#Smart Generative AI Agent

Check out Demo

Generative AI Powered Smart Bot Solution

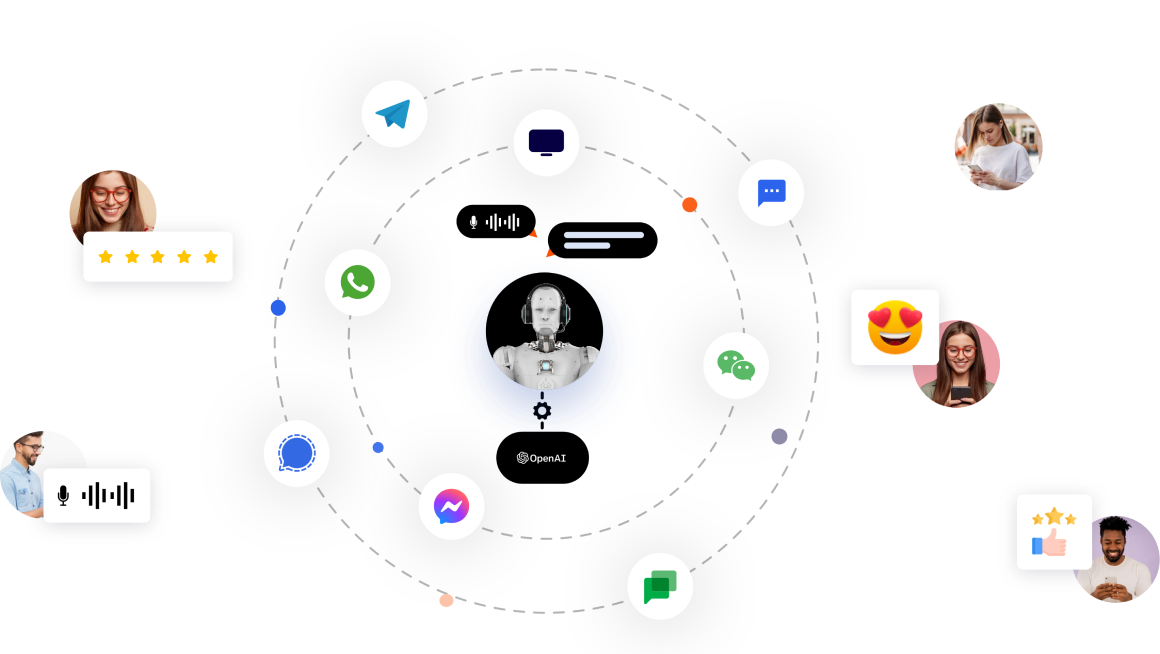

Omni-Channel Bots – Deploy on Chat, Voice, Email, Instagram, Facebook, WhatsApp and Even SMSCheck out Demo

Trusted by hundreds of leading companies

×

Check out the Enterprise Grade AI Agent Powered by Gen AI. No Setup Fees.

Unleashing the Power of AI ChatGPT’s Conversational Revolution in Human-Machine Interaction

As technology continues to advance, it has become increasingly important to develop more

intuitive human-machine interactions. Conversational AI has emerged as a breakthrough in this

field, enabling more human-like interactions between humans and computers. OpenAI’s

ChatGPT is a

cutting-edge language model at the forefront of this technological advancement. Its

ability to

comprehend and respond to a wide range of human language inputs makes it an invaluable tool for

various applications, including customer service, healthcare, and

entertainment.

By harnessing the power of ChatGPT, businesses and organizations can provide engaging

and

personalized experiences to their customers, revolutionizing the way we interact with

machines

and paving the way for a more intelligent and connected future. ChatGPT’s potential

to transform

the field of conversational AI is particularly evident in the business sector, where it can

streamline customer interactions and improve overall efficiency.

Empowering the Future of Life Insurance

Unlocking Limitless Possibilities with ChatGPT and GPT-Technologies

Life insurance companies are always looking for innovative ways to provide better services to

their customers. One of the most exciting advancements in the industry is the use of

conversational AI, such as OpenAI’s ChatGPT, and GPT technologies. These technologies offer

limitless possibilities for the future of life insurance. ChatGPT’s natural language processing

capabilities enable personalized and engaging customer experiences, improving customer

satisfaction and loyalty.

Furthermore, GPT technologies provide advanced machine learning capabilities, allowing for more

accurate underwriting and risk assessments. By leveraging these cutting-edge technologies, life

insurance companies can streamline their operations, reduce costs, and offer more

comprehensive

and affordable policies to their customers. The future of life insurance is being

shaped by

these technologies, and the companies that adopt them are poised for long-term success.

Changing the Game

How ChatGPT and GPT-Technologies are Reshaping the Future of Life Insurance

Let us discover the top 10 use cases that prove the powerful ROI of ChatGPT-powered chatbots in the Life Insurance Sector

1. Risk Assessment

Risk assessment plays a vital role in the Life Insurance market as it helps insurance

providers analyze the probability of a policyholder filing a claim and make informed

decisions regarding the appropriate level of coverage and premium rates. With advanced

technologies like ChatGPT, which possesses features like Parsing, Search, and

Summarization,

large quantities of data can be harnessed, including medical records, demographic

information, and historical claims data.

These cutting-edge Life Insurance Bots powered by GPT can identify patterns and trends in the data to suggest a customer’s risk profile using features like Clustering and Classification. Additionally, chatbot use cases in life insurance offer customers an innovative and effective way to communicate with insurance providers.

These cutting-edge Life Insurance Bots powered by GPT can identify patterns and trends in the data to suggest a customer’s risk profile using features like Clustering and Classification. Additionally, chatbot use cases in life insurance offer customers an innovative and effective way to communicate with insurance providers.

GPT-based Life Insurance chatbots can analyze customer comments,

social media posts, and other

sources of consumer sentiment with features like Sentiment Analysis, allowing

insurers to

extract valuable information and identify potential risks or opportunities in the market.

This

data can then be utilized to guide the risk assessment process, enabling insurers to

estimate

risk effectively, offer suitable coverage at a reasonable price, and ultimately enhance

the

customer experience.

2. Customer Support

The life insurance industry places a great deal of importance on customer support as a

means of creating and sustaining relationships with clients, which has a significant

impact on the overall customer experience. To provide superior services,

insurers

require an efficient customer support system that can boost customer happiness and

enhance the entire customer experience. The use of Life Insurance

bots, such as ChatGPT,

offers a powerful tool for insurers to understand customer input and preferences via

features like Sentiment Analysis and Text Conversation.

By collecting relevant data, insurers can enhance customer support procedures,

leading to

more efficient and effective management of consumer inquiries. The integration

of GPT-based

platforms into life insurance operations provides a competitive edge by optimizing customer

support operations and enhancing client experiences through data-driven insights. As a

result, insurers can reduce response times and increase customer

satisfaction, positively

impacting the entire customer experience.

3. Fraud Detection

Fraud detection is an essential aspect of the life insurance industry as it enables

insurance companies to limit losses caused by fraudulent activities. Fraudulent claims

can result in significant financial losses for insurers, leading to higher

premiums for

policyholders and even jeopardizing the financial stability of the insurer

in severe

cases.

GPT’s capabilities in life insurance can be highly beneficial, especially as ChatGPT’s Generative AI can produce synthetic data that can be utilized to train fraud detection algorithms. Life Insurance Bots wired with GPT can generate realistic-looking synthetic data that can be added to the limited training datasets typically available for fraud detection.

GPT’s capabilities in life insurance can be highly beneficial, especially as ChatGPT’s Generative AI can produce synthetic data that can be utilized to train fraud detection algorithms. Life Insurance Bots wired with GPT can generate realistic-looking synthetic data that can be added to the limited training datasets typically available for fraud detection.

The use of both actual and synthetic data can help fraud detection algorithms to be more

precise and effective in detecting trends and anomalies that suggest fraudulent activity. By

employing GPT-based Bots, insurers can minimize financial losses,

provide better services to

clients, and ensure the sustainability of their operations.

4. Sales Support

The use of GPT-based Life Insurance chatbots can significantly improve life insurance

sales. Reinforcement learning algorithms of the GPT Platform can enhance

decision-making

processes related to customer segmentation and lead priority by

continuously learning

from experience and feedback, resulting in higher conversion rates and increased

revenue

for insurance companies.

chatbots like ChatGPT can utilize natural language processing and features such as Text Completion and Text Conversation to identify potential customers and guide them through the sales process.GPT-powered Life Insurance Bots can further improve this process by constantly learning from user interactions and feedback to refine their responses and improve conversion rates.

chatbots like ChatGPT can utilize natural language processing and features such as Text Completion and Text Conversation to identify potential customers and guide them through the sales process.GPT-powered Life Insurance Bots can further improve this process by constantly learning from user interactions and feedback to refine their responses and improve conversion rates.

In addition, these chatbots can also leverage advanced features such as Search,

Summarization, and Sentiment Analysis of the GPT Platform to provide

personalized and

efficient customer support, further enhancing the overall customer experience.

By using

GPT-engineered Life Insurance chatbots, insurers can streamline their sales processes,

provide superior customer service, and gain a competitive edge in the market by leveraging

the power of AI.

5. Claim Processing

Claims processing is a critical function in the life insurance industry as it directly

affects customer satisfaction. Timely and accurate processing of claims is essential to

ensure that policyholders receive the benefits they deserve. Life Insurance

chatbots

powered by the GPT Platform can help streamline the claims process by

offering customers

real-time updates on the status of their claims, answering frequently asked

questions,

and assisting with the claims filing process.

The Multi-Modal capability and Speech-to-Text functionality of GPT-based Life Insurance chatbots can also be utilized to analyze and understand the information in all forms from the customer, improving the customer experience significantly. With the ability to process claims quickly and efficiently, GPT-powered Life Insurance Bots can help insurers reduce response times and improve customer satisfaction.

The Multi-Modal capability and Speech-to-Text functionality of GPT-based Life Insurance chatbots can also be utilized to analyze and understand the information in all forms from the customer, improving the customer experience significantly. With the ability to process claims quickly and efficiently, GPT-powered Life Insurance Bots can help insurers reduce response times and improve customer satisfaction.

By leveraging the power of AI to improve the claims processing experience, insurers can

strengthen their relationships with customers, increase loyalty, and gain a

competitive

advantage in the market.

6. Policyholder Outreach

ChatGPT, with its advanced features like Classification and Clustering,

can aid in

policyholder outreach for the life insurance industry. By analyzing customer

behavior,

preferences, and demographics, insurers can create targeted marketing campaigns and

customized communication strategies. In addition, GPT-based Life Insurance

chatbots can

be leveraged to facilitate policyholder outreach. These chatbots can assist customers,

answer their questions, and guide them through the policy purchasing process.

With the help of AI-powered chatbots, insurers can provide 24/7 customer support and improve the overall customer experience.

With the help of AI-powered chatbots, insurers can provide 24/7 customer support and improve the overall customer experience.

By using GPT-based Life Insurance chatbots for policyholder outreach, insurers can better

understand the needs and preferences of their customers, offer tailored solutions,

and

ultimately increase customer satisfaction and loyalty.

7. Risk Management

GPT-based Life Insurance Bots offer several features that can assist in risk management

in the life insurance sector, including Diversity Measurement, Anomaly

Detection,

Parsing, and Classification. Predictive analytics is a crucial aspect of

data analytics

that uses statistical algorithms and machine learning techniques to evaluate

data and

predict future events. In the context of risk management in the life

insurance industry,

predictive analytics may be used via ChatGPT-like advanced Bots to identify and

quantify

potential risks based on historical data and other relevant information.

For example, predictive analytics algorithms may be used to analyze policyholder behavior, such as claims history and lapse rates, to anticipate potential risks and develop strategies to mitigate them.

For example, predictive analytics algorithms may be used to analyze policyholder behavior, such as claims history and lapse rates, to anticipate potential risks and develop strategies to mitigate them.

By leveraging the powerful features of GPT-fueled Life Insurance Bots, insurers can

significantly improve their risk management procedures, leading to more effective and

profitable operations.

8. Personalized Marketing

ChatGPT-based Life Insurance chatbots can use Classification and Parsing

functionalities

to evaluate client data and develop tailored marketing strategies. The

Classification

feature may be used to categorize clients based on shared characteristics and

preferences, while the Parsing feature of the GPT Platform may be used to

examine client

data and extract relevant information.

By using these features of the GPT-based Bots, life insurance firms may produce targeted marketing campaigns that appeal to individual client interests and provide a more customized experience. This can improve customer satisfaction and loyalty, resulting in increased revenue and business growth for insurance companies.

By using these features of the GPT-based Bots, life insurance firms may produce targeted marketing campaigns that appeal to individual client interests and provide a more customized experience. This can improve customer satisfaction and loyalty, resulting in increased revenue and business growth for insurance companies.

9. Underwriting

The use of GPT-based Life Insurance Bots for underwriting in the life insurance industry

can streamline the process and enable insurers to evaluate risks more

accurately. The

bots can utilize natural language generation to create reports and summaries based on

data from various sources, including medical records, financial accounts, and

other

relevant information.

By leveraging features such as Clustering, Classification, and Search, the bots can assist in organizing and categorizing large amounts of data and identifying patterns that could indicate potential risks.

By leveraging features such as Clustering, Classification, and Search, the bots can assist in organizing and categorizing large amounts of data and identifying patterns that could indicate potential risks.

The bots can also use predictive analytics algorithms to analyze the data and

predict future

outcomes based on historical data and other relevant factors. With the help of

GPT-based

Life Insurance Bots, insurers can more efficiently and accurately underwrite policies,

ensuring that they provide adequate coverage while minimizing the risk of claims.

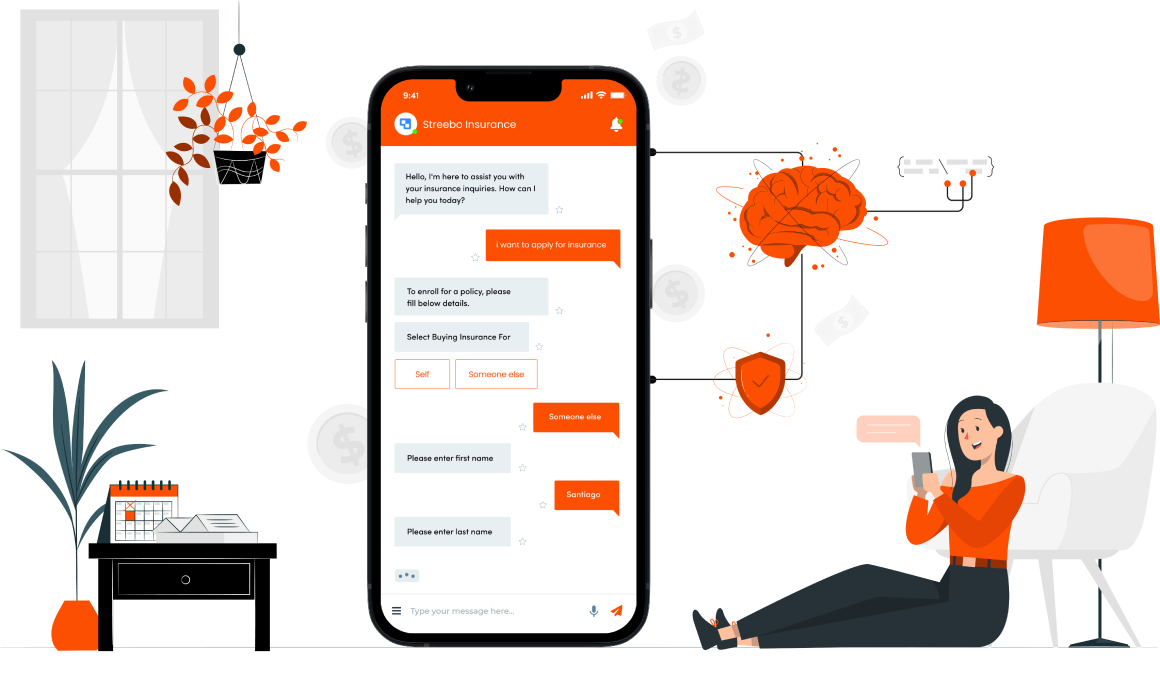

10. Policy Renewals

In addition to evaluating historical data, ChatGPT can also be used to interact with

policyholders and guide them through the policy renewal process. By

utilizing features

like Text Completion and Text Conversation, GPT-based Life Insurance chatbots can assist

policyholders in completing forms, answering questions about policy terms and

coverage,

and providing reminders about upcoming renewal deadlines.

These chatbots can also provide personalized recommendations based on the policyholder’s past usage and requirements to ensure that the policyholder receives the best possible policy for their needs. With the help of ChatGPT, insurers can streamline the policy renewal process, enhance customer satisfaction, and maintain long-term customer relationships.

These chatbots can also provide personalized recommendations based on the policyholder’s past usage and requirements to ensure that the policyholder receives the best possible policy for their needs. With the help of ChatGPT, insurers can streamline the policy renewal process, enhance customer satisfaction, and maintain long-term customer relationships.

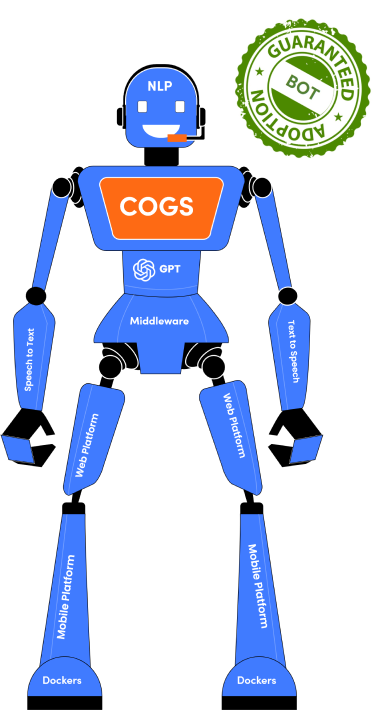

Introducing Streebots for Life Insurance Industry

A state-of-the-art solution powered by the latest in NLP and GPT technology.

We’ve developed

this solution to make the Life Insurance sector more secure and efficient!

Streebo has emerged as a leader in the AI industry by developing a ChatGPT solution that is

customized for the unique needs of the Life Insurance sector. This cutting-edge technology is

powered by advanced GPT language models and OpenAI’s API technology, which enables businesses to

efficiently engage with their customers in the digital realm. Streebo’s Life Insurance Bots are

integrated with industry-leading NLP engines from IBM Watson, Amazon Lex, Microsoft’s

CLU, and

Google Dialog to provide unmatched customer service and personalized experiences.

The use of the

latest GPT models in Streebo’s Bot Solutions unleashes a world of possibilities for innovation

in customer service in the Life Insurance industry, helping businesses stay ahead of the

competition and provide exceptional customer experiences.

Streebo’s Life Insurance Bots can offer superior engagement and automation, resounding

ROI, and guaranteed adoption.

Some of the features include:

Built-in domain intelligence

Built-in domain intelligence

Omnichannel experience on all platforms such as Facebook, WhatsApp, and Website

Omnichannel experience on all platforms such as Facebook, WhatsApp, and Website

Data security and compliance

Data security and compliance

Advanced chat analytics

Advanced chat analytics

Lower TCO

Lower TCO

Inbuilt live agent support

Inbuilt live agent support

Multi-lingual support

Multi-lingual support

Support of both Voice and Chat as well

Support of both Voice and Chat as well

Secured communication

Secured communication

Context Switching Capabilities

Context Switching Capabilities

99% Accuracy

99% Accuracy

Secure Transactions and Text Exchange

Secure Transactions and Text ExchangeWhen it comes to data processing and security, there can be no compromises. Our Bots understand this and use only the best in the industry – IBM Watson, Google’s GCP, Amazon’s Lex, and Microsoft Copilot Studio, Power Virtual Agents, to name a few. These branded NLPs provide unmatched peace of mind to enterprises that cannot afford any data breaches. But that’s not all – we go one step further by ensuring that all sensitive and other types of data are encrypted and masked using advanced algorithms. And with Open AI’s GPT Text Generation feature, there’s no need to worry about any manipulation, computation, or processing of business data. As a business owner, you can rest easy knowing that our Bots are the perfect ally to combat cybercrime and protect your sensitive information.

Clients that have deployed these Smart Bots are seeing

Increase in Revenue ~1-5%

Increase in Revenue ~1-5%

Improvement in Customer Satisfaction Ratings ~5-9%

Improvement in Customer Satisfaction Ratings ~5-9%

Reduction in customer service costs in half (50%+)

Reduction in customer service costs in half (50%+)

We guarantee to cut your current customer service costs in HALF!!

Final Food for Thought for Life Insurance Industry Leaders!

Cutting-edge technologies like Artificial Intelligence (AI) and GPT are transforming the life

insurance sector, offering new opportunities for innovation and growth. AI-powered solutions can

assist with a wide range of processes, including policyholder outreach, underwriting,

claims

processing, risk management, and policy renewals. According to a report by Grand

View Research,

the global AI in the insurance market size was valued at USD 1.2 billion in 2020 and is

projected to grow at a compound annual growth rate (CAGR) of 43.4% from 2021 to

2028.

Additionally, the adoption of chatbots in the insurance sector is expected to grow at a

CAGR of

25.2% from 2020 to 2027, according to another report by Grand View Research. These

statistics

suggest that the use of AI and GPT in the life insurance industry will continue to grow,

providing more opportunities for businesses to enhance customer experience and streamline

processes.

According to a report by MarketsandMarkets, the global AI in the insurance market size is

projected to grow from $1.3 billion in 2020 to $16.0 billion by 2026, at a CAGR of 44.0% during

the forecast period. The report cites the increasing adoption of chatbots and other AI-powered

tools in the insurance industry as a major driver of this growth, with the Asia Pacific region

expected to see the highest growth rate due to increasing investments in AI technology. With the

integration of Streebo’s ChatGPT Life Insurance Bots, businesses can tap into this rapidly

growing market and gain a competitive edge by delivering unparalleled customer experiences that

meet the evolving demands of today’s consumers.

Disclaimer: ChatGPT and GPT are registered trademarks and terms fully owned by Open.AI. The Author has used the term “ChatGPT Life Insurance” to convey the idea of a ChatGPT kind of Bot, but for Life Insurance.