Generative AI Powered Smart Bot Solution

Omni-Channel Bots – Deploy on Chat, Voice, Email, Instagram, Facebook, WhatsApp and Even SMSCheck out Demo

Check out the Enterprise Grade AI Agent Powered by Gen AI. No Setup Fees.

How AI-Powered Housing Finance AI Agents Are Transforming Financial Services

The Changing Face of Housing Finance

The housing finance industry stands at a pivotal crossroads. Rising customer expectations, evolving regulatory frameworks, and economic uncertainty are reshaping how financial institutions operate. Borrowers today demand speed, transparency, and personalized experiences whether applying for home loans, checking eligibility, or making EMI payments.

Traditional models of customer engagement based on manual processes, phone calls, and in-person visits are increasingly inadequate. They slow down loan disbursals, limit scalability, and frustrate both customers and employees.

In this evolving digital-first era, AI-powered chatbots and AI agents for housing finance are redefining financial service delivery. These intelligent systems do far more than answer customer questions they automate complex workflows, deliver tailored financial advice, and enhance customer relationships across every digital channel.

By integrating Generative AI, machine learning, and natural language processing, housing finance AI agents are helping financial institutions boost efficiency, accelerate loan approvals, and provide round-the-clock assistance all while maintaining compliance and trust.

Why Housing Finance Needs AI Agents Now

01.

Mounting Operational Pressure

With growing housing loan demand, strict compliance requirements, and rising customer inquiries, housing finance companies are under constant strain. Manual processes and legacy systems slow down operations and increase costs.

An AI agent for housing finance can automate loan pre-screening, eligibility checks, documentation support, and repayment reminders freeing up relationship managers and underwriters to focus on strategic tasks and high-value interactions.

Hi, I want to check my loan eligibility.

Sure! Please share your monthly income and existing EMI details.

Income is ₹65,000, no EMIs.

Great! Based on this, you are pre-eligible for a housing loan. Want to start the quick pre-screening?

Hi, I want real-time updates on my home loan.

Sure! Your loan is currently under document verification.

Can I get this update on WhatsApp too?

Yes! I can send updates across WhatsApp, website, and mobile app.

02.

Escalating Customer Expectations

Today’s borrowers expect the same digital experience they get from e-commerce and fintech platforms instant answers, personalized recommendations, and seamless access across web, mobile, and messaging apps.

A chatbot in housing finance meets customers where they are whether on WhatsApp, the website, or mobile app providing real-time loan updates, payment schedules, and even tailored advice based on their financial profile.

03.

Labor Shortages and Budget Constraints

Hiring and retaining customer service or back-office staff is expensive and time-consuming. With an AI-powered housing finance chatbot, companies can ensure uninterrupted support without scaling human resources.

Available 24/7, these bots reduce call center workload, minimize wait times, and enable institutions to serve more customers with fewer resources.

I need help, but your call center is busy.

No worries! I’m here 24/7 to support you instantly.

Can you tell me my repayment schedule?

Yes! Here is your full EMI schedule with due dates.

Can you analyse my loan history?

Yes! Your repayment behavior is strong, and your risk score is low.

What does that mean for me?

You may be eligible for a top-up loan and better interest rates.

04.

The Shift Toward Data-Driven Finance

Every borrower interaction generates valuable insights from sentiment to risk indicators. Modern AI agents in housing finance analyze this data to detect emerging borrower trends, predict loan default risks, and optimize marketing campaigns.

These AI-driven insights help housing finance providers make informed lending decisions, enhance cross-selling, and improve compliance monitoring.

Intelligent Finance Automation Reimagined with Smart & Secure Housing Finance AI Agent Solution

Housing finance thrives on trust, precision, and timely service yet legacy systems often create silos that slow down decision-making and frustrate customers.

That’s why Streebo, a global leader in digital transformation and AI solutions, has developed the Generative AI–Powered Housing Finance AI Agent a secure, human-like assistant designed to transform how financial institutions manage customer interactions, loan operations, and compliance.

Powered by the world’s leading AI frameworks including IBM watsonx, Google Gemini, Microsoft Copilot Studio & Enterprise GPT on Azure, Amazon Bedrock, and SageMaker this intelligent solution connects data, documents, and workflows across departments such as lending, customer service, collections, and audit.

By leveraging Generative AI, NLP, and ML, the housing finance chatbot allows seamless, conversational interactions between customers and the institution helping users check loan eligibility, upload KYC documents, resolve EMI issues, or access real-time loan statements in a compliant digital environment.

The AI agent continuously learns and improves through real-time feedback, enabling more personalized and contextually accurate responses over time across digital channels, call centers, and social platforms.

Performance at Scale

99%+ contextual accuracy

in query resolution and loan process automation

1,000+ concurrent interactions

across chat, web, voice, and mobile

Seamless integration

with CRM, core banking, and document management systems

The Housing Finance AI Agent is more than automation it’s your digital relationship manager. It engages customers with empathy and precision anytime, anywhere.

Key Features

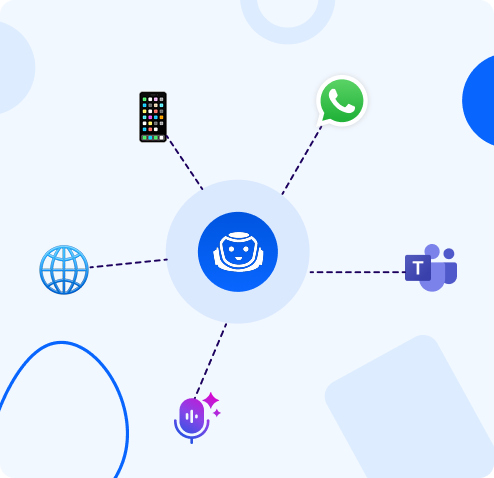

Omnichannel Engagement

Works seamlessly across mobile apps, web portals, WhatsApp, Facebook Messenger, Instagram, Telegram, Email, SMS, TikTok, and voice interfaces.

Voice AI Enablement

Supports multilingual, speech-based interactions for easy accessibility.

Secure Cloud Infrastructure

Deployable on Azure, AWS, or IBM Cloud with strict data protection standards.

Auditability & Compliance

Ensures transparency, traceability, and regulatory adherence.

Customizable & Scalable:

Adaptable for use cases across loan origination, collections, and customer servicing.

This enterprise-grade solution empowers financial institutions to modernize operations while maintaining full control over data, security, and customer experience.

The Rise of the AI Agent in Housing Finance

An AI agent for housing finance acts as a digital financial advisor a conversational interface capable of understanding user intent, processing financial data, and executing transactions securely.

Unlike traditional chatbots that rely on scripted responses, modern AI agents leverage large language models and generative AI to converse naturally, adapt dynamically, and continuously improve through interaction data.

For instance, when a customer asks, “Am I eligible for a home loan?” the AI agent not only calculates eligibility in real-time but also guides them through documentation, EMI options, and application submission providing an end-to-end experience.

Department-Wise Use Cases: Real-World Applications in Housing Finance

Loan Origination Faster Onboarding & Eligibility Checks

AI chatbots simplify the customer onboarding process, helping users upload KYC documents, check eligibility, and generate loan quotes instantly.

Impact: Faster approval cycles and improved customer satisfaction.

Loan Servicing 24/7 Customer Support

Chatbots for housing finance respond to customer queries about EMIs, interest rates, and repayment schedules, even outside office hours.

Impact:Reduced call center load and consistent customer experience.

Loan Collections Automated Payment Reminders

AI agents send automated payment reminders, generate digital receipts, and provide quick payment links.

Impact: Reduced delinquency rates and improved recovery efficiency.

Underwriting Support Smart Document Analysis

The AI agent analyzes financial statements, tax documents, and income proofs using AI-powered OCR.

Impact: Reduced underwriting time and increased accuracy.

Customer Retention Personalized Offers

AI chatbots identify customers eligible for refinancing or top-up loans and engage them proactively.

Impact: Higher cross-sell conversion and customer loyalty.

Compliance Management Intelligent Monitoring

AI systems monitor policy adherence, generate compliance reports, and flag anomalies automatically.

Impact: Reduced compliance risk and faster audit readiness.

Employee Assistance HR & Operational Support

AI chatbots can answer employee questions about policies, payroll, and internal processes.

Impact: Improved staff productivity and engagement.

Marketing & Lead Generation AI-Driven Campaigns

AI agents capture leads through social channels, qualify them, and route them to sales teams in real-time.

Impact: Enhanced marketing ROI and reduced acquisition costs.

Executive Dashboards Real-Time Analytics

AI-powered dashboards provide leadership with insights into loan trends, delinquency rates, and operational performance.

Impact: Data-backed decision-making and better forecasting.

The Omnichannel Advantage: Meeting Borrowers Everywhere

Borrowers today interact across diverse platforms websites, apps, messaging tools, and voice assistants. A housing finance chatbot with omnichannel capability ensures consistent and personalized experiences across all these touchpoints.

Web & Mobile: Instant eligibility and EMI calculators

Social media: Conversational loan assistance via WhatsApp and Messenger

Voice Interfaces: Hands-free service through Alexa or Google Assistant

Internal Platforms: Integration with Microsoft Teams or Salesforce for agent support

This multi-channel reach drives accessibility and creates a unified digital experience for every customer.

Voice AI: Expanding Access and Inclusion

In many regions, borrowers may prefer speaking over typing, especially those less familiar with digital interfaces. Voice-enabled AI agents make financial services accessible through natural speech.

Customers can ask, “What’s my outstanding loan amount?” or “When is my next EMI due?” and receive instant, voice-based answers.

By supporting multiple languages, Voice AI bridges the gap between digital sophistication and financial inclusion ensuring every borrower can access housing finance services effortlessly.

Conversational AI: The Next Evolution in Housing Finance

Just as online banking once transformed financial services, conversational AI marks the next evolution. Through AI-powered chatbots for housing finance, institutions can shift from static service models to personalized conversations that build trust, empathy, and financial confidence.

Those who adopt conversational AI now will lead the future of customer engagement in financial services while others risk falling behind in a rapidly digitalizing landscape.

Measurable Impact of AI in Housing Finance

Cost Optimization

AI automates Tier 1 and Tier 2 queries, cutting operational costs by up to 40%.

Faster Turnaround

Loan applications and support requests are processed more quickly and accurately.

Revenue Growth

Proactive loan recommendations and cross-sell campaigns drive higher portfolio yields.

Insight Generation

AI analytics reveal borrower behavior and lending trends for strategic planning.

Always-On Availability

AI agents never sleep ensuring customers get 24/7 access to assistance.

Building Secure and Compliant AI-Powered Finance

Security and compliance are non-negotiable in financial services. The AI agent for housing finance is built with enterprise-grade safeguards:

Data Encryption: All transactions are encrypted end-to-end.

Regulatory Compliance: Adheres to RBI and financial data protection standards.

Scalability: Handles millions of concurrent conversations securely.

Auditability: Full logs for traceability and compliance audits.

Human Escalation: Escalates to human agents when needed for complex cases.

This ensures innovation without compromising governance or customer trust.

Pricing Model

Pay Per Usage

(per message/token based pricing)

Starts at $99/month for multi-tenant SAAS or $999/month for single-tenant (Private Hosting)

Per User Pricing

Starting @ 1$/user – unlimited chats

Single-Tenant Ready-to-Go Pre-Trained Smart AI Agent: Customer can choose to Buy the AI Agent Solution (contact sales for pricing)

Conclusion: The Future of Housing Finance Is Conversational

AI is no longer a luxury it’s the foundation of customer-centric financial transformation. The era of AI-powered housing finance chatbots has arrived, empowering lenders to streamline operations, cut costs, and improve customer experiences dramatically.

Institutions that embrace conversational AI today will lead the market in efficiency, compliance, and borrower satisfaction. Those that don’t risk being left behind.

Frequently Asked Questions (FAQs)

What is an AI Agent for Housing Finance?

An AI agent for housing finance is a virtual assistant powered by Generative AI that automates customer interactions, assists with loan applications, and provides real-time support all through natural, human-like conversations.

How does a chatbot benefit housing finance institutions?

A chatbot for housing finance automates repetitive tasks such as eligibility checks, payment reminders, and loan tracking, reducing operational costs while improving customer satisfaction.

Which departments can benefit most?

Departments including Loan Origination, Customer Service, Collections, Compliance, and Marketing benefit significantly from automation using AI agents.

How secure is a Housing Finance AI Agent?

It follows enterprise-grade encryption, cloud security standards (Azure, IBM, AWS), and local data protection laws ensuring complete privacy and compliance.

Can AI agents integrate with existing systems?

Yes. They connect seamlessly with CRMs, ERPs, LOS (Loan Origination Systems), and document management tools via secure APIs.

Can AI chatbots work across multiple channels?

Absolutely. AI chatbots in housing finance operate across websites, apps, WhatsApp, Facebook Messenger, and even voice assistants like Alexa or Google Assistant.

What role does Voice AI play in financial inclusion?

Voice AI enables accessibility for non-digital-savvy users by letting them interact naturally, ensuring every customer can access financial services easily and inclusively.

The Time to Act Is Now

Empower your housing finance institution with AI-driven automation. Enhance customer engagement, streamline workflows, and build a future where financial services are not just digital but truly conversational.