Generative AI Powered AI Agents for Home Insurance Customer Service

Revolutionizing House Insurance Support with Always on AI Agents

Homeowners today expect faster, more dependable, and more accessible service than ever before. Whether they’re filing a claim after a storm, checking coverage details, updating address records, or simply comparing policies, house insurance customer service is under more pressure to deliver real time, accurate, and convenient support across all channels.

Now

However, most house insurance providers still operate within outdated systems. Customers wait on IVR lines, browse unintuitive websites, and submit queries by email often receiving responses days later. In today’s digital first world, that’s no longer acceptable.

Enter the next generation of support: Generative AI powered AI Agents. These advanced, enterprise grade virtual assistants are transforming how home insurers engage with prospects and serve their policyholders 24/7, across all digital channels, with deep backend connectivity.

Why House Insurance Needs a Smarter Customer Service Model

The home insurance industry is traditionally complex, full of long documents, confusing clauses, and policyholder uncertainty. Today’s homeowners expect:

A pipe burst, need help!

I can help right away. Do you want to file a claim now?

Yes, what do you need?

Just upload a photo of the damage.

Done. How do I pay my premium?

You can pay securely here via card, transfer, or wallet. Process now?

Instant responses to time sensitive issues (e.g., burst pipes, fire claims)

24/7 availability, even during weekends or holidays

Conversational simplicity, with minimal insurance jargon

Multichannel accessibility not just via phone or email

Secure transactions, like premium payments or claim submissions.

Legacy support models fail to meet these expectations. By deploying a house insurance customer service AI agent, insurers can modernize their digital front office, reduce operational costs, and build trust with every customer interaction.

Smart Insurance Automation with Gen AI Home Insurance AI Agents

Streebo, a global leader in digital transformation and AI powered automation, specializes in building industry specific AI Agent solutions tailored for sectors like insurance. Powered by platforms such as IBM watsonx, Microsoft Copilot Studio, Google Gemini, and Amazon Bedrock, these pre trained AI Agents help home insurance companies launch secure, scalable, and human like service experiences in record time with 99% response accuracy.

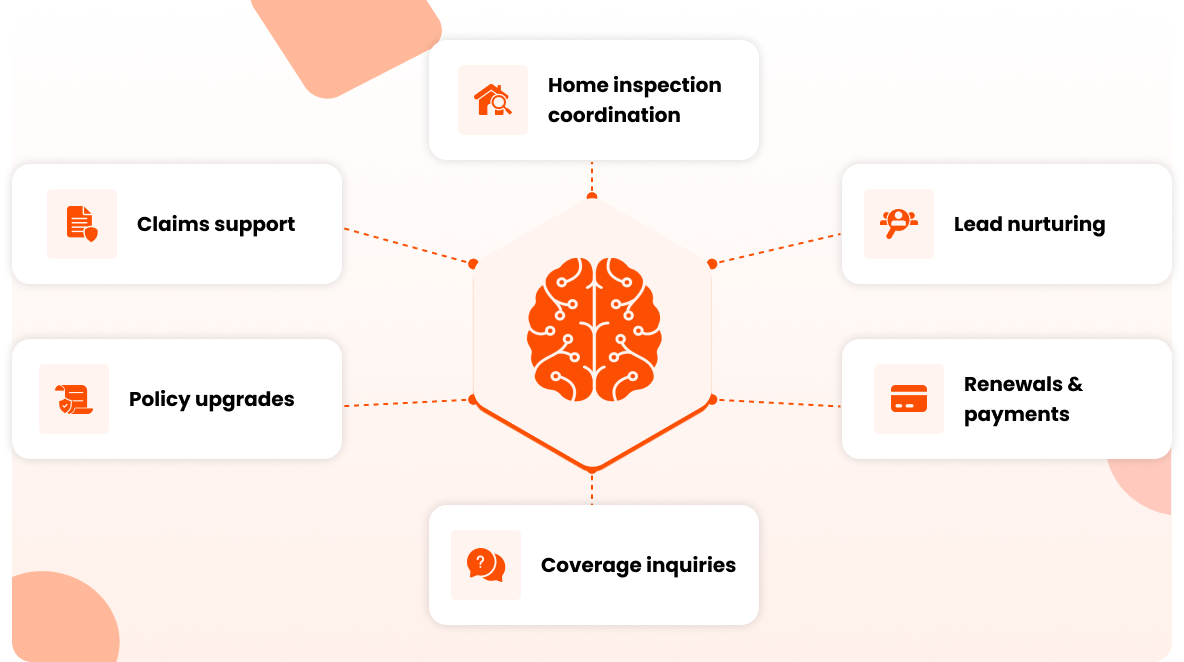

This AI Agent solution is not another FAQ bot. It’s an intelligent, omnichannel assistant capable of handling thousands of conversations simultaneously across use cases like:

All without the need for human intervention unless necessary.

Key Use Cases for House Insurance AI Agents

AI Agents for home insurance deliver measurable value across the policyholder journey. Below are just a few of the key use cases:

I want a home insurance quote.

Sure! Can you share your property type and location?

It’s a single-family home in Austin, valued at $350,000.

Got it ✅ Your instant quote is $92/month. Would you like me to send the full plan details?

01.

Lead Qualification and Quote Assistance

Using intelligent conversation flows, the customer support chatbot for house insurance collects key homeowner details (property type, location, value) and provides instant quotes.

02.

Policy Comparison and Education

Homeowners can ask questions like, “What’s the difference between basic and premium plans?” or “What does my flood add on include?” and get precise answers contextualized to their property and location.

What’s the difference between the basic and premium home insurance plans?

Basic covers fire, theft, and burst pipes. Premium adds higher limits plus flood and earthquake protection

And what does my flood add-on include?

It covers structural damage, repairs, and personal belongings, customized for your property’s flood zone.

I’m ready to buy my home insurance policy.

Great! Please upload your ID and property documents securely here.

![]() Documents_FY24.pdf

Documents_FY24.pdf

3.0MB

Identity verified ✅ Your purchase is complete, and your policy documents are now available to download.

03.

Policy Purchase and Document Submission

The house insurance customer service chatbot guides users through secure document uploads, identity verification, and final purchase all without needing to speak to an agent.

04.

Claims Initiation and Tracking

From hail damage to water leaks, homeowners can report incidents, upload photos, and receive claim status updates via chat.

I need to report hail damage to my roof.

Sorry to hear that. Please upload a photo of the damage to start your claim.

Uploaded. How can I track the claim?

Your claim is registered ✅ You’ll get real-time status updates here in chat.

I need to update my home address.

Sure! Please share your new address.

1245 Greenview Lane, Austin, TX. Can I also add valuables coverage?

✅ Address updated. Yes, I can add valuables coverage-here are the options.

05.

Account Updates and Policy Modifications

Changes like address, payment methods, or adding additional coverage can be made instantly with assistance from the customer service AI agent for house insurance.

06.

Renewal Reminders and Upsells

AI Agents proactively notify customers of upcoming renewals, suggest relevant upgrades (like natural disaster coverage), and complete the transactions all in the same chat.

Your home insurance renews next week. Renew now?

Yes

Add natural disaster coverage too?

Yes, please.

✅ Renewal + upgrade done. Policy ready to download.

I need a home inspection after my claim.

Sure! Available slots are: Tomorrow 11 AM, Fri 2 PM, Sat 10 AM. Which works best?

Tomorrow at 11 AM.

✅ Appointment booked. The inspector will visit your property tomorrow at 11 AM.

07.

Home Inspection Coordination

Customers needing post claim inspections or pre issuance evaluations can use the virtual assistant for house insurance customers to schedule appointments without calling in.

The Old World vs. New World Real Life Home Insurance Scenarios Transformed

Let’s walk through five common interactions and see how the shift to a generative AI powered AI Agent dramatically improves outcomes.

Scenario 1

Getting a Quote for a New Home

John visits an insurance provider’s website and fills a long form.

Your form has been submitted successfully. We will contact you soon.

it took me almost half an hour to fill this out, i hope i got reply soon.

That’s too long… I’ll skip it.

Old World

John visits an insurance provider’s website to get a quote. He’s required to fill out a 20-field form, download a PDF, and wait two days for a human call back. He gives up halfway.

Outcome

No quote. No lead. Lost opportunity.

Hi, I’d like a home insurance quote.

Sure! What’s your ZIP code and property value?

73301, property worth $350,000.

Got it ✅ Based on your area and value, I recommend two policies.

Great, what are the quotes?

- Policy A: $89/month

- Policy B: $105/month

New World with AI Agent

John interacts with a chatbot for house insurance customer service on the insurer’s mobile app. Within a 3-minute chat, the AI agent recommends two policies based on his ZIP code and property value and shares quotes instantly.

Outcome

Lead captured. Quote delivered. John proceeds to purchase.

Scenario 2

Submitting a Claim After Storm Damage

My roof was damaged in a hailstorm, I need to file a claim.

You’ll need to email us photos of the damage.

Okay, done. When will I hear back?

Someone will follow up in 5–7 days.

😞 That’s too long, I really need help now.

Old World

Maria calls the helpline after a hailstorm damages her roof. She waits 40 minutes, is asked to email photos, and is told someone will “follow up in 5-7 days.”

Outcome

Delay. Stress. Frustration builds.

My roof was damaged in a hailstorm, I need to file a claim.

Please upload photos of the damage.

Photos uploaded.

✅ Got them. Let me check your policy… good news, it covers hail damage.

Great, what’s next?

Your claim is filed ✅ Claim number: HS-2387. You’ll receive updates right here in the app.

New World with AI Agent

Maria opens the insurer’s app and initiates a claim through the ai agent for house insurance customer service. It guides her to upload photos, checks her policy, and confirms her claim number all in minutes.

Outcome

Claim filed. Transparency maintained. Customer loyalty strengthened.

Scenario 3

Modifying Policy Details

I need to update my email address.

After Several attempts send email to support.

9 April

Me

I can’t remember my password

12 April

Tower Insurance Customer Service

We’ve received your request. Please reset your password to continue.

12 April

Me

That took too long.

Old World

Steve wants to update his email address. He logs into the portal but forgets his password. After several failed attempts, he emails support. A response arrives two days later.

Outcome

Time wasted. Negative experience.

Hi, I want to update my email address.

Of course! First, can you confirm your date of birth for verification?

05/12/1986.

✅ Verified. What’s your new email address?

steve.newmail@example.com

Your profile is updated, and a confirmation has been sent to your new email.

New World with AI Agent

Steve messages the automated assistant for house insurance customers. After quick verification, the AI agent updates his profile and confirms via email.

Outcome

Task completed in under 2 minutes. Customer delighted.

Scenario 4

Renewal Reminders and Policy Lapse

I didn’t get any renewal notice-why did my policy lapse?

It was sent by mail, but it looks like it didn’t reach you.

Now what do I have to do?

You’ll need a new home inspection and must pay reactivation fees.

That’s frustrating, I never even got the letter.

Old World

A renewal reminder is sent via snail mail, and it’s lost in transit. Policy lapses, and reactivation requires re inspection and added fees.

Outcome

Revenue lost. Customer churn.

🔔 Reminder: Your home insurance renews next week. Renew now via chat?

Yes, let’s do it.

Great! Do you want to keep the same coverage or explore upgrades?

Keep the same coverage.

Perfect. Processing your renewal now…

✅ Done! Your policy is renewed, and confirmation has been sent to your email and app.

New World with AI Agent

The virtual assistant for house insurance customers sends a renewal alert via app, SMS, and email. The customer renews via chat with instant confirmation.

Outcome

Policy retained. Upsell offered. Long term customer secured.

Scenario 5

Policy Clause Clarification

Old World

Nina wants to understand her deductible clause. She’s referred to a dense 40-page PDF and still doesn’t feel confident.

Outcome

Lack of clarity. Loss of trust.

I want to understand my deductible clause.

Sure! Your deductible for roof repairs is $1,500.

Oh, that’s much clearer.

Glad to help! Would you like me to email you a simplified version of the clause?

Yes, please send it.

✅ Done. A plain-language copy is in your inbox.

New World with AI Agent

The house insurance customer service AI agent answers in plain language: “Your deductible for roof repairs is $1,500.” It offers to email the simplified clause too.

Outcome

Customer confident. No support ticket raised. Time saved.

Behind the Scenes Architecture and Integrations

The house insurance AI Agent isn’t just an interface it’s a deeply integrated, intelligent service orchestrator.

Core Integrations:

Policy Admin Systems

(for verifying customer data and policy details)

CRM Platforms

(for lead tracking and personalization)

Document Management Systems

(for uploading and retrieving paperwork)

Claims Engines

(for end-to-end claim tracking)

Payment Gateways

(for premium collections, refunds, and renewals)

Can you confirm my current home insurance coverage?

✅ Your policy is active with $250,000 coverage.

Great. I also need to submit my property inspection report.

Please upload it here—I’ll store it securely for review.

![]() property inspection_FY24.pdf

property inspection_FY24.pdf

3.0MB

Done, thanks!

Smart, Configurable Workflows:

These workflows are tailored for each insurer, supporting functions like:

Product browsing

FNOL (First Notice of Loss)

Adjuster appointment setting

Add on recommendations.

Underwriting queries

Coverage verification

Measurable Business Impact

Here’s how AI Agents improve customer service and the bottom line:

3x more quotes converted into policies.

3x more quotes converted into policies. 25% shorter purchase cycles

25% shorter purchase cycles

75% of Tier 1 queries automated.

75% of Tier 1 queries automated. 40% savings in agent costs

40% savings in agent costs

30% more policies renewed on time.

30% more policies renewed on time. 2x increase in upsell acceptance.

2x increase in upsell acceptance.

90%+ positive interaction rating

90%+ positive interaction rating 24/7 availability without staffing increases

24/7 availability without staffing increases

Unique Differentiators of AI Agent for House Insurance

Not a generic bot. Pre trained on real world housing insurance conversations.

Built on IBM watsonx, Google Gemini, Microsoft Copilot Studio, Amazon Bedrock.

Fetch real time values (deductibles, premium balance, payout eligibility).

Deployable on web, mobile apps, SMS, email, and voice channels.

Escalates to human agents with full chat context.

Detailed dashboards for usage, drop offs, and model training.

Pricing Options

Starts at $99/month for multi-tenant SAAS or $999/month for single-tenant (Private Hosting)

Starting @ 1$/user – unlimited chats

Ready to Modernize House Insurance Customer Service?

Here’s what you get:

Pre integrated with insurance backend systems.

Pre integrated with insurance backend systems. 30-day free trial (no credit card required)

30-day free trial (no credit card required) Custom demo for your use case

Custom demo for your use case Human like, 24/7 customer support for your policyholders

Human like, 24/7 customer support for your policyholders

Experience the future of house insurance support.

Deploy your AI Agent today and watch your customer satisfaction and revenue grow.