Insurance Chatbots on Instagram: A New Digital Gateway to Insurance Engagement

What’s your age group?

What’s your age group?-

Are you looking for individual or family coverage?

Are you looking for individual or family coverage?

Instagram is no longer just a playground for lifestyle brands, fashion influencers, or food bloggers. In today’s hyper connected world, it’s also become a powerful platform for industries once deemed too traditional for social media including insurance.

Welcome to the age of the Instagram chatbot for insurance, where AI powered conversations are quietly transforming the customer journey. From helping users file claims via DMs to guiding them through policy comparisons in seconds, these bots aren’t just answering questions they’re defining how the modern insurance buyer engages, learns, and purchases.

At the intersection of trust, convenience, and automation lies the Instagram AI agent for insurance a conversational assistant that operates natively within Instagram DMs, equipped with generative AI, natural language processing, and smart CRM integrations.

In this article, we’ll dissect why the insurance sector is embracing Instagram chatbots, explore key use cases and capabilities, and examine how brands are using them to drive revenue, cut operational costs, and engage with the next generation of customers.

Why Insurance Needs Instagram Chatbots & AI Agents Now More Than Ever

The insurance industry, though traditionally conservative, is at an inflection point. With declining engagement on conventional platforms and rising expectations for digital first services, insurance companies are forced to rethink how they communicate.

Here’s the problem: websites are cluttered, mobile apps are underutilized, call centers are overwhelmed, and younger generations are increasingly skipping these channels altogether. Where are they instead? Instagram.

With over 500 million daily active users and nearly 60% of its user base under 34, Instagram offers a unique opportunity for insurers to meet prospects and policyholders exactly where they spend their time.

Instagram AI Agent Integration for Insurance brings a bold proposition: what if your insurance company could answer questions, generate quotes, provide documentation, and even collect premiums all without ever leaving the Instagram app?

That’s not a future vision it’s happening today through intelligent chatbot integrations that turn every Instagram DM into a lead, a support case, or a policy sale.

Instagram + Insurance: A Strategic Audience Match

The global insurance market is undergoing rapid transformation, with digital engagement strategies taking center stage. While traditional players struggle to modernize, insurance startups and forward thinking insurers are seizing the moment especially on social platforms like Instagram..

Why Instagram Makes Sense for Insurance Brands

Let’s look at the numbers:

Instagram boosts over 2 billion monthly active users with more than 500 million logging in daily.

Instagram boosts over 2 billion monthly active users with more than 500 million logging in daily.

71% of Instagram users are under 35, a prime target for health, auto, term life, renters, and travel insurance.

71% of Instagram users are under 35, a prime target for health, auto, term life, renters, and travel insurance.

Users spend an average of 30 minutes per day on Instagram, providing ample touchpoints for engagement.

Users spend an average of 30 minutes per day on Instagram, providing ample touchpoints for engagement.

90% of Instagram users follow at least one business account, signalling their openness to brand interaction.

90% of Instagram users follow at least one business account, signalling their openness to brand interaction.

(Source: Statista)

This demographic includes first time job holders looking for basic life and health policies, new parents researching child plans, gig workers seeking flexible coverage, and digital nomads needing travel or asset protection.

When insurers use AI powered chatbot to Instagram, they gain a direct line of communication with this mobile first audience without redirecting them to a clunky app or generic website.

It’s a win win: Users get instant responses inside the app they already trust, while insurers automate key workflows at scale.

Use Case Matchmaking: Instagram Users Meet Insurance Products

| Instagram User Type | Insurance Needs | Bot Engagement Opportunity |

|---|---|---|

| Digital Creators & Freelancers | Health, gadget, and income protection policies | Auto quotes via DM and reminders to renew |

| Young Families | Term life, child plans, maternity insurance | Chat based needs assessment & policy matching |

| Students & Millennials | Travel, auto, and renter’s insurance | Real time pricing tools and claim initiation |

| Remote Workers & Digital Nomads | Global health and personal liability coverage | Smart plan recommendations via carousels |

The convergence of Instagram integration for insurance and Gen AI technologies is rewriting the insurance engagement playbook. From storytelling in Reels to seamless service in DMs, insurers now have a full funnel experience embedded inside a single app.

Smart & Secure Gen AI Powered Instagram Chatbot for Insurance

Streebo, a leading Digital Transformation & AI Company built an insurance focused Instagram chatbot to help providers transform customer service, boost conversions, and deliver real time support inside one of the world’s most engaging platforms. The solution is not just another generic bot it’s a purpose built, insurance ready virtual assistant that can understand, respond, and resolve with accuracy and empathy.

At its core, the chatbot leverages the most advanced generative AI engines available in the market today, including Microsoft Copilot & GPT on Azure, Google Gemini, IBM Watsonx, Salesforce Einstein Copilot, Amazon Bedrock & Sagemaker including open source models like Cohere. These large language models (LLMs) are intelligently orchestrated to provide accurate policy recommendations, handle complex customer queries, and engage in fluid, human like conversations with insurance buyers and policyholders. Whether a user is comparing term life plans or seeking travel insurance for an upcoming trip, the chatbot engages with precision and context.

What sets our Instagram chatbot apart is its seamless integration with an insurer’s existing ecosystem. It plugs directly into popular CRM systems like Salesforce and Zoho, connects with underwriting engines and policy administration systems, and even supports payment gateway integrations for real time premium collection and policy issuance. By working as an intelligent layer over Instagram DMs, the chatbot can initiate and complete end to end customer journeys starting from a comment on a post or a story swipe up, all the way to generating a quote or submitting a claim with 99% accuracy

- Get quotes

- Compare plans

- Pay premiums

- File claims

The conversational UI is designed specifically for Instagram’s visual and mobile first interface. Rich cards, carousels, quick replies, and swipe able menus provide users with an experience that feels native to the platform. Behind the scenes, a dynamic NLP engine supports multilingual conversations, allowing insurance companies to serve diverse audiences across regions and languages without friction.

Implementation is fast and efficient. With pre trained templates covering more than 30 insurance specific use cases including policy comparisons, premium payments, claims assistance, and KYC documentation the chatbot can be launched within just 2 3 weeks. A no code conversation builder allows insurers to fine tune or expand chatbot flows without relying on technical teams, giving marketing and customer service departments full control over bot behaviour and messaging.

Security, reliability, and scalability are built into the foundation. The chatbot can handle thousands of simultaneous conversations without performance degradation, ensuring policyholders receive prompt support even during high demand periods such as renewal cycles or after natural disasters. It can be deployed in the cloud, on premise, or in hybrid environments depending on the insurer’s IT policy and infrastructure preferences.

Together, these capabilities empower insurance companies to reimagine how they interact with customers on Instagram turning the platform from a branding tool into a fully operational digital branch that’s always open, always smart, and always in sync with what modern consumers expect.

Instagram AI Agent Capabilities in the Insurance Sector

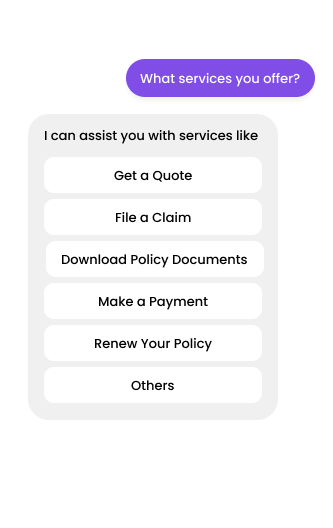

What makes an Instagram chatbot for insurance different from a standard website bot or mobile app assistant?

The answer lies in contextual intelligence, personalization, and channel native automation.

Here are the powerful capabilities unlocked by deploying an Instagram AI agent for insurance:

Conversational Onboarding & Risk Profiling

AI agents on Instagram for insurance can guide users through a quick Q&A session right in DMs to determine their insurance needs. No need for lengthy forms or complicated jargon.

Quote Generation in Real Time

With backend integrations, chatbots can instantly fetch personalized premium estimates based on user inputs ideal for auto, life, and health policies.

Rich Media Integration

Carousel based coverage comparisons, video explainers about policies, and swipe able claim checklists all native to Instagram’s interface.

Multilingual Support

Serve diverse demographics by switching languages automatically based on user preferences eliminating language as a barrier to understanding.

Seamless DM Automation

Using Instagram DM automation, bots can handle quote requests, policy clarifications, and payment reminders without human intervention.

API and CRM Integration

AI powered Instagram bots can plug into CRMs and policy management systems to fetch customer data, push updates, and trigger workflows in real time.

Automated Claims Pre screening

Enable policyholders to report damages via photos or voice notes, with bots capturing all necessary metadata for faster claims processing.

This isn’t just chat its smart conversational commerce, tailored for the insurance buyer of today.

Top 12 Use Cases of Instagram Chatbots & AI Agents for Insurance

These use cases are designed to enhance customer engagement, streamline operations, and offer real time service all within Instagram’s native environment using Instagram chatbot integration with insurance and AI powered chatbot to Instagram capabilities.

01

Personalized Policy Discovery

Bot Role: Acts as a virtual advisor by asking users simple, dynamic questions to recommend insurance plans based on age, income, lifestyle, and needs.

Value: Reduces decision fatigue and increases conversions through guided discovery.

02

Real Time Quote Generation

Bot Role: Instantly calculates and shares premium estimates based on user inputs (e.g., vehicle type, age, destination, family size).

Value: Saves time and keeps customers engaged during the decision making phase.

Absolutely! Based on your details:

Absolutely! Based on your details:

🛫 Destination: Italy

👨👩👧 Family Size: 2 Adults + 1 Child

📅 Trip Duration: 7 Days

✅ Coverage: Medical emergencies, baggage loss, trip delays, and cancellation

Estimated Premium: $72 total

03

Claims Filing & Pre Screening

Bot Role: Guide user step by step to submit claim related details (incident type, documents, photos) directly via DM..

Value: Cuts down manual errors and accelerates claim initiation, reducing call center load.

04

Branch & Network Hospital Locator

Bot Role: Uses ZIP code or GPS to locate the nearest branch, network hospital, or service center and provides map links.

Value: Reduces friction in emergencies or when accessing offline services.

🏥 Bayview Medical Center – 1.2 miles

🏥 Bayview Medical Center – 1.2 miles

📍 Sunrise Health Clinic – 2.0 miles

📌 View on Map

Need directions or more options?

05

Policy Renewal & Premium Payment Reminders

Bot Role: Sends automated renewal reminders with payment links and offers an option to update policy coverage during the same interaction.

Value: Prevents policy lapses and increases upsell opportunities.

06

Financial Education & Awareness

Bot Role: Shares short educational messages, infographics, or interactive FAQs explaining terms like deductibles, coverage limits, exclusions, and co pay.

Value: Empowers users with knowledge, builds trust, and reduces dependency on agents.

A deductible is the amount you pay out of pocket before your insurance starts covering costs. Here’s how it works:

A deductible is the amount you pay out of pocket before your insurance starts covering costs. Here’s how it works:

- Your deductible: $500

- Your claim amount: $1,500

- Insurance covers: $1,000 (after you pay the first $500)

07

KYC & Document Collection

Bot Role: Collects and verifies documents like ID proof, address proof, vehicle registration, etc., through secure DM channels.

Value: Simplifies onboarding and post purchase document workflows.

08

Compare Policy Features

Bot Role: Allows users to compare different plans (e.g., Bronze vs. Silver vs. Gold) with visual cards for sum assured, coverage, exclusions, and premium.

Value: Simplifies complex choices and boosts transparency.

Silver Plan

- Premium: $48/month

- Coverage: Up to $50,000

- Includes hospitalization & diagnostics

🥇 Gold Plan

- Premium: $72/month

- Coverage: Up to $100,000

- Best for families or long-term care

- Includes dental, maternity, and wellness benefits

✅ Make & model

✅ Registration number

✅ Date of purchase

I’ll update your policy and send a revised document right after verification.

09

Mid Term Endorsements & Policy Changes

Bot Role: Helps users request changes like address updates, nominee revisions, or coverage enhancements.

Value: Provides convenient policy servicing, reducing dependency on human agents.

10

Claim Status Tracking

Bot Role: Allows users to check the real time status of filed claims using their reference number or policy ID.

Value: Reduces inbound inquiries and enhances trust by offering transparency.

📄 Status: Under Review

🕒 Last Updated: 2 days ago

✅ We’ll notify you as soon as it moves to the next stage. Want real-time alerts?

📞 Call back in: 15 min / 1 hour

📅 Or pick a slot: Book Appointment

11

Request Call Back or Schedule Appointment

Bot Role: Enables users to schedule a callback from a human agent or set an appointment for an in person meeting at a branch.

Value: Balances self service with human interaction when needed.

12

Post Purchase Support & Policy FAQs

Bot Role: Answers common post sale queries such as grace period, cancellation terms, refund timelines, and coverage queries.

Value: Reduces post sale anxiety and improves satisfaction.

📄 Status: Under Review

🕒 Last Updated: 2 days ago

✅ We’ll notify you as soon as it moves to the next stage. Want real-time alerts?

These focused use cases demonstrate the full potential of AI agent integration with insurance Instagram strategies not only enhancing customer experience but also simplifying internal workflows across customer acquisition, service, and retention.

The Power of Instagram DM Automation for Insurance: Always On, Always Accurate

Imagine having a smart insurance advisor available 24/7 who never sleeps, never gets tired, and responds within seconds. That’s the power of Instagram DM Automation when applied to the insurance industry using AI agents.

Whether a customer is exploring policy options at 2 PM or filing a claim at 2 AM, the Instagram AI agent for insurance ensures your brand is always available, responsive, and reliable.

Key Advantages of Instagram DM Automation in Insurance:

24/7 Instant Service

Instagram DM automation means your insurance brand never closes. Customers can initiate claims, renew policies, and ask policy related questions anytime without waiting for office hours.

Intelligent Routing & Escalation

Instagram DM automation means your insurance brand never closes. Customers can initiate claims, renew policies, and ask policy related questions anytime without waiting for office hours.

Example:

Hey, I don’t understand the difference between term and whole life insurance.

-

Bot responds with a visual comparison If the user types “I still need help,” the bot routes the request to an advisor via WhatsApp or phone.

Structured Data Collection

The bot collects user inputs in a standardized format age, location, type of insurance, family size making it easy to plug into underwriting tools and CRM platforms.

Automated Workflows with Zero Friction

From issuing e policy documents to sending confirmation messages, bots automate the full lifecycle using structured flows that follow compliance and audit standards.

Secure & Compliant Interactions

Insurance involves sensitive data. With end to end encryption and multi layered authentication (e.g., OTP or PIN verification), bots deliver secure experiences within Instagram DMs.

High Speed Response = Higher Conversions

Speed is critical. A Harvard Business Review study found that responding within 5 minutes increases conversion likelihood by 900%. DM automation ensures sub 10 second replies every time.

In a nutshell, Instagram DM automation isn’t just a messaging tool it’s an end to end insurance service engine operating within the customer’s favourite app.

Business Benefits of Instagram Chatbot Integration for Insurance Companies

Adopting an AI powered chatbot to Instagram isn’t just a tech upgrade it’s a strategic investment with tangible ROI. From improving operational efficiency to increasing customer satisfaction, here’s how insurers can reap the rewards.

01

Reduced Operational Costs

By automating routine interactions like quote generation, claim initiation, document submission, and FAQs, insurers can cut down on the volume of live agent queries by up to 60%.

-

Cost reduction per interaction: From $5 $7 via call center to less than $0.50 via chatbot

Cost reduction per interaction: From $5 $7 via call center to less than $0.50 via chatbot

02

Improved Lead Conversion Rates

Instagram chatbots engage users the moment they comment, click an ad, or send a message dramatically reducing response time and increasing the chances of conversion.

-

Response time improvement: From 3 hours (manual DM handling) to 3 seconds (automated)

Response time improvement: From 3 hours (manual DM handling) to 3 seconds (automated)

-

Lead to policy conversion uplift: 18 25% increase with guided bot flows vs. static web forms

Lead to policy conversion uplift: 18 25% increase with guided bot flows vs. static web forms

03

Personalized User Experience

With CRM integration and NLP capabilities, bots tailor each interaction to the individual using first names, remembering preferences, and suggesting upgrades.

-

Effect: Higher retention, lower churn, better upselling of premium products

Effect: Higher retention, lower churn, better upselling of premium products

04

Better Customer Retention

Ongoing engagement through reminders, claim updates, and helpful tips ensures users don’t drop off after purchase. The chatbot becomes a companion, not just a tool.

-

Result: 20% higher policy renewal rates when supported by automated DM reminders

Result: 20% higher policy renewal rates when supported by automated DM reminders

05

Intelligent Data Collection & Insights

Every conversation with an Instagram chatbot for insurance is a data goldmine. Bots capture behaviour patterns, preferences, objections, and trends that can be used to fine tune product offerings and marketing strategy.

06

Faster Policy Servicing

Midterm endorsements, address changes, or nominee updates usually take 24 48 hours through email or app forms. With bots, they’re handled in minutes via structured DM flows.

07

Regulatory Compliance & Audit Trails

All interactions can be logged securely and exported for audit purposes ensuring alignment with insurance regulations and industry compliance protocols.

08

Enhanced Brand Positioning Among Digital Natives

Being available on Instagram with automated, intelligent, and friendly interactions positions the insurance brand as modern, accessible, and trustworthy, especially among Gen Z and Millennials.

These benefits collectively lead to a digital ecosystem where insurers reduce cost to serve, improve customer loyalty, and stand out in a crowded market while offering 10X better customer experiences.

Conclusion: Insurance Has a New Front Office and It’s in the Instagram Chatbot

The era of form based insurance journeys is ending. In its place rises a newmodel conversational, mobile first, and deeply integrated into the daily habits of the digitalconsumer. Instagram, once reserved for lifestyle brands and influencers, is now a strategiccustomer engagement channel for the insurance industry.

With a smart, pre trained, and domain specific Instagram chatbot for insurance, providers can respond faster, reduce servicing costs, and convert passive interest into policy signups. What was once a branding space now becoming a 24/7 digital branch intelligent, interactive, and instantly available.

This is not a future forecast. It’s happening now. Insurance companies embracing AI agent integration with Instagram are already reaping the benefits: lower costs, faster conversions, higher retention, and happier customers.

If you’re ready to experience the transformation, our team is here to help. We offer plug and play Instagram chatbot deployments tailored to your business goals. You can launch in just a few weeks, with prebuilt insurance workflows, secure integrations, and multilingual capabilities baked in.

Request a walkthrough.

Get a 30 day free trial no credit card required.

Or simply share your use case and we’ll show you what your AI powered Instagram journey could look like.

Let Instagram become your smartest channel where insurance conversations aren’t just happening but converting.