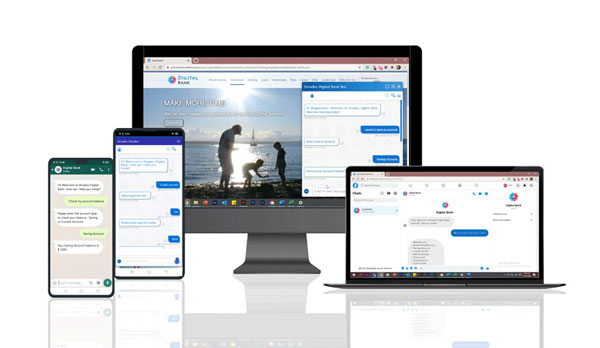

Post Covid-19 era, the digital traffic has shifted. According to a Tech Crunch article, over 40% of traffic has surge has been observed on social media platforms. Banks have to be where their users are hanging out and, in this case, the social media platforms such as Facebook Messenger and WhatsApp. Asynchronous messaging is the norm and expectation from the consume in this new era. Hence to provide seamless, hassle-free, and quick customer service, Banking Chatbots/Conversational Interface that can respond on these newer channels and platforms have become a need of hour.

Banking Bots Solution – AI Powered Pre-Trained Bots

We, at Streebo have launched a digital Bot Store comprising of 50+ pretrained AI Powered Chatbots pertaining to variety of Industries and Technologies. We have fully integrated, functional, and highly intelligent Banking Bots that will extend your existing web and mobile apps to external facing social media channels such as Facebook Messenger, WhatsApp, SMS, among others. Streebo’s AI powered bots also support voice assistants such as Google Home and Amazon Alexa. Moreover, the transactions which happens via chatbot are highly secured as we leverage a leading Natural Language Processing technology such as “IBM Watson”, Google Dialog and Amazon Lex.

Business Benefit

Apparently, banks that have deployed this AI Bot have seen an increase in conversion by 15%, and reduction in call-handle times by over 18%

Hence by implementing AI Powered Banking Chatbots and Conversational Interfaces, Banking Sector will witness benefits such as:

- Increased Revenue & Customer Outreach because of the extended presence on multiple digital channels such as WhatsApp, Facebook Messenger, SMS among others.

- Increased Productivity by automating business processes.

- Round the clock Customer Query Resolution which will significantly increases Customer Satisfaction rate and Customer Retention rate

- Hence Virtual Assistants will not only be cost effective but will also ease out business management by providing automated customer support.

Why Streebo‘s Banking Bots:

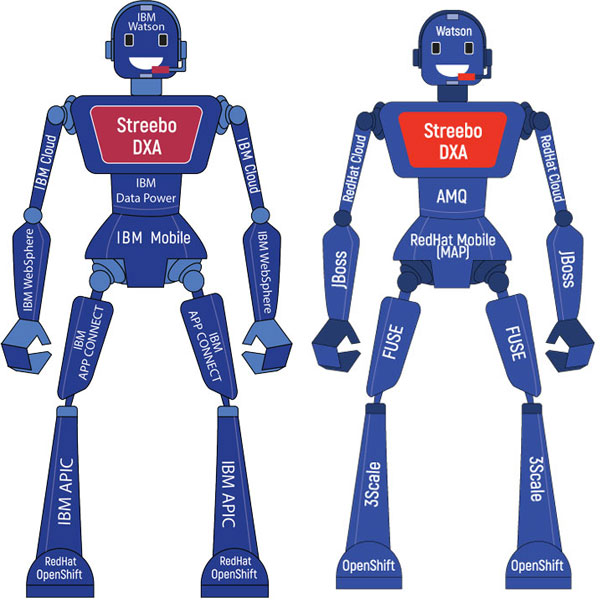

Streebo in collaboration with leading technology organizations like IBM, RedHat, Google, Amazon and HCL Technologies has created a powerful and secured solution that can be deployed in Financial Institutions to take the Customer, Agent and Employee experience to the next level – Below are the key differentiators of Streebo’s Pre-Trained banking bots.

- Built in Domain Intelligence – Streebo along with its technology partners brings in decades of Banking and Financial Services experience that is fed to these Bots thus allowing Banks to deploy highly intelligent Bots that are pre-trained to conduct a variety of functions.

- Flexible Technology Options – Streebo’s Pre-Trained Banking Bots are assembled using a variety of technologies from various companies. For instance, our customers can choose NLP from either IBM Watson, Google Dialog or Amazon Lex.

- Application Platform technologies include support for standard J2EE engines including IBM WebSphere or JBOSS and can be deployed as standard Docker and Kubernetes packages on platforms such as RedHat OpenShift

- Pre-Integrated with Backends – Streebo’s banking Bot comes in pre-integrated with common core banking systems such as SAP Core banking and Finnacle.

- Flexible Deployment Options – Streebo’s Pre-Trained Bot can be deployed on-premise or on IBM Cloud, Microsoft Azure, Amazon AWS or Google Cloud Platform

- Ease of Development & Maintenance – Streebo’s Pre-Trained Bot is built using open standards such as Java and JavaScript. Also comes bundled in with Streebo’s bot Builder a low code no code tooling to assemble, integrate and manage the bot. Thus, making it easy for both Line of Business and people in IT with minimal or no background in Artificial Intelligence to assemble, integrate and manage the bot moving forward. Streebo’s bot builder is an optional development only tooling that customer can choose or they can directly develop and manage it using standard IDEs such as Eclipse and Visual Studio

Our Banking Chatbot Supports Below mentioned Features:

- Omni-channel Solution

- Secured

- Multilingual Support with support for over 38 languages

- Support for both voice and chat channels

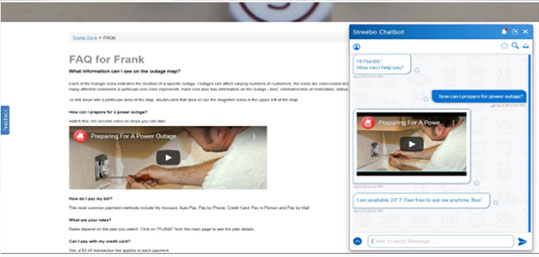

In-built Live-Agent Support Our pretrained Banking Bots supports below mentioned use cases:

Customer Facing Bots:

- FAQs

- Branch Locator

- Open an Account

- Apply for a Credit Card

- Apply for an FD

- Avail a Loan

- Personal Loan Calculator

- Learning Center (Videos/Articles)

- Talk to a Live Agent for assistance

- Check Balance

- Check last 5 Transactions

- View Account Statement

- Add Beneficiary

- Fund Transfer

- Apply for Mortgage Loan

- Block Credit/Debit Card

- Multi Factor Authentication

- End-to-end 256 bit encryption

- Check/Download Statement

- Check/Download FD Summary

- Request a Cheque Book

- Reset PIN

- Bill Payment

- Mobile Recharge

- Track Loan Application

- Update KYC

- Submit Fom 15G/15H

- Update Personal Details

- Value Added Services –

- All type of Recharges (Mobile, Data card, DTH), All type of Utility Bill Payment and Wallet Recharge, Travel Booking (Cab, Bus, Rail, Flight), Hotel Booking, Holiday Booking, Movies (One Third party integration), Browse plans for recharge

- Rewards Point – Balance, History, Redemption, Queries

- Find IFSC

Agent Facing Bots:

- FAQs

- Branch Locator

- Check offers/contests

- Performance Management

- Check customer list

- Filter customers to check individual customer details

- Check customer specific offers and reminders if any

- Open an account on behalf of customers

- Multi Factor Authentication

- End-to-end 256 bit encryption

- Agent Registration and Password Reset

- Role Based Login – Access Control

- Agent Dashboard –

DD collection, RD collection, Services, Share Purchase, Request info and Mini statement. - New Member Creation

- Request Information and Tracking Customer Service Requests

- Add/View/Update customer KYC details

- Investment Calculator

- Talk to a Live Agent for assistance

- Find IFSC