Generative AI Powered Financial Services AI

Agent on Facebook

Delivering Conversational Banking and Financial Advisory at Scale

The financial services industry encompassing consumer banking, credit unions, investment firms, lending institutions, and insurance providers is undergoing a dramatic digital transformation. Customers today are mobile first, digitally savvy, and demand instant access to financial services. They expect seamless, real-time assistance, personalized advice, and 24/7 support across all channels they frequent, not just apps or websites.

While banks and financial institutions have made significant investments in mobile apps, web portals, and contact centre automation, a critical engagement channel remains largely underutilized: Facebook.

With over 3 billion monthly active users, Facebook has evolved into more than just a social network. It’s now a discovery, support, and commerce engine where consumers compare credit cards, research insurance options, inquire about loan eligibility, and seek real time support. Yet, most financial institutions are still failing to leverage Facebook as a strategic customer engagement touchpoint.

This presents a massive opportunity.

For organizations across retail banking, consumer lending, personal finance, wealth advisory, and insurance services, the next wave of transformation lies in meeting customers where they are most active and responsive on Facebook.Deploying a Facebook Financial Services AI Agent powered by generative AI can help institutions provide personalized guidance, answer FAQs, handle transactions, and qualify leads in real time without agent intervention.

In a market where trust, speed, and accessibility define customer loyalty, financial institutions that embrace conversational AI on Facebook will not only differentiate themselves but also drive higher engagement, lower operational costs, and greater customer satisfaction.

Why Financial Behaviour Is Changing and Why Facebook Is the New Digital Branch

Consumers’ relationship with money is rapidly evolving. From budgeting and credit management to investment and insurance, customers now want financial empowerment at their fingertips on platforms they already use daily. And that platform is Facebook.

Gone are the days when banking meant visiting a branch or navigating frustrating IVR systems. Today’s customers expect to check loan eligibility, get credit score tips, invest in mutual funds, or file insurance queries right from their phone, without switching apps. Facebook Messenger has organically become the modern digital branch always open, real time, and hyper convenient.

This shift is not just generational. Whether it’s Gen Z managing digital wallets or Baby Boomers inquiring about retirement planning, users across demographics are now embracing chat first interactions. The Facebook Financial Services chatbot is no longer a novelty it’s becoming the go to digital support channel, outpacing traditional apps and static email systems by delivering instant, contextual, and personalized service.

Key Shifts Driving the Change

Chat First Banking

Users prefer to engage via financial service Facebook chatbot than fill long forms or wait on support lines.

Real Time Expectations

Questions like “Am I eligible for a car loan?” require instant answers. Facebook AI Agent for financial service delivers exactly that.

Simple Over Technical

The Agent replaces dense brochures with plain language making financial service chatbot integration with Facebook an intuitive interface for all demographics.

Mobile Centric Use

80% of users access Facebook via mobile. With Facebook financial service chatbot for customer support, every action from KYC to payment becomes mobile native.

24/7 Availability

The Facebook financial service AI Agent is always active, allowing support even on weekends or holidays.

Why Facebook Is a Core Channel for Financial Services

Massive User Base

The world’s largest digital audience is on Facebook ideal for launching Facebook financial service chatbot integration strategies in both emerging and mature markets.

Rich Features

Messenger offers native capabilities like payments, carousels, forms, and real time tracking perfect for personalized financial interactions.

Customer Familiarity

Millions already use Messenger to interact with businesses. Extending that experience with a Facebook financial service AI Agent creates zero friction.

Enter: The Generative AI Powered Facebook AI Agent for Financial Services

Streebo, a leading provider of Digital Transformation and Conversational AI solutions, has developed a Generative AI powered Financial Services Chatbot for Facebook that enables banks, insurers, and financial institutions to deliver seamless, secure, and intelligent customer interactions directly within Facebook Messenger, platform millions already use every day.

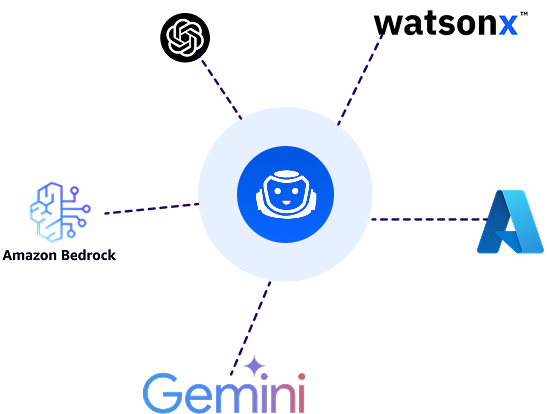

Powered by industry leading Generative AI platforms including IBM watsonx, Google Gemini, Microsoft Copilot Studio & Enterprise GPT on Azure, Amazon Bedrock, and more, the chatbot leverages advanced large language models (LLMs) to provide contextual, accurate, and real time responses across a wide range of financial queries with 99% accuracy.

This AI Agent is not a simple, rules based chatbot. It’s an enterprise grade, multilingual, and context aware assistant, designed to handle thousands of simultaneous financial interactions ranging from account openings, balance inquiries, and loan applications to investment advice, credit card servicing, and fraud alerts.

Whether it’s a prospect comparing home loan options, a young investor exploring SIPs, or a retiree checking on annuity disbursements, the chatbot understands user intent, retrieves secure backend data, and executes transactions with speed, accuracy, andcompliance all within the convenience of Facebook Messenger.

Use Cases for Facebook AI Agent in Financial Services

01.

Lead Engagement and Qualification

Capture leads from Facebook ads, Messenger campaigns, and business pages using the Facebook chatbot for financial service. Qualify them through guided conversations and push them further into the funnel all without needing an app or phone call.

02.

Personalized Product Discovery

Let customers explore accounts, loans, and investment options with a conversational interface. The financial service Facebook AI agent uses profile inputs and integrations to suggest tailored products.

03.

Loan Origination and Servicing

From eligibility checks to EMI calculators, application uploads, and approvals, your AI agent for financial service Facebook covers every step of the lending lifecycle.

04.

Customer Account Services

Enable requests such as address changes, nominee updates, and interest certificates through chat. This is where financial service chatbot integration with Facebook shows real time backend power.

05.

Secure Payments and Reminders

Notify customers about upcoming EMIs, due dates, and renewals. Let them make secure payments directly within Messenger using the Facebook financial service AI agent.

06.

Investment Guidance and Upsell

The AI Agent simplifies complex financial products and offers upsell recommendations during chat. This positions your financial service Facebook chatbot as both a support agent and a digital wealth advisor.

07.

Fraud & Dispute Handling

If fraud is suspected, the customer initiates a chat, and the Facebook financial service chatbot for customer logs and escalates the issue automatically.

Current World vs. New World: How Financial Institutions and NBFCs Are Reshaping Customer Service on Facebook

Scenario 1

Personal Loan Inquiry from a First Time Borrower

Old World

Emily, a recent college graduate, comes across a Facebook ad for personal loans from a well-known NBFC. Curious about whether her part time income makes her eligible, she sends a message to their Facebook page. Her question is left unanswered for over 24 hours. When a representative finally responds, they redirect her to the website. Frustrated and unsure where to start, Emily never returns.

Outcome

A hot lead is lost. The institution does not engage a prospective borrower now of interest, leading to lower conversion and poor social responsiveness.

New World with Facebook AI Agent

Emily sends the same question on Messenger and is greeted instantly by the AI Agent. After asking a few quick questions about her employment and income, the bot shares eligibility criteria, recommended loan products, and even ocuments required to proceed. She is offered the option to continue the application or request a call.

Outcome

Emily is nurtured in real time and guided to the next step boosting application initiation by over 35%. The institution saves manual effort and reduces drop offs.

Scenario 2

Existing Customer Asks About Loan Foreclosure

Old World

James, a customer with a home renovation loan, wants to foreclose his loan early. He messages the company’s Facebook page but receives a generic reply: “Please call customer support.” After spending 15 minutes on hold and verifying his identity twice, he’s told the foreclosure amount will be emailed within two business days.

Outcome

James experiences delays and frustration. The financial institution wastes resources handling a common, automatable query manually.

New World with Facebook AI Agent

James sends a message through Facebook Messenger. The AI Agent securely verifies his identity using OTP, retrieves his loan details, and shares the current foreclosure amount in real time along with a downloadable summary and next step instructions.

Outcome

James completes the process in minutes, without a single phone call. The NBFC reduces service time from 2 days to 2 minutes while offering a superior customer experience.

Scenario 3

Missed EMI and Penalty Clarification

Old World

Ashley, who has a small consumer durable loan, misses an EMI due to a payment issue. She sends a message on asking about the penalty. An automated response directs her to email support. It takes two days to get a response, by which time another late fee has been added.

Outcome

Ashley becomes frustrated and considers refinancing with another lender. The NBFC loses customer confidence and may incur recovery costs.

New World with Facebook AI Agent

Ashley sends the same message on Messenger. The AI Agent instantly verifies her, checks her EMI schedule, displays the missed payment, current penalty, and upcoming due date. It also enables her to make the payment directly or set up auto debit again.

Outcome

Ashley avoids further penalties and pays on time. The NBFC recovers revenue faster and lowers delinquency rates all with zero human involvement.

Scenario 4

Investment Product Exploration

Old World

Ethan, a freelance professional, is interested in recurring deposits. He messages a financial institution on Facebook but is told to “check the website.” Once there, he finds too many options and no assistance. Overwhelmed, he exits without selecting a product.

Outcome

The institution loses an interested prospect due to poor guidance and lack of contextual engagement.

New World with Facebook AI Agent

The AI Agent engages Ethan in Messenger, asking about his income, savings goal, and preferred tenure. It recommends two recurring deposit schemes, shows expected returns, and explains maturity timelines. Ethan is also offered a callback option for onboarding.

Outcome

Ethan receives personalized guidance and proceeds to open a deposit. The institution improves product uptake and enhances customer satisfaction with a modern, self-serve experience.

Scenario 5

NOC Request After Loan Repayment

Old World

Michael has just completed his loan repayment and messages the NBFC on Facebook to request his NOC (No Objection Certificate). He is asked to email a generic inbox and wait for a reply. Days pass and he follows up twice before receiving his document.

Outcome

Michael feels neglected and dissatisfied. The delay risks damaging brand reputation and leads to poor post loan engagement.

New World with Facebook AI Agent

Michael messages via Messenger. The AI Agent verifies his credentials, checks his loan status, confirms closure, and instantly shares a digital NOC. It also initiates the dispatch of a hard copy and provides tracking details.

Outcome

Michael receives everything he needs instantly. The institution offers a frictionless post loan experience and maintains positive customer sentiment, increasing the likelihood of repeat business or referrals.

Business Impact of Facebook Financial Service Chatbot

30% Higher Lead Conversion

30% Higher Lead Conversion 3x Faster Customer Response Time

3x Faster Customer Response Time 70% Tier 1 Query Automation

70% Tier 1 Query Automation

40% Reduction in Call Center Load

40% Reduction in Call Center Load 25–35% Increase in Upsell Opportunities

25–35% Increase in Upsell Opportunities 10x More Customer Interactions Managed Simultaneously

10x More Customer Interactions Managed Simultaneously

Source: Business Insider

Key Differentiators of the Facebook Financial Service AI Agent

Unlike traditional support bots, the Facebook financial service AI Agent is a domain specific, enterprise grade solution designed for real world applications in lending, investments, policy servicing, and customer support. Here’s what makes it different:

This is not a generic chatbot.The AI agent for financial service Facebook is pre trained on use cases specific to the financial services industry covering everything from EMI clarifications and foreclosure handling to investment inquiries and insurance policy servicing.

Unlike static scripts, the Facebook financial service chatbot uses advanced large language models (LLMs) to understand natural language, retain conversation context, and handle multi step journeys with accuracy. It’s a true financial service Facebook AI agent, capable of resolving complex queries across the customer lifecycle.

With support for secure APIs, this Facebook financial service chatbot for customer interactions integrates with CRMs, loan origination systems, collections platforms, and document repositories. The result is real time, end to end query resolution. This level of financial service chatbot integration with Facebook is what sets it apart from standalone support tools.

The Facebook chatbot for financial service runs directly within Facebook Messenger allowing customers to access 24/7 support without downloading an app or visiting a website. It turns Messenger into a digital branch for anytime, anywhere service.

Built with OTP verification, audit logs, encryption, and access controls, the Facebook AI agent for financial service meets industry standards for data privacy and regional compliance.

Designed to support thousands of concurrent conversations, the Facebook financial service chatbot also scales across multiple regions and languages. For institutions with broader omnichannel strategies, it aligns with long term digital transformation goals while delivering fast ROI.

Pricing Options

Starts at $99/month for multi-tenant SAAS or $999/month for single-tenant (Private Hosting)

Starting @ 1$/user – unlimited chats

Experience Banking Without Hold Times.

share your use case we’ll build a tailored experience.

Request a Demo