Generative AI Powered AI Agent for Banking Corporate Agents

Transforming Corporate Banking Through Intelligent, Automated Conversations

Introduction: The Corporate Banking Landscape Is Evolving

Corporate banking is no longer confined to boardrooms, branch visits, or a chain of phone calls with Relationship Managers. In an era where speed, efficiency, and personalization define success, corporate clients expect the same digital first, on demand experience they’ve grown used to as consumers.

Yet, corporate banking processes remain labour intensive, complex, and relationship driven. Whether it’s obtaining loan approvals, requesting transaction reports, managing trade finance instruments, or addressing KYC issues traditional systems often involve delays, manual follow ups, and fragmented communication.

That’s where the Generative AI Powered AI Agent for Banking Corporate Agents comes in delivering real time, context aware, secure digital conversations to meet the fast-paced expectations of corporate banking clients.

This is not your average chatbot. It’s an enterprise grade, AI powered virtual assistant that simplifies how corporate agents, relationship managers, and SME clients engage with banking services across channels, 24/7.

Why Banking Needs an AI Agent for Corporate Agents

Corporate Clients Expect More and Faster

Modern enterprises operate globally, across time zones and markets. Their financial needs don’t follow a 9-to-5 schedule. With expectations for always on support, real time insights, and self-service capabilities, banks can no longer rely solely on traditional models.

Key Drivers for AI Agents in Corporate Banking:

Speed and Accuracy:

From balance confirmations to trade finance queries, clients demand instant, accurate information.

Reduced Friction:

Business customers want conversational access, not complex portals or static documents.

Cost Optimization:

Relationship managers are burdened with routine tasks that AI agents can easily manage, freeing them for strategic work.

Scalability:

AI agents can simultaneously assist thousands of clients without delays or drop in service quality.

Personalization:

Clients expect advice and updates tailored to their account type, activity, and preferences.

I need my account balance and trade finance status.

Your balance is $2.6M, and invoice #TF1093 is approved, pending verification. Should I email the summary?

Yes, and show payments above $50K.

Done. Also, your fixed deposit is maturing soon — want a reinvestment suggestion?

Yes, suggest something safe but slightly higher yielding.

I’d recommend the Corporate SmartYield Plan, offering 5.2% annualized with flexible liquidity.

Great. Thanks for the quick help!

This shift is fuelling the adoption of AI agent banking corporate agent integration enabling seamless, intelligent interactions.

What is a Banking Corporate Agent AI Agent?

The AI agent for banking corporate agents is a conversational interface powered by Generative AI that automates high value banking functions. It engages corporate clients and relationship managers via voice or chat across channels web portals, mobile apps, messaging apps, email, or embedded systems.

It’s not just reactive; it’s initiative-taking. It nudges clients for KYC updates, alerts them on credit renewals, recommends treasury products, and much more all in natural language.

What exactly is a Banking Corporate Agent AI Agent?

It’s a Generative AI–powered conversational assistant that automates high-value banking functions.

How does it help corporate clients?

It provides self-service via chat or voice, handles secure transactions, integrates with core banking.

And treasury, and even nudges clients for renewals or KYC updates — all in natural language.

Core Capabilities Include:

Conversational self-service for corporate clients

Integration with core banking, trade finance, treasury, and CRM

Secure transaction handling and document uploads

AI generated recommendations and intelligent routing.

Multi turn, multilingual dialogue support.

AI Agent Solution for Corporate Banking

Streebo, a global leader in AI and Digital Transformation, brings a pre trained, customizable, and scalable Generative AI powered AI Agent purpose built for corporate banking operations.

Unlike basic bots, AI agent is trained on corporate banking intents such as:

Working capital management

Credit limit utilization.

LC/BG tracking

Daily transaction summaries

Treasury product advisory

What’s our current working capital position?

Your net working capital stands at $4.8M, up 6% from last week. Would you like a breakdown by receivables and payables?

Yes, please.

Done — shared to your dashboard and email.

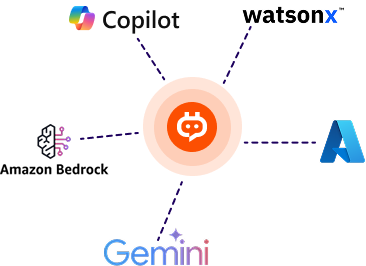

Built on top of advanced LLMs like IBM watsonx, Microsoft Copilot Studio, Google Gemini, and Amazon Bedrock, this solution empowers your AI Agent to function within strict industry compliance guardrails while achieving up to 99% human-level accuracy – transforming corporate banking interactions with unmatched responsiveness, intelligence, and efficiency.

Key Use Cases Across the Corporate Banking Lifecycle

The AI agent is designed to support corporate agents and business clients across the full lifecycle of banking interactions. Here’s how:

Client Onboarding & Documentation

Collects required documents and KYC information via chat.

Verifies data and submits directly to compliance systems.

Reduces onboarding time from days to hours.

Trade Finance & Guarantees

Tracks status of Letters of Credit, Bank Guarantees, Invoice Financing.

Alerts customers at every stage issuance, acceptance, maturity.

Supports document upload and discrepancy management.

Treasury & Forex Advisory

Shares daily forex rates, interest trends, and fixed income recommendations.

Responds to queries like “What’s the 1 year forward USD/INR rate?”

Offers pre-approved treasury products for eligible customers.

Renewal & Compliance Alerts

Reminds customers of upcoming limit renewals.

Sends nudges for overdue documentation.

Prevents account freezes through initiative-taking engagement.

Credit and Loan Management

Provides updates on sanctioned limits and loan balances.

Notifies customers of upcoming EMI schedules.

Supports real time loan eligibility checks and documentation requests.

Payments and Collections

Enables payment initiation and real time tracking.

Notifies about failed transactions or pending approvals.

Shares collection status and generates digital receipts.

Daily Banking Operations

Shares MT940/950 reports on request.

Updates on account balances, transactions, and inward/outward remittances.

Allows scheduling of reports and alerts.

Product Cross Sell & Upsell

Uses interaction history to recommend new services.

Promotes addons like payment gateways or ERP integrations.

Drives adoption through contextual offers.

Old World vs New World: Corporate Banking Reimagined

Scenario 1

Balance Confirmation for Audit

Old World

The corporate customer sends an email requesting audit confirmation. The bank RM takes 2 3 days to reply after manual verification.

Outcome

Delayed audit process. Risk of misreporting.

New World with AI Agent

Can I get the balance confirmation for audit?

Authenticated ✅ Here’s your signed audit confirmation document. document.pdf📄

Perfect, that was really fast. Thanks! 🙌

Customer asks: “Can I get the balance confirmation for audit?” The AI agent authenticates and generates a signed document instantly.

Outcome

Audit closes faster. Customer confidence boosted.

Scenario 2

LC Status Check

Old World

Hi, I need confirmation on LC #43527.

Thanks for calling. I’ll need to verify this manually. Please hold.

I’ve already been waiting… is this really going to take so long?

Your request is still under manual verification. I’ll get back to you shortly.

This delay is slowing down my decision-making.

Client calls the RM and waits 2 hours for confirmation on LC acceptance.

Outcome

Operational delays. Poor experience.

New World with AI Agent

What’s the status of LC #43527?

Let me check the latest records. One moment…

Retrieved ✅ LC #43527 is accepted and active.

Great, thanks for the quick update.

Client types: “What’s the status of LC #43527?”

The agent retrieves real time data and responds instantly.

Outcome

Quicker decisions. Enhanced productivity.

Scenario 3

Renewal Missed

Old World

Renewal notice sent via post or email. Customer misses it. Limit suspended.

Outcome

Credit operations halted. Revenue loss.

New World with AI Agent

Reminder 📩 Your credit limit renewal is due in 5 days. Would you like to renew now?

Yes, let’s do it.

Great ✅ I’ve pre-filled your renewal details. Please confirm.

Confirmed.

Done! Your limit is extended on time.

Awesome, no disruption this time. Thanks!

AI agent reminds user 5 days before renewal. With one tap, they confirm the renewal.

Outcome

No disruption. Limit extended on time.

Scenario 4

Cross Selling Missed

Old World

Hi, I just completed my monthly transaction summary.

Thanks for informing me. By the way… are you interested in a loan product?

Not sure, why are you suggesting this?

I don’t have your full activity details, so I’m just sharing general offers.

This doesn’t really fit my needs… feels irrelevant.

Relationship Manager lacks visibility into client behaviour. Cross sell attempts are manual.

Outcome

Upsell opportunity missed.

New World with AI Agent

I’ve detected that your recent activity shows interest in treasury services.

Would you like to explore related products?

Sure, what do you recommend?

Based on your profile, a short-term bond product could be a good fit.

That sounds interesting.

Great ✅ I can share detailed options and help you invest right away.

Perfect, thanks for the personalized suggestion!

AI agent detects interest in treasury services and recommends a short-term bond product.

Outcome

Higher wallet share. Personalized engagement.

Integration Framework

Banking chatbot for corporate agent is built with modular APIs and connectors to integrate with:

CRM & Relationship Manager Tools

Trade Finance Platform: LC/BG workflows

Core Banking System (CBS): Limits, balances, transactions.

Treasury Management Systems

Document Management and Compliance Tools

Payment Gateways & Settlement Engines

This ensures end to end digitization of all corporate banking functions through one conversational interface.

Key Business Outcomes

01.

Faster Client Conversion

AI agent acts on inquiries within seconds, not hours.

AI agent acts on inquiries within seconds, not hours.

Helps capture and qualify leads autonomously.

Helps capture and qualify leads autonomously.

Result:

Up to 35% higher conversion of SME and mid-market clients

Show our liquidity position.

Total deposits $4.6M, payables $1.2M, receivables $2.8M — liquidity surplus $2.3M.

I need to check my LC status.

Sure, I can help! Please upload the required document.

document.pdf uploaded

Done ✅ Your LC status is updated. With automation like this, support costs are reduced by up to 50%.

02.

Lower Operational Costs

Automates balance checks, document uploads, LC status updates.

Automates balance checks, document uploads, LC status updates.

Helps capture and qualify leads autonomously.

Helps capture and qualify leads autonomously.

Result:

Up to 50% reduction in support costs

03.

Improved Renewal Rates

Initiative-taking nudges for renewals, KYC updates, and limit reviews

Initiative-taking nudges for renewals, KYC updates, and limit reviews

Digital completion of renewal flows

Digital completion of renewal flows

Result:

25 30% improvement in adherence to banking cycles

I forgot to update my KYC for renewal.

No worries! I’ll guide you through the renewal flow right now.

Okay, let’s do it.

Great! I’ve started your digital renewal process. ✅

All steps are completed, and your account is now updated — ensuring 25–30% better adherence to banking cycles.

I just completed my transaction.

Great! Based on your profile, would you like to explore our FX services?

Sure, tell me more.

Excellent choice ✅ Pre-qualified clients like you often see a 20–40% lift in product adoption with our tailored offers.

04.

Increased Cross Sell Revenue

Context aware nudges for FX services, loans, or CMS

Context aware nudges for FX services, loans, or CMS

High acceptance from pre-qualified clients

High acceptance from pre-qualified clients

Result:

20 40% lift in product adoption

05.

Global 24/7 Access

Support clients across time zones.

Support clients across time zones.

No RM dependency for routine needs

No RM dependency for routine needs

Result:

10x increase in client touchpoints

It’s midnight here, but I need support.

I’m available 24/7. How can I help you today?

I just want to check my account balance.

Done ✅ No RM dependency needed. With round-the-clock support, banks see a 10x increase in client touchpoints.

Key Differentiators of Gen AI Powered Corporate Banking AI Agent

Purpose Built for Corporate Banking

Pre trained on corporate banking use cases such as LC/BG tracking, working capital management, credit utilization, and treasury advisory not a generic chatbot.

Omnichannel Presence with WhatsApp Integration

Seamlessly deployable across WhatsApp, web, mobile apps, and SMS enabling clients to interact on their preferred channels.

Powered by Industry Leading LLMs

Supports IBM watsonx, Microsoft Azure Copilot, Google Gemini, and Amazon Bedrock giving banks flexibility in LLM orchestration based on performance and cost.

99% Response Accuracy

Delivers near human, high confidence answers on complex banking intents, reducing misinformation risk and building client trust.

Enterprise Grade Compliance & Security

Aligned with SOC 2, ISO 27001, and internal banking governance policies all interactions are audit trail ready and data secure.

Real Time Backend Integration

Connects with core banking, credit, treasury, and CRM systems for real time responses no manual back-office lookups required.

Configurable, No Code Interface for Business Teams

Enables rapid customization and intent expansion by business analysts without technical support, accelerating time to market.

Agent Assist Mode

Offers real time AI powered suggestions to human agents (RM or support staff), boosting first call resolution rates and agent productivity.

Initiative-taking Engagement Capabilities

Sends alerts and reminders for credit limit breaches, LC expiries, or settlement delays helping clients stay ahead and informed.

Multilingual Support

Communicates in regional and global languages for localized corporate banking outreach.

Accelerated RM Onboarding

Empowers new relationship managers with AI guidance, reducing training cycles and boosting early productivity.

Unified Client Experience

Delivers consistent and accurate responses across all digital touchpoints, ensuring a cohesive and professional brand experience.

Pricing Options

Starts at $99/month for multi-tenant SAAS or $999/month for single-tenant (Private Hosting)

Starting @ 1$/user – unlimited chats

Ready to Redefine Your Corporate Banking Services?

Launch your own AI assistant for corporate banking in just days

Launch your own AI assistant for corporate banking in just days

Pre trained, pre integrated, and customizable

Pre trained, pre integrated, and customizable

Backed by world class AI platforms

Backed by world class AI platforms

no credit card needed

no credit card needed

Or request a tailored demo for your unique workflows

Or request a tailored demo for your unique workflows

FAQs for Corporate Banking AI Agent Solutions

What is a Corporate Banking AI Agent?

It is a Generative AI powered virtual assistant trained on specific corporate banking workflows such as LC/BG tracking, credit utilization, working capital management, and treasury advisory. It operates across platforms like WhatsApp, web, and mobile apps to provide instant, accurate, and compliant responses.

How is it different from a generic chatbot or virtual assistant?

Unlike basic bots that only respond to FAQs, this AI Agent is pre trained on enterprise banking use cases, integrates with core systems (e.g., CBS, CRM, Treasury), and delivers 99% accurate responses with audit trails and compliance built in.

What types of queries can the AI Agent handle?

- Letter of Credit (LC) or Bank Guarantee (BG) status requests

- Credit limit utilization and alerts

- Working capital position summaries

- Fund transfers and workflow initiation

- Treasury product recommendations

- Daily transaction reports

Can the AI Agent integrate with our existing systems?

Yes. The solution offers seamless backend integration with core banking, credit, treasury, CRM, ERP, and notification systems using REST APIs, middleware, or direct connectors.

Is the AI Agent secure and compliant?

Absolutely. It is designed with enterprise grade security and compliance in mind, supporting frameworks like SOC 2, ISO 27001, GDPR aligned practices, and includes full audit logging.

How accurate is the AI Agent?

The AI Agent delivers up to 99% response accuracy for supported use cases. It uses industry leading LLMs like IBM watsonx, Microsoft Azure Copilot, Google Gemini, and Amazon Bedrock.

How long does implementation take?

Typical implementation takes 4–6 weeks, thanks to pre-built banking intents and integration accelerators. Timelines may vary slightly based on custom workflows or system access.

Can RMs and support teams use the AI Agent internally?

Yes. In Agent Assist Mode, the AI Agent helps relationship managers and support staff resolve queries faster, access client insights, and improve service quality.

Does the AI Agent support multilingual interactions?

Yes. It can be configured to manage multiple languages for both inbound and outbound conversations, supporting local, regional, and international banking use cases.

Can the AI Agent be customized to match our workflows and brand?

Yes. The AI Agent is fully configurable — from branding and tone to workflows, language, and channel deployment. Non-technical users can also make updates via a no-code interface.