Generative AI Powered Banking AI Agent Solution on Facebook

The Future of Banking Engagement Has Shifted to Facebook

The banking industry is at a tipping point. Traditional touchpoints like branches, call centers, and web portals are no longer sufficient to meet the dynamic expectations of today’s digital first customers. Instead, people now prefer channels that are fast, familiar, and part of their daily routines and that’s where Facebook comes into play.

With over 3 billion monthly active users, Facebook has transformed from a social media network into a multipurpose platform. Whether it’s connecting with friends, discovering products, or consuming news, users spend an average of 33 minutes per day on the platform (Statista, 2024) more than any banking portal could ever hope for.

For banks, this means one thing: engagement should happen where the customers already are. And Facebook, especially through Messenger, is now a top tier customer service channel.

That’s where the Generative AI Powered Banking Chatbot on Facebook steps in.

Unlike traditional bots that can only answer static FAQs, this AI agent is context aware, intelligent, and capable of handling complex workflows such as loan eligibility checks, card blocking, EMI reminders, and even secure transactions all within Messenger.

This is not just about chat. It’s about reshaping the entire banking experience into a real time, multilingual, hyper personalized engagement model embedded inside a platform customers already trust and use every day.

As customer expectations evolve toward instant, 24/7 assistance with zero friction, deploying a Facebook native AI agent becomes not just a digital innovation but a competitive necessity.

Why Facebook Is Now Critical to Banking

As consumer behavior shifts dramatically toward digital, banks must evolve from traditional service models to platform native customer experiences. Facebook, with its extensive reach and versatile tools, has emerged as a strategic channel for this evolution especially through Facebook Messenger.

A Massive, Mobile First User Base

A Massive, Mobile First User Base

Facebook is accessed by over 3 billion users globally every month, with more than 80% of that engagement occurring via mobile devices (Data Reportal). For retail and digital banks, this aligns perfectly with the mobile first expectations of modern customers. Whether it’s Gen Z opening their first account or a working professional checking their credit card due date, mobile friendly engagement is non negotiable.

Rising Demand for Chat First Experiences

Rising Demand for Chat First Experiences

Today’s users prefer chat over calls or emails. A Twilio report found that 68% of customers choose messaging channels when given the option. Messenger provides a real time, asynchronous interface ideal for banking use cases allowing customers to start a conversation and return later without losing context.

Higher Engagement Rates than Email or Apps

Higher Engagement Rates than Email or Apps

Traditional marketing or service communications via email often get ignored or filtered. In contrast, Facebook Messenger sees open rates as high as 88%, and response rates around 35% significantly outperforming emails or app push notifications (Statista, 2025).

Frictionless Entry Point

Frictionless Entry Point

Banks already maintain verified Facebook business pages. Embedding a banking AI agent directly into Messenger requires no other apps or downloads making onboarding effortless. Customers can initiate chats while browsing posts, ads, or even during off hours converting passive engagement into transactional conversations.

Trusted Environment with Embedded Tools

Trusted Environment with Embedded Tools

Facebook Messenger supports a range of interactive tools from quick replies and carousels to secure payment APIs and handoff protocols. This makes it fully equipped to handle not just support requests, but also complex banking workflows like policy disclosures, KYC collection, and multi product upsells.

Always On, Scalable Support

Always On, Scalable Support

Unlike human agents limited by time zones or shifts, Facebook banking chatbots operate 24/7, providing uninterrupted support even during public holidays, outages, or crises a key factor in maintaining service SLAs and customer satisfaction.

Delivering Intelligent Banking Engagement on Facebook Messenger

Streebo, a leading provider of Digital Transformation and Conversational AI solutions, has developed a Generative AI powered Banking Chatbot for Facebook that enables banks to deliver seamless, secure, and intelligent customer interactions directly within Facebook Messenger a platform customers already use every day.

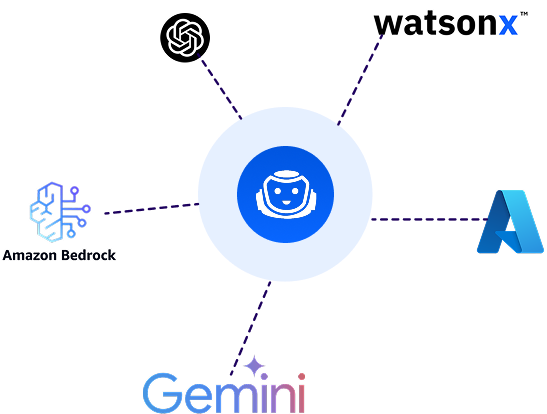

Powered by industry leading Generative AI platforms including IBM watsonx, Google Gemini, Microsoft Copilot & Enterprise GPT on Azure, Amazon Bedrock, and more, the chatbot leverages the latest in large language models (LLMs) to deliver highly accurate, real time responses.

This AI agent is not a static rules based bot. It is an enterprise grade, multilingual, context aware assistant designed to handle thousands of banking interactions simultaneously ranging from balance checks and card upgrades to KYC updates and loan inquiries.

Whether it’s a prospect exploring fixed deposit options, a customer requesting a duplicate credit card, or someone seeking EMI deferral support, the chatbot responds instantly, understands intent, and executes backend workflows in real time with 99% accuracy.

Real Banking Use Cases Delivered by Facebook Chatbots & AI Agents

The integration of a Generative AI powered banking chatbot into Facebook Messenger is redefining how banks manage customer interactions across the entire lifecycle from acquisition and onboarding to servicing, retention, and cross sell. With deep backend integration, the chatbot becomes a functional extension of the bank’s digital front office, embedded within the Facebook ecosystem that users already trust and use daily.

01

Lead Qualification from Ads and Posts

The AI agent engages users who click on sponsored Facebook ads or interact with the bank’s posts or stories. It immediately captures key information like the customer’s intent, income range, and preferred banking product, and guides them to the appropriate next step whether that’s viewing a product comparison, completing a form, or speaking to an advisor.

02

Loan Eligibility and Instant Quotes

Customers looking for home loans, personal loans, or auto financing can input basic details such as income, employment status, and credit behavior. The chatbot connects to internal credit scoring systems and returns pre-approved limits or personalized interest rates all without requiring an app download or branch visit.

03

Account Opening and Onboarding

New customers can open savings or current accounts directly through Messenger. The AI agent collects eKYC documents, verifies them using OCR and facial match APIs, and gives the information securely to the bank’s core systems for account activation often within minutes.

04

Card Services and Fraud Protection

Users can request a new debit or credit card, block a lost card, set travel notifications, and check transaction limits all through natural language queries. If suspicious activity is detected, the chatbot can proactively alert the customer and walk them through verification or dispute steps in real time.

05

Balance Inquiries and Transaction History

Authenticated users can ask for current balances, mini statements, or pending debits. Responses are fetched live from the core banking system and shown instantly in the Messenger thread, reducing app dependency and call center volume

06

Bill Payments and EMI Management

The chatbot supports recurring and one time payments for utilities, loans, and credit cards. It sends reminders ahead of due dates, allows users to complete payments securely, and generates digital receipts all within the chat.

07

Policy or Product Clarifications

When users are unsure about the terms of a banking product such as the lock in period of a fixed deposit or eligibility for a student account the AI agent provides plain language explanations, using product data and customer context to tailor the answers.

08

Branch and ATM Locator

The chatbot can pull up nearby ATMs or branches based on the user’s location, share operating hours, and even link to Google Maps for directions.

09

Cross Selling and Upselling

Based on user history and current inputs, the chatbot finds suitable upsell opportunities such as offering a travel credit card to a user who recently queried foreign exchange rates. These are delivered in a contextual, non intrusive manner, increasing conversion without hard selling.

10

Customer Support and Escalation

For queries that cannot be resolved automatically, the AI agent hands off the chat with full conversation context to a human agent through an integrated CRM or helpdesk system. This ensures that escalations are smooth, professional, and efficient.

Old World vs New World Real Banking Interactions Transformed by the Facebook AI Agent

Customers no longer want to switch channels or repeat themselves. When they’ve already engaged with a bank on Facebook whether by commenting on a post, viewing an offer, or chatting about an earlier inquiry they expect to handle everything within that thread. This is where a Generative AI powered Facebook chatbot becomes a powerful service layer allowing customers to stay in the same space and complete real transactions securely.

Scenario 1

Credit Card Product Exploration

Old World

Amelia clicks on a credit card banner ad and lands on a website that asks her to fill out 10 fields, then wait for a call. She exits without finishing.

Outcome

- No application submitted

- Drop off at form level

- Lead lost

New World with Facebook AI Agent

Amelia clicks on the same ad but chooses “Message Us.” She’s greeted by the bank’s AI chatbot, which asks 3 simple questions about income and usage, then suggests two credit cards she qualifies for all in Messenger.

Outcome

- Offer delivered instantly

- High intent lead converted

- No app installs or callback needed

Scenario 2

Missed EMI and Payment Assistance

Old World

Ravie misses his EMI date. The reminder was sent via SMS, but he didn’t notice. He now must call the bank, wait in queue, and pay a penalty

Outcome

- Payment delayed

- Call center burdened

- Poor customer sentiment

New World with Facebook AI Agent

Ravie had messaged the bank’s Facebook page last week for loan info. Today, he returns to that chat thread and types: “Is my EMI paid?” The AI agent checks his profile and responds: “Your EMI is due today. Would you like to pay now?”

Outcome

- Timely payment completed

- No missed deadline

- Seamless self service experience

Scenario 3

Blocking a Lost Debit Card During Active Chat

Old World

Faren loses her debit card during a weekend shopping trip. Unsure of what to do, she searches for the helpline number. It’s offline. She panics.

Outcome

- Hours of uncertainty

- Delayed resolution

- Risk of unauthorized use

New World with Facebook AI Agent

Faren had just chatted with the bank’s Facebook bot earlier that day for checking her balance. She reopens the Messenger thread and types: “I lost my card.” The bot securely verifies her and blocks the card instantly.

Outcome

- Immediate resolution

- No need to install app or call

- Customer stays in control

Scenario 4

Student Account Opening While Browsing Facebook

Old World

Leo, a university freshman, tries to open a student account online. The process is confusing, and a form asks for documents he doesn’t have ready. He postpones the task.

Outcome

- Frustrated journey

- Low engagement

- Delayed onboarding

New World with Facebook AI Agent

Leo sees a student account promo while browsing Facebook and clicks “Send Message.” The chatbot walks him through eligibility, uploads his documents, and sends his details for review all in a single session.

Outcome

- Zero confusion

- Instant document collection

- Account creation started successfully

Scenario 5

Exchange Rate Clarification for Travel Plans

Old World

Sandra is planning a trip and wants to convert currency. She googles rates, lands on an outdated page, and doesn’t know which rate applies to her travel card.

Outcome

- Confusing experience

- Potential loss of trust

- No cross sell engagement

New World with Facebook AI Agent

While casually checking her card balance via Facebook Messenger, Sandra asks: “How much INR will I get for $1000 on my forex card?” The AI agent provides the real time rate and offers to help her reload or order a new card.

Outcome

- Exact rate shared instantly

- Upsell triggered naturally

- Frictionless travel support

Key Integrations and Technical Framework

The AI powered banking Facebook chatbot is more than a conversation tool it’s a fully integrated, compliant service interface embedded within Messenger. It connects with the bank’s core infrastructure to enable secure, real time, end to end transactions.

The banking chatbot on Facebook retrieves balances, transaction history, loan status, and profile details directly from core systems all within Messenger.

The Gen AI agent for banks on Facebook handles pre qualification, document upload, eKYC, and instant offer generation by integrating with credit engines and origination platforms.

The Facebook banking chatbot supports secure EMI payments, utility bill settlements, and credit card dues through PCI compliant payment gateways using simple, conversational steps.

The Facebook chatbot for banking allows customers to upload KYC or loan documents securely and integrates with enterprise DMS for storage, tracking, and compliance workflows.

Measurable Business Impact for Banks

Increased Lead Conversion

Increased Lead Conversion

Banks using a Facebook chatbot for banking in ads and posts report up to 30% higher conversion rates and 3X more engagement compared to web forms

-MobileMonkey

Lower Support Center Load

Lower Support Center Load

The AI powered banking Facebook chatbot automates 70 80% of Tier 1 queries, leading to a 40 50% reduction in support costs and improved response speed.

-MobileMonkey

Higher Satisfaction and Retention

Higher Satisfaction and Retention

Real time support, 24/7 availability, and multilingual features in the banking chatbot on Facebook boost CSAT by 20 35% and improve customer retention.

-MobileMonkey

Better Engagement at Lower Cost

Better Engagement at Lower Cost

A Facebook AI agent for banks uses an existing platform to achieve 5 10X higher daily user activity than mobile apps without added app development or infrastructure costs. (Source: Statista, Twilio)

-Statista, Twilio

Faster Sales and Higher Revenue

Faster Sales and Higher Revenue

With CRM integration, banking AI agent on Facebook drives 20 25% more cross sell and upsell conversions and shortens the sales cycle through instant, contextual offers in Messenger.

-Statista, Twilio

Core Differentiators of the Facebook Banking AI Agent

Here’s what makes the Facebook AI agent for banks truly stand out:

The banking Facebook chatbot supports the entire customer lifecycle from product inquiries and pre qualification to onboarding, servicing, renewals, and dispute handling. These aren’t just conversational flows they’re actionable transactions backed by system integration.

It connects to core banking systems, CRM, loan origination systems, and document repositories. This allows the AI agent for banking on Facebook to fetch account data, send loan applications, schedule appointments, process KYC, and more all within Facebook Messenger.

Whether a user asks about a specific clause in a loan brochure or seeks clarity on mortgage tax benefits, the Gen AI agent for banks on Facebook can extract responses from structured databases and unstructured sources such as policy PDFs, FAQs, training documents, and even website content.

When queries exceed automation thresholds, the chatbot seamlessly transfers the session to a human agent via integrated CRM or helpdesk platforms. The banking chatbot on Facebook keeps the entire conversation history, ensuring the customer never has to repeat themselves.

Built on top of Generative AI models like Amazon Bedrock, IBM watsonx Orchestrate, Google Gemini and, Microsoft Copilot & Enterprise GPT on Azure, the banking Facebook chatbot is trained on thousands of banking terms, FAQs, and regulatory phrases. It understands everyday language, decodes intent, and responds with accuracy even when queries are vague or informal.

The Facebook chatbot for banking can converse fluently in over 38+ languages, adapting tone and terminology to the user’s regional and cultural context.

The tone of voice, regulatory language, escalation logic, and service rules are fully customizable. This ensures the banking AI agent on Facebook keeps compliance while aligning with the bank’s brand identity and service philosophy.

Administrators get real time dashboards to monitor how users interact with the Facebook AI agent for banks. Key insights include:

Resolution times

Resolution times

Escalation rates

Escalation rates

Drop off points

Drop off points

Frequently asked queries

Frequently asked queries

CSAT and NPS scores

CSAT and NPS scores

Security is foundational to every deployment of the banking AI agent on Facebook. The system uses End to end encryption and Multi factor identity verification. With secure access controls and encrypted integrations, the AI powered banking Facebook chatbot can handle high sensitivity workflows like card blocking, fund transfers, and document verification without any compromise on trust.

The AI powered banking Facebook chatbot supports multimodal interactions, allowing users to communicate through text, voice notes, images, and documents within Messenger. Customers can, for example, upload a utility bill photo for address verification or send a voice query about their loan balance making interactions more natural and accessible across user types.

Pricing Options

Starts at $99/month for multi-tenant SAAS or $999/month for single-tenant (Private Hosting)

Starting @ 1$/user – unlimited chats

See the Transformation for Yourself

Start with a 30-day free trial no credit card

required Or share your use case, and we’ll build a custom demo tailored to your banking operations.