Generative AI Powered Smart Bot Solution

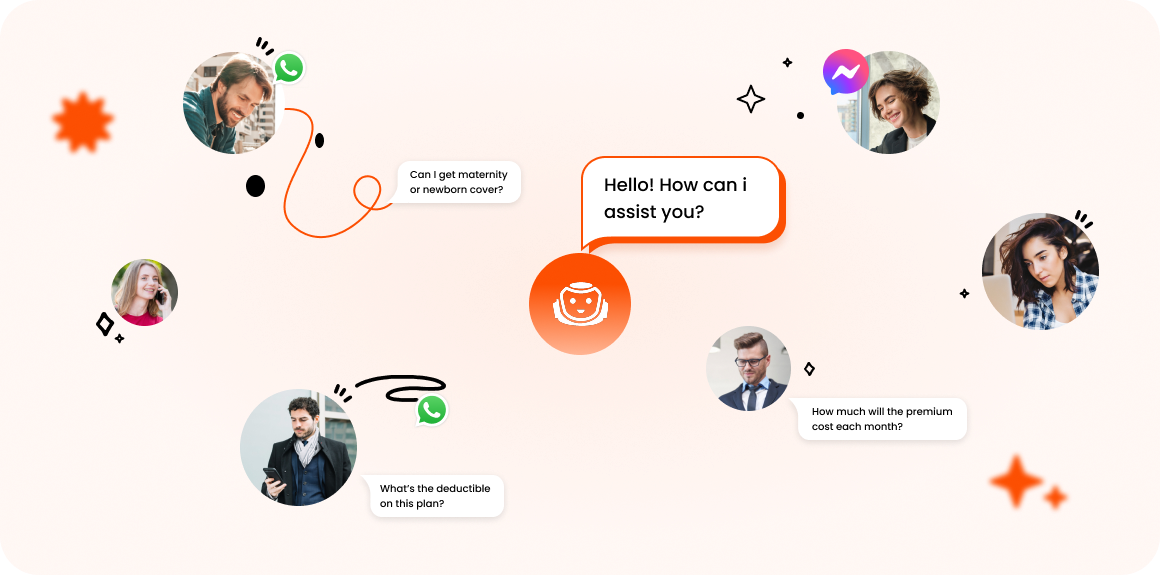

Omni-Channel Bots – Deploy on Chat, Voice, Email, Instagram, Facebook, WhatsApp and Even SMSCheck out Demo

Check out the Enterprise Grade AI Agent Powered by Gen AI. No Setup Fees.

Generative AI Powered Health Insurance Marketing AI Agent

The Future of Health Insurance Marketing is Now

The health insurance industry is experiencing a major digital

transformation. The surge in consumer expectations, heightened competition, and the demand for

personalized healthcare coverage have intensified the need for real time, intelligent marketing

strategies. Traditional approaches to customer acquisition and engagement via forms, cold calls, and email

campaigns are no longer sufficient to attract and retain today’s digital first health insurance buyer.

Enter the Generative AI powered Health Insurance Marketing AI Agent a game changer in how

health insurers connect with prospects, generate leads, and drive policy conversions.

Unlike

conventional tools or FAQ bots, this AI Agent is built for sophisticated, human like, multi turn

conversations that deliver policy recommendations, explain benefits, assist in lead qualification, and

even support plan upgrades all in real time, across web, mobile, or any preferred communication channel.

Whether your goal is to engage young adults seeking affordable coverage, families exploring

comprehensive health plans, or seniors interested in Medicare supplements, a well-trained marketing AI

agent for health insurance ensures that your brand provides immediate, accurate, and personalized support.

Changing Consumer Behavior in Health Insurance From Static Forms to Conversational Experiences

Prospective health insurance buyers now expect instant answers and effortless comparison. They no longer want to navigate dense PDFs or wait for callbacks. Instead, they want to ask, “What plans cover dental and maternity?” and receive an intelligent, conversational response within seconds.

Here’s what’s changing in consumer behavior:

Most customers prefer chat-based support over phone calls or email.

Over 70% of users research health insurance on smartphones. A health insurance chatbot for marketing must be mobile optimized.

Health concerns arise anytime. Prospects and policyholders want answers outside business hours.

Buyers want tailored advice not generic plans.

This evolution has made deploying an AI Agent for health insurance marketing not just useful but critical.

Smart and Secure GenAI Powered AI Agent for Health Insurance Marketing

Streebo, a leading provider of AI driven digital transformation solutions, introduces a purpose-built Health Insurance Marketing AI Agent. This secure and intelligent generative AI solution is designed to modernize how health insurance providers attract, educate, and convert prospects across digital channels.

Built on top of industry leading Large Language Models (LLMs) such as IBM watsonx,

Microsoft Copilot Studio, Google Gemini, and Amazon Bedrock, this AI Agent understands health insurance

specific customer intents. It can handle a wide range of queries including policy comparisons, eligibility

checks, benefit breakdowns, and premium estimates.

The AI Agent connects effortlessly with

existing enterprise systems such as CRMs, policy management tools, claims databases, and secure document

vaults. This allows insurance companies to deliver a fully automated and seamless customer journey across

platforms like websites, mobile apps, WhatsApp, and Facebook Messenger.

Once live, the Health

Insurance AI Agent acts as a digital concierge for your marketing and customer acquisition teams. It can

greet users with personalized plan suggestions, answer regulatory and coverage related questions,

pre-qualify leads, and guide high intent users to a licensed advisor for follow up.

Security

and compliance are built into the core of this AI Agent. It is designed to handle personally identifiable

information (PII) and health related data in accordance with HIPAA and other regional regulations.

Features like consent capture, encrypted communication, access control, and audit logging ensure that

every interaction is both secure and compliant.

More than just an automation tool, this AI

Agent creates a personalized and trust building experience. Every message is context aware, empathetic,

and based on real time user behavior and data. For health insurance providers, this results in better lead

quality, higher conversion rates, and improved customer satisfaction, all while meeting strict regulatory

standards.

Old World vs New World Scenarios in Health Insurance Marketing

Health Insurance Marketing: Old World vs. New World

Scenario 1

Inbound Lead Handling

Your form has been submitted successfully. We will contact you soon.

Newgen Healthcare

Hi Amelia, we’ve got your form let’s start the process with available plans….

Old World

A prospect visits your website late at night, curious about family health insurance plans. There’s no live agent. They fill out a generic contact form and wait days for a response. By the time someone reaches out, the interest has faded.

Outcome

-

Lost lead. Low engagement. Poor conversion.

New World

The AI Agent instantly welcomes the prospect on the website, asks key qualifying questions, and recommends family plans that match their needs. It even schedules a callback with a licensed advisor the next morning.

Outcome

-

Higher engagement. Faster follow up. Improved conversion rate.

Scenario 2

Plan Comparison and Decision Making

Old World

Customers are overwhelmed with plan brochures filled with jargon. They call the support center for clarification, but long wait times frustrate them. Many abandon the process.

Outcome

-

Decision fatigue. Drop offs in the evaluation stage.

New World

The AI Agent offers side by side plan comparisons in simple language and can explain differences in coverage, deductibles, and premiums based on the user’s profile.

Outcome

-

Clear decision making. Increased customer confidence and plan signups.

Scenario 3

Compliance in Conversations

Old World

A human agent inadvertently shares plan details that conflict with local regulatory guidelines or mishandles sensitive customer information.

Outcome

-

Risk of non-compliance. Potential penalties. Loss of trust.

New World

The AI Agent is programmed with guardrails that ensure compliant responses, encrypted communication, and auto consent capture before sharing personal data.

Outcome

-

Secure, regulation aligned conversations. Lower legal risk.

Scenario 4

Open Enrolment Surge

Old World

During open enrolment, call centers get flooded. Prospects face long hold times or never get through. Many miss their enrolment window.

Outcome

-

Lost business. Overloaded staff. Frustrated customers.

New World

The AI Agent scales effortlessly to handle thousands of queries in parallel, offering instant assistance on plan options, deadlines, and eligibility.

Outcome

-

Better throughput. Lower cost per interaction. More enrolments captured on time.

Scenario 5

Upsell Based on Life Events

Old World

Customer gets married. No one follows up to suggest family coverage.

Outcome

-

Missed upsell.

New World

The marketing chatbot for health insurance detects life event via chat and recommends a family floater policy.

Outcome

-

Higher premium value. Better coverage. Stronger relationship.

Core Capabilities of the Health Insurance AI Agent

-

Automatically engages web visitors or social ad respondents.

-

Collects name, age, income, family details.

-

Suggests the right plans based on eligibility.

-

Acts as a powerful chatbot for health insurance lead generation.

-

Uses real time underwriting APIs to share premiums.

-

Helps users compare plan benefits side by side.

-

Increases transparency and trust.

-

Assists with ID verification and document collection.

-

Integrates with eKYC and onboarding systems.

-

Enables completion of policy purchase within one conversation.

-

Answers complex questions like:

“What is co pay?” “Is infertility treatment covered?” -

Improves decision making with clear, jargon free language.

-

Update address, change nominee, download policy all in chat.

-

No waiting. No forms.

-

Sends proactive alerts for policy renewal.

-

Guides users to upgrade plans or add riders.

-

Accepts payments within chat.

-

Supports First Notice of Loss (FNOL).

-

Guides customers through documentation.

-

Tracks claim status and updates in real time.

-

Recommends dental, maternity, or critical illness add-ons.

-

Personalizes offers based on current plan and behavior.

Integration & Technology Stack

The health insurance chatbot for marketing is not a standalone tool it becomes a functional extension of your digital front office.

Backend Integration Includes:

Policy Administration Systems (PAS)

Fetch plan details, process endorsements.

CRM

Maintain lead journeys and customer history.

Document Repositories

Upload and retrieve e copies.

Payment Gateways

Collect premiums and renewals securely.

Claims Management Systems

Track lifecycle, resolve escalations.

Configurable Workflows for Marketing Success

AI Agent platform comes with prebuilt and configurable workflows such as:

Lead Qualification Scripts

Quote Journey Playbooks

Renewal Reminder Sequences

Claims FAQ Responses

Add on Suggestion Trees

Personalized Upsell Conversations

Each can be tailored to your branding, products, and underwriting rules.

Business Impact of Deploying the AI Agent

-

30% increase in quote to policy conversion

-

50% shorter lead response time

-

80% automation of Tier 1 queries

-

40% reduction in support staff workload

-

25% higher renewal rate

-

2x increase in repeat engagements

-

20-35% uplift in add on sales

-

Enhanced plan upgrades from basic to comprehensive

Key Differentiators of Gen AI Health Insurance Marketing AI Agent

Specifically trained on health insurance marketing, sales, and service use cases to deliver high accuracy responses that reflect real industry scenarios with 99% response accuracy.

Designed to meet HIPAA, SOC 2, and regional data protection standards with built in consent management, audit trails, and secure data handling.

Built on enterprise grade LLMs like IBM watsonx, Microsoft Copilot, Google Gemini, and Amazon Bedrock to ensure flexibility, reliability, and performance.

Connects seamlessly with CRMs, policy and claims systems, and marketing platforms to support a fully automated and connected user journey.

Deploy once and engage users across website, mobile app, WhatsApp, Facebook Messenger, Instagram, and more while maintaining brand consistency.

Qualifies leads in real time using smart dialog flows and routes high intent users to human agents or enrolment specialists.

Adapts conversations based on traffic source and campaign context to improve targeting, engagement, and conversion.

Supports rich media inputs including text, voice, images, and documents, and engages users in over 40 global languages to serve diverse populations effectively.

Handles thousands of concurrent conversations 24×7, especially during high demand periods like open enrolment.

Provides actionable analytics on user behavior, drop offs, and campaign performance to continuously improve outcomes.

Pricing Options

Starts at $99/month for multi-tenant SAAS or $999/month for single-tenant (Private Hosting)

Starting @ 1$/user – unlimited chats

Experience the Future of Health Insurance Marketing Today

Launch your fully functional health insurance marketing AI agent in just days.

✅ Start with a 30-day free trial no credit card required

📩 Or share your

use case and get a custom demo tailored to your insurance product

Discover what a truly

intelligent, generative AI powered insurance engagement looks like.