

a social network it is a daily touchpoint

where customers seek information, compare services, and engage with businesses. For insurers, it

has become essential to provide timely, secure, and intelligent interactions on this platform,

especially through Facebook Messenger.

That’s where the Generative AI powered Insurance

Facebook Chatbot comes into

play.

This AI agent is not a static FAQ tool. It is a dynamic, multilingual, and enterprise grade

assistant capable of handling thousands of insurance interactions simultaneously ranging from

policy inquiries and premium estimations to claims support and renewals.

Whether it’s a potential customer comparing term plans, an existing policyholder inquiring about

a payment receipt, or a user seeking clarification on exclusions the AI powered Facebook chatbot

ensures every interaction is immediate, accurate, and context aware.

This article explores why leading insurers are adopting Gen AI

powered AI agents on Facebook,

how customer behavior has shifted, and what business benefits can be realized by deploying a

secure, scalable, and intelligent chatbot tailored to insurance workflows.

How Insurance Customer Behavior Has Changed and Why Facebook Matters

From Policy Search to Claims Customers Expect Instant Engagement

Digital engagement in the insurance sector is no longer limited to web portals or mobile apps. Today’s policyholders and more importantly, prospects expect insurers to be accessible across the platforms they use every day. Facebook, particularly through Messenger has emerged as a preferred communication channel for various customer segments, including millennials, Gen Z, and digitally mature users.

Whether it’s exploring health insurance options, understanding motor coverage, or raising a query about a pending life insurance claim, customers are turning to Facebook to interact with insurers on their terms and timeline.

Key Behavioral Shifts Driving the Change

Chat First Expectations

Chat First Expectations

Policyholders are more inclined to initiate conversations through chat rather than navigate static FAQ pages or wait on IVR calls. Facebook Messenger is often their first choice for quick engagement.

Low Tolerance for Delays

Low Tolerance for Delays

Inquiries like “Can I pay my premium late?” or “Is dental covered under this plan?” demand real time responses. Traditional response channels especially email or offline branches fall short in meeting this need.

Demand for Simplified Experiences

Demand for Simplified Experiences

The average insurance buyer doesn’t want to interpret technical jargon or decode dense policy PDFs. They want clear answers quickly and in conversational language. A Gen AI powered chatbot on Facebook delivers that simplicity.

Increased Mobile Usage

Increased Mobile Usage

80% of Facebook usage occurs on mobile devices. Insurance customers now expect the entire customer journey from policy comparison to claim submission to be manageable on their smartphone, within a chat interface.

Preference for 24/7 Support

Preference for 24/7 Support

Insurance needs do not follow office hours. Whether it’s an emergency hospitalization at midnight or a renewal query over the weekend, customers expect insurance support to be always on.

Why Facebook Is the Channel of Choice

With billions of users globally, Facebook offers unmatched reach especially in emerging and mobile first markets.

Facebook Messenger sees open rates of up to 88%, significantly higher than traditional email.

Customers already interact with brands on Messenger, making it a low friction, trusted environment for insurance conversations.

Messenger supports carousels, quick replies, rich media, payments, and secure hand offs all essential for insurance interactions.

In short, Facebook is not an alternate channel anymore it is a core channel for customer service, policy servicing, and lead generation in insurance.

Delivering Scalable, Intelligent Insurance Engagement on Messenger

Streebo, a leading Digital Transformation & AI Company,

has come up with a purpose built

Generative AI powered Insurance Chatbot for Facebook

that enables insurers to elevate customer

experience by engaging policyholders and prospects directly within Facebook

Messenger platform

millions already use daily.

This AI agent empowers insurance providers to deliver real time, conversational service across

the entire customer lifecycle covering product exploration, quote requests, policy servicing,

claims assistance, and renewals. It eliminates the need for customers to rely on complex

portals, wait in call queues, or download additional apps. Instead, every critical interaction

can happen naturally and securely through a familiar messaging interface.

The chatbot is designed to work in tandem with existing enterprise infrastructure. It

connects securely with backend systems such as policy

administration platforms, customer

databases, payment gateways, document repositories, and claims management

tools. This

ensures every customer request whether informational or transactional is handled with full

data context, accuracy, and compliance.

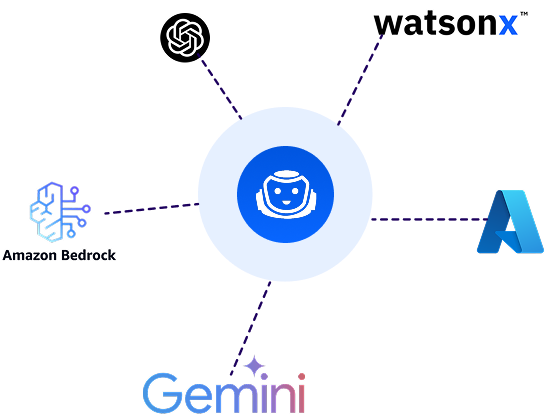

Unlike traditional rule based bots, this AI agent is powered by advanced

Generative AI

technologies including IBM Watsonx, Microsoft

Copilot Studio, Google Gemini, and Amazon

Bedrock. This allows it to interpret natural language, understand intent, and

manage

nuanced, multi turn conversations in real time.

For example, if a customer asks, “What’s covered under my current plan, and can I add a

dependent mid-term?”, the chatbot interprets the query, accesses backend policy details, and

guides the customer step by step all within the same thread with 99%

accuracy.

By integrating intelligent conversation capabilities with

enterprise grade data access, the Gen

AI powered Facebook chatbot enables insurers to reduce manual workload, improve service

accuracy, boost customer satisfaction, and significantly shorten response times all while being

available 24/7.

Key Use Cases Across the Insurance Lifecycle Powered by the AI Agent on Facebook

The introduction of a Gen AI powered insurance chatbot on

Facebook is enabling insurers to

engage

customers more efficiently at every critical touchpoint from product discovery to policy

servicing

and claims. With deep backend integration and intelligent conversational capabilities, the

chatbot

becomes a functional extension of the insurer’s digital front office inside platform users

already

trust and use daily.

Here’s how insurance organizations are leveraging the insurance

Facebook chatbot to modernize

engagement and streamline processes:

01

Lead Engagement and Prospect Nurturing

The Facebook chatbot for insurance can engage users who interact with sponsored posts, business page content, or Messenger ads. It captures essential information like name, location, and intent, then initiates guided conversations to identify the user’s needs, helping move them further down the funnel without requiring app downloads or email follow ups.

02

Quote Estimation and Product Exploration

Customers can request personalized product recommendations and premium estimates based on basic profile inputs. The AI agent for insurance on Facebook pulls data from underwriting engines and policy configurators to generate accurate, compliant, and real time quotes all within the Messenger conversation.

03

Digital Policy Purchase Journey

Once a product is selected, the chatbot guides users through a complete onboarding workflow facilitating ID verification, document collection, and policy finalization. The insurance AI agent for Facebook integrates seamlessly with internal systems to ensure every completed interaction translates into a valid policy issuance.

04

Policy Service Requests and Account Management

Through structured conversations, users can request updates such as address changes, nominee modifications, or benefit summaries. The insurance chatbot integration with Facebook enables real time servicing by connecting with policy administration platforms and delivering immediate confirmation or follow up instructions.

05

Renewal Management and Payment Assistance

The insurance Facebook chatbot helps reduce lapse rates by sending timely renewal alerts and assisting users with updating or modifying their policies. Customers can request revised terms, switch plans, or complete payments directly through Messenger, ensuring the continuity of coverage without administrative overhead.

06

Claims Notification and Tracking

From initiating the claim to submitting required documents, the Facebook chatbot for insurance supports the entire claims workflow. It assists users in logging an incident, providing supporting evidence, and checking claim progress all while ensuring that data is captured accurately and routed through the correct backend systems.

07

Product Clarifications and Documentation

The AI agent for insurance on Facebook answers detailed queries about coverage limits, exclusions, riders, and policy clauses. It draws from structured documents and APIs to provide accurate responses based on a customer’s specific policy or inquiry, supporting compliance and customer clarity.

08

Cross Selling Based on Customer Behavior

Using internal customer data and behavioral cues from ongoing conversations, the chatbot identifies opportunities to recommend supplementary products or policy upgrades. The insurance AI agent for Facebook supports contextual promotions that increase wallet share without interrupting the user experience.

Old World vs New World Real Life Insurance Interactions Transformed by the Facebook AI Agent

Outdated insurance workflows often create delays, friction, and missed revenue

opportunities. In contrast, the AI agent for insurance on

Facebook simplifies and accelerates

each interaction leading to improved satisfaction, higher conversion, and lower operational

effort.

Here’s how the transformation looks, scenario by scenario:

Scenario 1

Product Inquiry and Quote Drop Off

Old World

A prospect visits the insurer’s website to compare products. The journey is complex, requiring multiple form fields and jargon heavy inputs. The user abandons the process without completing the quote request.

Outcome

- No lead captured. No follow up. Missed conversion.

New World with Facebook AI Agent

The same prospect clicks on a Facebook ad and is greeted by the insurance Facebook chatbot. It captures basic details through a guided chat, provides two personalized plan options, and shares a quote within seconds.

Outcome

- Lead captured. Quote delivered. High intent user retained and nurtured within Messenger.

Scenario 2

Account Information Update

Old World

A policyholder wants to update their phone number. The web portal requires a login, which the customer has forgotten. A call to support leads to long hold times and a request for a written email with ID proof.

Outcome

- Time lost. Frustration escalates. Update delayed.

New World with Facebook AI Agent

The customer messages the Facebook chatbot for insurance. After verification, the chatbot updates the contact detail and confirms the change all within Messenger.

Outcome

- Issue resolved instantly. Customer experience enhanced. Manual effort eliminated.

Scenario 3

Claim Filing and Document Confusion

Old World

A customer initiates a claim via email but is unsure of the required documentation. The insurer replies after two days with a generic PDF. Confusion leads to delays in filing and verification.

Outcome

- Claim processing delayed. Customer trust eroded. Higher support load.

New World with Facebook AI Agent

The user messages the insurance AI agent for Facebook saying, “How do I file a claim?” The chatbot checks policy eligibility, shares a tailored checklist, and accepts document uploads in the same thread.

Outcome

- Claim initiated correctly. Time to resolution reduced. Support costs lowered.

Scenario 4

Missed Renewal Window

Your policy renewal is due in 5 days.

Old World

A renewal reminder is sent via email, but the customer misses it. The policy lapses, requiring a fresh application and underwriting.

Outcome

- Policy discontinued. Revenue lost. Reacquisition required.

New World with Facebook AI Agent

The AI agent for insurance on Facebook sends a Messenger alert five days before renewal. The customer confirms with one click and completes payment in chat.

Outcome

- Policy retained. No underwriting delay. Recurring revenue secured.

Scenario 5

Add On Clarification and Upsell Opportunity

Old World

A customer explores policy add-ons but is confused by terminology in the brochure. Without personalized support, they skip the purchase altogether

Outcome

- Upsell lost. Engagement opportunity missed. Customer journey interrupted.

New World with Facebook AI Agent

During a Messenger conversation, the Gen AI powered insurance chatbot on Facebook identifies eligibility and suggests a relevant add on. It explains the benefit in simple language and processes the upgrade instantly.

Outcome

- Upsell completed. Average policy value increased. Customer engagement deepened.

Solution Capabilities & Integration Framework

The Gen AI powered insurance chatbot on Facebook is designed to integrate deeply with enterprise insurance systems while delivering flexible, scalable, and secure customer experiences. More than a conversation interface, it becomes a fully operational service layer bridging backend processes with real time customer needs through Facebook Messenger.

Seamless Backend Integration

The chatbot connects to all essential business systems, including:

Policy administration for retrieving coverage details and enabling mid term updates

CRM platforms to maintain lead and customer context

Claims systems to initiate, track, and support claims

Payment gateways for collecting premiums and processing renewals

Document management systems to exchange and store relevant files securely

This ensures that every interaction handled by the insurance Facebook chatbot is accurate, timely, and data driven.

Configurable Workflows Across Insurance Functions

The Facebook chatbot for insurance is built with a library of adaptable workflows covering:

Product inquiries and quote generation

Policy issuance and onboarding

Customer service interactions

Renewals, upgrades, and add-ons

Claims assistance from FNOL to status tracking

These workflows are designed to reflect your internal processes while offering customers a consistent and simplified experience.

Business Impact Quantifiable Benefits for Insurance Providers

Implementing a Gen AI powered insurance chatbot on Facebook helps insurers improve customer service, boost conversions, and cut operational costs all within a channel customers already trust.

Faster Lead Conversion

Engages prospects instantly through Messenger, turning ad clicks and post interactions into guided sales conversations.

-

Up to 30% increase in quote to policy conversions

Up to 30% increase in quote to policy conversions

-

3x faster response to inbound inquiries

3x faster response to inbound inquiries

Lower Support Costs

Automates high volume queries like payment, claims, and policy information without agent involvement.

-

Up to 80% Tier 1 query automation

Up to 80% Tier 1 query automation

-

40% reduction in customer service costs

40% reduction in customer service costs

Improved Renewals and Upsells

Sends timely nudges for renewals and identifies upsell opportunities based on profile and behavior.

-

Up to 25% increase in renewal adherence

Up to 25% increase in renewal adherence

-

20 35% lift in upsell and cross sell conversions

20 35% lift in upsell and cross sell conversions

Scalable Engagement

Handles thousands of parallel conversations without time or geographic constraints.

-

10x increase in interaction capacity

10x increase in interaction capacity

-

Consistent service delivery across regions

Consistent service delivery across regions

Enhanced Compliance

All chat activity is logged and encrypted, aligning with audit and data privacy regulations.

-

Stronger regulatory readiness

Stronger regulatory readiness

-

Fewer manual errors and compliance gaps

Fewer manual errors and compliance gaps

Key Differentiators of the Gen AI Powered Insurance Chatbot on Facebook

The AI agent for insurance on Facebook is purpose built to meet the complex needs of modern insurers. Below are its core differentiators that make it more than just a messaging bot:

Tailored for insurance specific use cases quote assistance, claims support, policy servicing, renewals, and lead qualification.

Seamlessly connects with policy admin systems, CRM, claims engines, payment gateways, and document repositories.

Leverages platforms like IBM Watsonx, Google Gemini, Microsoft Copilot Studio, and Amazon Bedrock for natural, intelligent conversations.

Eliminates channel switching users can inquire, purchase, renew, or file claims without leaving Facebook.

Fully adaptable conversation flows based on organizational processes, compliance needs, and product structure.

Fetches, updates, and processes live policy data securely in response to customer input enabling end to end self service.

Handles thousands of simultaneous interactions with consistent speed and accuracy, across time zones and markets.

Tone, terminology, and prompts are fully editable to align with your company’s brand and regulatory language.

For complex cases, the chatbot transfers conversations with full context to support agents through integrated CRM.

Comes with dashboards to monitor usage, resolution rates, drop offs, and train the model for continuous improvement.

Pricing Options

Starts at $99/month for multi-tenant SAAS or $999/month for single-tenant (Private Hosting)

Starting @ 1$/user – unlimited chats

See the transformation for yourself.

Launch a fully functional AI agent in days

Customizable for your products and workflows

Pre integrated with core insurance systems

Get started with a 30-day free trial no credit card required. Or share your use case, and we’ll build a tailored demo around your needs.

Experience the future of insurance engagement on Facebook.

Chat On Facebook

Chat On Facebook